#Silver #Gold #Platinum #Comex #Shadowcontracts UPDATE!

#Silversqueeze/#PSLVChallenge edition!

With interesting data on $PSLV and $SLV shorts. Data first, analysis below! 👇

#WSS #Wallstreetsilver #PSLV #goldsqueeze #platinumsqueeze #Fintwit @WallStreetSLVR @Galactic_Trader

#Silversqueeze/#PSLVChallenge edition!

With interesting data on $PSLV and $SLV shorts. Data first, analysis below! 👇

#WSS #Wallstreetsilver #PSLV #goldsqueeze #platinumsqueeze #Fintwit @WallStreetSLVR @Galactic_Trader

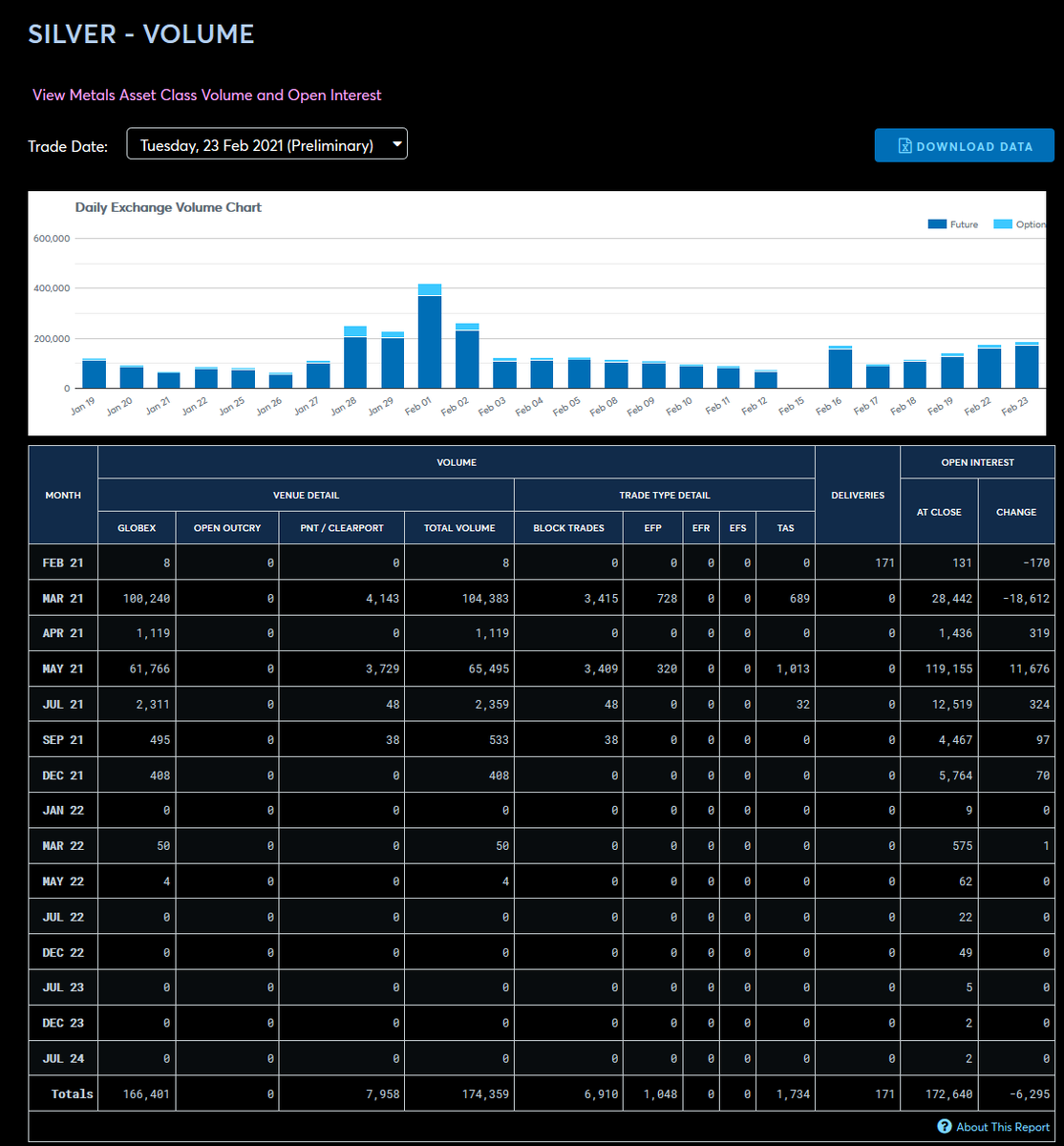

First the one everyone wants to know: #Silver.

77 shadowcontracts, meaning +385,000 ounces found and put up for delivery *this month*, before the delivery wall hits in just a few days. Calendar says "last day of delivery 26th of February" - these ounces will be delivered by then

77 shadowcontracts, meaning +385,000 ounces found and put up for delivery *this month*, before the delivery wall hits in just a few days. Calendar says "last day of delivery 26th of February" - these ounces will be delivered by then

Preliminary rollover of -10,8k which'll go up to ~-11,5k in the final report. I've seen these numbers before and it was expected, the question is, is that gonna happen more?

To hit the previous record of ~16k, they need to shed another ~32k contracts in 4 days.

To hit the previous record of ~16k, they need to shed another ~32k contracts in 4 days.

But in previous months, the biggest rollover happened 2-3 days BEFORE the final day. The last 2 days still have big rollover, but substantially less.

It's impossible to call at this point! But my bet would still be on 1 massive rollover day with ~15k contracts minimum.

It's impossible to call at this point! But my bet would still be on 1 massive rollover day with ~15k contracts minimum.

Regardless of March - May is in a *huge* amount of trouble. Total open interest still remains elevated. It's been above 180k for February, and usually during rollover it decreases (with the slams) then it increases during the delivery month again.

There's been no drawdown.

There's been no drawdown.

Finally, as it pertains to the #PSLVChallenge; It shows that it's not only VERY possible to move the silver price based on the push into $PSLV - we've done it.

Futures volume increased only minimally (people riding our wave). 175k futures+options VS 418k on February 1st.

Futures volume increased only minimally (people riding our wave). 175k futures+options VS 418k on February 1st.

Price sure as shit spiked though!

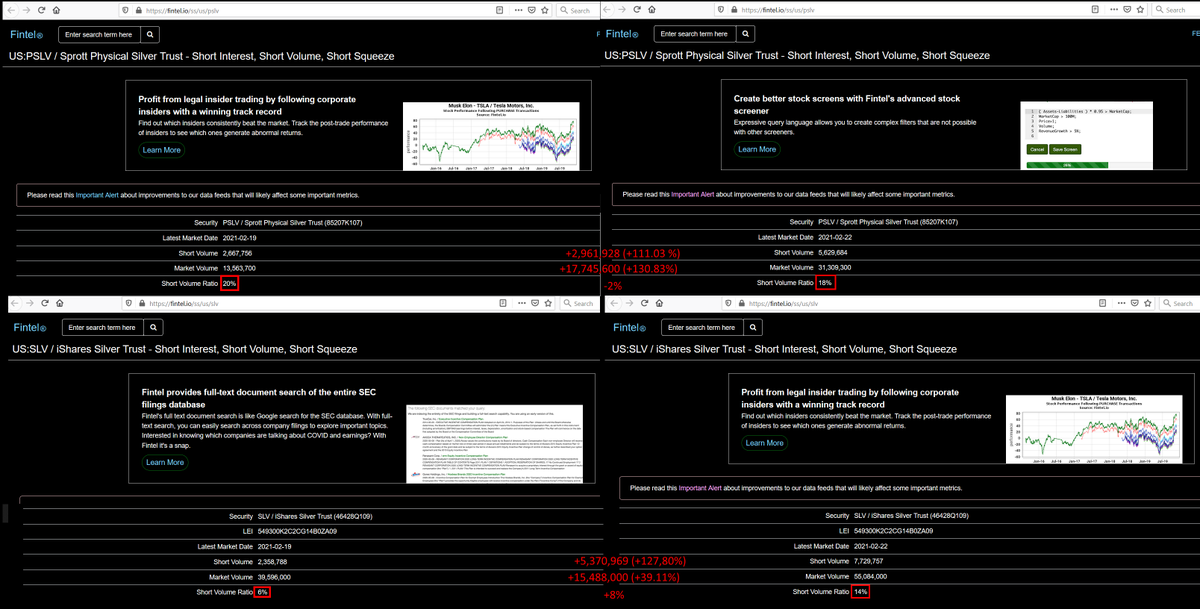

Meanwhile, it could've spiked alot more. That's what the 4th picture i added showed:

$PSLV and $SLV short volume changes between last Friday and Monday.

It shows that, as a percentage of trading volume, shorts decreased by 2% for PSLV.

Meanwhile, it could've spiked alot more. That's what the 4th picture i added showed:

$PSLV and $SLV short volume changes between last Friday and Monday.

It shows that, as a percentage of trading volume, shorts decreased by 2% for PSLV.

Smart when it spikes up like that.

HOWEVER!

As a percentage of volume, Shorts in SLV increased from 6% to 14%, EVEN WHEN TRADING VOLUME WENT UP ~40% IN $SLV!

And according to my theory of "you can't trade what isn't there"..

SHORTS ON THIS ASSET NEARLY TRIPLED BY DAYS END 👇

HOWEVER!

As a percentage of volume, Shorts in SLV increased from 6% to 14%, EVEN WHEN TRADING VOLUME WENT UP ~40% IN $SLV!

And according to my theory of "you can't trade what isn't there"..

SHORTS ON THIS ASSET NEARLY TRIPLED BY DAYS END 👇

Meanwhile, short volume on $PSLV doubled as well.

But this is expected. When volume increases that much, it draws attention, and plenty of people (and algorithms) who have no idea *why* it spiked, think it's a fluke and will short it.

Most times they're right. Not yesterday.

But this is expected. When volume increases that much, it draws attention, and plenty of people (and algorithms) who have no idea *why* it spiked, think it's a fluke and will short it.

Most times they're right. Not yesterday.

But alot of shorts got out. Smart.

That's why short volume as a percentage of total volume dropped.

The fact that last Friday, the difference was 20% for $PSLV and 6% for $SLV shows that the powers that be wanted to keep control - and lost it.

Thanks to @TeminatorTrader btw.

That's why short volume as a percentage of total volume dropped.

The fact that last Friday, the difference was 20% for $PSLV and 6% for $SLV shows that the powers that be wanted to keep control - and lost it.

Thanks to @TeminatorTrader btw.

I can't see the total short interest, that requires a subscription, and i'm still poor xD

But if anybody wants to spend some dosh, the site itself seems very good for intel, and the sub's only $25 a month:

fintel.io/ss/us/pslv

I'd say it'd be invaluable to #Wallstreetbets.

But if anybody wants to spend some dosh, the site itself seems very good for intel, and the sub's only $25 a month:

fintel.io/ss/us/pslv

I'd say it'd be invaluable to #Wallstreetbets.

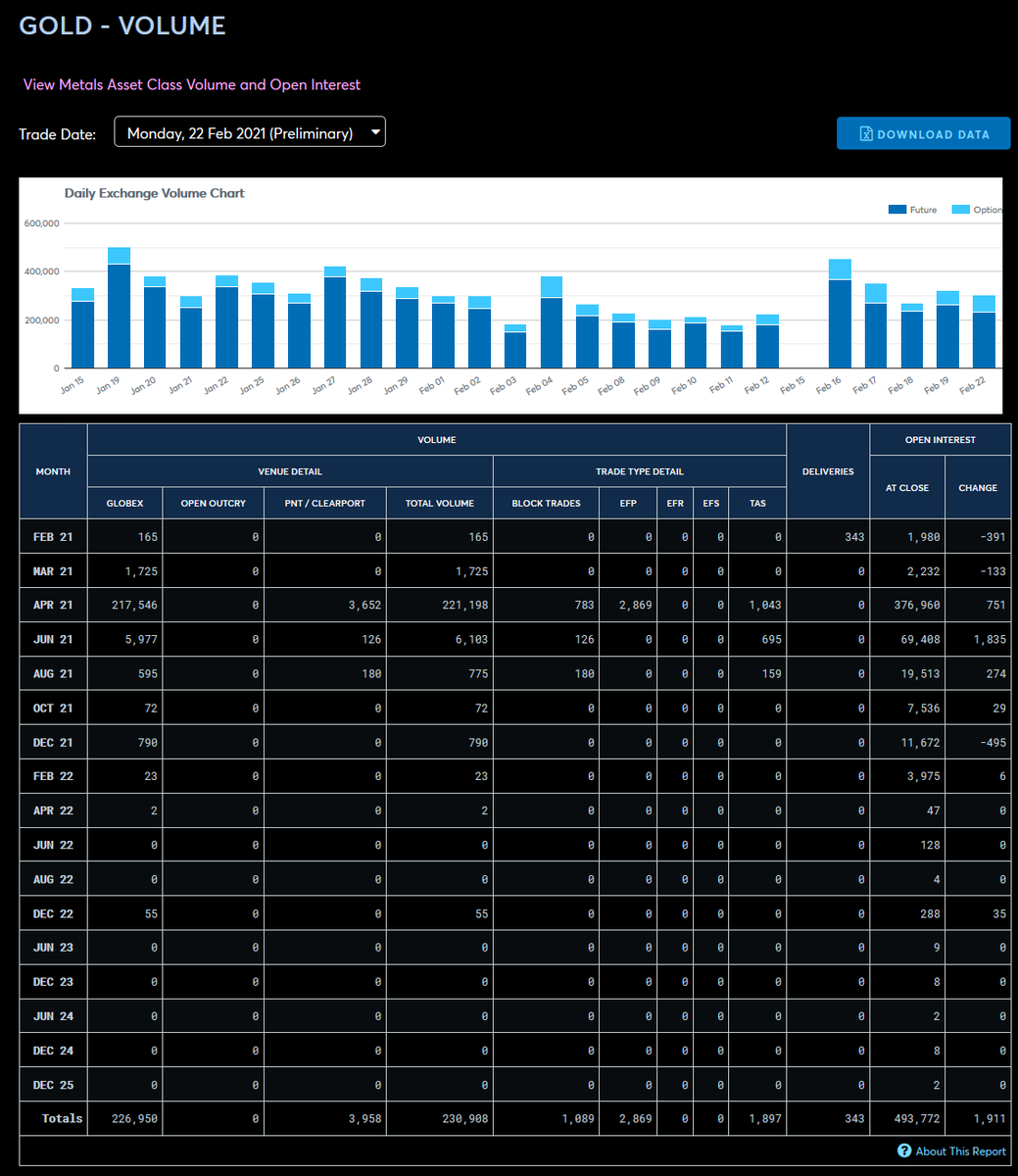

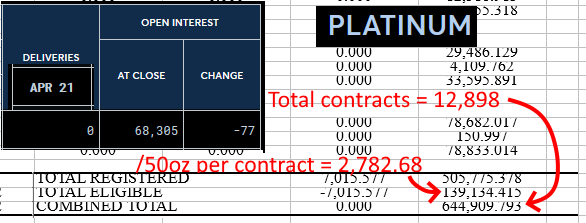

Finally i added #gold and #platinum, because we don't plan for perfection. Assume Comex lives through March. No call on how many rabbits are left in the hat.

For March, the plan will be #HODL #silver, buy some if you don't have it, but otherwise, #goldsqueeze/#platniumsqueeze.

For March, the plan will be #HODL #silver, buy some if you don't have it, but otherwise, #goldsqueeze/#platniumsqueeze.

It's very simple:

If there's no open interest to deliver, Comex can't post a delivery failure.

And for April, deliverable on March 31st, there's almost no open interest.

Meanwhile, there won't be any open interest added to March silver no matter how much we buy. It'll be May.

If there's no open interest to deliver, Comex can't post a delivery failure.

And for April, deliverable on March 31st, there's almost no open interest.

Meanwhile, there won't be any open interest added to March silver no matter how much we buy. It'll be May.

BUT!

#GOLD IS IN *MUCH WORSE SHAPE!*

We've been focusing on the Silver mining supply deficit. And yes, it'll make Silver soar...

...But only when Silver starts counting as money.

>RIGHT NOW, SILVER DOES *NOT* COUNT AS MONEY!<

Because the populace doesn't see it that way.

#GOLD IS IN *MUCH WORSE SHAPE!*

We've been focusing on the Silver mining supply deficit. And yes, it'll make Silver soar...

...But only when Silver starts counting as money.

>RIGHT NOW, SILVER DOES *NOT* COUNT AS MONEY!<

Because the populace doesn't see it that way.

Yes, when the Comex breaks, that vision is restored.

But as it stands, on February 23rd, To the VAST MAJORITY - Silver is a relic.

But... Gold isn't.

All the >rich< look to Gold as the ultimate backup. Gold is viewed as 100% money, even when it has industrial applications.

But as it stands, on February 23rd, To the VAST MAJORITY - Silver is a relic.

But... Gold isn't.

All the >rich< look to Gold as the ultimate backup. Gold is viewed as 100% money, even when it has industrial applications.

There's 2 things here:

- Mass demand. Silver will soar because little capital demand comes from the many.

- Value Compression. Gold will soar because it's a way for the rich to store alot of value in a small space.

Buffett tried buying Silver once. The carry cost killed profits

- Mass demand. Silver will soar because little capital demand comes from the many.

- Value Compression. Gold will soar because it's a way for the rich to store alot of value in a small space.

Buffett tried buying Silver once. The carry cost killed profits

I have evidence of course; My #Shadowcontracts pattern that changed back in December. While i've been tracking #Silver mostly, i've also tracked #gold at key times, as well as collected data for the October month - a non-active month traditionally.

Please Compare:

Please Compare:

The start of January deliveries was the same - Shadow contracts the week before, roll over the first week after deliveries, and after the bulk was delivered, SC's again.

There were shadowcontracts in Silver yesterday. While this was the runup to the September/December walls:

There were shadowcontracts in Silver yesterday. While this was the runup to the September/December walls:

So i'm not sure to read that as either Panic or Arrogance. I'm willing to bet on Panic though 🤣

Regardless, the point is clear: Supply side, #Silver's worse. Demand side, #Gold's worse.

And #Platinum is just a combination of everything. Industrial, rarity, and supply crunch.

Regardless, the point is clear: Supply side, #Silver's worse. Demand side, #Gold's worse.

And #Platinum is just a combination of everything. Industrial, rarity, and supply crunch.

AND as i was writing all of this, the #NYAG just ruled #Tether a fraud.

So we can expect a massive rotation out of #bitcoin/#crypto into the one true safety now: #Silver, #gold, and #Platinum.

SO #HOLDTHELINE YOU APES!

SILVER THIS WEEK! GOLD/PLATINUM NEXT MONTH!

So we can expect a massive rotation out of #bitcoin/#crypto into the one true safety now: #Silver, #gold, and #Platinum.

SO #HOLDTHELINE YOU APES!

SILVER THIS WEEK! GOLD/PLATINUM NEXT MONTH!

The fight draws to an end. Stay frosty!

#Wallstreetsilver #WSS #Silversqueeze #PSLV $PSLV #PSLVchallenge @PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree @LawrenceLepard @TheEarlyStage @BullionStar @jameshenryand @ThHappyHawaiian @TeminatorTrader @SilverChartist

#Wallstreetsilver #WSS #Silversqueeze #PSLV $PSLV #PSLVchallenge @PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree @LawrenceLepard @TheEarlyStage @BullionStar @jameshenryand @ThHappyHawaiian @TeminatorTrader @SilverChartist

• • •

Missing some Tweet in this thread? You can try to

force a refresh