@CarnegieEndow @natixis

carnegieendowment.org/2020/02/13/eco…

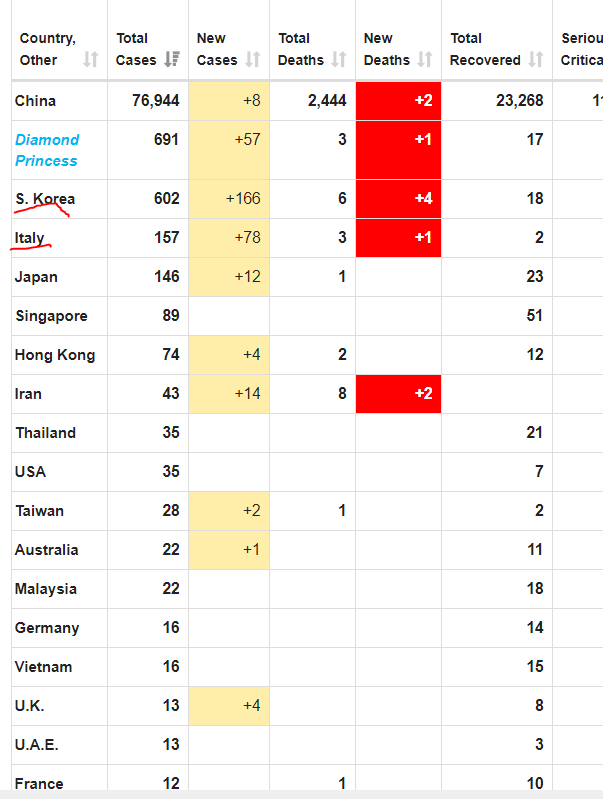

South Korea cases are 602 & 6 deaths & 18 recovered. Italy got 157 & 3 deaths. Both SK & IT are big economically (1.5trnSK & 2trn IT)

On the policy side, both fiscal & monetary policy are deployed but targeted...

What's most key is really the willingness of people to take RISK & so

Beyond China, let's talk about South Korea & also Japan (and of course Southeast Asia).

Anyway, let's move on. China is #1 of Asia in economic size & Japan is #2 & South Korea is #4 (India higher).

So? SK got 602!

And these are globally significant markets - not just for Asia but the world.

As South Korea's my bread & butter. Let's discuss! SK growth slowed to 2% in 2019 & got double digits decline of exports.

That leaves weak domestic demand onshore as SMEs suffer too. OK, and then the trade-war hits & then the virus.

Btw b/c domestic demand isn't a source of growth does not mean it is not important

What's the impact of this? Weaker consumption. So what? It means HELP IS NEEDED!!!

a) Chanel News Asia at 915am on 26 Feb to discuss Southeast Asia & the corona virus

b) CNBC International at 1130am on 27 Feb on South Korea & postmortem analysis of BOK decision 🇰🇷