Thread reviewing the Bank of International Settlement's paper on Fintech & BigTech lending

bis.org/publ/work779.p…

⬇️⬇️⬇️

(1/15)

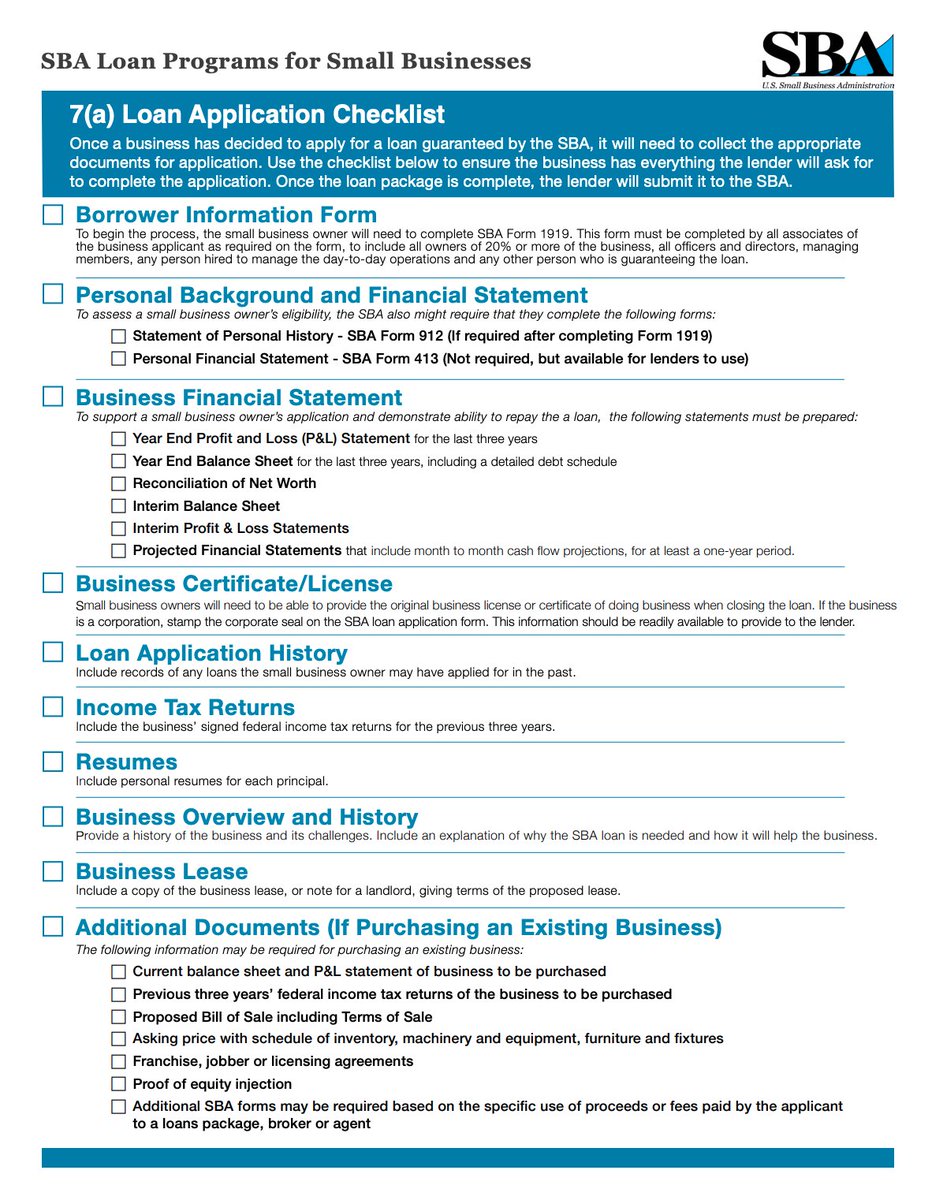

Check out this list of requirements by the US Small Business Administration to obtain a loan. Plan a few weeks to work that off

sba.gov/sites/default/…

(2/15

(3/15)

(4/15)

(5/15)

(7/15)

(8/15)

(9/15)

(10/15)

Check out this introduction if you're interested. Also being not a data scientist, it's an interesting concept.

(11/15)

(13/15)

(14/15)

Check out the full paper here:

bis.org/publ/work779.p…

(fin)