SPX Component GEX is the aggregate GEX of S&P 500 components (AAPL, AMZN, BAC, etc.), measured in 1% moves, and denominated in dollars.

It can be found here -> dix.sqzme.co

That said, it correlates strongly to SPX index gamma.

1. The January option expiration is next week, so the gamma from January LEAPS (lots of OI) is elevated.

2. The market is going berserk, because reasons. So more calls are ATM, so gamma is higher.

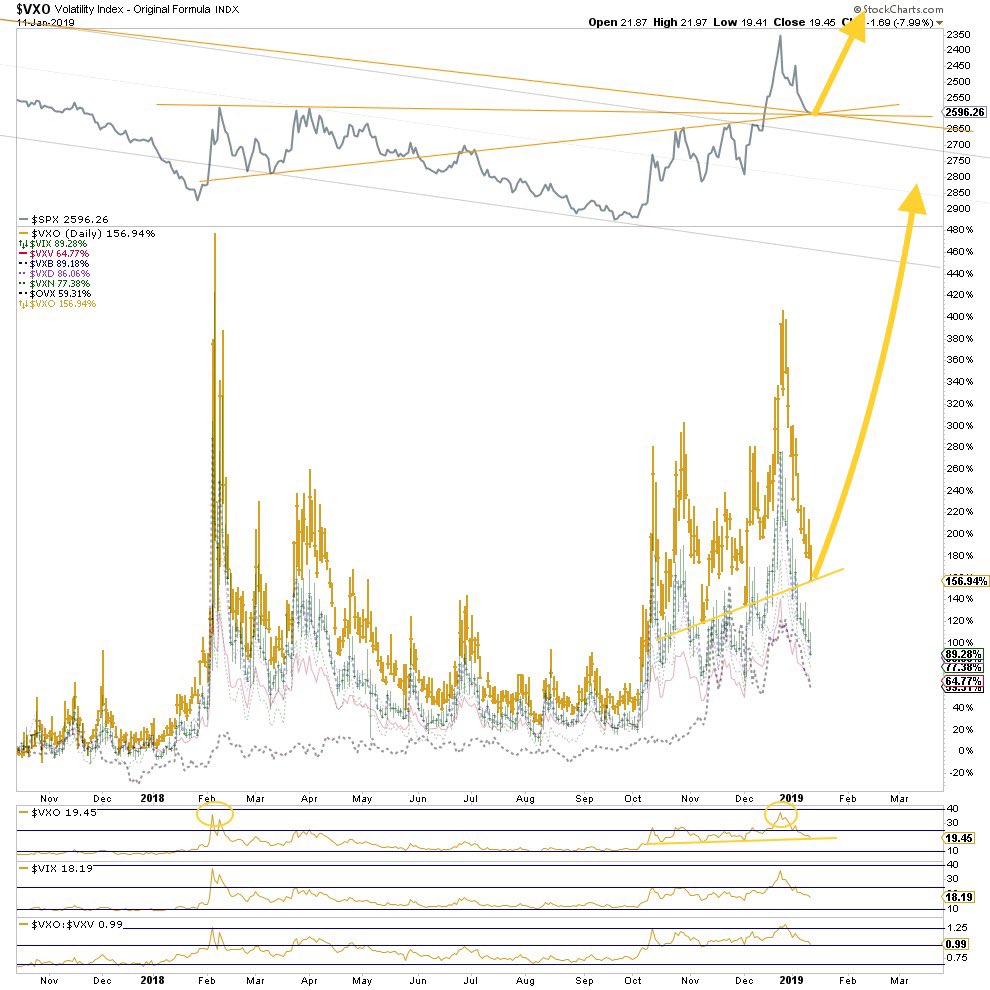

Remember Volmaggedon in February of '18? That break only occurred because the January OpEx (which caused high GEX) had passed.

Some are concerned that this could happen again.

Back in February, DIX was low, because folks were selling hard into dark pools, taking profits.

Right now, that type of selling just hasn't started yet.

Be mindful of an increase in volatility after the January options have expired, but you probably won't see the likes of Volmaggedon again.