#Fed #FOMC statement largely unchanged

- NEW qualitative outcome-based forward guidance for QE program that links the horizon to max employment + price stability goals

- no change to composition or size of QE, but a floor of "at least" $120bn per month

- NEW qualitative outcome-based forward guidance for QE program that links the horizon to max employment + price stability goals

- no change to composition or size of QE, but a floor of "at least" $120bn per month

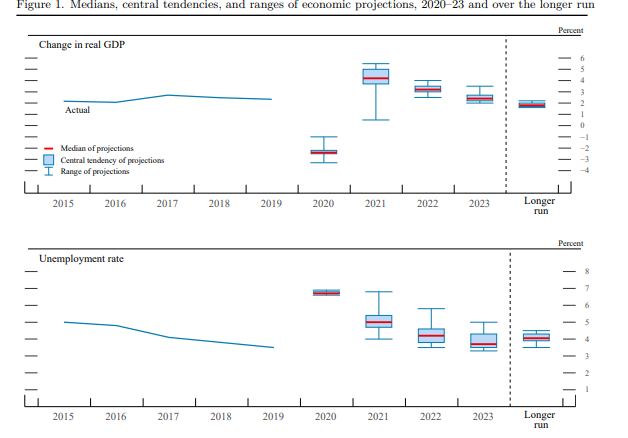

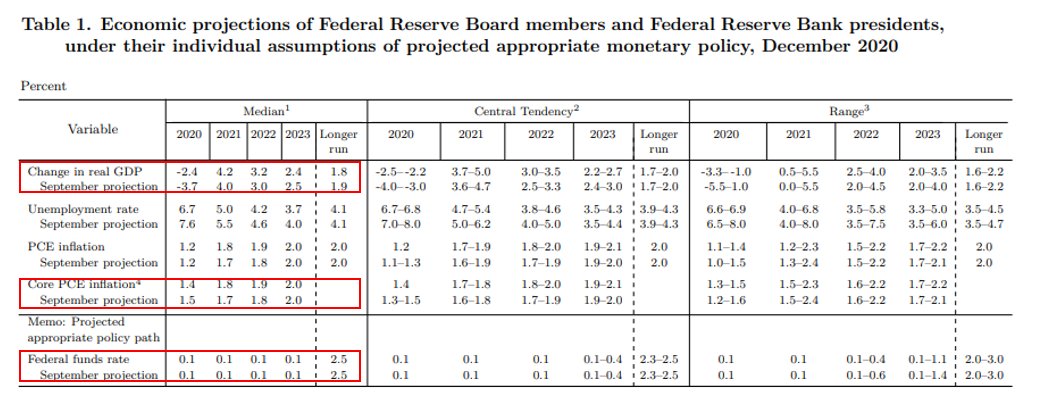

The latest economic projections:

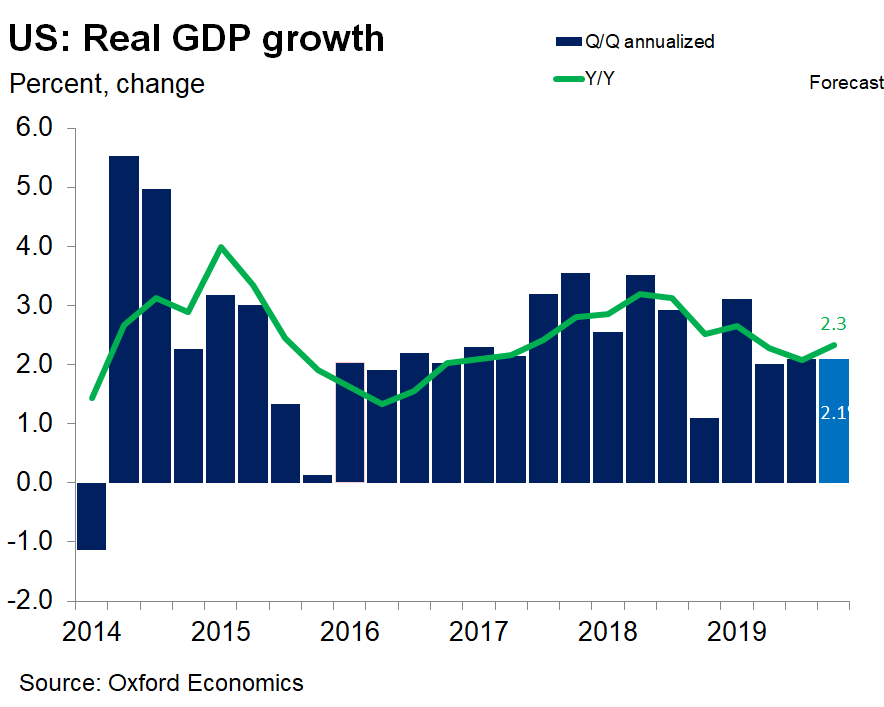

- Stronger near-term growth expectations

- Quite strong #GDP expectations for 2021

- Lower unemployment projections: below 4% in 2023

- #Inflation only a tad firmer: below 2% till 2023

- #Fed funds rate at zero through 2023

- Stronger near-term growth expectations

- Quite strong #GDP expectations for 2021

- Lower unemployment projections: below 4% in 2023

- #Inflation only a tad firmer: below 2% till 2023

- #Fed funds rate at zero through 2023

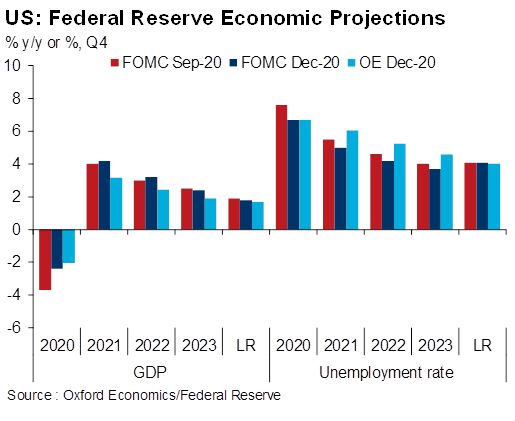

The #Fed's #GDP growth & #unemployment forecasts help explain why the Fed decided not to increase size or composition of QE.

They foresee rather strong growth in 2021 with a rapid decline in the unemployment. I wonder what their labor force participation rate assumptions are.

They foresee rather strong growth in 2021 with a rapid decline in the unemployment. I wonder what their labor force participation rate assumptions are.

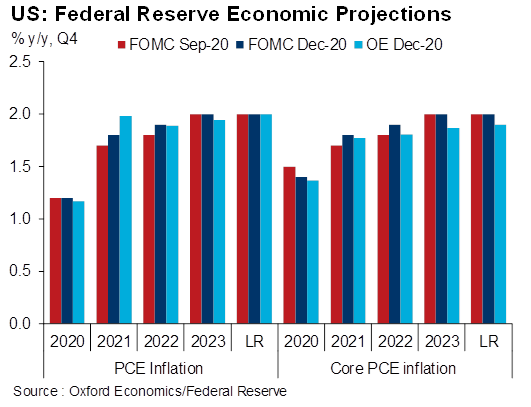

Headline #inflation could surprise the #Fed in 2021, especially given their optimistic take on GDP growth and employment progress

• • •

Missing some Tweet in this thread? You can try to

force a refresh