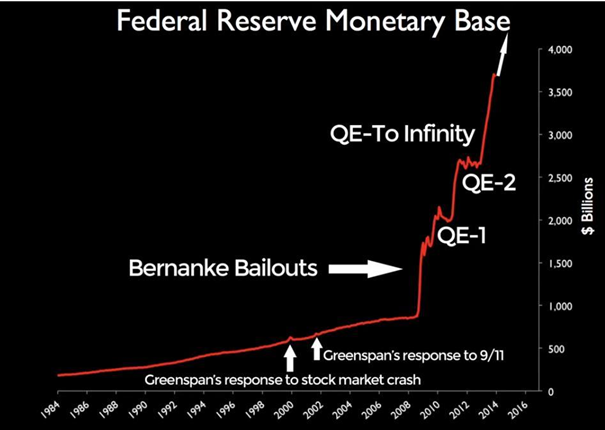

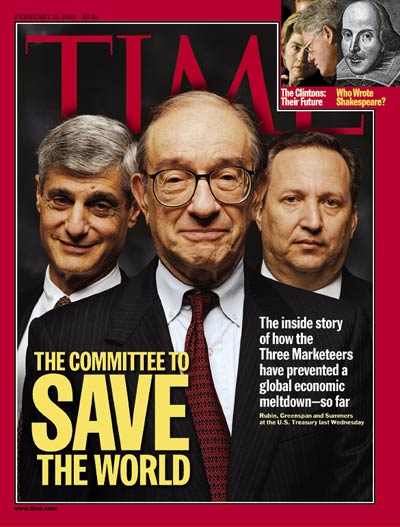

Ben, Ben....helicopter Ben

This is Europe’s "Whatever it takes" moment 2.0, but this time it will only be bigger and more massive.

ft.com/content/1b0f03…

The #Fed will open all flood gates, this is just the beginning.

With rates at zero we might be witnessing the end of the fiat dollar experiment.

This is history in the making.

bloomberg.com/news/articles/…

0% Interest Rate

0% Reserve Requirement

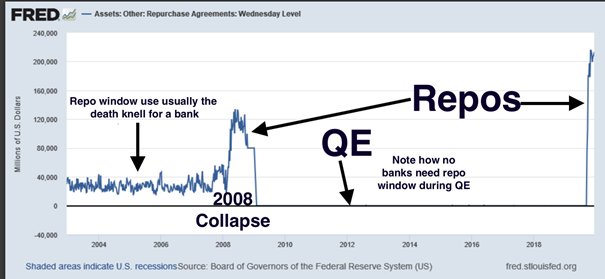

1.5T USD in extended repo operations

700B USD printed out of thin air QE4 launched

To sum it up, they will print like never before.

I still believe there is a fair chance the corona situation will ease from April/May on and the panic will magically disappear over the summer.

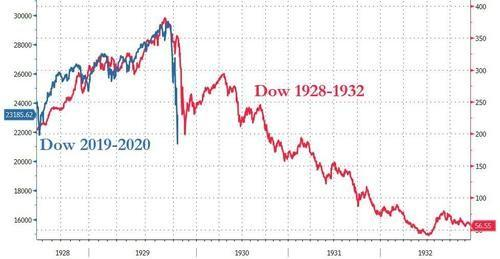

In the short term it will get worse though.

Actually the #Fed might have lost control already.

Just let that sink in: this is the status quo while the world goes into lockdown.

What will happen to all those zombies?

Banks: Watch closely for early signs of stress. If one domino falls, they could all go this time. Protect yourself!

bloomberg.com/news/articles/…

Just getting back to normal after a few months?

Unfortunately, I do not see this happening. Paper currencies will get printed into oblivion.

Doing business as usual will not work this time.

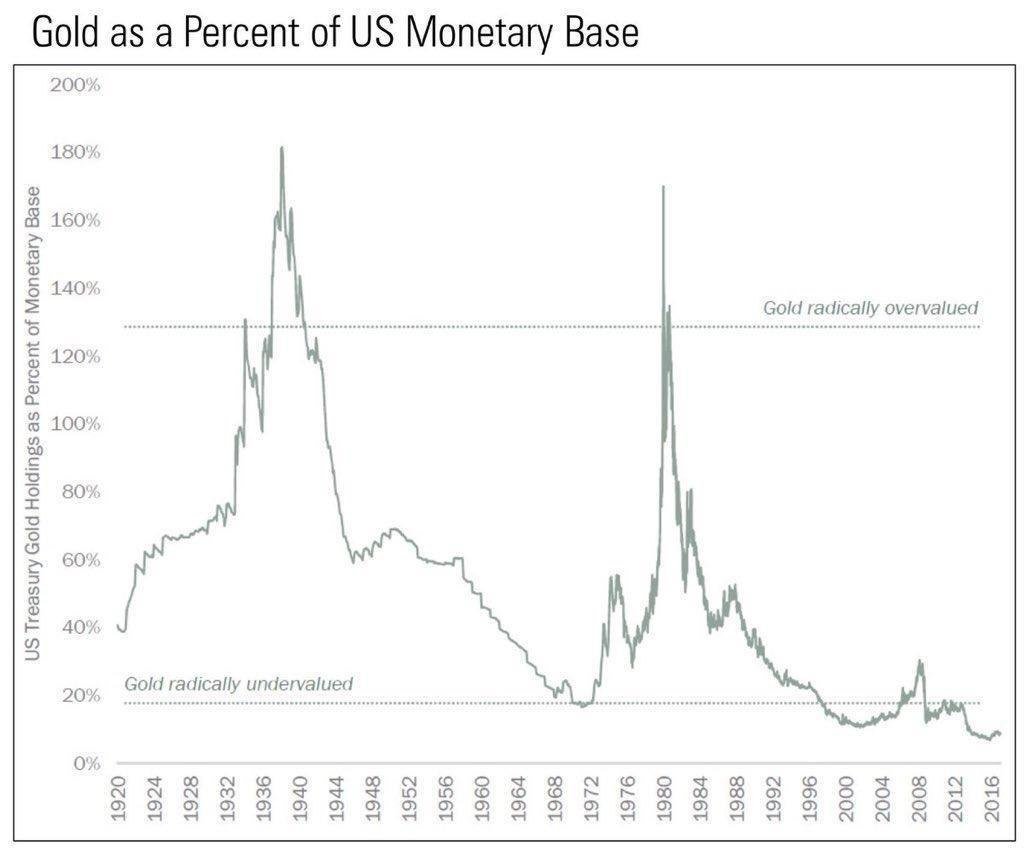

There is only one logical step left once fiat currencies blow up:

Central Banks will create a digital currency and issue fiat money on a blockchain!

People will demand something differently.

The only solution will be a Gold Standard. Am I crazy?

Well let's think about how it might go down.

Step 2: Audit of US gold supply

Step 3: The Fed will be dissolved

Step 5: Old fed dollars will be exchangeable through a certain rate.

On the contrary all fiat currencies will become worthless overnight.

Maybe we could see a coordinated effort between several countries (US, China, Europe, Russia)

But what if there are many signs that the Trump administration is in favor of a Gold Standard?

wsj.com/articles/SB123…

"I think the time has come to have a debate over gold, and the proper role it should play in our nations monetary affairs."

thinkprogress.org/rep-mike-pence…

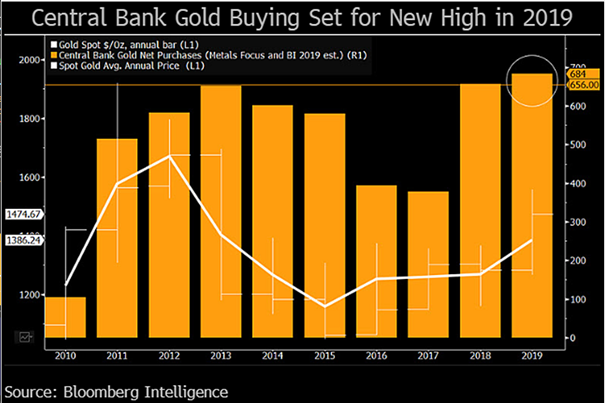

There are also other trends that indicate huge shifts.

@HoweGeneration describes in his book that historically every four generations major events take place that have a huge impact on society.

@RaoulGMI , @ttmygh , @ErikSTownsend are big fans of his work.

Guess what, we are right in the middle of another Fourth Turning that will once again change everything.

The transition to a Gold Standard will lead to a lot of turmoil in the world and won't be a smooth transition!

But it will also be the start of a golden economic age.

Give the current events everything might happen way faster than expected

(No Financial advice, just a few guesses for fun on my end)

Cash is King? Well during a deflation this might be true (right now) during a reset or strong inflation it will be worthless.

Don’t forget, money on your bank account does not belong to you but your bank! If your bank goes bust, the money is gone!

Overvalued right now, no need to own it during a Fourth Turning.

Farmland different story, cant go wrong with that

If you are reading this and don't own any Gold/Silver -> Run and get some as fast as possible 👻

During a currency reset we will see absurd price levels

You might run into trouble getting physical gold/silver right now. Reports keep popping up that everything is sold out.

“By now it is abundantly clear that the physical gold market and paper gold market will disconnect.”

zerohedge.com/commodities/pr…

More volatile than Bitcoin but as Gold itself historically cheap! Buy a few and hold on to them for a while and do not look at price levels

Tricky one short-term! Mid-long term super bullish.

As @saifedean has put it many times. A Gold Standard might be the biggest "risk" to Bitcoin short-term.

It is also still unclear how Bitcoin will perform during economic turmoil.

That being said, Bitcoin should have a place in everybody’s portfolio.

Whereas fiat currencies are on the verge of the biggest coordinated QE program the word has ever seen, Bitcoin will be the scarcest asset ever known at the end of the decade.

This will be the biggest finance story in the 2020ies!

Less incentive to buy bitcoin as an inflation hedge, but Bitcoin still offers attributes regarding financial privacy and sovereignty a Gold Standard can never offer.

The separation of state and money is still a vision I strongly believe in.

Stay safe out there, enjoy the show and get some hard money just in case the biggest wealth transfer from paper assets to sound money will take place.

Better to be safe than sorry.

Good Luck

Over and out.