What do you say of a Bank where big borrowers turn into problematic assets?

financialexpress.com/industry/banki…

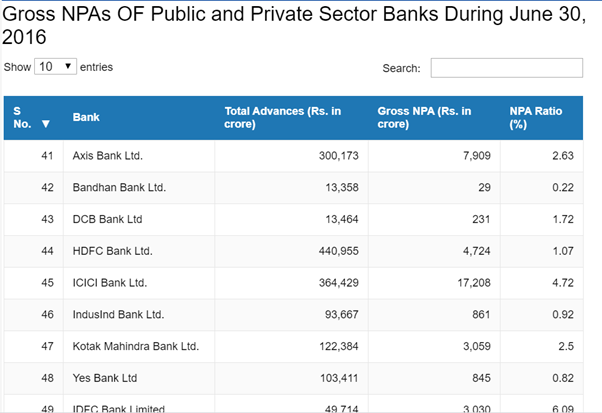

Rising NPA's: Apart from these, Yes Bank suffered a dramatic doubling in gross non-performing assets over the April-September 2019 to ₹17,134 crores.