BOT 🇹🇭 on wed (hold at 1.25%) - hold (newsworthy out of Thailand is politics not monetary)

Taiwan 🇹🇼 hold at 1.375

Indonesia hold at 5% (50bps RRR in effect 4 Jan)

BOJ hold at -0.1% as out of ammo

Yep, that's how I talk in real life - one strong stream of consciousness of many thoughts firing at once😬...

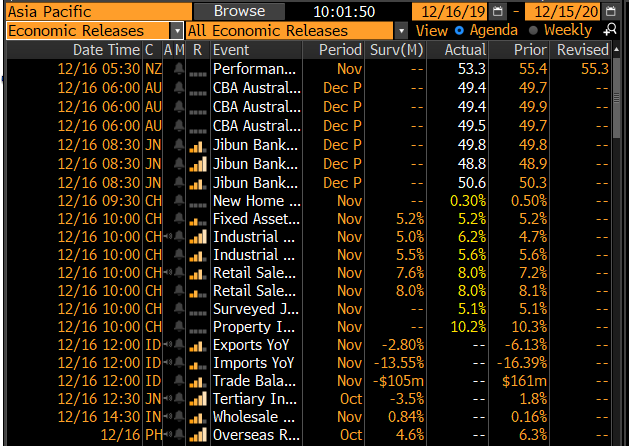

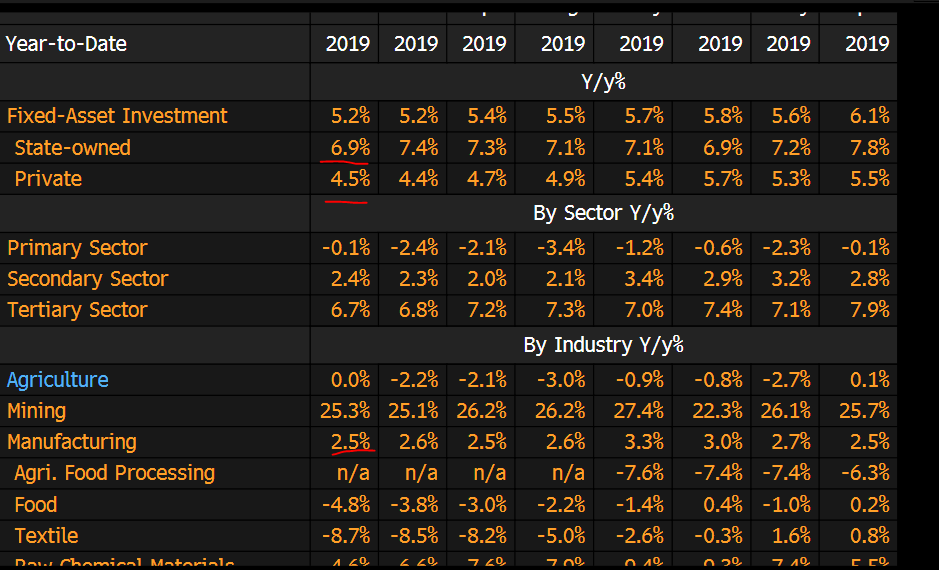

But FAI (investment) is same at 5.2% & retails sales slowed on a ytd basis at 8% from 8.1%.

In short, a spurt but investment remains weak!!! Will post details in a bit!

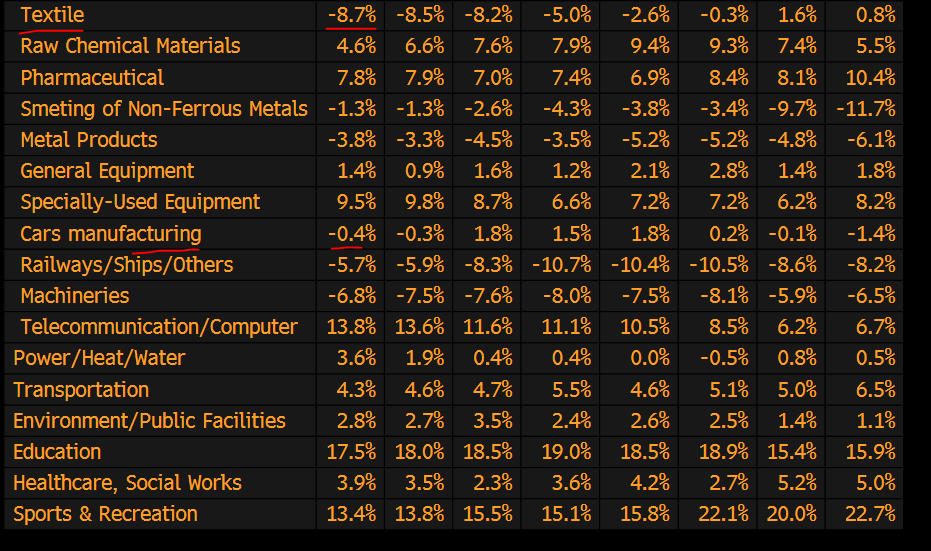

What is key about state-owned investment deceleration is that it is different from 2015 & 2016 bounce & why this time it's WORSE. Help not here yet

Cost cutting & growth seeking remain the theme for firms as they must all turn Japanese to protect shrinking profit margin. And yes, that impacts u too 👈🏻👈🏻👈🏻