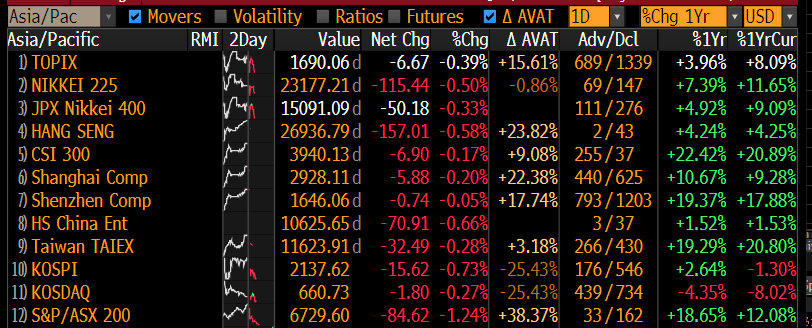

Houston, we got a demand problem in Asia!!!

South Korea has the WORST performance of exports in North Asia despite similar profile

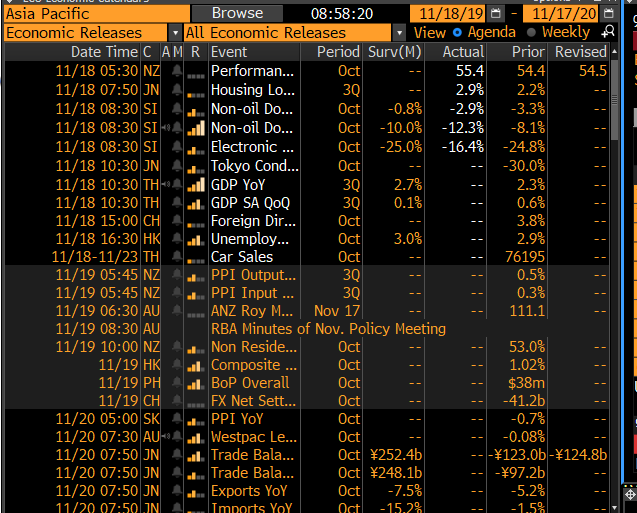

The losers are of course low-skilled Korean workers. Moon's higher wage policy accelerates offshoring👈🏻

This has led to higher investment in Taiwan & also higher growth rates while South Korea has less.

Important because the 5yr is where loans are bench-marked & signal easing direction even if the magnitude is small.

Hehlp is coming, says the PBOC, just be patient w/ us given higher CPI👈🏻