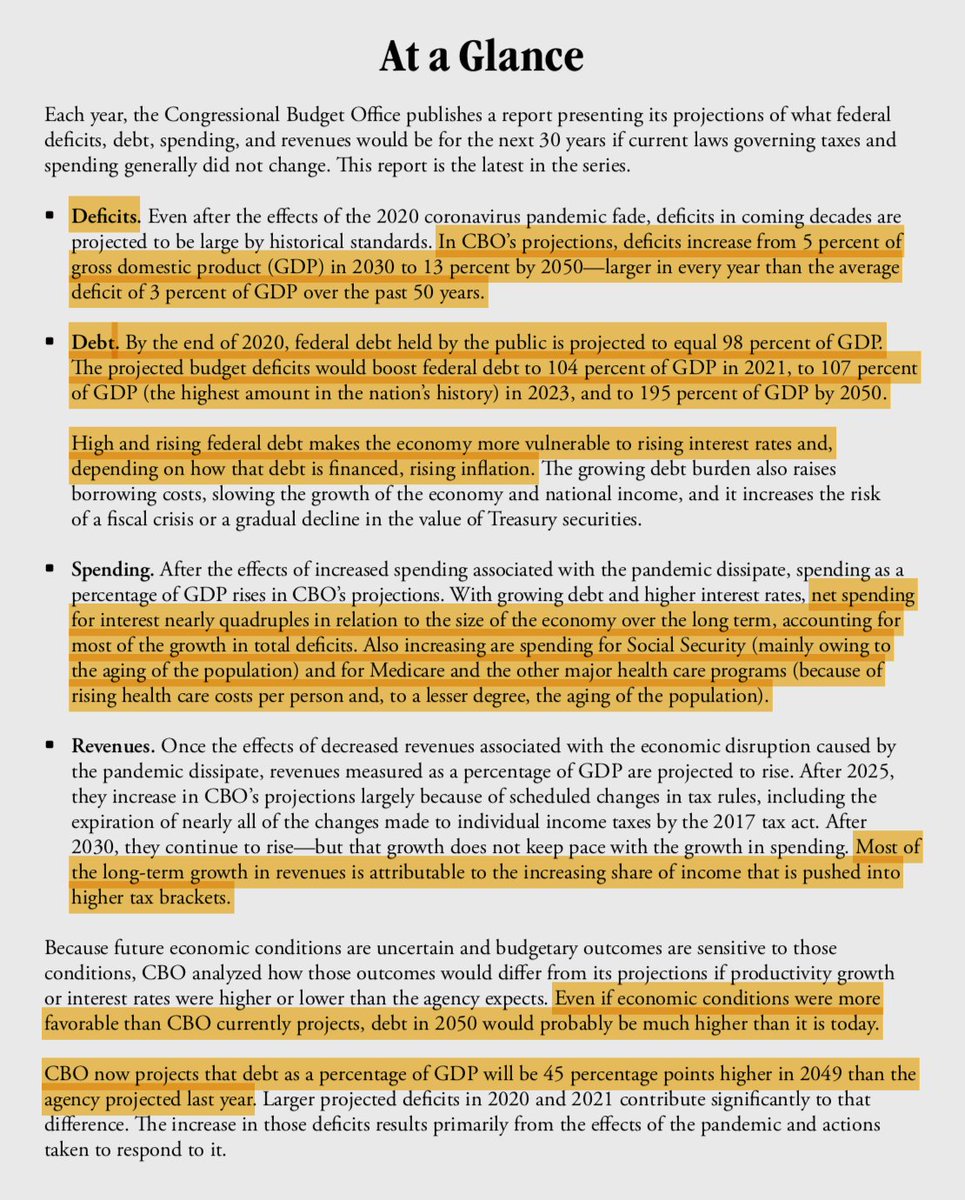

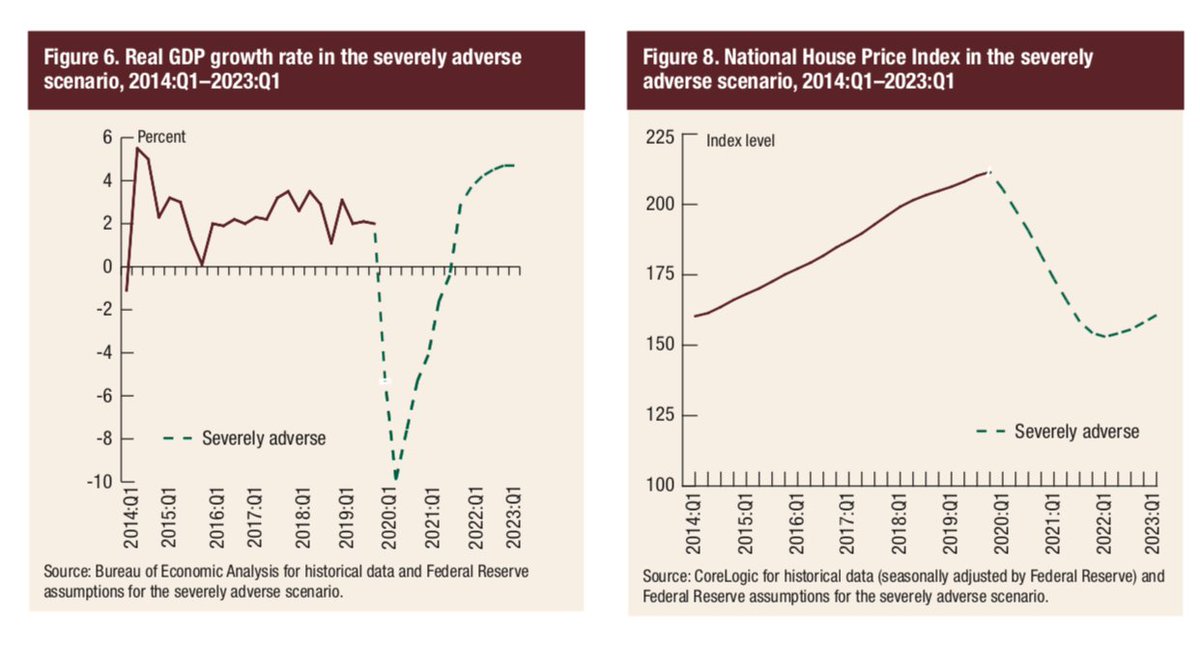

The Fed 'Dodd-Frank Act #StressTest 2020' results provide some bland but interesting perspectives on what a "severely adverse" scenario would look like & how it would affect key financial institutions: federalreserve.gov/publications/f… #GlobalTrends #Macro #Risks Some takeaways...(1/3)

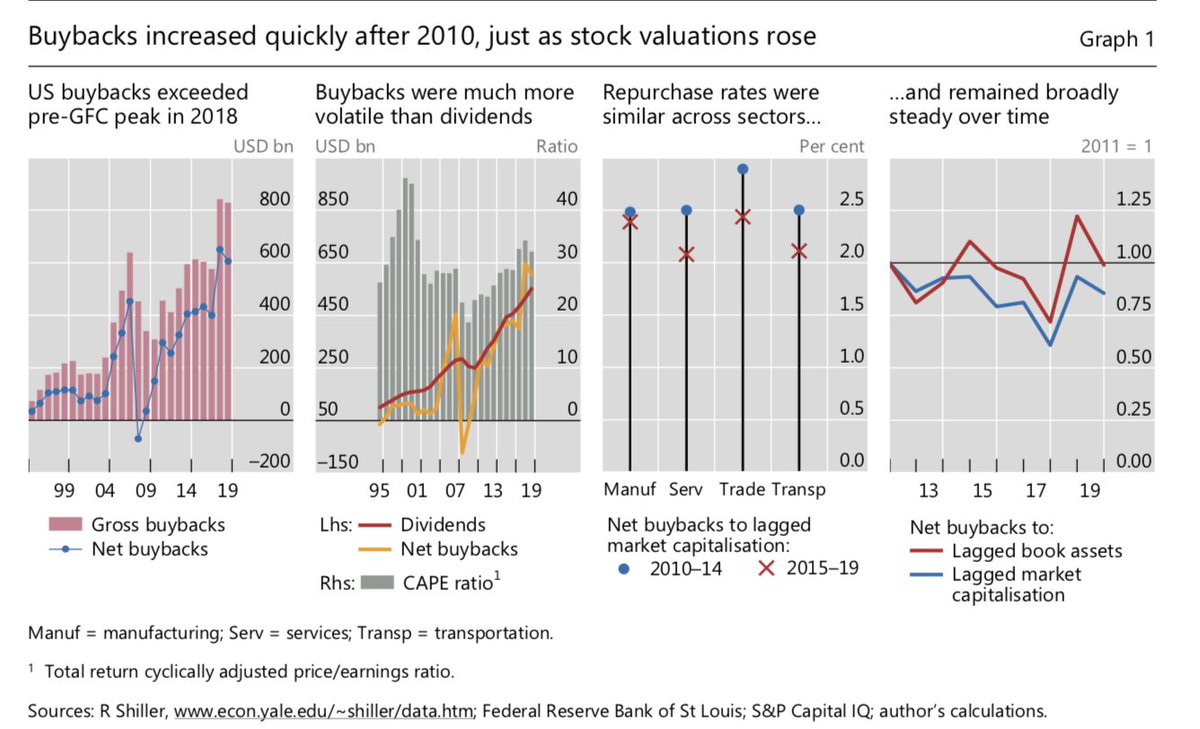

2/3 What a 2020 "Severely Adverse" scenario would look like according to the June #StressTests...#Macro #Investing #Risks #CorporateCredit #LeveragedLending #CLOs #Credit #Banks #ETFs

3/3 What a "severely adverse" scenario would do to the key financial institutions according to the Fed's June #StressTests...#Macro #Investing #Risks #Banks #Credit

• • •

Missing some Tweet in this thread? You can try to

force a refresh