wtop.com/dc-transit/202…

You drive a regular gas car. You pay $100 a year in net gas tax

I drive a fuel-efficient car. I pay $50 a year in net gas tax

Because I am getting one over on the gas tax, I must pay a $50 fee to get me in line with what the gas-user paid

Gas tax revenues continue to fall, and fuel-efficient drivers aren't paying their fair share.

A wickedly fuel-efficient gas car driven loads of miles annually could have the same net tax paid as a behemoth that's rarely used.

That sounds like I am subsidizing the choice to drive more. The longer the state-wide average ride (most of which are commutes), the higher the fee.

Buy an EV because you want to burn less gas, save money and not harm the environment so badly: Pay up buddy.

Buy a massive 15 mpg SUV because you have kids and might make a trip one day: You're good.

wtop.com/virginia/2019/…

These cars don't get past inspection. Either the kids (or their parents) get them up to minima, or they are illegal.

You just pay as you go. The more you drive, the more you pay. The story is here:

wtop.com/dc-transit/201…

wtop.com/dc-transit/202…

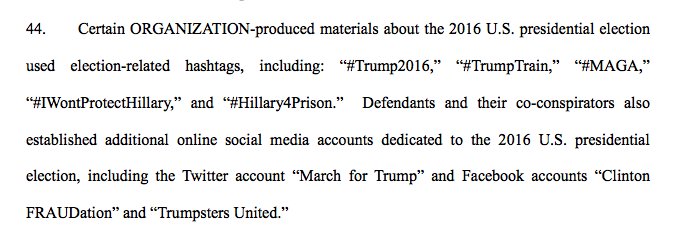

* The Federal gas tax is 18.4 cents per gallon

* It is not indexed to anything and has not been raised since 1993

* States have their own gas taxes

eia.gov/tools/faqs/faq…

Because it is a baked-in cost, drivers don't really make decisions about it. Gas has incredible elasticity of demand; when you need gas, you stop and get it.

taxfoundation.org/states-road-fu…

citylab.com/transportation…

citylab.com/transportation…