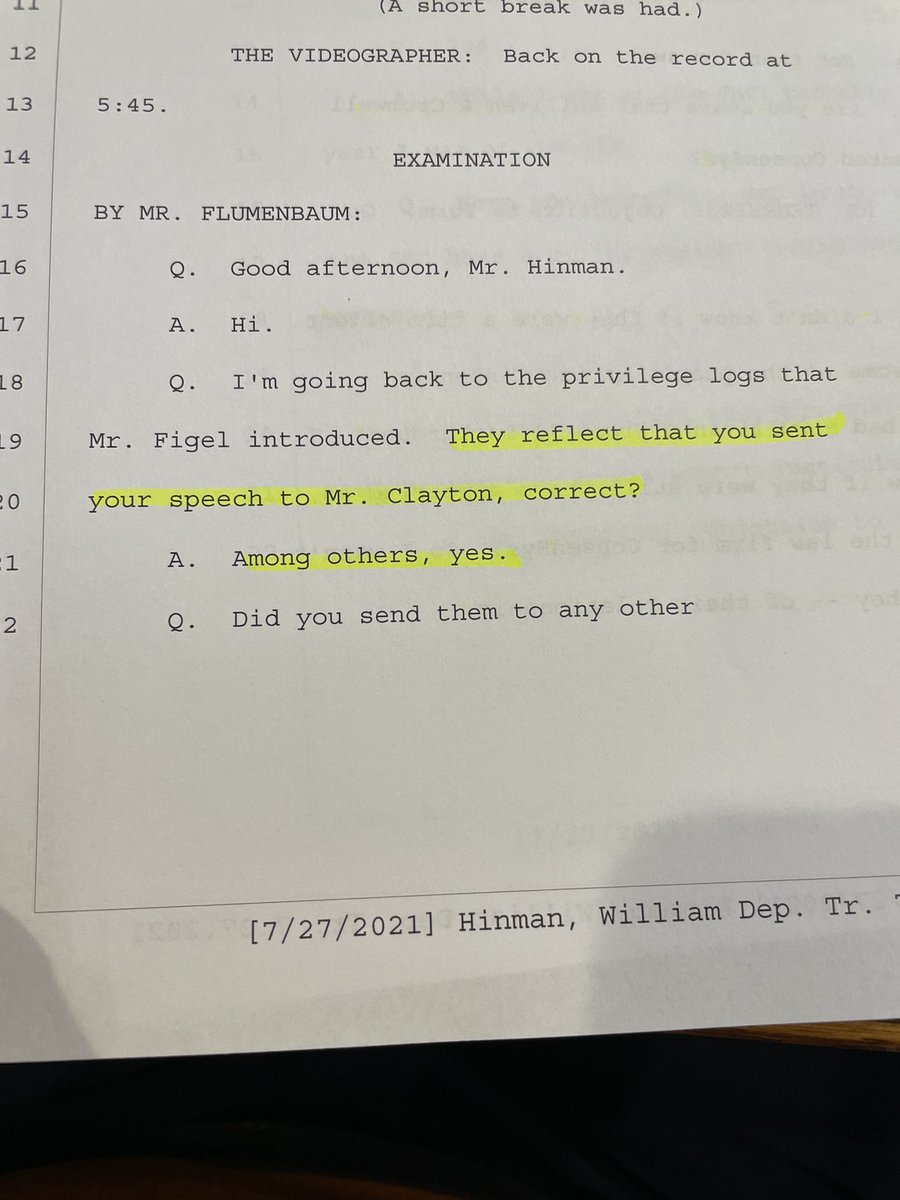

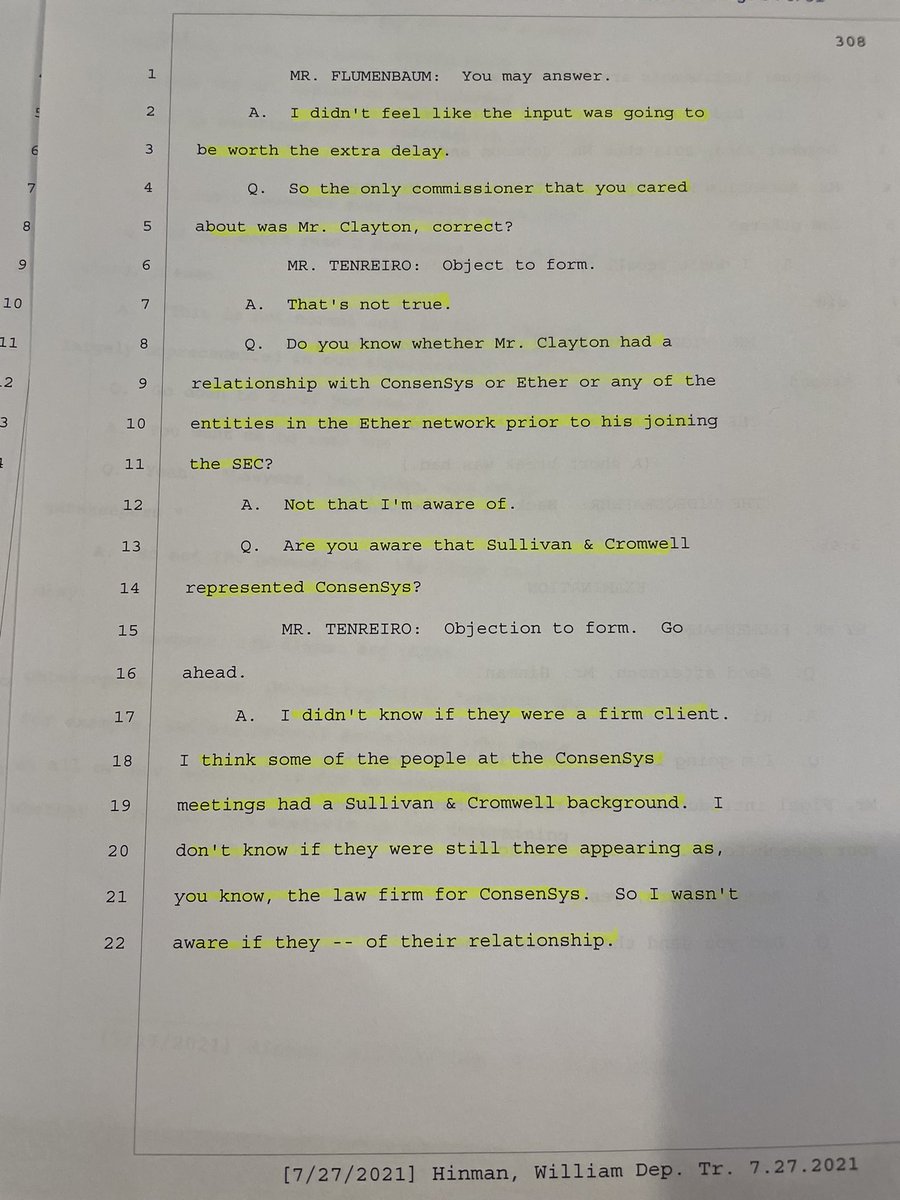

William Hinman gave Ether a free pass regarding its ICO because he adopted the decentralization argument fed to him by prominent Ether investors.

That’s a fact, not an opinion. Nancy Wojtas was there and she speaks the truth. @CGasparino @EleanorTerrett @LizClaman @TeamCavuto👇

That’s a fact, not an opinion. Nancy Wojtas was there and she speaks the truth. @CGasparino @EleanorTerrett @LizClaman @TeamCavuto👇

https://twitter.com/digitalassetbuy/status/1438553340368064525

Hinman never explained exactly what about Ether’s “decentralized structure” caused sales of Ether to fall outside the U.S. securities laws. Its

3 1/2 years later and market participants and investors still don’t know how to define “sufficient decentralization.”

3 1/2 years later and market participants and investors still don’t know how to define “sufficient decentralization.”

@Ripple fought hard to get any evidence related to the SEC’s analysis of Ether, #Bitcoin and XRP.

If Ripple can show the #XRPLedger is equal or more decentralized than the Ether Network, Ripple could win based on fair notice.

But what does “sufficiently decentralized” mean?

If Ripple can show the #XRPLedger is equal or more decentralized than the Ether Network, Ripple could win based on fair notice.

But what does “sufficiently decentralized” mean?

Before we can have an honest discussion regarding decentralization, we must first distinguish the Token from the Network.

Most Ripple and XRP critics immediately raise the issue that Ripple owns 55% of all XRP. They argue, therefore, XRP is centralized.

Most Ripple and XRP critics immediately raise the issue that Ripple owns 55% of all XRP. They argue, therefore, XRP is centralized.

Critics often conflate Token ownership with network centralization. In my opinion, the @SECGov is also guilty of focusing too much on the token itself, when analyzing U.S. securities laws. I’m not alone in my belief. @HesterPeirce has been critical of the SEC for this approach.

During @ThinkingCrypto1’s first interview of Hester, she states she’s trying to get her colleagues to stop thinking of the Token as the security. Its quite alarming she spends anytime making that point b/c Howey never declared the 🍊to be a security.👇

The SEC alleges that all XRP including the XRP traded in the secondary market represents an investment contract with Ripple. In short, the SEC alleges the very nature of XRP makes it a security.

Therefore, if the SEC gets what it wants, all XRP will be deemed a security.

Therefore, if the SEC gets what it wants, all XRP will be deemed a security.

I & 52,000 others, from around the 🌎, have joined in the fight against the SEC’s overreach. @Ripple lawyers must defend 1,700 #XRP transactions the SEC claims are transfers of unregistered securities. Ripple lawyers defend their clients from paying $1.3 billion in disgorgement.

#XRPHolders simply seek a firm declaration of the law. In fact, Ripple could lose part of the case (i.e. sales of XRP by Ripple between 2013-2017 are ruled securities) while #XRPHolders get a total victory. Our victory comes in the form of a Declaratory and/or Summary Judgement.

Although Congress should be providing the clarity, it’s unlikely to happen and @GaryGensler will NEVER define sufficient decentralization b/c he wants maximum prosecutorial options. Thus, how Judge Torres rules regarding XRP may be the only guidance the market and investors get.

One key to victory is making sure the Court is aware of the distinction between the Token and the Network because the analysis may come down to what constitutes sufficient decentralization.

If Token ownership is a determining factor then XRP isn’t sufficiently decentralized.

If Token ownership is a determining factor then XRP isn’t sufficiently decentralized.

But if sufficient decentralization is determined by analyzing the control over the network (as it should be), then the #XRPLedger is without question sufficiently decentralized.

A valid argument exists that the #XRPL is more decentralized than the #Ethereum Network.

A valid argument exists that the #XRPL is more decentralized than the #Ethereum Network.

In fact, one could argue that, at times, the #XRPL has been more decentralized than the #Bitcoin Network.

Until very recently, an overwhelming percentage of #Bitcoin mining was centrally located in China. “In 2019, it had reached as high as 75 percent.”

thehill.com/policy/finance…

Until very recently, an overwhelming percentage of #Bitcoin mining was centrally located in China. “In 2019, it had reached as high as 75 percent.”

thehill.com/policy/finance…

More significant, 3 years ago #BItcoin Mining giant Bitmain mined 42% of all blocks in one week, “steadily moving closer to controlling a majority 51% of the network hash rate.👇

So how do the above facts affect the concept of sufficiently decentralized?

bitcoinist.com/bitmain-51-per…

So how do the above facts affect the concept of sufficiently decentralized?

bitcoinist.com/bitmain-51-per…

If 4 miners control 65% of the #BTC Network hash rate, is #Bitcoin sufficiently decentralized?

I can make a strong argument that the #XRPL is more decentralized than #Ether - both today and back in 2018 when ETH investors “convinced” Hinman to give ETH a regulatory free pass.

I can make a strong argument that the #XRPL is more decentralized than #Ether - both today and back in 2018 when ETH investors “convinced” Hinman to give ETH a regulatory free pass.

Don’t believe me? Then listen to lawyers like Nancy Wojtas and Wendy Moore, who were involved in the private meetings between #Ether investors and Hinman. Wojtas disagreed with Hinman and stated Ether was NOT decentralized. Notice how Wendy Moore reacts with “Why isn’t Ripple?”

https://twitter.com/digitalassetbuy/status/1443162434156511232

So what makes XRP centralized? Many argue the Token ownership by @Ripple.

Yet, “there’s nothing widespread about Bitcoin ownership.”

Whales continue to own most of the #Bitcoin

“About 2% of the anonymous ownership accounts control 95% of #BTC”👇

bloomberg.com/news/articles/…

Yet, “there’s nothing widespread about Bitcoin ownership.”

Whales continue to own most of the #Bitcoin

“About 2% of the anonymous ownership accounts control 95% of #BTC”👇

bloomberg.com/news/articles/…

Or, is decentralization determined by control over the network?

If so, Ripple controls less than 5% of the Validators on the #XRPL.

Ripple proposed an amendment to the #XRPL and it was vetoed by the majority of the XRP Network for over 2 years.

If so, Ripple controls less than 5% of the Validators on the #XRPL.

Ripple proposed an amendment to the #XRPL and it was vetoed by the majority of the XRP Network for over 2 years.

Let’s go back to the 55% of XRP owned by Ripple: @JoelKatz, co-creator of the #XRPL, stated that a super majority of the Network could force Ripple to burn its XRP escrow.

So how do we determine sufficiently decentralized? The SDNY Court in #Telegram cited a very simple test.

So how do we determine sufficiently decentralized? The SDNY Court in #Telegram cited a very simple test.

It’s called the Bahamas Test. You simply ask “What if the creators or promoters of the Token took the money they made from sales of the Token and disappeared to the Bahamas 🇧🇸? Would the token or the technology/platform survive without further effort by those same promoters?

The #XRPL has a built-in DEX - the first decentralized exchange of its kind. There are hundreds of developers building on the #XRPL - independent of Ripple. In 2018 if Ripple and it’s executives disappeared to the Bahamas with the money made from XRP sales, the #XRPL continues.

In 2018 (when Hinman gave the free pass), would Ether have survived if @VitalikButerin @ethereumJoseph and company disappeared to the Bahamas? What about Ether 2.0?

Lubin and Vitlalik admit they knew Ether wouldn’t scale when they built it and it’s still being worked on today👇

Lubin and Vitlalik admit they knew Ether wouldn’t scale when they built it and it’s still being worked on today👇

https://twitter.com/notgrubles/status/1175188890736631809

Even @mcuban recently said he was confident “Vitalik will figure it out.”

The Bahamas Decentralization Test is magnificent in its simplicity. When you consider that test along with @HesterPeirce’s Safe Harbor proposal it’s not difficult to figure out what the U.S. should do.

The Bahamas Decentralization Test is magnificent in its simplicity. When you consider that test along with @HesterPeirce’s Safe Harbor proposal it’s not difficult to figure out what the U.S. should do.

Come up with objective criteria that gives clarity AND promotes innovation in the United States 🇺🇸Congress is unlikely to act. Genlser wants maximum uncertainty so he can continue to pick the winners and the losers. @CGasparino @bgarlinghouse @RaoulGMI @EleanorTerrett @TeamCavuto

In the meantime, the Cryoto market in the United States could rise or fall on what happens in the SDNY where sufficient decentralization could get redefined.

Over 50K #XRPHolders are trying to do their part while many fail to realize that almost all tokens are in danger in 🇺🇸👇

Over 50K #XRPHolders are trying to do their part while many fail to realize that almost all tokens are in danger in 🇺🇸👇

https://twitter.com/CryptoLawUS/status/1450907976106233862

• • •

Missing some Tweet in this thread? You can try to

force a refresh