1. A recap on #China electricity shortage, National Development and Reform Commission (#NDRC) that’s at the center of news, and what’s next.

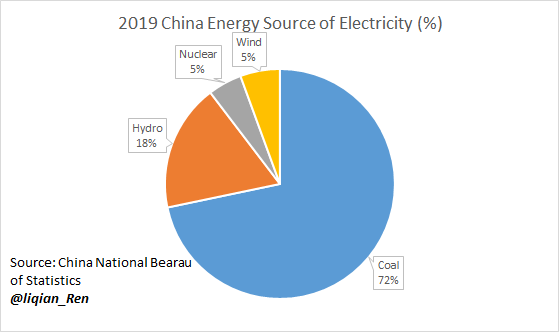

2. Like any sudden shortage, it’s demand, supply, low slack and sudden shock. Due to low price of Coal in 2020 right after Covid, and government's push to reduce overcapacity and carbon emissions, coal inventory was low. China electricity is 70%+ coal power.

3. This September 3rd Moody’s report on coal sector was a 2 weeks early to be noticed. They mention 10 largest producers – all SOEs – accounted for nearly 53% of China's coal production in 2020, while three regions represented 70% of total production

moodys.com/research/Moody…

moodys.com/research/Moody…

4. On the demand side, the economy was recovering, particularly in industrial manufacturing and export, which are the two main drivers of 2020 China growth with continued weak consumption.

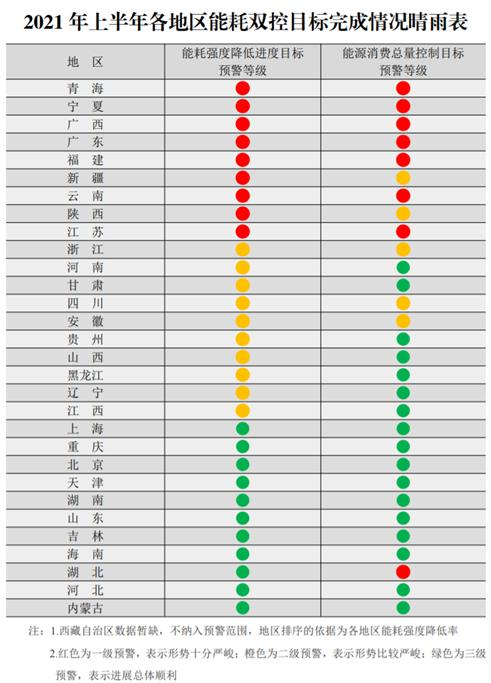

5. This coupled with the hard environmental targets that’s forcing high energy users and inefficient users to halt production.

https://twitter.com/liqian_ren/status/1439438098845380608

6. Different regional reasons for the electricity shortage. Northeast rust belt, sudden reduction on wind power. Shanghai surrounding area, more driven by environmental targets. Southern provinces, more by heat induced demand. There was electricity imbalance across the country.

7. In most news of electricity shortage, NDRC is brought up frequently. The closest equivalent I can think is OMB(Office of Management Budget). Think NDRC as the planning side of Chinese economy, not the market/private business side which various estimates put around 60% of GDP.

8. Every level of government has a NDRC. The national NDRC is dubbed “little state council”. It’s behind strategic and detailed planning, including one belt one road, or what the electricity/water price should be. Its English website is informative. en.ndrc.gov.cn

9. That lays another #China wrinkle of this electricity crisis. The coal price is decided by market, but electricity price, majority of coal production and electricity production, and energy efficiency standards are set by NRDC! (wink wink, they kind of messed up)

10. As coal price increased in 2021, the SOE electricity generators have no incentive to increase electricity because its price is fixed. The more they generate power using coal, the more money they lose. Classic Econ 101 at work.

11. NRDC’s fingers are everywhere, as every bridge government wants to build needs NRDC approval. Not surprising when there is government power on where money is spent, there is rampant corruption. Search for NRDC corruption and many high profile cases.

12. Huatai Securities’ analysts assessing the production of electronics manufacturing companies, directly affecting most in this high-low order: semiconductor packaging and testing> consumer electronics manufacturing> communications equipment manufacturing> semiconductor foundry.

13. The impact is real, but the hard tech industries favored by the government is less hit. Many of them expect this to be short to medium term, lower growth numbers of next 1-6 months.

14. Expect (NDRC) to order increased coal electricity production, both dominated by state owned enterprises as NRDC needs to show they can clean up the mess. There is also discussion on reforming electricity pricing mechanism to reflect more market prices of coal (#inflation)

15. Some interesting energy crisis history around the world.

https://twitter.com/JKempEnergy/status/1349358099392573446

16. A very funny joke of the electricity crisis on Chinese social media. Japanese Animation Series Ultraman 奥特曼was taken down and re-stocked after some parents complained of violence. The crisis is the revenge of the Ultraman.

https://twitter.com/Dali_Yang/status/1442580524220944393

17. Hunan NDRC allows transmission electricity cost from wholesale to end-users. Guangdong Electricity Exchange allows 10% float. NDRC(发改委) central to this crisis. Business oriented provinces/Guangdong follow more market mechanism #China #Inflation

https://twitter.com/LHongqiao/status/1442840409181462528

@threadreaderapp unroll #NDRC #China #Electricty #Shortage #Exchange #Growth #Guangdong #Hunan #Energy #Environment #Coal #发改委 #电力交易 #economy

18. National #NDRC Econ. Adj. Bureau gave Q&A for energy security next 6 mons. Points outlined in this thread already. If I were snarky yesterday, should've added extra plot: someone in this Bureau is trying to hold on to his job/praying for a mild winter. ndrc.gov.cn/xwdt/xwfb/2021…

• • •

Missing some Tweet in this thread? You can try to

force a refresh