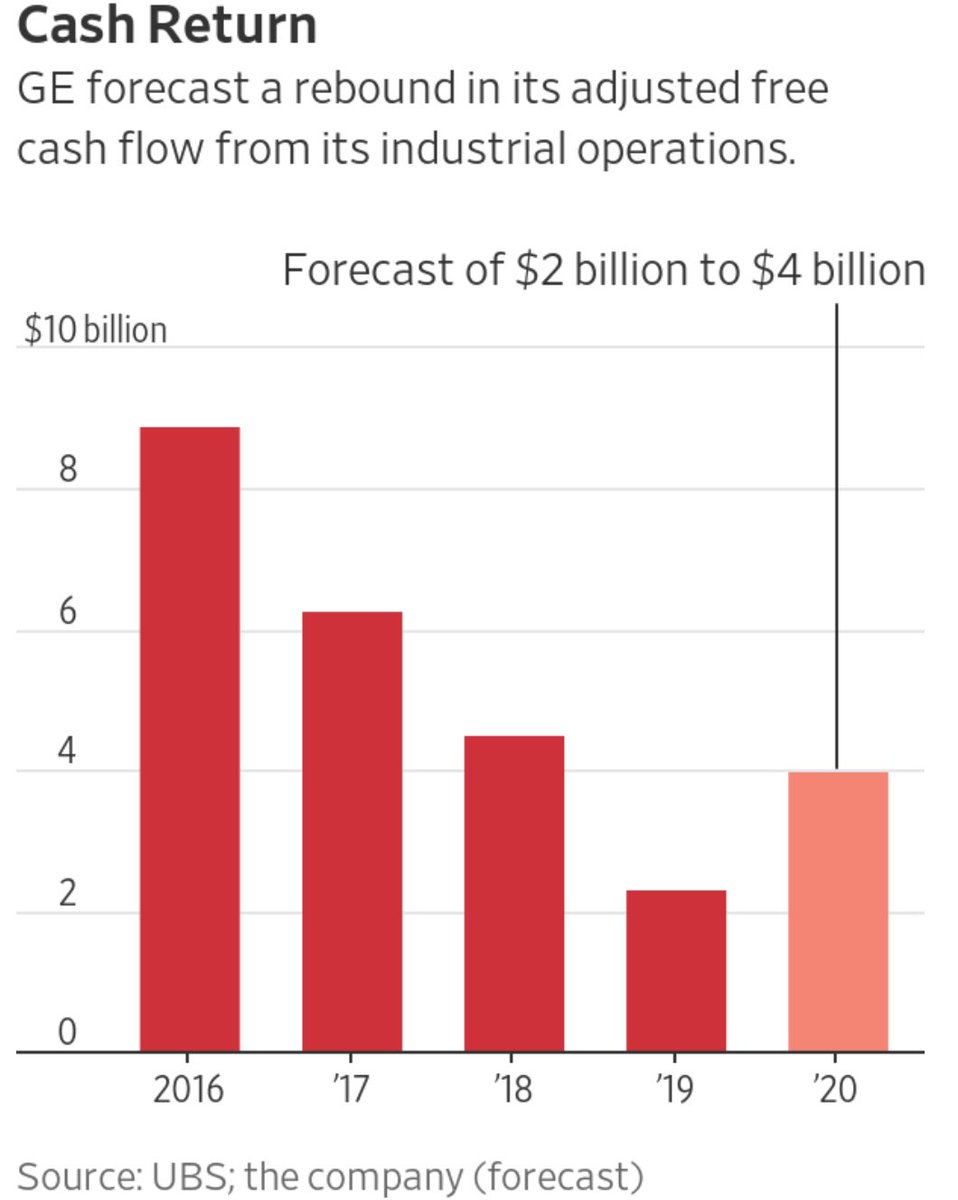

"Free cash flow from industrial operations was $3.9B in the fourth quarter. GE set a higher cash target for 2020 of $2B to $4B - above the $3B analysts expect on average." google.com/amp/s/mobile.r…

Cash is oxygen for a business and is a fact. You can count it and spend it. Earnings, especially adjusted earnings, are an opinion.

Cash is also critical for startups. No cash? No future.