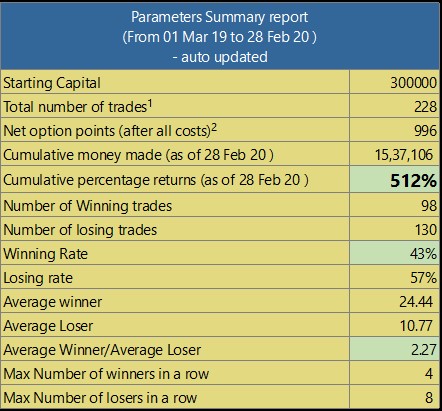

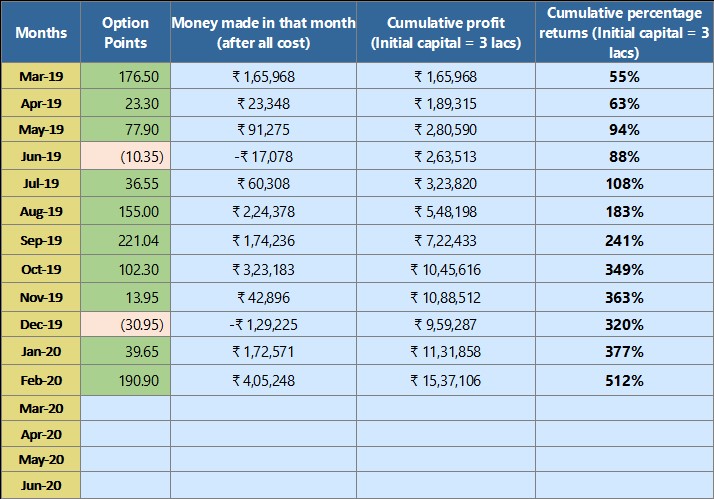

1. Starting capital - 3L

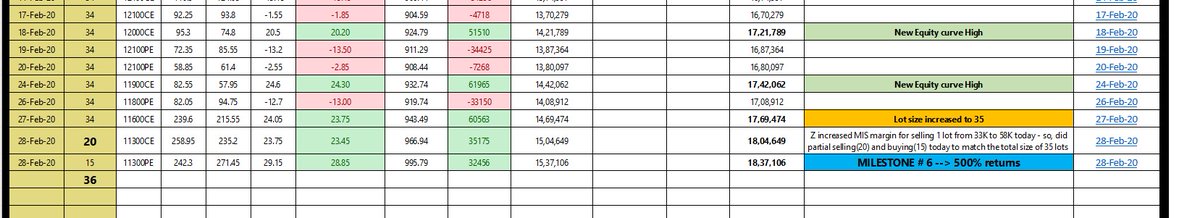

2. Made 512% (milestone #6)

3. Acct equity = 18.37L

4. Cumulative money made = 15.37L

5. Options pts = 996 (average = 83 pts/month)

6. Current lot size = 36

marketswithmadan.com/intraday-optio…

(1/19)

1. Made 512% (with compounding) & 83 points per month on an average (ard 150/160 pts in futures equiv)

Never thought about any of these numbers (even in my wildest dreams) when i started. It was a crazy ride !!

(2/19)

3. Good money can be made in both the forms. In options, wecan trade multiple strikes & deploy more money. Execution will start to play a big role once we move up in size

(3/19)

He made my intraday trading life much simpler and easier..zero stress

(4/19)

6. 3L to 15L was in options buying & as i have never done directional option selling ever, will do option selling from 15L to 30L 😊

Buying or selling - call will be taken after 30L

(5/19)

a)"See, i told you" - Daytrading does not work(most probably the person would have failed in daytrading and hence, the comment) 😊

(6/19)

c) Mkt condtions were conducive initially and now, your system lost edge...

(7/19)

Most of these comments came in as innuendos but over the next several months, they slowly stopped coming 😊

(8/19)

9. In intraday, there is a slight advantage in option selling but it also depends on the average time of the trade.

More on this topic after few months.

(9/19)

11. Many got inspired from seeing this live intraday options account and started doing it themselves..atleast dozens. So, glad to see it 🙏

(10/19)

Wanted to quote a thirukural here - "தெய்வத்தால் ஆகாது எனினும் முயற்சி தன் மெய்வருத்தக் கூலி தரும்" - talks about 'trying' 😊😊

(11/19)

No anxiety, no stress, no managing/adjusting trades every minute - at the end of day, we need to protect our health...not just the account

(12/19)

Like one big trade to take the account from 50L to 1Cr...

(13/19)

14. Act on an idea ->Learn from mistakes -> Build on it -> Repeat the process. This is what defeats uncertainty and markets are no exception.

(14/19)

16. It is easier for many of us if we walk the path someone has walked already...

(15/19)

Hope you guys take mechanical trading + Money mgmt + execution (holygrail) + compounding the account seriously now.

(16/19)

18. There will be lot of missed trades, wrong trades, failures, frustrations, agony, ppl laughing/ridiculing at you and myriad number of things..

(17/19)

19. Create a mechanical system ->devise MM -> bring capital -> work on things that are making your execution difficult (has to be easy) -> take all the trades -> gain psychological resilience (it happens simultaneously)..

(18/19)

Hope this thread would be of help to someone out there 👍

Happy trading all and have fun !!

(19/19)