This is a communication failure. You don't impose a moratorium on a major bank without a clear end game.

Markets hate uncertainty.

It will create panic. RBI's goal should be to not create unnecessary panic.

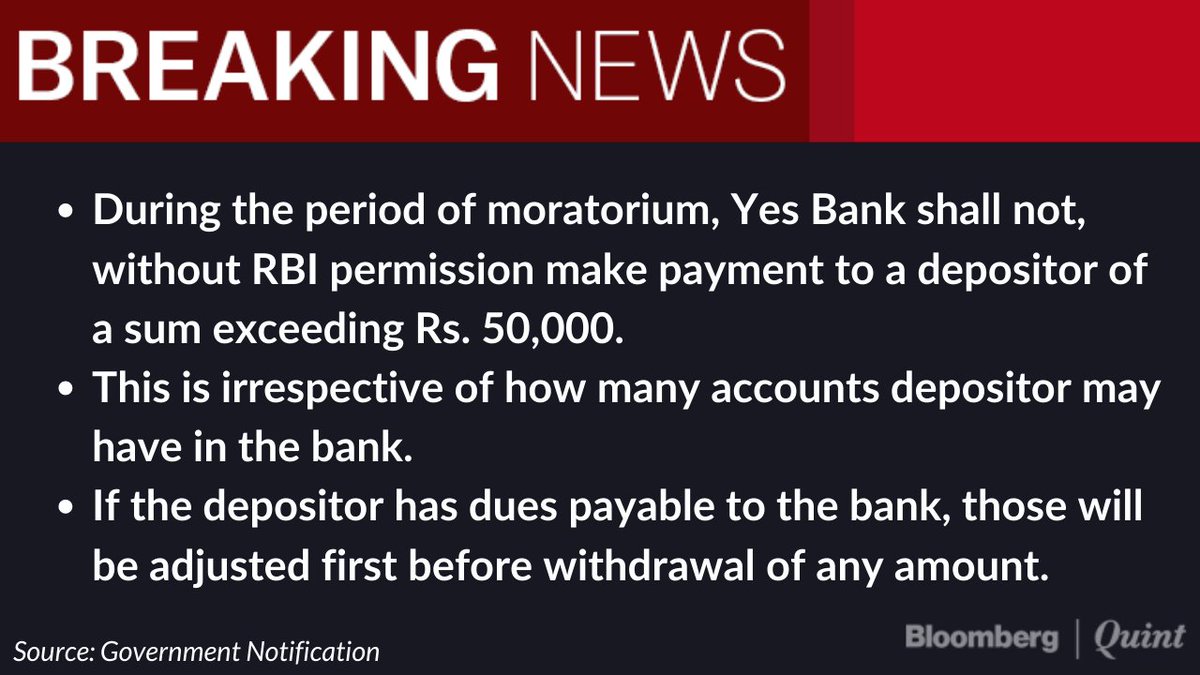

50k withdrawal restriction is presumably to prevent run on the bank and buy time.

Depositors don't like arbitrary restrictions. Every depositor will withdraw 50k.

It will create a mini-run. I hope they are prepared.

Get everyone in a room, and come out only with a complete solution (bailout, buyout whatever).

Has been done before by Volcker and JPMorgan.

Cannot play this out in the public domain over days. Crucial trust is lost in the banking system.

Shout from rooftops that a solution is in place and they are figuring out final steps. Like literally use all media and comm channels at their disposal to repeat this message all day long. Use the 24/7 news cycle for full benefit.

16,18,325. That's the number of retail shareholders holding #YesBank as of December 2019. HT @ActusDei

8 crore shares YES bank delivery today. HT @varinder_bansal

"No one issued a sell report at 400 or 300"

That's the point of a black swan event. If everyone saw it coming it wouldn't be this disaster, would it?

"This shows equities are risky, avoid them"

More companies become multi-baggers than go bankrupt. Those are the odds. Don't judge from outcomes.

As one good outcome should not make you bullish, one bad outcome should not make you bearish.

"If you can keep your head when all about you are losing theirs and blaming it on you" - Kipling

Repeated often, but not enough times.

Don't fall in love with any one stock.

In hindsight, everyone will say they knew #YesBank is a value trap. But do note number of retail investors grew in the last 2 years by 8x.

No. Inform the investor but don't block a transaction. Blocking creates more fear and panic.

In fact, show that all systems are running smoothly to build confidence.

We blame regulators to be over-reaching, this is the same!

It also creates a precedent that someone someday can block an outcome with the reason that it is better for you. It is a slippery slope.

Give investor all the information, don't force a choice.

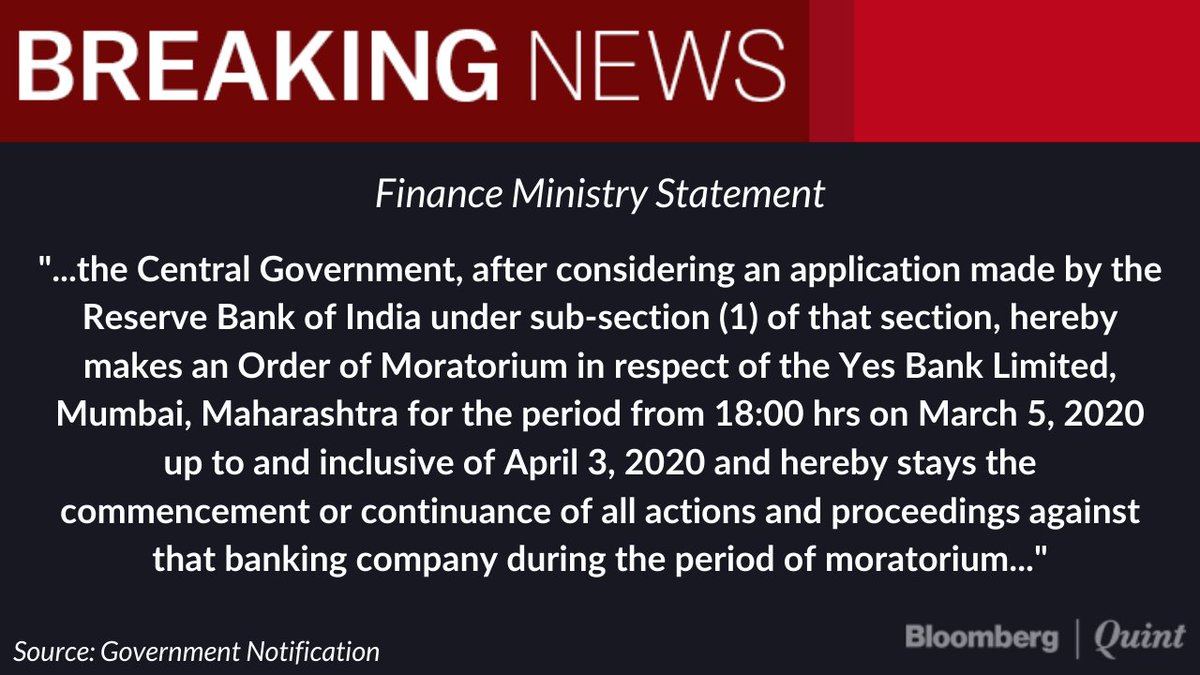

RBI Governor @DasShaktikanta "you will see very swift action from RBI, 30 days is the outer limit. RBI will come out with a scheme very shortly. Depositors interests will be fully protected"

Still, should have announced with "scheme" in place.

Every big bank CEO jostling for space on TV - we have/haven't been invited to take part in the bailout...

I want to assure every depositor's money is safe, and I’m in constant touch with RBI: Finance Minister Nirmala Sitharaman

But first we will wait for a day and watch a circus unfold!

#NoEmpathy #YesBank

Perpetual debt marked at zero. This is what most MF schemes owned.

The loss of trust and the discomfort caused is real. It affects the not so well off worse. Policy has to come with a huge dollop of #empathy

It is not a spreadsheet restructuring.

Wonderful reporting by @ActusDei @livemint

livemint.com/industry/banki…

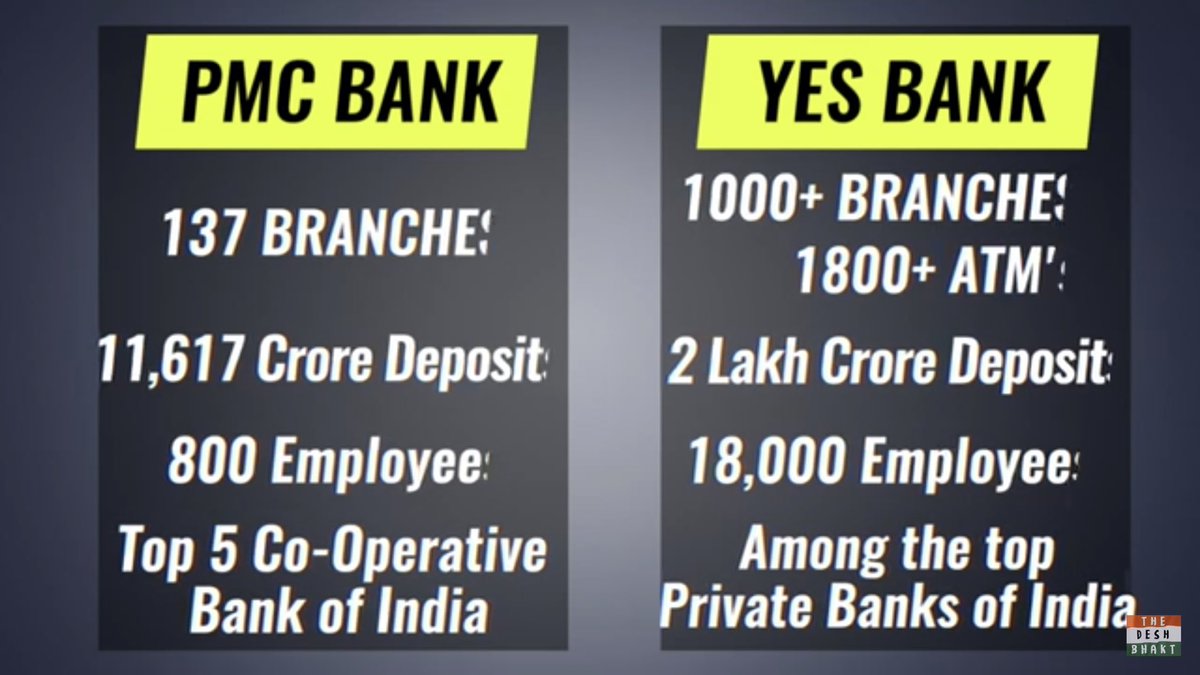

HT @TheDeshBhakt

Do you know section 45 of the Banking Regulation? Section 35A of the Act ibid? India's bankruptcy code?

If you don't, do not touch Yes bank stock with a barge pole.

Bankruptcies are technical. Trade rumours on your own risk.