The year is 2003. RBI issues a new banking license & Yes Bank is born. Meanwhile, Ashok Kapur & Rana Kapoor take charge. The former, calm & Composed. The latter Brash & Aggressive. The Yin & the Yang. They make perfect partners

Ashok Kapur passes away in the 2008 Mumbai terrorist attacks. Rana Kapoor tries to consolidate power. Ashok Kapur's wife stages a boardroom battle. Rana Kapoor refuses to relent. He eventually comes out on top

Aggressive growth is the mantra. The bank tries to find as many corporates who are desperate for a loan and makes them pay top dollar each time they borrow.

More loans, more fee, more interest, more everything. Life's great

The model works. Yes Bank is on a growth path like no other. But it comes at a cost. Some of their borrowers look too suspect. Can they honour their repayment obligations if their fortunes turn for the worse? Questions linger.

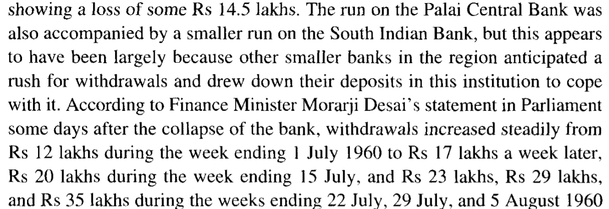

Many corporates in India are now struggling. They can barely make their repayments. Yet, Yes Bank continues to report great numbers. It seems their borrowers are finding ways to keep coming good on their payments.

What's the missing piece?

Can't make your interest payment? Here's a new loan. Running out of money to keep operations afloat? Another loan will fix it. Anything to show the world that all your loans are being repaid in full.

Or have they already noticed? Is the party finally over?

RBI forces a review. It calls on all banks to come clean. How many loans have gone bad? How many borrowers are unlikely to pay in full? What's the total loss you will accrue in the process. Tell us now and tell us everything

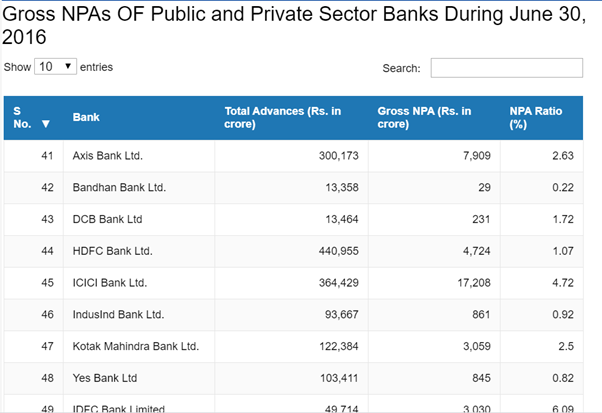

RBI finds a divergence in Yes Bank's reported numbers. It's a travesty. So many bad loans. So many borrowers on the brink. It's nothing like they said it was. And it's Rana Kappor's fault. RBI refuses to grant him another term as CEO

There's an exodus now. Members of the top management are leaving en masse. The stink is far worse than anyone ever imagined it to be. Rumour has it that Yes Bank might never recover close to a 100 billion rupees in loans.

A HUNDRED BILLION RUPEES

As it dawns on the new mgmt that most of their borrowers are likely to default, they know its time to pull all the stops and raise more money (from investors) so that they can continue to honour their financial obligations.

YES BANK NEEDS MONEY ASAP

Meanwhile, RBI stands on the sidelines and keeps watch.

One look at Page 54 of RBIs latest Financial Stability Report and you will see a sombre reminder of what happens when a big bank fails.

The shockwaves will push the entire banking system to the brink

Insiders fear that if Yes Bank defaults on its financial obligations, they might go bankrupt. It is inevitable. Once word hits the street, depositors will rush to withdraw every single penny they hold. A line must be drawn and it must be drawn now

RBI finally takes control. It supersedes the board and imposes a withdrawal limit. The Saga is finally at a climax

But the devastation it left behind is unparalleled. Dejected customers. Worried shareholders. Despondent Business partners.

Praying &Hoping

The good news is nothing lasts forever.”

― J. Cole

Not even diamonds