We hope that people will take these slides and the associated data and use them, improve upon them, and share them

find it here 👇 + a few favorites in the thread

coinsharesgroup.com/research/2019-…

and @marty_stenson for pulling more than a few all nighters w/ me! (eagles still suck tho)

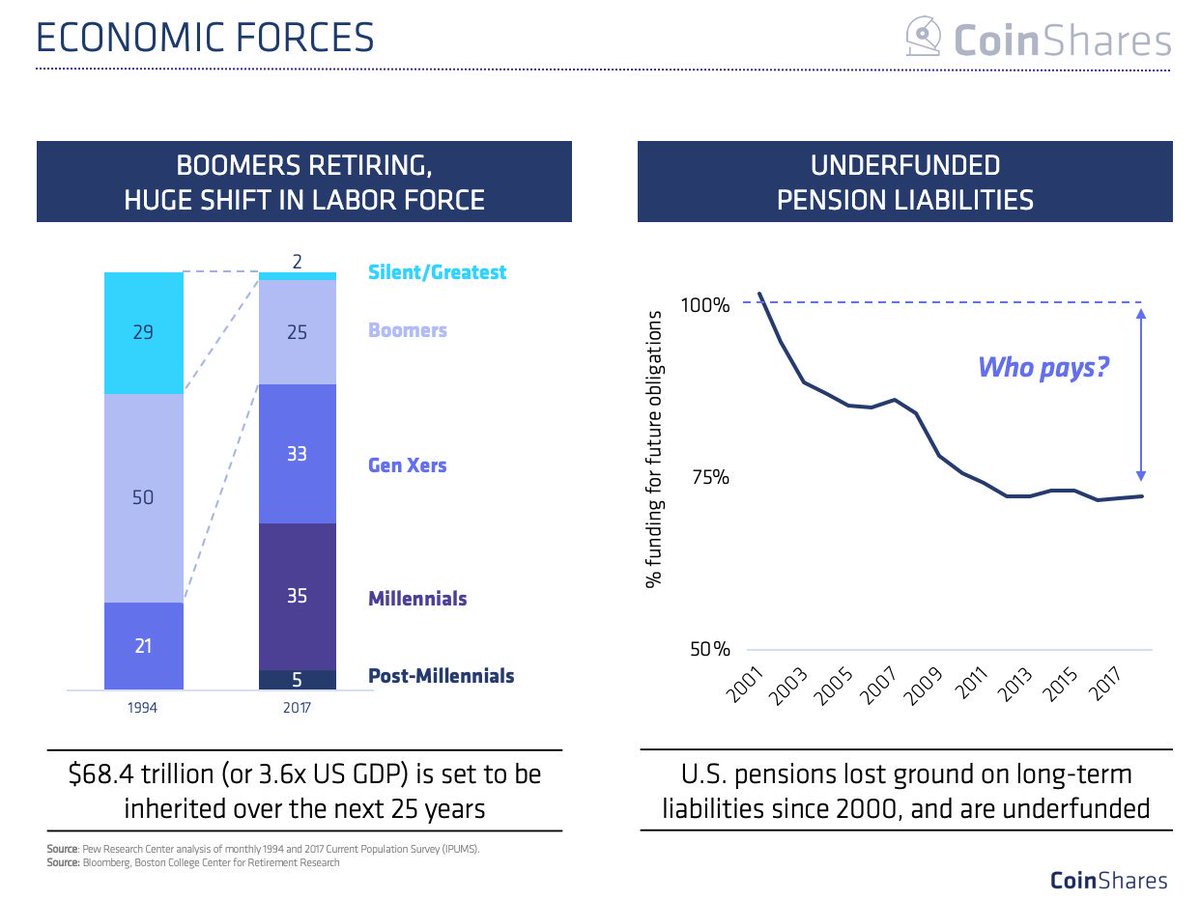

boomers are retiring, with ~$70T set to be inherited over the next 20 years.

but, pensions are underfunded by 25%. who will pay?

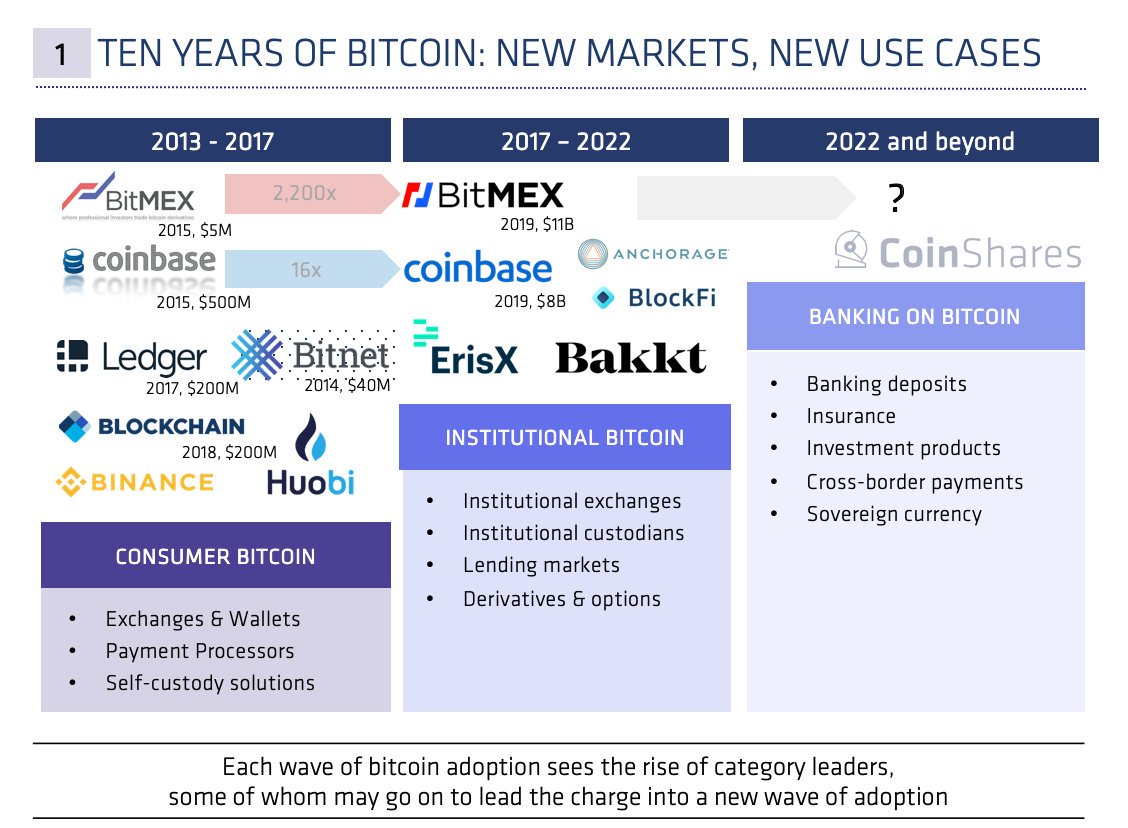

the last ten years of bitcoin have seen the transition from "consumer" to "institutional", with industry leaders going on to define new market segments

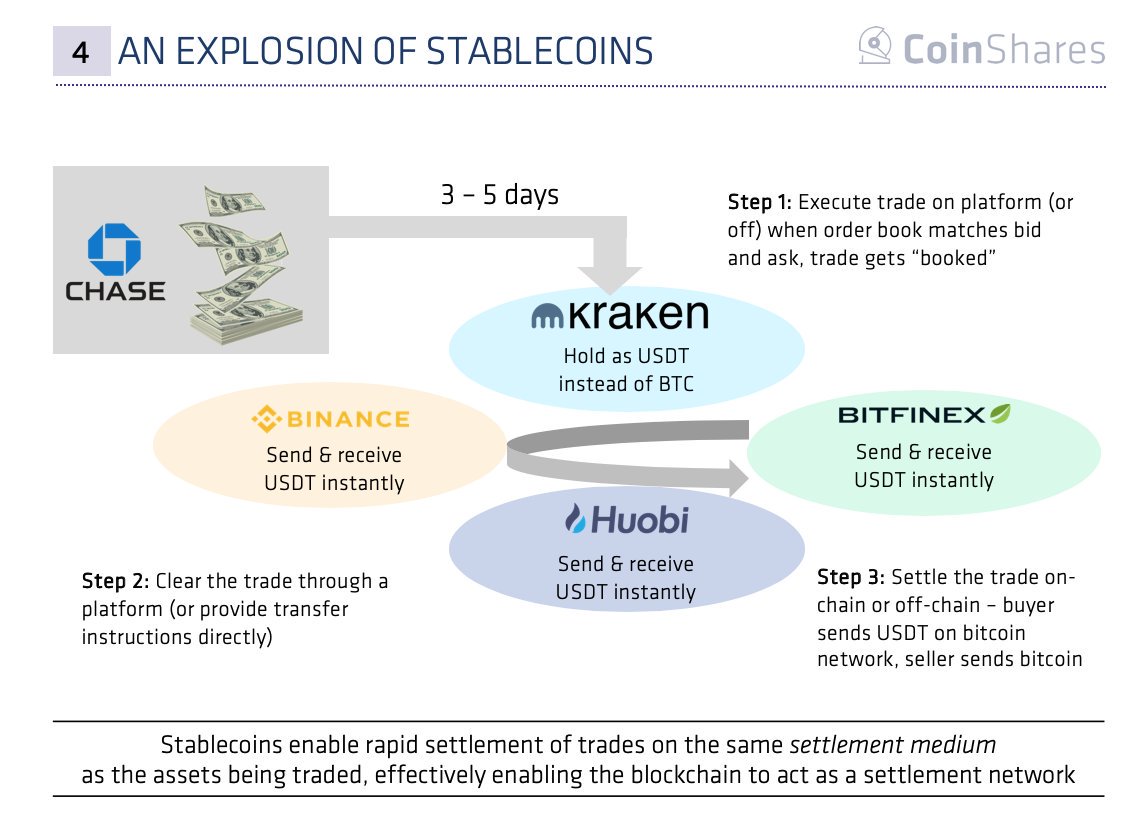

while the stablecoin market nearly trebled over the last year, @Tether_to has maintained its 80% market share

why stablecoins? because they enable global cash settlement on-chain (see 4 am slide on clearing & settlement w/ cash v USDT)

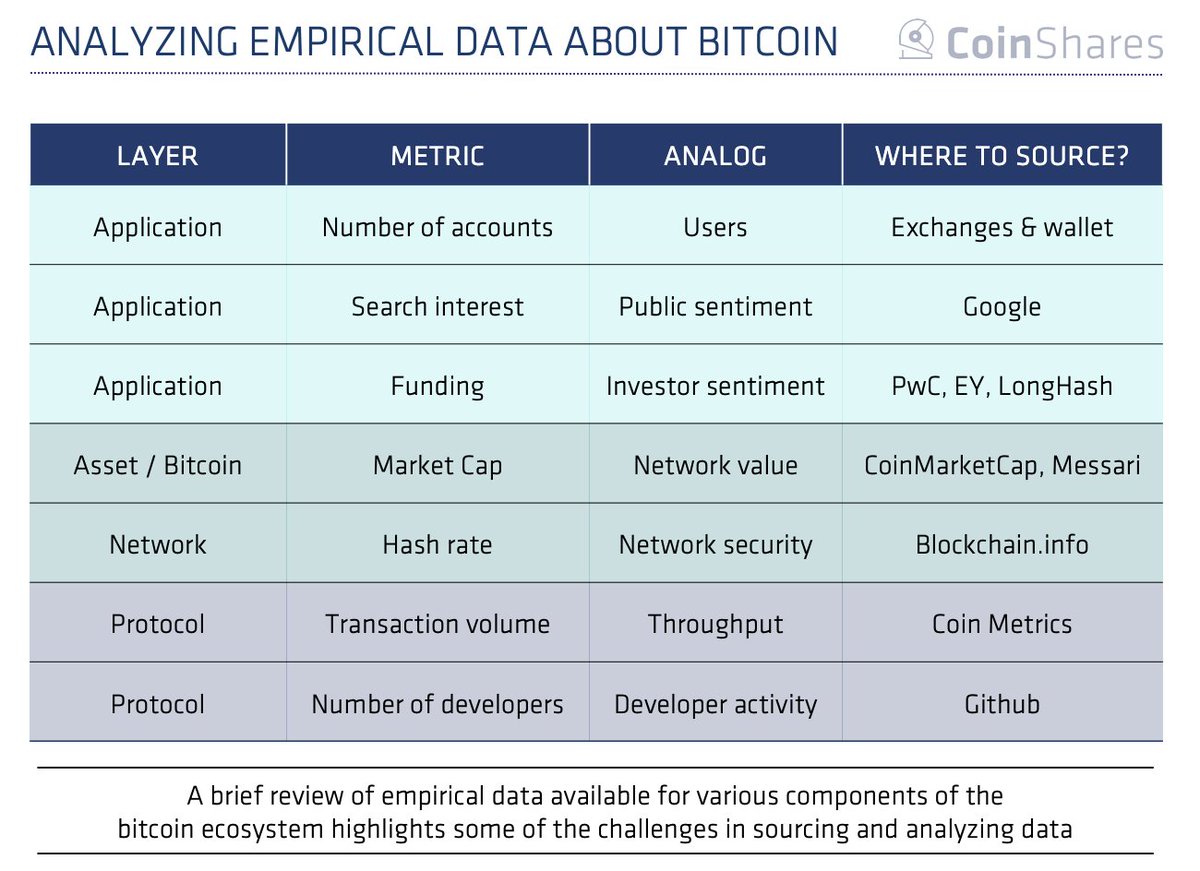

much of "crypto" still feels like pseudo-science due to a lack of data. (more here: meltdem.substack.com/p/crypto-is-mo…)

an initial review of data and sources highlights this challenge

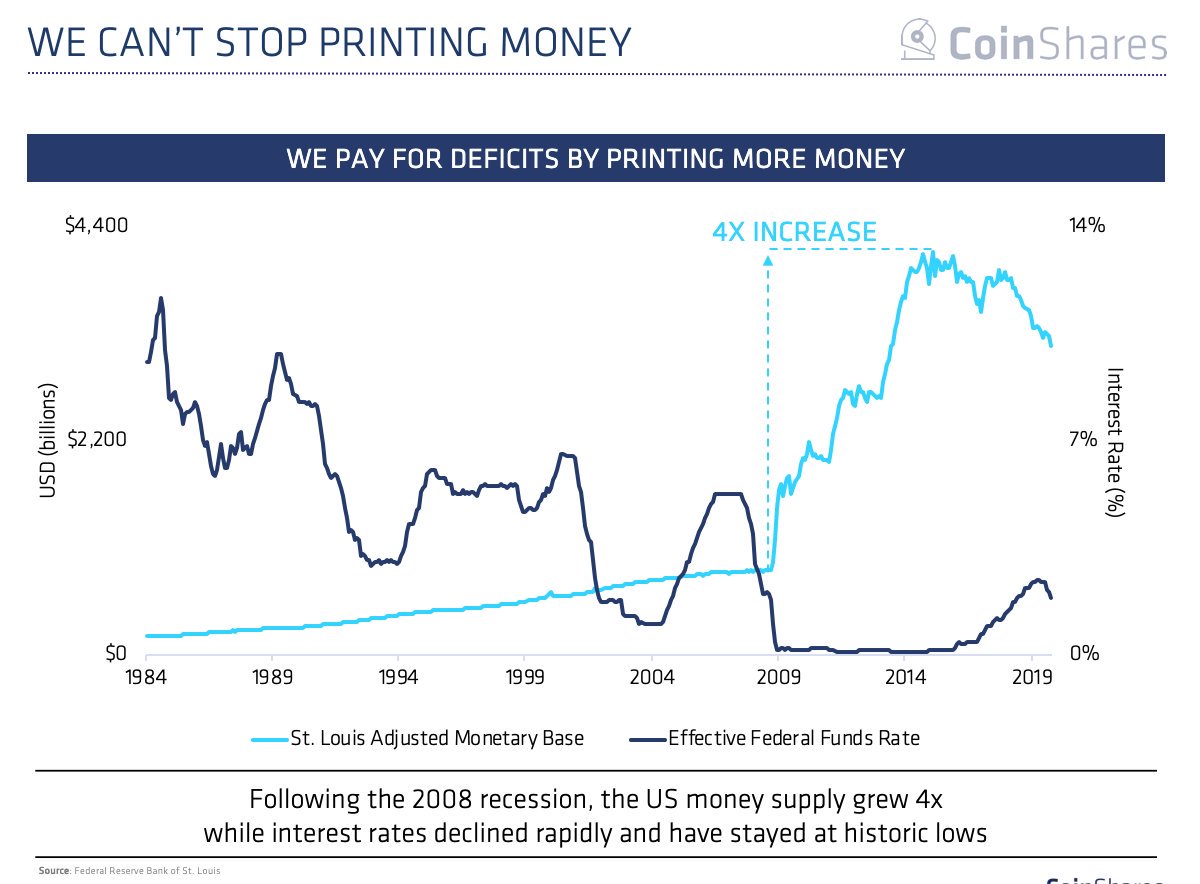

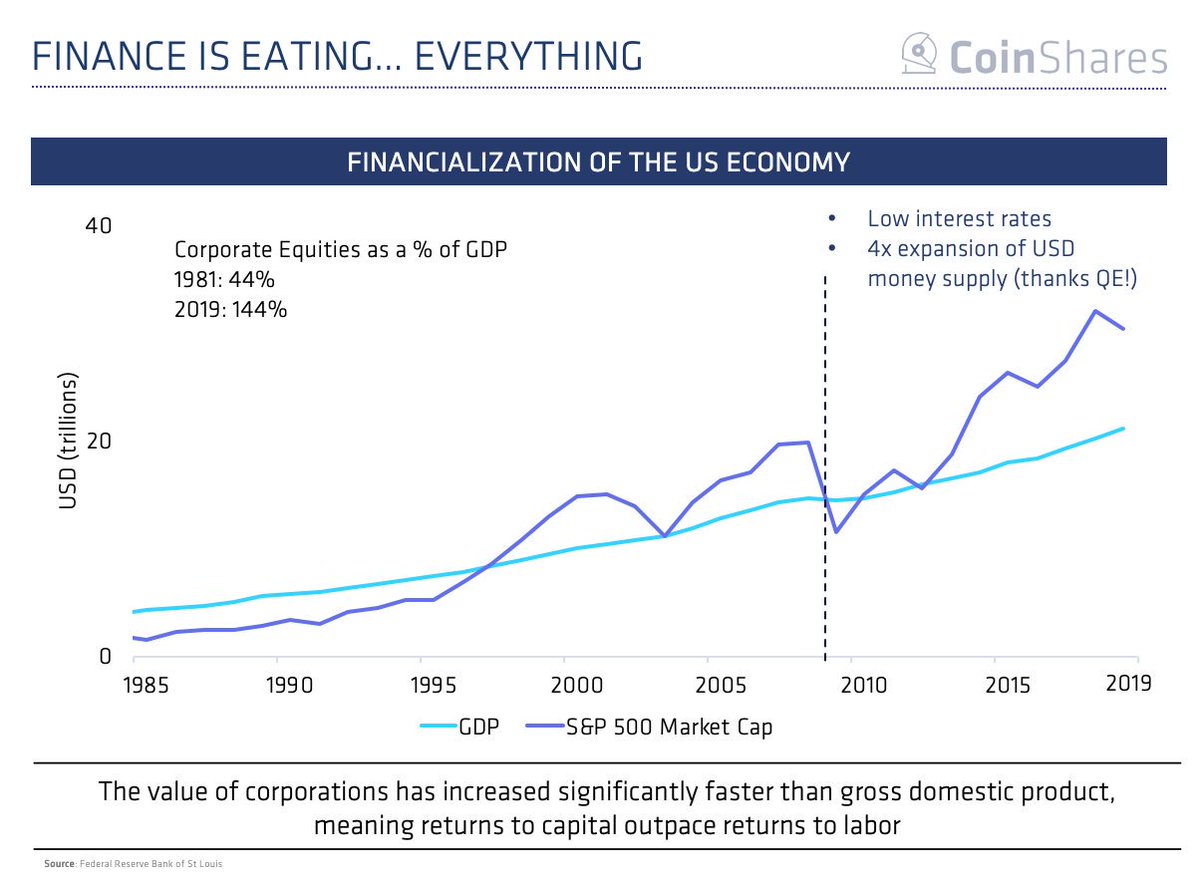

since the financial crisis, the US money supply has increased 4x while the effective interest rate has hit all time lows

returns to equity capital (S&P500) have outpaced returns to labor (GDP) - largely fueled by low interest rates and expansion of the money supply

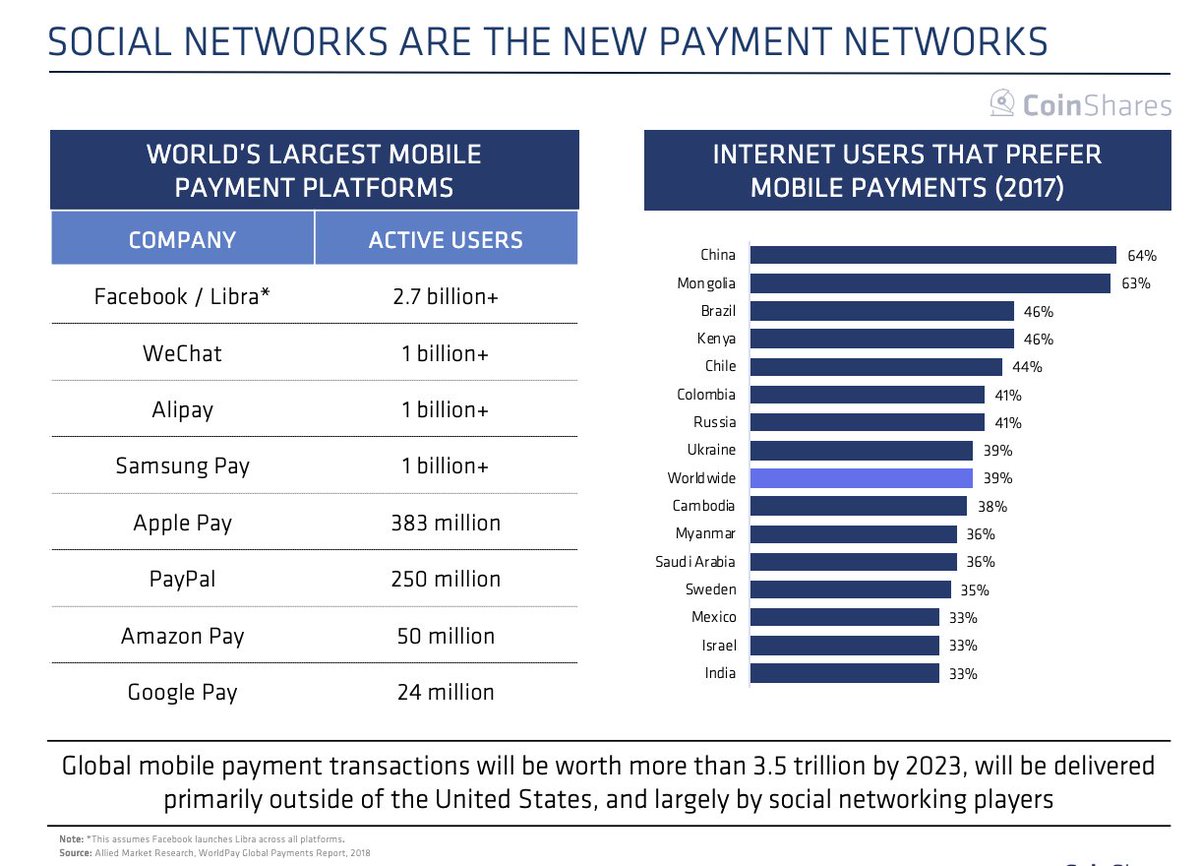

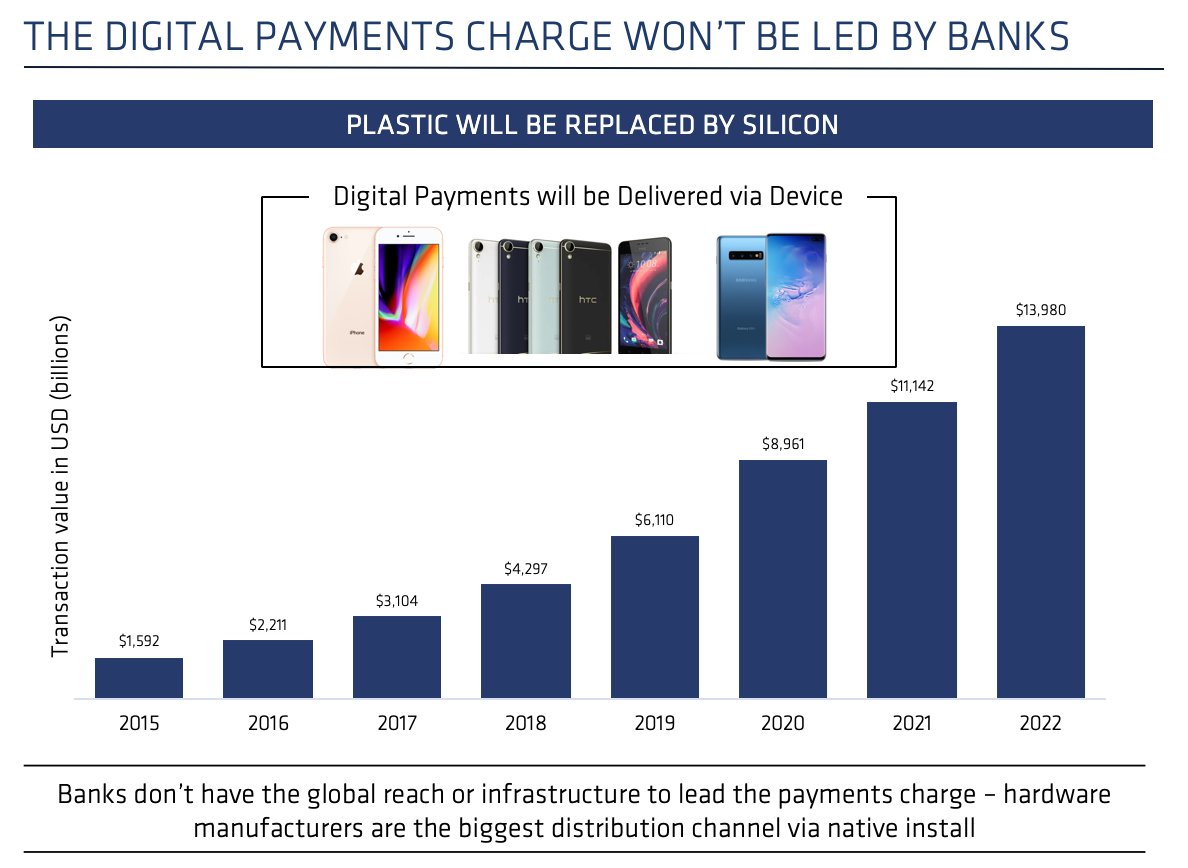

social networks are the new payment networks, and they're going to be monster distribution channels. they'll partner with handset / hardware firms on building a strong native install base.

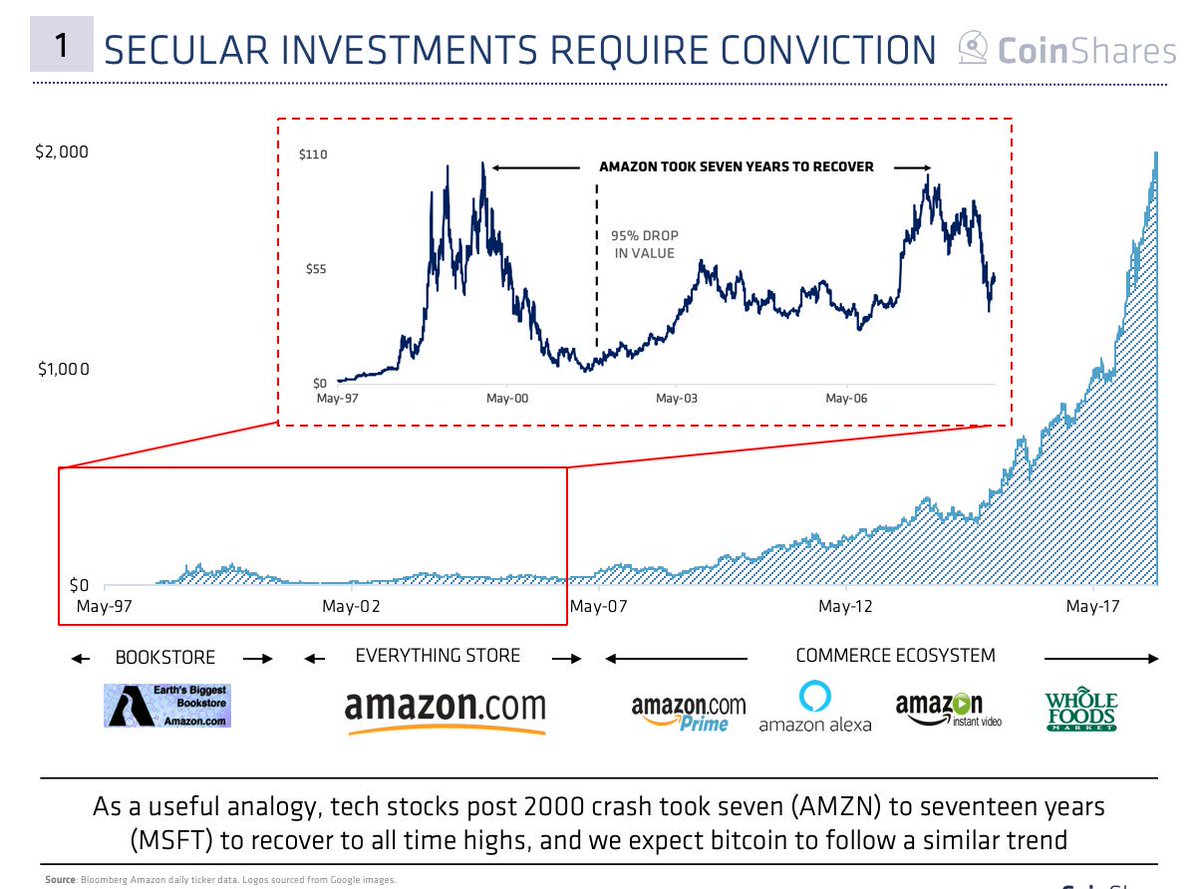

bitcoin is a secular trend. secular trends require conviction. if you bought amazon $AMZN in 99, you were underwater for SEVEN years.

cyclical trend (zoomed in) = ugly

secular trend (zoomed out) = beautiful

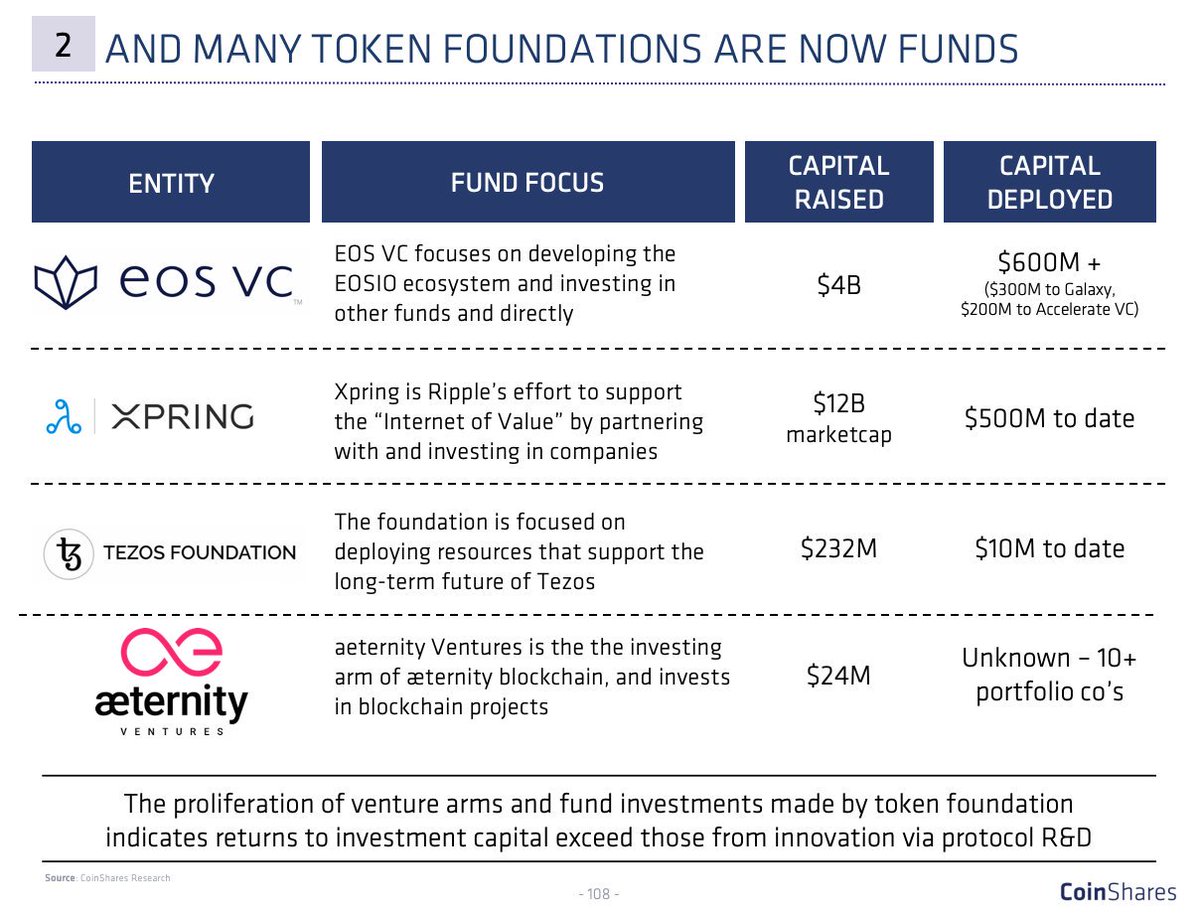

looking at the results of ICO financing, many crypto foundations are now operating as formal or informal investment funds

using a token to bootstrap open source protocol development seems inefficient...

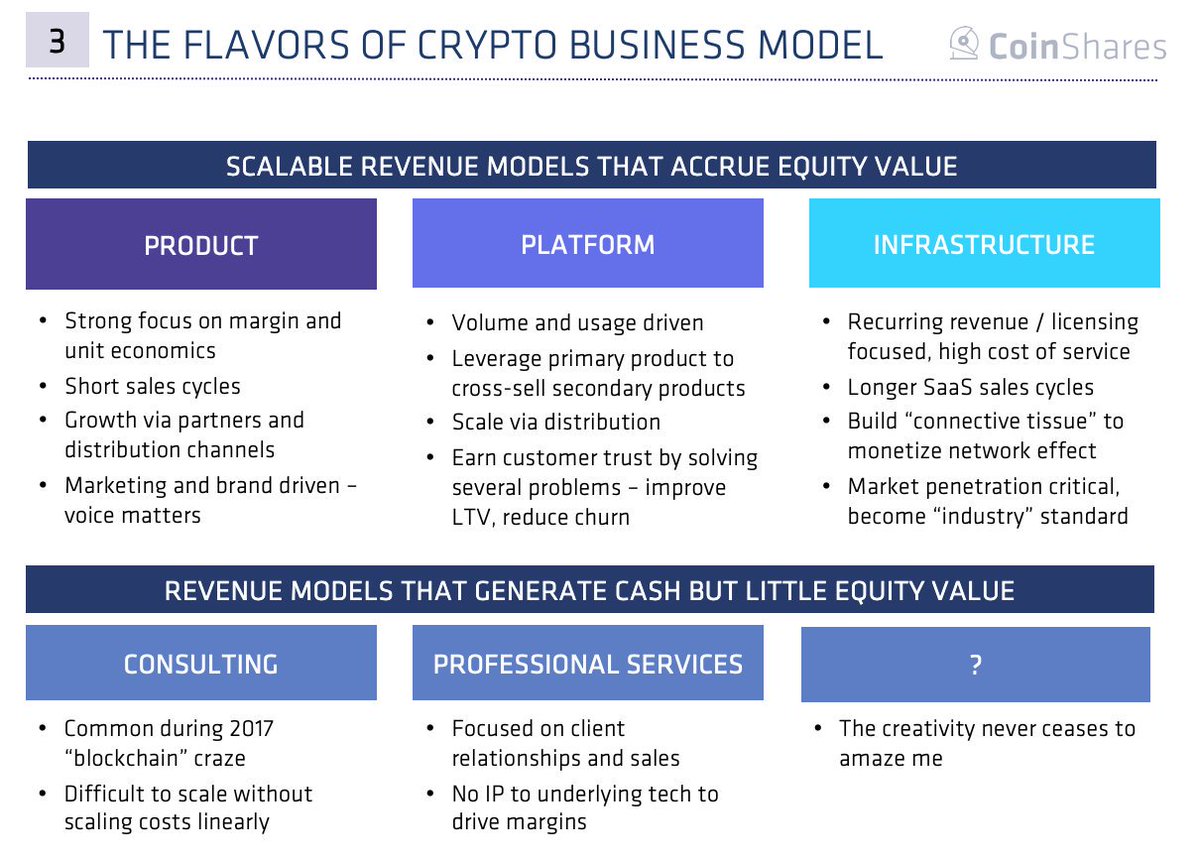

let's talk business models and how companies make money. we see three primary business models that accrue equity value, and a handful of business models that could be cash cows but are not scalable.

if advertising drove internet business models, transactions drive crypto business models!

while eyeballs + clicks = revenue in internet land, volume + spread = revenue in crypto land.

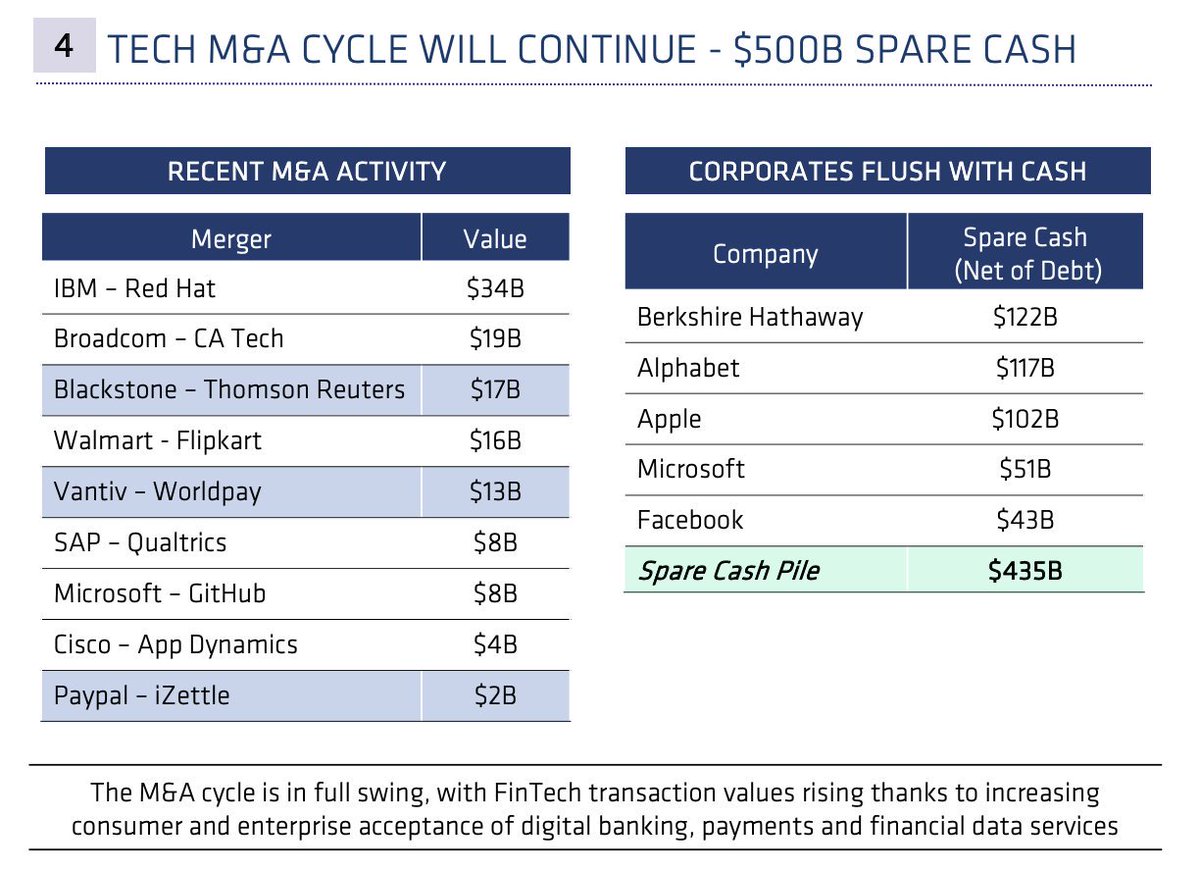

the market is ripe for M&A activity - lots of spare cash on corporate balance sheets, and 2018 was a strong year for FinTech M&A w/ 2 deals > $10B

however, not many attractive M&A targets yet - need stable revenue + FCF

while the trend is towards centralized, surveillance / oversight driven platforms, the tools of the revolution are also proliferating

thanks to @torproject @getongab @SamouraiWallet @OPENDIME @signalapp (add your favorites pls!)

we are just getting started. so buckle up, my friends, and enjoy the ride! we're right there with you.

the the moon 🚀🌙 and beyond