Here is the link to Part 2

He who wears the crown must bear its weight they say

Everyone was happy

This was by no means illegal.

In Nigeria, things work differently

It did not 'disappoint'.

The company had taken what accountants call an impairment on all its legacy holdings.

To make matters worse, the auditors would also report a major breach.

But by December, there was actually no cake to be eaten.

COP was not what it seemed

They soon went to work.

It would be a move of a grand master

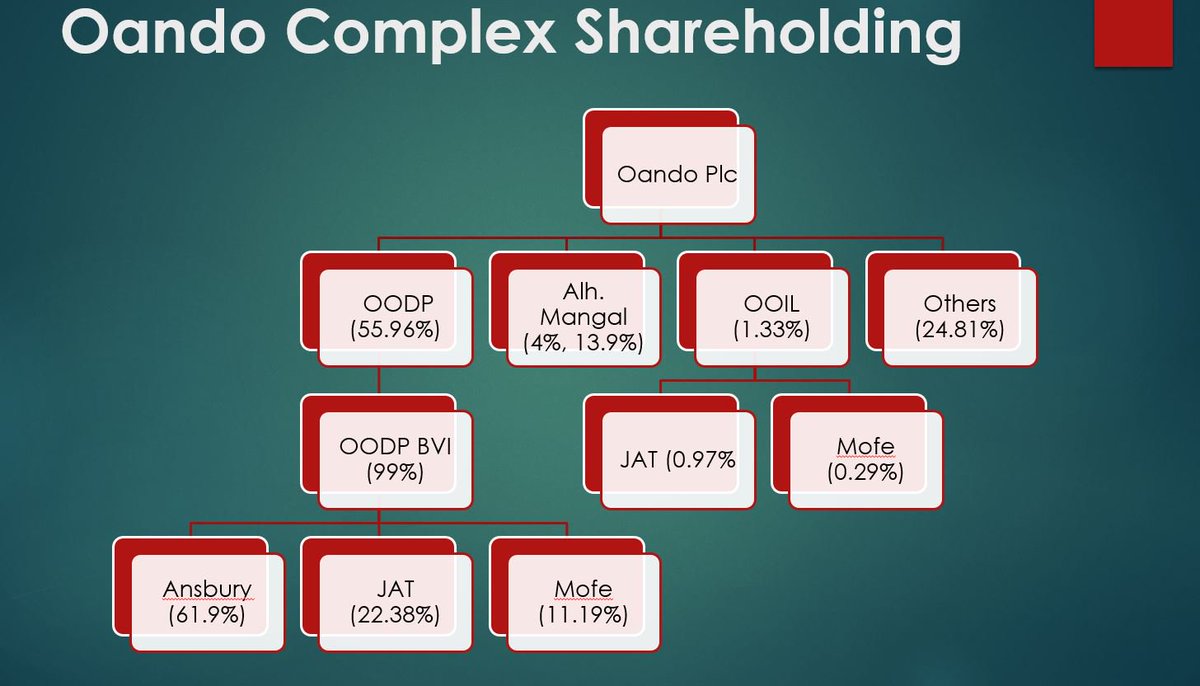

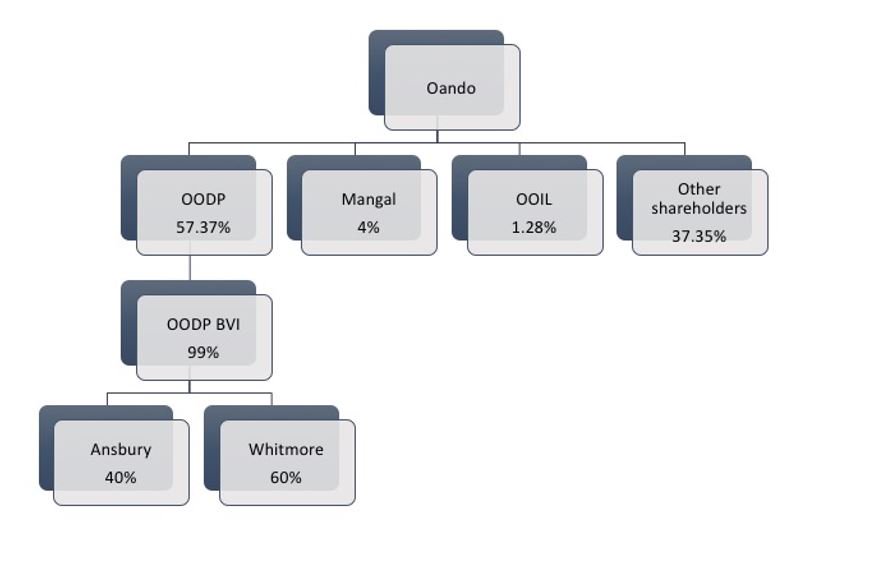

Only JAT & Mofe could pull this off

JAT had survived once again.

But battles lay ahead

The rich cried

They didn't stop there

Either by providence or being smart, it was a move of a grand master.

The "Oando" in the "ER"...well....

I would like to thank the fantastic team at Nariametrics

This thread is a Nairametrics creation

*End*