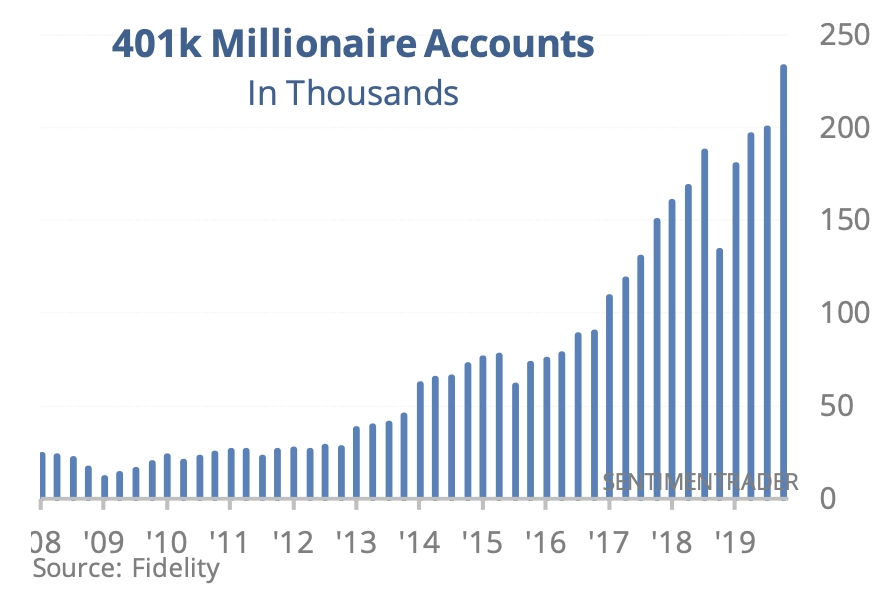

"According to brokerage giant Fidelity, a record number of their 401k account holders now have balances exceeding $1 million." — @sentimentrader

Now... Yes, we could all start a discussion about what this might mean for the stock market...

Instead, I feel a big congratulations is...

In 2020 & beyond, my focus will continue towards financial independence advice & wisdom.

And I'm not here to sell you anything!

Sure, some investors have made money speculating in cryptocurrencies, others trading long-duration bonds...

All of those stories, plus many more, make for great articles in the financial media. However, your chance of...

Historically, for centuries, most success — with highest probability — has come from investing in income-producing businesses & real estate of quality that stands above the rest.

Keep it simple!

All of that stuff will just confuse you & create forced mistakes through your investment life.

If you can focus on the simple but extremely important things such as growing your income & reducing your expense.

If you invest only in quality assets, at reasonable prices without ever overpaying.

You will beat the 99%.