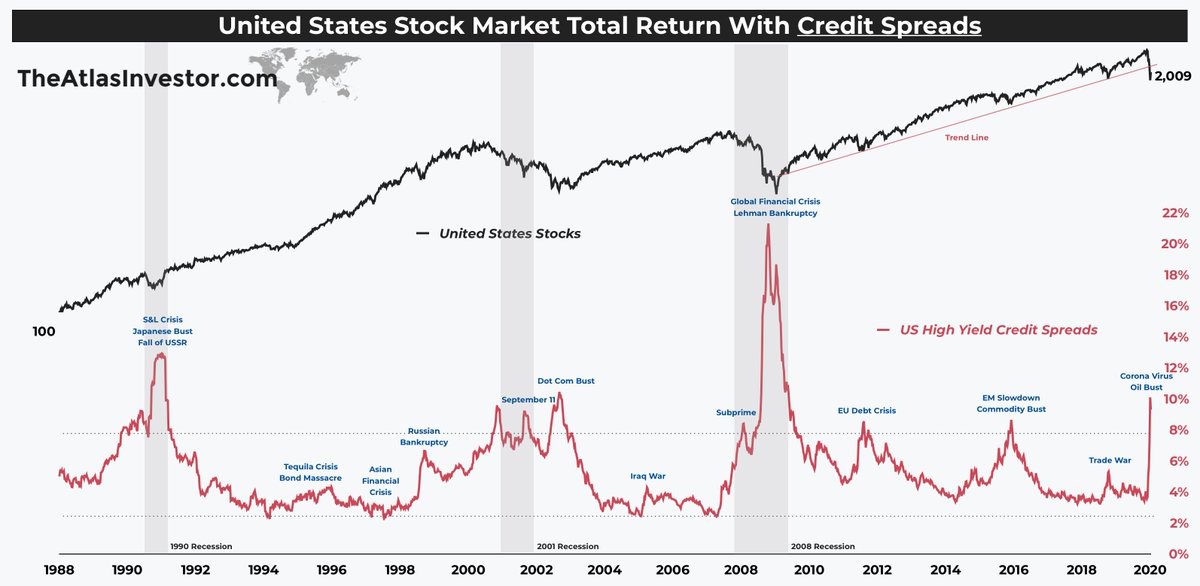

Like so many others, I've been waiting (hoping?) for the stock market to crash properly.

Now it has, and it could go lower. Who knows.

But why?

Because I've started a trust fund for my unborn kid(s).

Therefore I just want something passive and something that stands a chance of doing well.

Investment parameters?

I'm going to start with a decent lump sum. This should help a lot because it's very wise to back up a truck after a crash.

I'm also going to buy every single month (Small Cap Value index) with a meaningful amount & increase those contributions by 10% every single year.

I'm fortunate to have a very high saving rate (70%+).

Also discussed the lump sum & contributions, which will stay well above inflation (I happen to think inflation is north of 5% & maybe more).

If you ask me today, I think it's a perfect time to start investing.

However, ask me how I went in about 30 years time. 😂