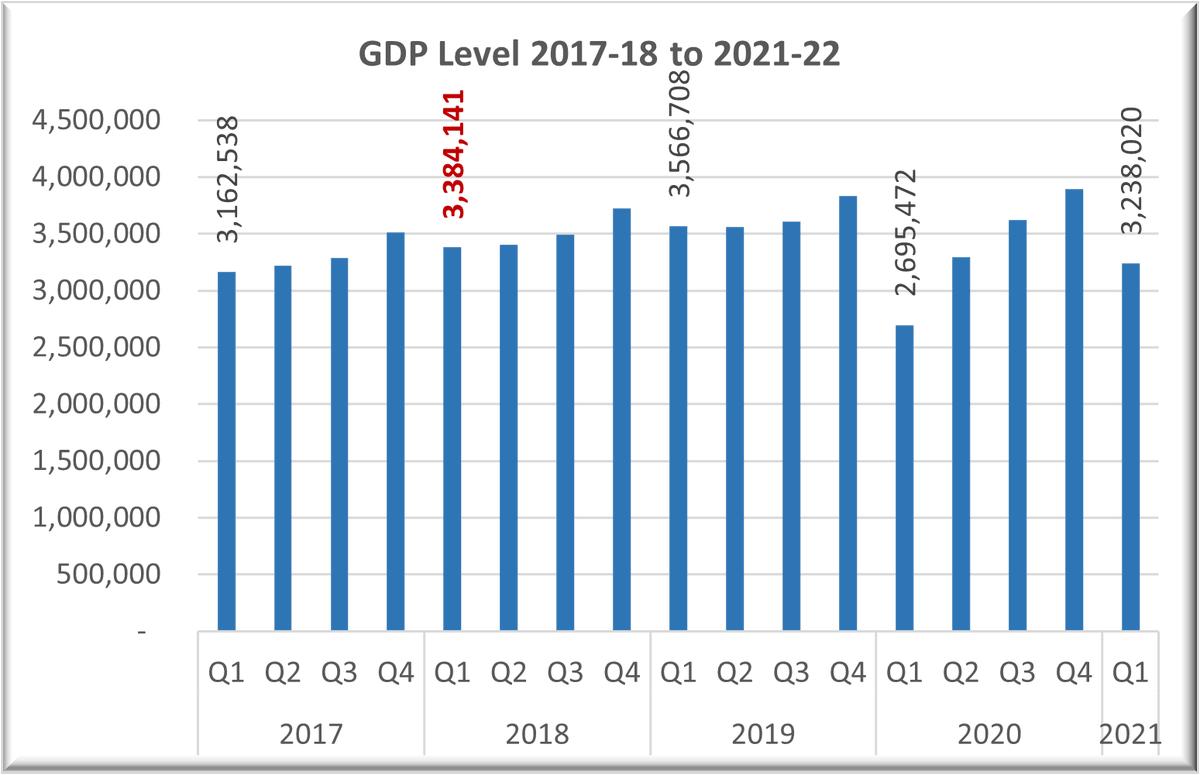

GDP Data: Looking back to see where we are!

Lot of ground to cover?

1. GDP is less than 2018-19. Higher by 2.39% from 2017-18. Nearly Static over 4 years.

2. PFCE is less than 2017-18. Consumers, the biggest contributors are struggling.

@SahilKapoor @dugalira @CafeEconomics

Lot of ground to cover?

1. GDP is less than 2018-19. Higher by 2.39% from 2017-18. Nearly Static over 4 years.

2. PFCE is less than 2017-18. Consumers, the biggest contributors are struggling.

@SahilKapoor @dugalira @CafeEconomics

3. Govt. Final Cons Exp up by a CAGR of 3.75% over 4 years. Less than last year.

4. GFCF is less than 2018-19. CAGR of 0.82% over 4 years.

4. GFCF is less than 2018-19. CAGR of 0.82% over 4 years.

5. Inventory significantly less than 2018-19. Does it say something about business confidence?

6. Always lumpy. But not a great picture. Last quarter was one of the best. This is one of the two worst quarters in 4 years.

6. Always lumpy. But not a great picture. Last quarter was one of the best. This is one of the two worst quarters in 4 years.

@threadreaderapp unroll

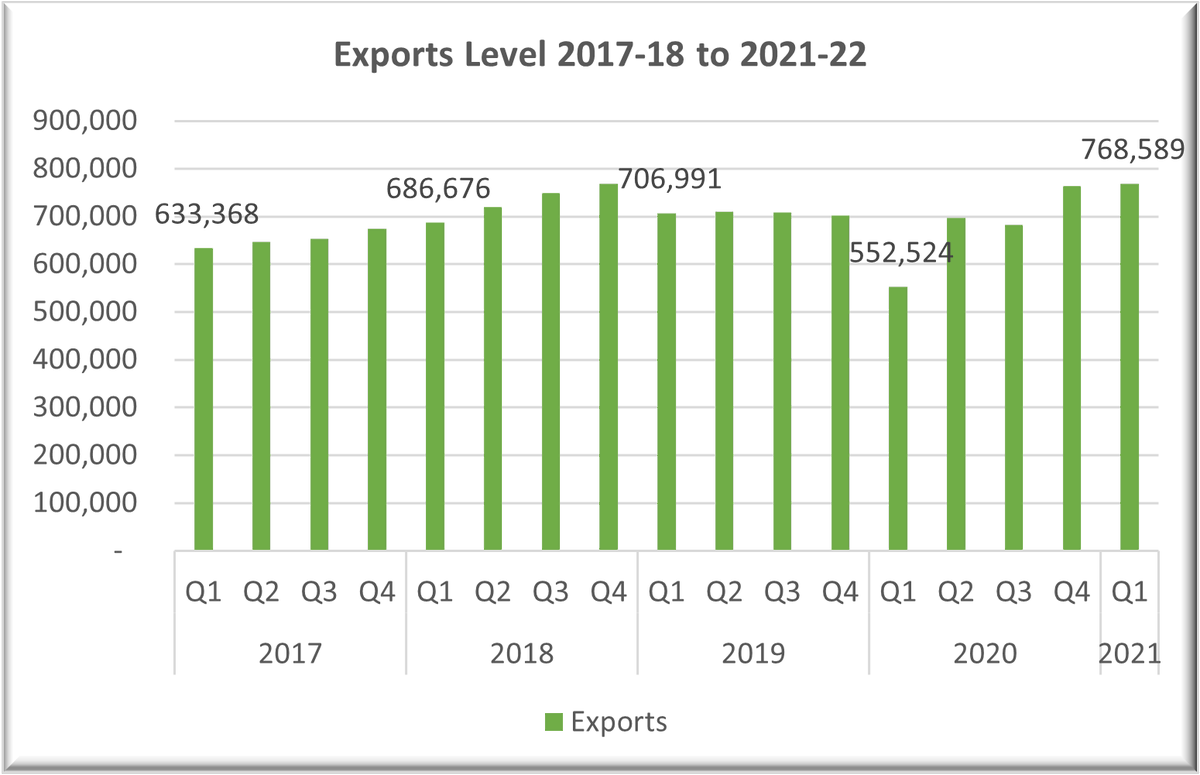

Exports are doing well. CAGR is 4.95% - Not bad at all as the global economy is is going through a tough phase.

• • •

Missing some Tweet in this thread? You can try to

force a refresh