It's important for SaaS to recoup upfront costs thru ongoing subscriptions.

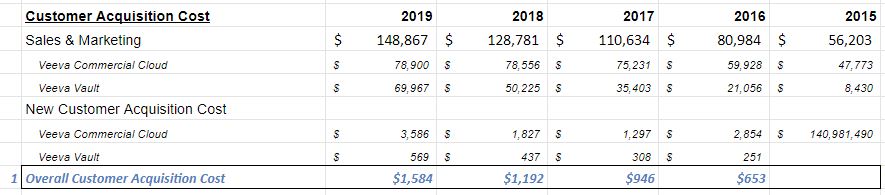

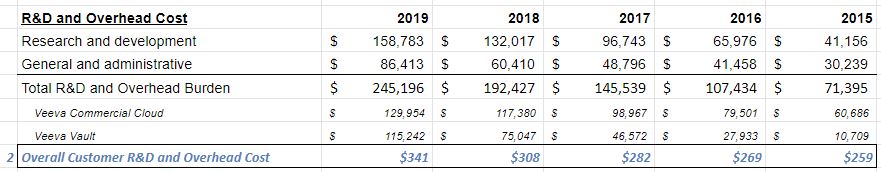

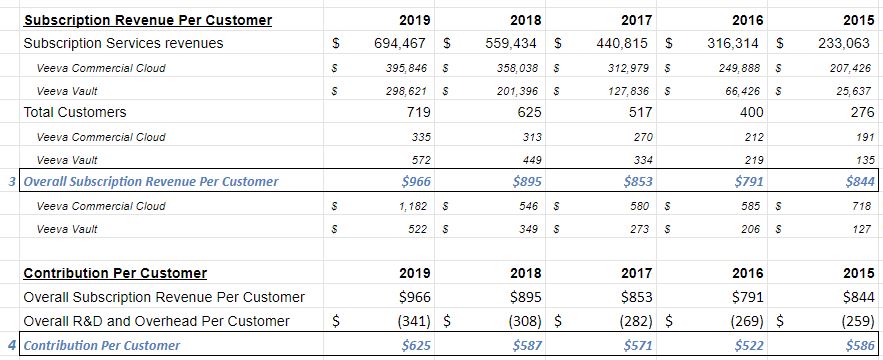

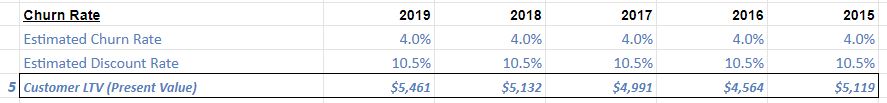

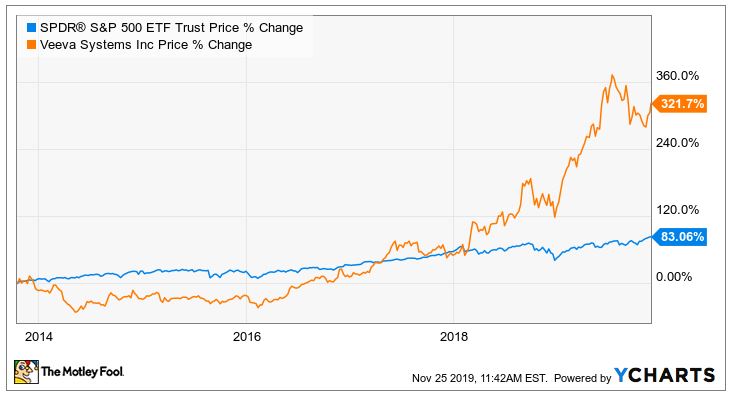

I'll walk through my process, using Veeva Systems $VEEV as an example.

docs.google.com/spreadsheets/d…

Not all growth is profitable & not all SaaS comps will be around in 10 yrs.

But look for quality. Compelling products create switching costs, which lead to high retention rates & yrs of recurring subscriptions.

I've included both below. And my DMs are open, if you have specific questions.

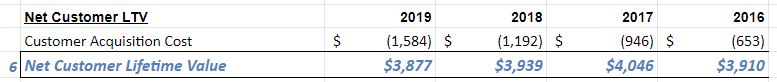

- If we use *Sub Gross Profit* rather than Sub Rev, Net Customer LTV is $2.4m

- If we also include Prof Svcs & use the Combined Gross Profit, Net CLTV is $2.9m

- If we only use Sub Gross Profit & apply 15% Churn (most conservative!), Net CLTV is still $900k