Here we go. All about economic impact of virus!

Before we talk about the impact of China, we must discuss the role of China in global TRADE & INVESTMENT:

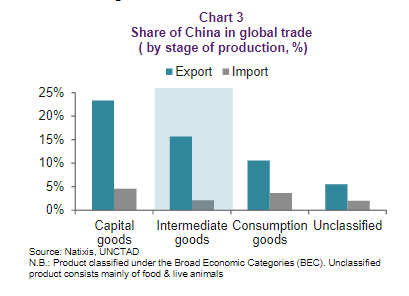

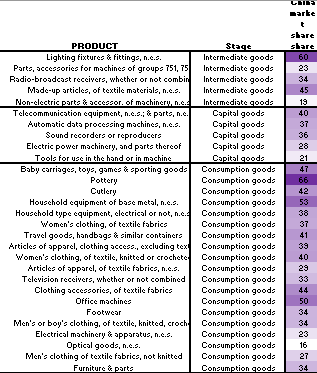

*1/5 manufactured items are exported out of China - that share higher for some electronics, textile and household goods. So China is the manufacturing center.

Exposure is through SUPPLY CHAIN (intermediate goods - as in if u don't get parts, can't make it) and also through IMPORTS of FINAL GOODS.

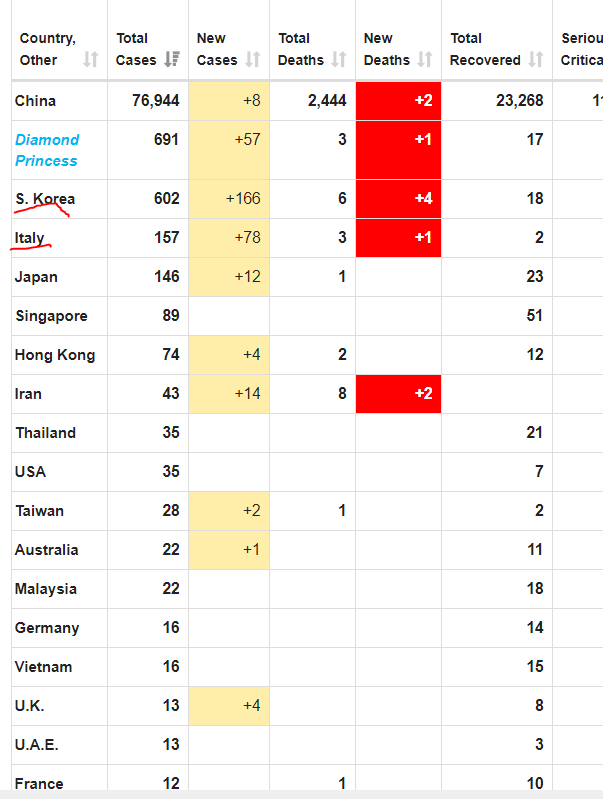

What has happened w/ the virus? How does that matter?

Since the infection has slowed ex Hubei, normalization BUT...

scmp.com/tech/big-tech/…

A massive risk. And that risk is more concentrated for some & can be mitigated by deep pockets but on a macro basis, that RISK DOESN'T GO AWAY.

That's just China supply chain.

And u know that what happens in China matters for the REST OF ASIA. That's where we'll go next.

Okay, but who owns these Southeast Asian electronic & textile production firms???

"If you think trade-war made global supply chain sexy, then well the corona virus is gonna make it SEXIER 😉."