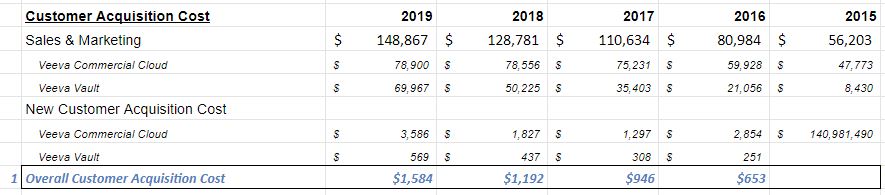

Always look at assumptions carefully.

pmjar.com/wp-content/upl…

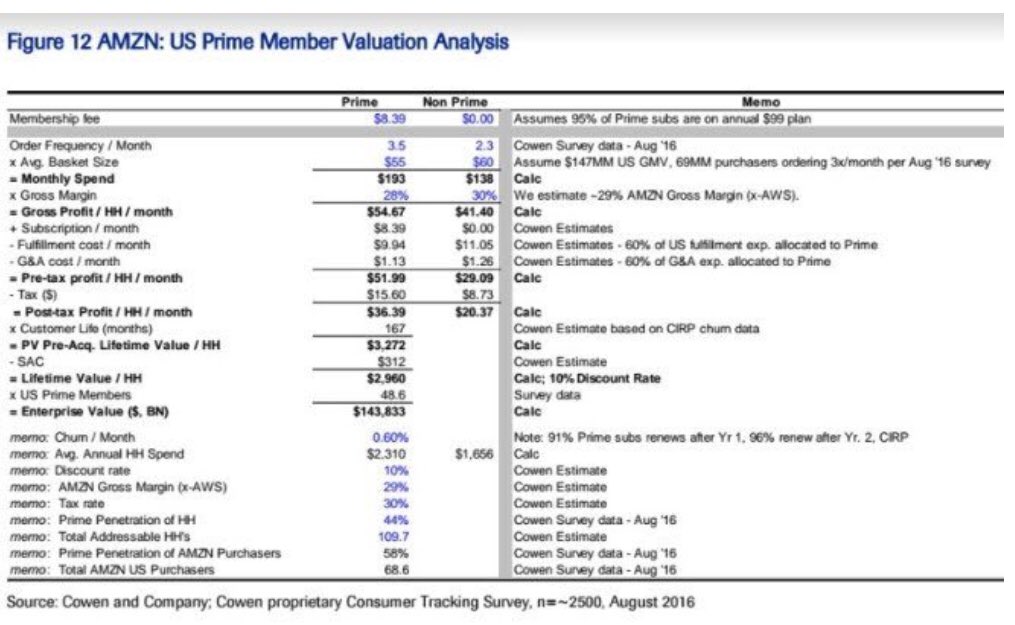

Which assumptions/model inputs produce the greatest sensitivity in the outcomes?

What should be done to reduce risk in this case?

If this was disclosed by every company would it be easier to calculate NPV/LTV?

How many methods are used to calculate customer churn? Which method is most valuable?