🇺🇸August #Jobsreport: "It's a softie"

🟡Payrolls +235k

🤏Private +243k

🤏Goods +40k

🤏Services +203k

🔴Gov -8k

🟢Revisions⬆️134k

✅#Unemployment 5.2% (-0.2pt)

🟡Participation rate 61.7% (flat)

✅Wages +0.6%

🔴Job loss vs Feb'20: 5.3mn

⬆️Share regained:76%

🟡Payrolls +235k

🤏Private +243k

🤏Goods +40k

🤏Services +203k

🔴Gov -8k

🟢Revisions⬆️134k

✅#Unemployment 5.2% (-0.2pt)

🟡Participation rate 61.7% (flat)

✅Wages +0.6%

🔴Job loss vs Feb'20: 5.3mn

⬆️Share regained:76%

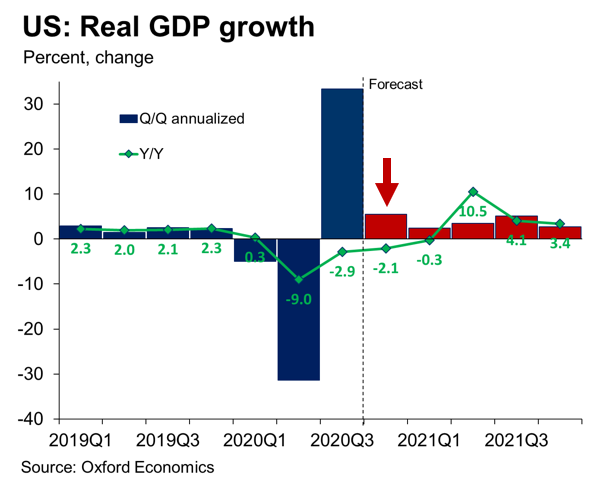

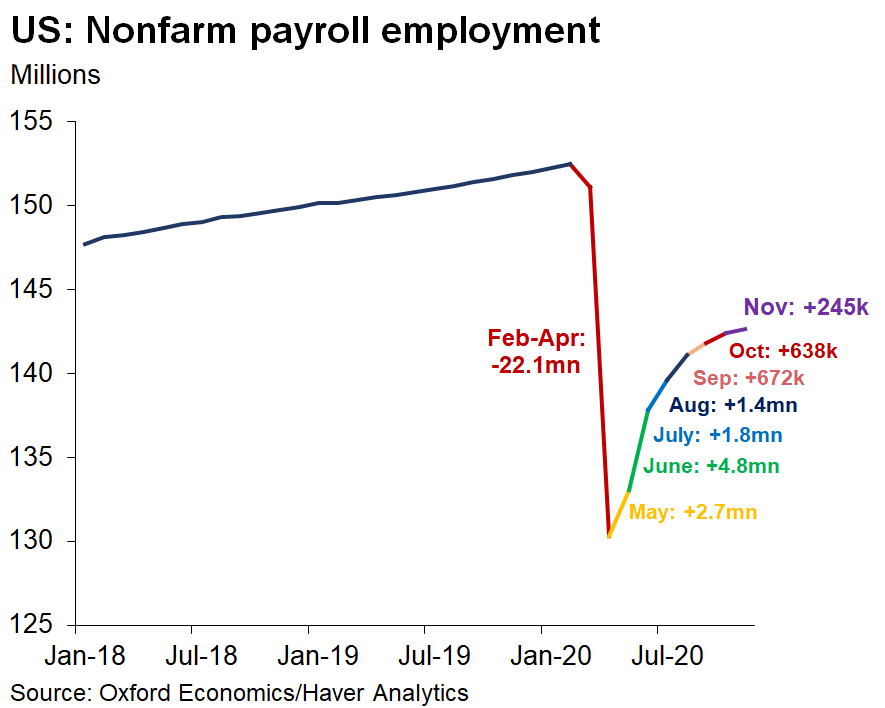

The US labor market is exiting the summer with much less momentum then when it entered with only a 235k advance in August

▶️Only 1/3 of 3-month trailing average of 750k

▶️Well short of our under-consensus 675k call

▶️Only 1/3 of 3-month trailing average of 750k

▶️Well short of our under-consensus 675k call

The breadth of job gains in the private sector cooled visibly in August with 62% of industries growing, from 69% in July

Which sectors cooled?

The Covid sensitive ones and the ones experiencing lingering supply-side constraints, but the weakness was concentrated in the leisure and hospitality sector (flat for the month -- no blue bar below)

The Covid sensitive ones and the ones experiencing lingering supply-side constraints, but the weakness was concentrated in the leisure and hospitality sector (flat for the month -- no blue bar below)

🇺🇸Looking ahead, the key challenge is to get the "face-to-face" sectors back to pre-#Covid levels.

Via:

▶️a strong and sustainable health recovery ⚠️⚠️

▶️reestablishing childcare

▶️ensure proper work incentives (wages)

Via:

▶️a strong and sustainable health recovery ⚠️⚠️

▶️reestablishing childcare

▶️ensure proper work incentives (wages)

🇺🇸US labor market: The final leg of a marathon is the most difficult

The US economy is 76% of the way back to pre-pandemic employment levels with a shortfall of 5.3 million #jobs, but the shortfall relative to the pre-virus trend is close to 9 million jobs!

The US economy is 76% of the way back to pre-pandemic employment levels with a shortfall of 5.3 million #jobs, but the shortfall relative to the pre-virus trend is close to 9 million jobs!

The progress we've made since the trough of the #Covid crisis is impressive, but the lingering #jobs shortfall is very large compared with prior recessions, and the road to a full #labor market recovery will take time

The household survey contained more encouraging news

🟢#Unemployment rate -0.2ppt to 5.2%: lowest post-pandemic

🟢U-6 under-employment rate -0.4ppt to 9.2%: very encouraging as it reflected fewer marginally attached workers (mostly fewer discouraged workers)

🟢#Unemployment rate -0.2ppt to 5.2%: lowest post-pandemic

🟢U-6 under-employment rate -0.4ppt to 9.2%: very encouraging as it reflected fewer marginally attached workers (mostly fewer discouraged workers)

With the "part-time for economic reasons" workers nearly back to pre-Covid levels, the focus will turn to "permanent layoffs" and those "not in the labor force but wanting a job"

The labor force participation rate remained steady at 61.7% – reflecting persistent labor supply constraints.

It's been moving sideways for a year now, reflecting the multiple labor supply constraints including virus, unemployment benefits, childcare issues & early retirements

It's been moving sideways for a year now, reflecting the multiple labor supply constraints including virus, unemployment benefits, childcare issues & early retirements

🇺🇸Age-adjusted labor force participation rate continues to rise, but remains well short of its pre-pandemic level

🇺🇸The decline in the share of long-term unemployment remains in place -- another encouraging sign in this labor market recovery

🇺🇸US #labor market still has a long way to go until a full recovery

We believe the #Fed will opt to wait until the November FOMC meeting to make a formal tapering announcement, and start reducing asset purchases in Dec/Jan, depending on employment & inflation developments

We believe the #Fed will opt to wait until the November FOMC meeting to make a formal tapering announcement, and start reducing asset purchases in Dec/Jan, depending on employment & inflation developments

• • •

Missing some Tweet in this thread? You can try to

force a refresh