🇺🇸#Jobsreport: An early blossom for employment

🟢Total +379k in Feb

💪Private +465k

Goods -48k

Services +513k

👎Gov -86k

🟡Revisions +38k

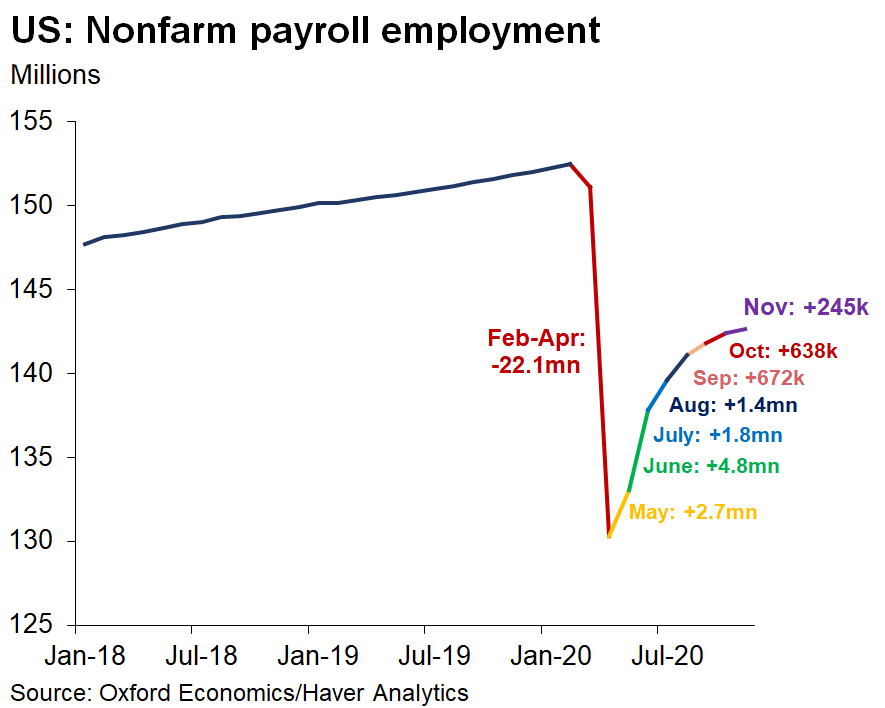

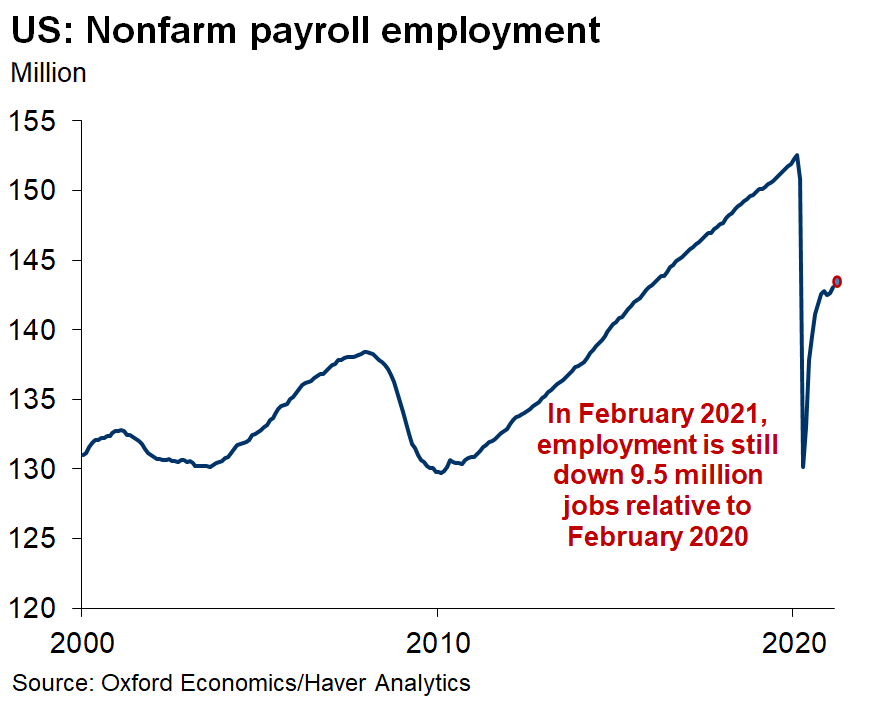

🛑Job loss relative to Feb'20: 9.5mn

🛑Share of #COVID19 loss regained only 58%

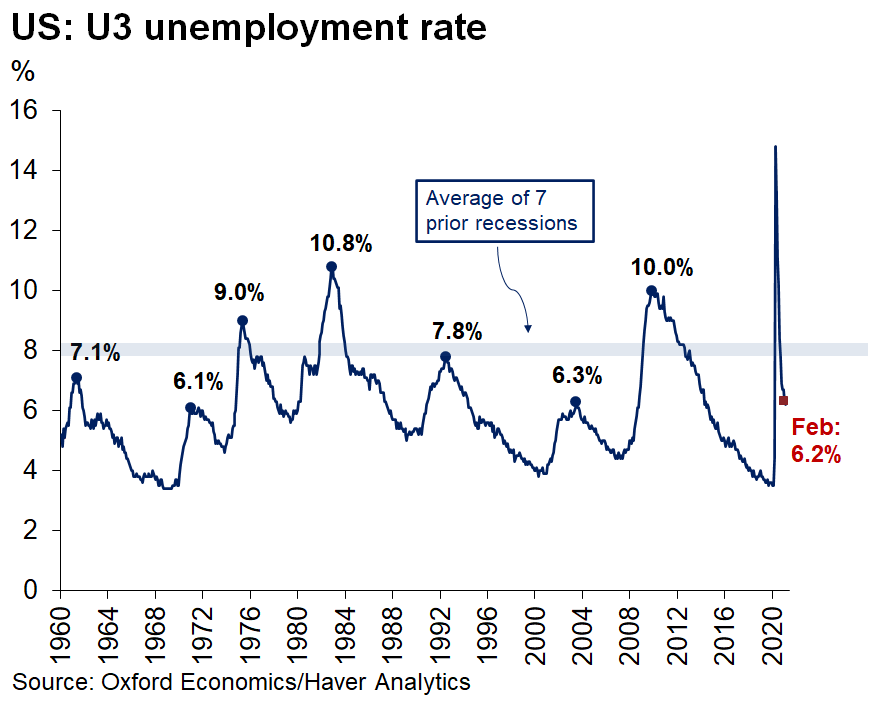

#Unemployment rate: 6.2% (-0.1pt)

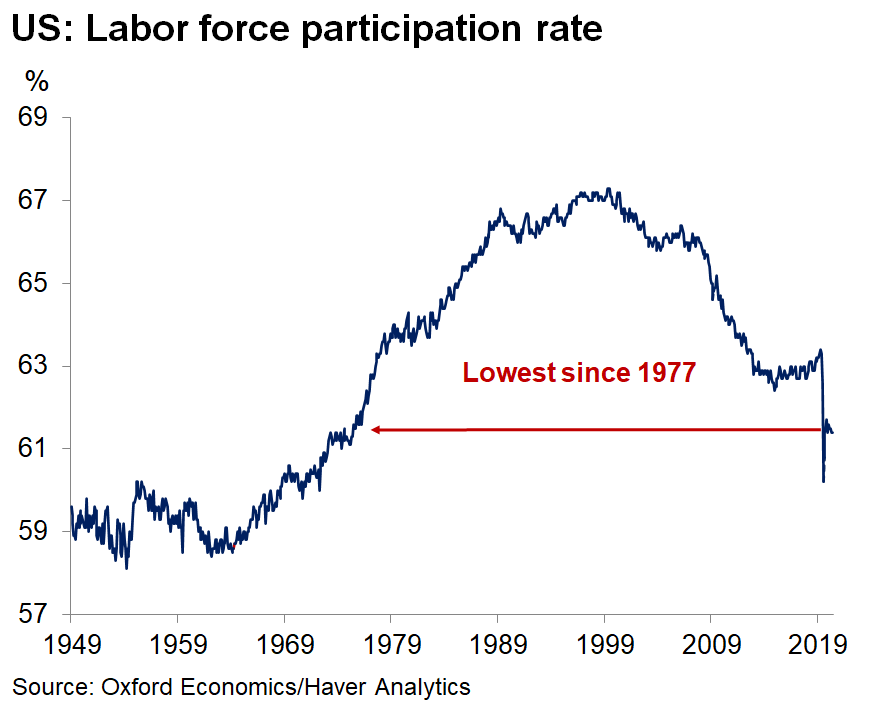

LFP 61.4% (flat)

🟢Total +379k in Feb

💪Private +465k

Goods -48k

Services +513k

👎Gov -86k

🟡Revisions +38k

🛑Job loss relative to Feb'20: 9.5mn

🛑Share of #COVID19 loss regained only 58%

#Unemployment rate: 6.2% (-0.1pt)

LFP 61.4% (flat)

Many elements of positive news:

1. Upward revisions to Dec/Jan: +38k

2. The 3-month averages are perking up

Total +80k

Private +94k

Goods +7k

Services +87k

Gov -14k

3. Private payroll diffusion bounced to 57%

1. Upward revisions to Dec/Jan: +38k

2. The 3-month averages are perking up

Total +80k

Private +94k

Goods +7k

Services +87k

Gov -14k

3. Private payroll diffusion bounced to 57%

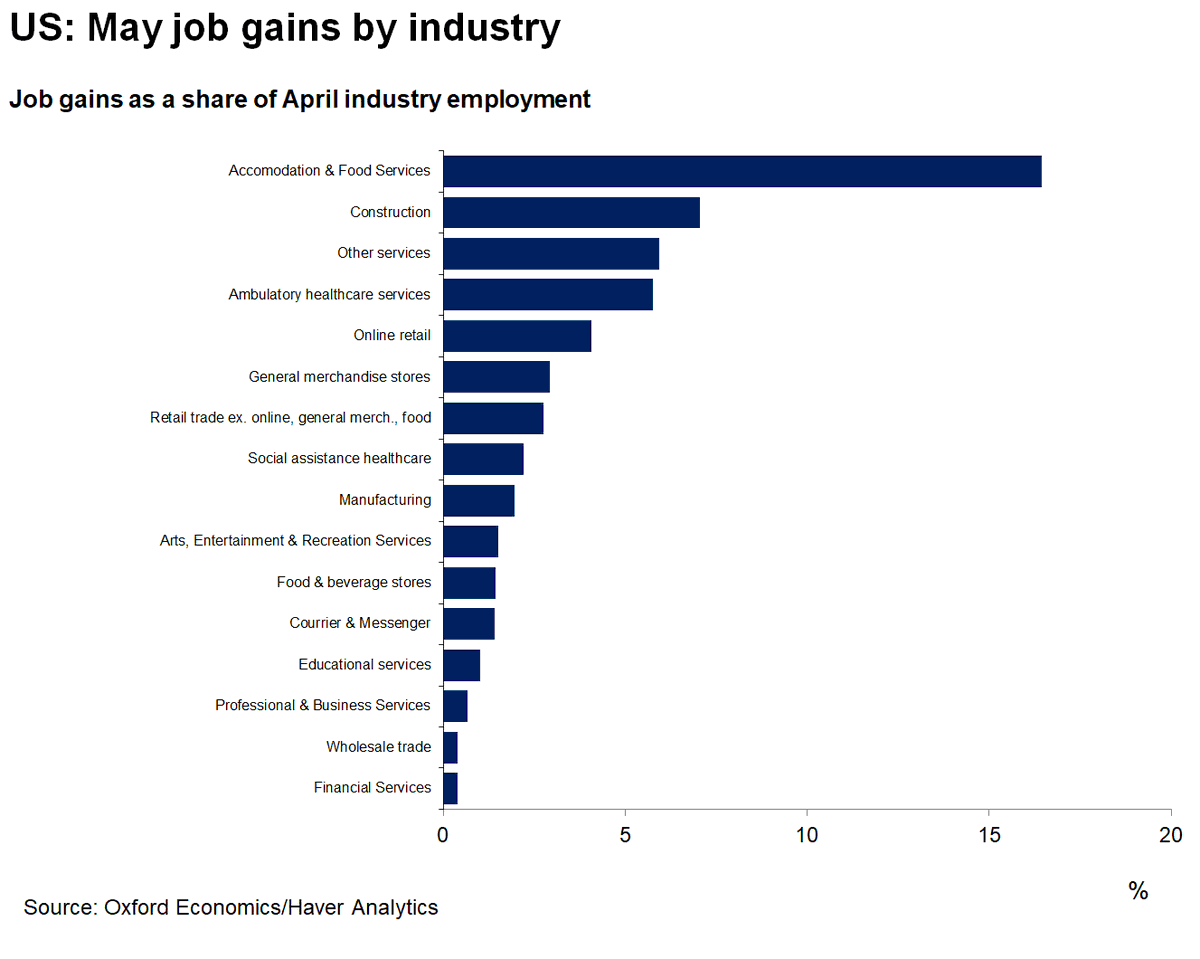

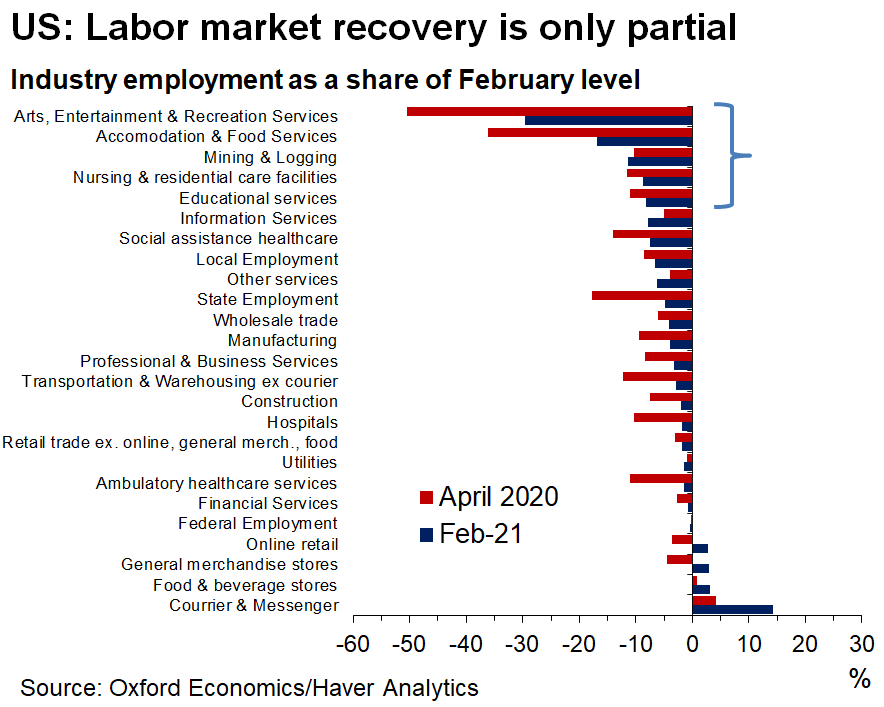

It's not just about being above the zero line, it's about ensuring a broad and inclusive labor market recovery

Very encouraging to see some sectors doing better than pre-#Covid (grocery, online, couriers).

Now the key challenge is to get the "face-to-face" sectors back to pre-Covid levels.

How? Via a strong and sustainable health recovery

Now the key challenge is to get the "face-to-face" sectors back to pre-Covid levels.

How? Via a strong and sustainable health recovery

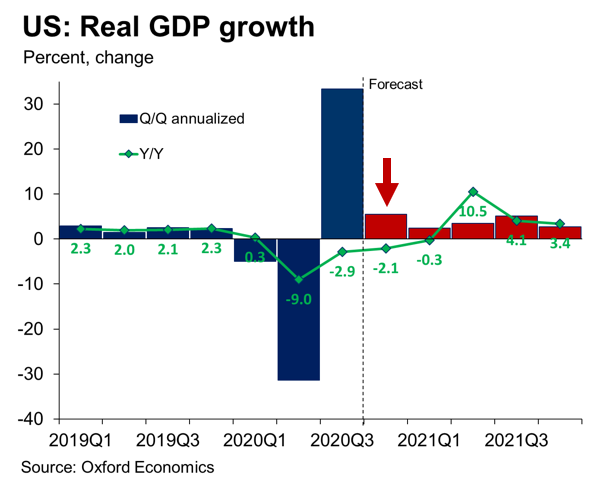

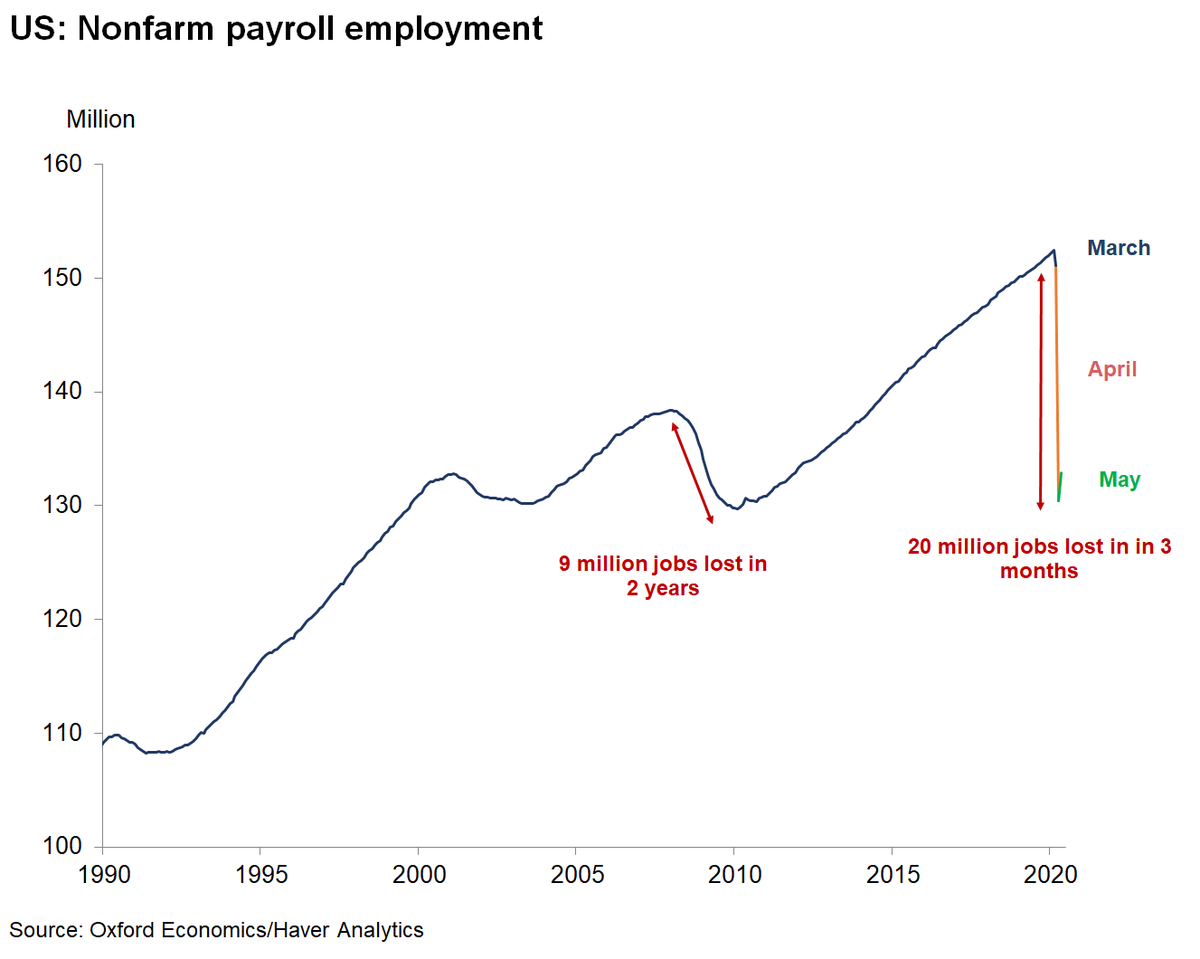

Because despite the hype about today's strong #jobsreport and despite the 12.9 million jobs recovery since April 2020, 🇺🇸employment remains 9.5mn lower than pre-pandemic.

🇺🇸 #Unemployment details:

U-3 rate -0.1ppt to 6.2% in February

Why? The number of employed individuals rose and the number of unemployed individuals fell while labor force participation held steady

U-3 rate -0.1ppt to 6.2% in February

Why? The number of employed individuals rose and the number of unemployed individuals fell while labor force participation held steady

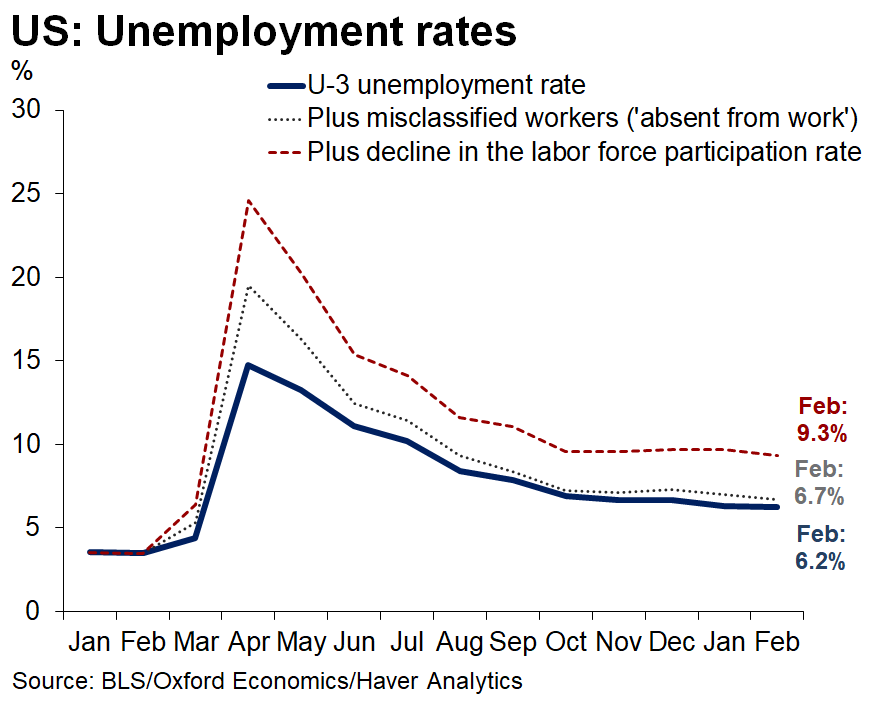

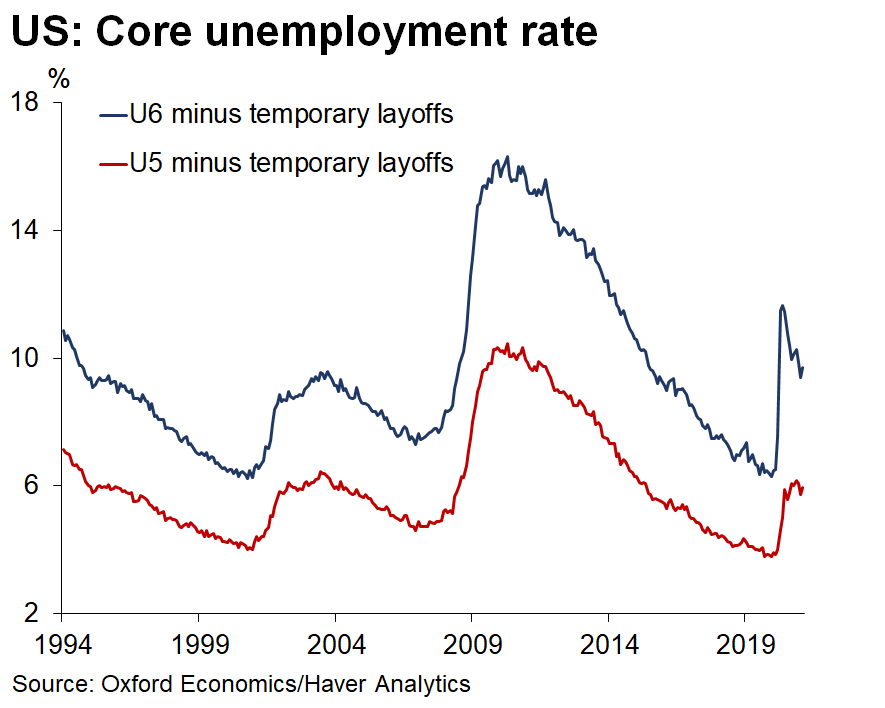

🚨 Still, the most concerning element is that U-3 #unemployment fails to capture the extent of the labor market damage

Adjusting for misclassification & for the millions that have exited the labor force (by choice or obligation), the true unemployment rate is closer to 9.3%

Adjusting for misclassification & for the millions that have exited the labor force (by choice or obligation), the true unemployment rate is closer to 9.3%

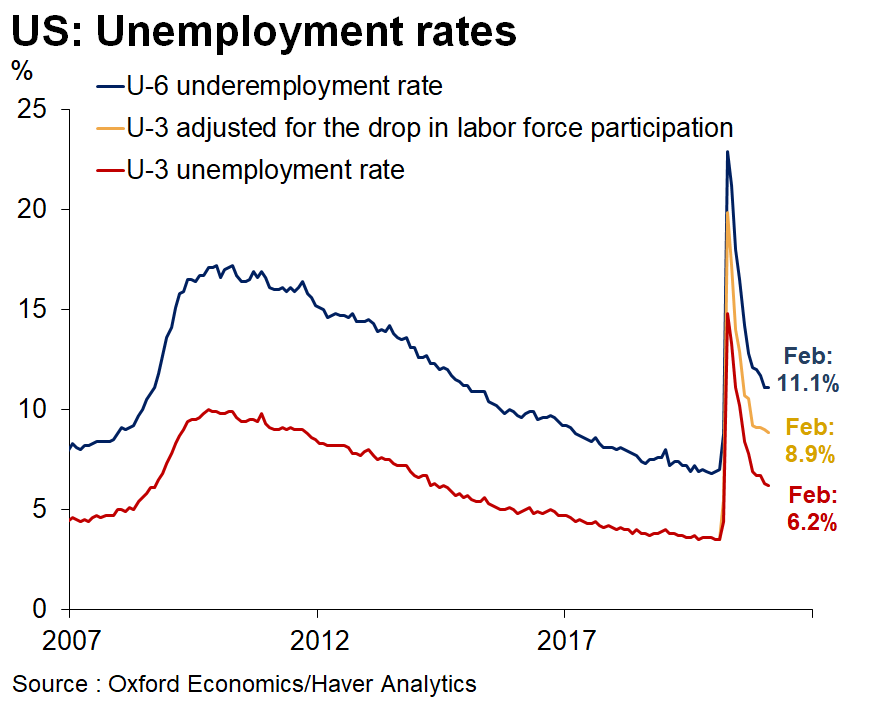

The U-6 under-employment rate -- factoring those marginally attached and those working part-time but wanting full time employment -- held steady at 11.1%.

However, it's also under-estimated and remains very high in level terms.

However, it's also under-estimated and remains very high in level terms.

The adjusted U-5 and U-6 measures of #unemployment provide a more accurate picture of the long road ahead to a full labor market recovery

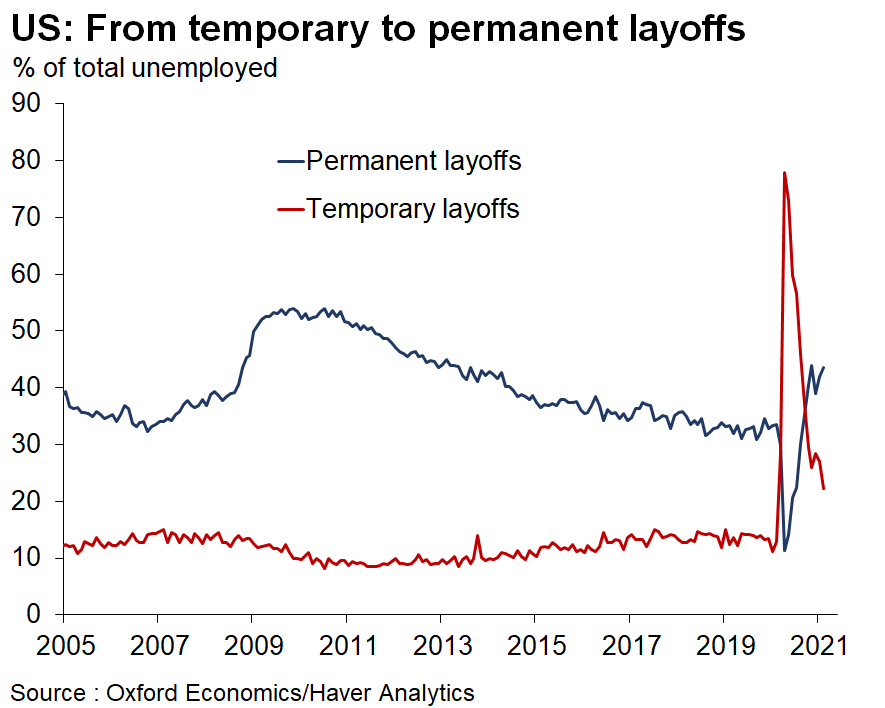

Important on the split of temporary/permanent #unemployment:

Share of permanent unemployed rose from 42% to 44%

Share of temporary unemployed fell from 27% to 22%

Share of permanent unemployed rose from 42% to 44%

Share of temporary unemployed fell from 27% to 22%

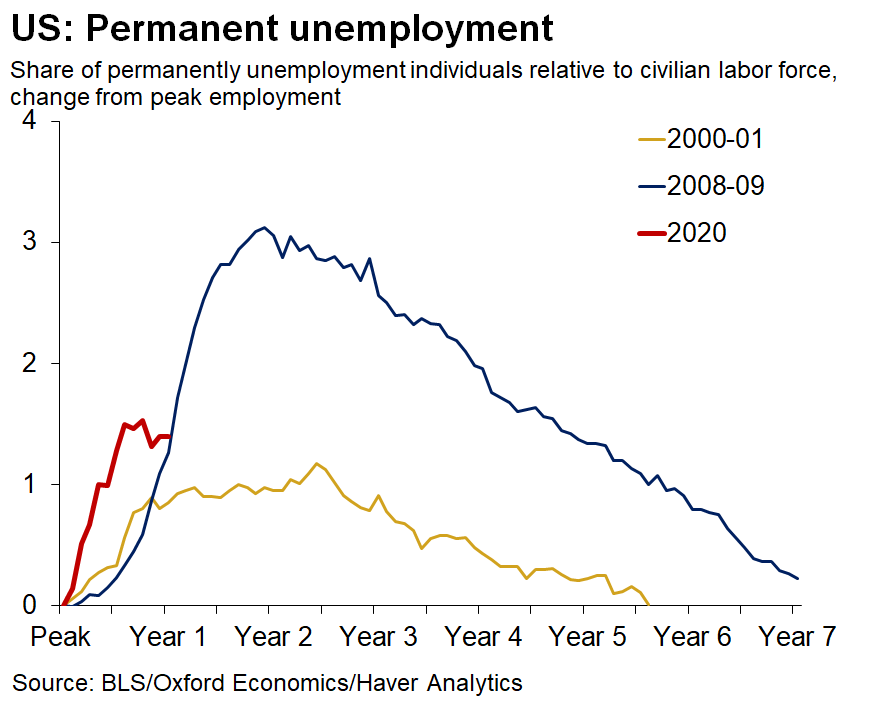

With 4.3 million permanently unemployed individuals, the rise in permanent #unemployment was faster than during the 2 prior recessions. Encouragingly though, the trend has stabilized. Now we need to get on a downward trend!

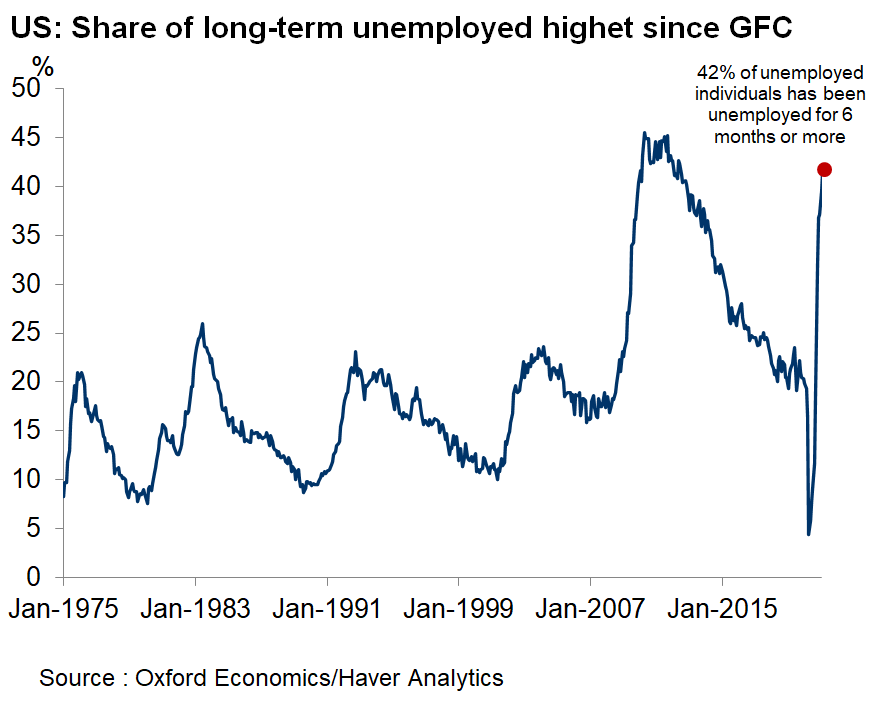

Another concern is #unemployment duration:

🛑More than one out of two unemployed individual has been unemployed for more than 15 weeks

🛑42% of those unemployed have been so for over 27 weeks

🛑More than one out of two unemployed individual has been unemployed for more than 15 weeks

🛑42% of those unemployed have been so for over 27 weeks

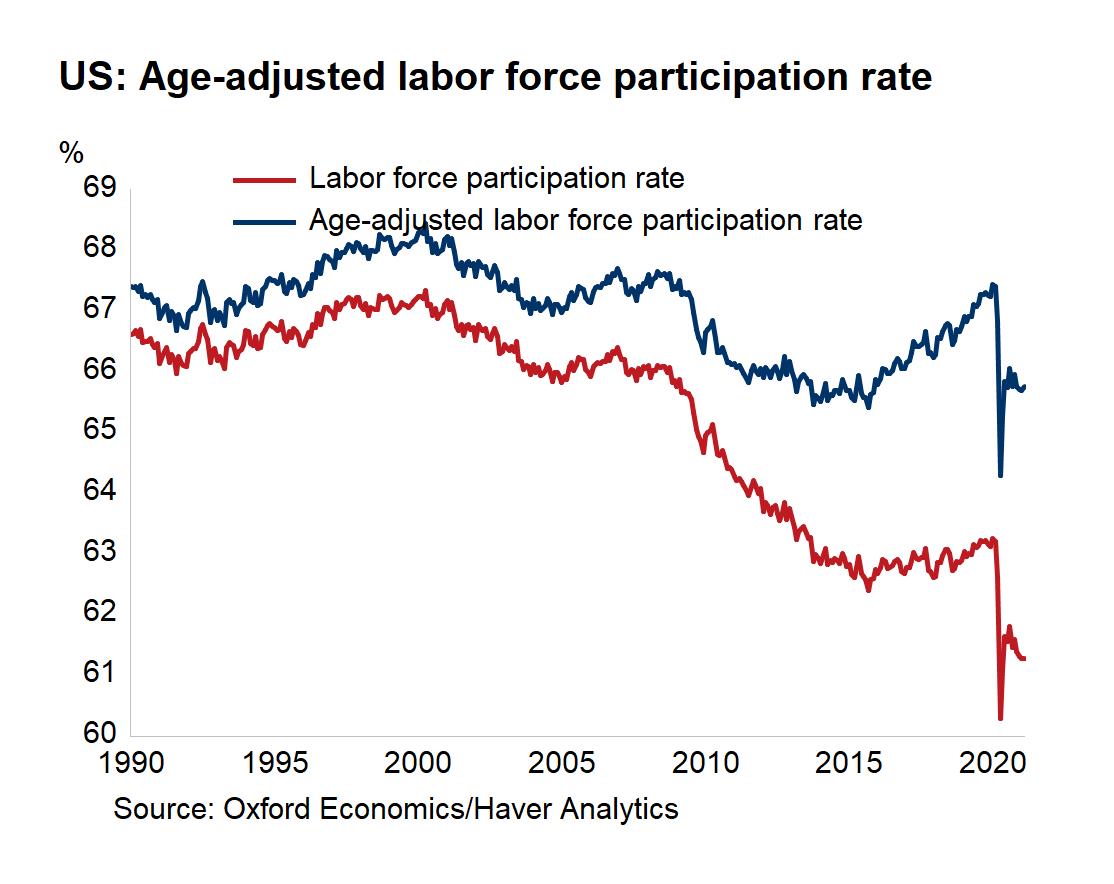

🇺🇸The age-adjusted labor force participation rate shows how difficult is was to regain the pre-GFC levels -- it took a decade!

We're now back to levels consistent with 2014-2015

>> About 4 years before we reclaimed pre-GFC levels

We're now back to levels consistent with 2014-2015

>> About 4 years before we reclaimed pre-GFC levels

• • •

Missing some Tweet in this thread? You can try to

force a refresh