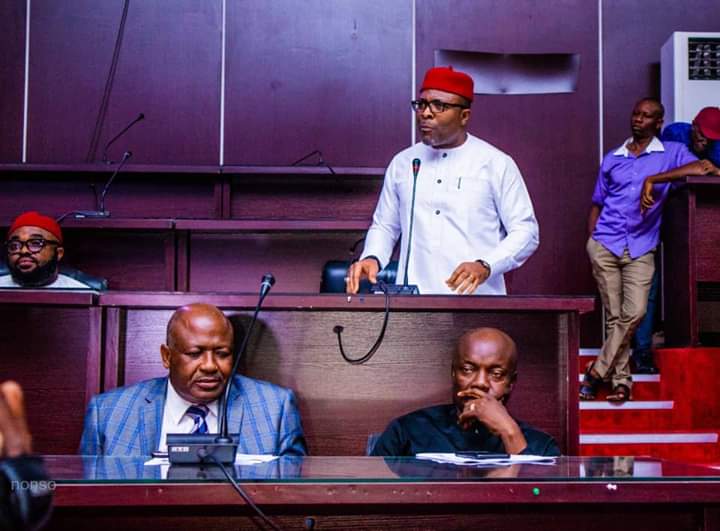

Mr. Speaker, Honorable members, having reviewed the activities of our Government thus far, may I at this point present to you the year 2020 budget dubbed “Rebuild Imo – Budget One”.

The 2020 budget proposal, which encapsulates government’s political, economic and social development and strategies, therefore aims at giving the citizenry a sense of belonging.

The 2020 budget is six-pronged, thusly:

• Rebuilding Infrastructure – especially roads and smart electricity sub-sector.

• Health delivery – with focus on health insurance, primary healthcare and cleaner environment.

• Ease of Doing Business (EoDB).

• Job/Wealth Creation and Youth Empowerment.

• Enhancement of Internally Generated Revenue (IGR)

• Aggressive road reconstruction programmes

• Smart Public Private Sector Partnerships

• Capacity building especially for the youth, provision of Agricultural inputs and development of agricultural infrastructure.

• Health insurance, primary healthcare and cleaner environment.

A. MACRO-ECONOMIC ENVIRONMENT

Mr. Speaker, Honourable Members of the State Assembly, the 2020 Budget is predicated on the following assumptions:

• FGN’s adoption of an oil price benchmark of US$57 per barrel, daily oil production estimate of 2.18 mbpd and an exchange rate of N305 per US Dollar for 2020.

I. Given the very fact the IGR is the sine quo non to budget success, the 2020 Budget has a total budgeted recurrent revenue of N140,330,473,912, representing 71% of the budget.

PERSONNEL COST

Very much unlike the 2019 budget that has N15,304,901,626 as personnel cost for Ministries , the proposed 2020 budget has N 8,949,496,411 as its personnel cost which represents a 41.5% reduction in Personnel Cost.

The overhead cost in the proposed 2020 budget will relatively increase to N 34,702,219,005 from the N17,112,658,110 that was approved in the 2019 budget.

Mr. Speaker, Honorable members, after a painstaking review of impactful variables,

S/N RECURRENT REVENUE ITEMS 2020 PROPOSED BUDGET 2019 APPROVED BUDGET

2. State share of the Federation Account 58,700,000,000 50,000,000,000

3. Value Added Tax (VAT) 13,000,000,000 12,000,000,000

19,000,000,000

5. Excess Crude Nil 3,000,000,000

6. 13% Derivation Fund 10,000,000,000 6,000,000,000

TOTAL 140, 330, 473,912 97, 690, 048, 847

S/N RECURRENT EXPENDITURE ITEMS 2020 PROPOSED BUDGET 2019 APPROVED BUDGET

2. Personnel Costs (Ministries) 8,949,496,411 15,339,776,626

3. Subvention Costs 31,422,859,611 13,602,316,397

4. Crfc (*) 16,303,247,101 16,303,247,101

TOTAL 91,377,822,128 62,176,372,227

S/N CAPITAL RECEIPTS ITEMS 2020 PROPOSED BUDGET 2019 APPROVED BUDGET

1. Internal Loans 18,970,909,061 50,000,000,000

3. Grants 952,500,000 1,688,800,000

TOTAL 57,276,798,416 179,128,022,965

S/N SECTORS 2020 PROPOSED BUDGET 2019 APPROVED BUDGET

1. Ministry Of Works 41,318,250,095

2. Economic Sector 23,249,659,233 96,482,956,846

4. Admin Services Sector 16,425,907,270 58,888,999,396

5. Counterpart Funds Exp 4,146,034,868 9,690,401,940

TOTAL 106,229,450,200 214,641,699,585

(A)

S/N REVENUE AMOUNT

1. Internally Generated Revenue 36,460,473,912

2. Statutory Allocation 58,700,000,000

3. Value Added Tax (VAT) 13,000,000,000

5. Other external revenue 3,170,000,000

TOTAL 140,330,473,912

S/N EXPENDITURE AMOUNT

1. Recurrent Expenditure 91,337,822,128

2. Capital Expenditure 106,229,450,200

TOTAL 197,607,272,328

S/N RECURRENT EXPENDITURE AMOUNT

1. Personnel Cost (Ministries) 8,949,496,411

2. Overhead Cost 34,702,219,005

4. CRFC 16,303,247,101

Total Recurrent Expenditure 91,337,822,128

S/N CAPITAL EXPENDITURE AMOUNT

1. Ministry of Works 41,318,250,095

2. Economic Sector 23,249,659,233

3. Social Services Sector 21,089,598,734

5. Counterpart Funds 4,146,034,868

Total Capital Expenditure 106,229,450,200

On the strength of the foregoing, I am pleased to give assurances of our commitment to ensure value for money and to implement the Budget in prudent, accountable and responsible manner.

Long live Imo State

Rt. Hon. Chukwuemeka Ihedioha, CON

Governor, Imo State