You never thought that #SNEAKERS would take it this far

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

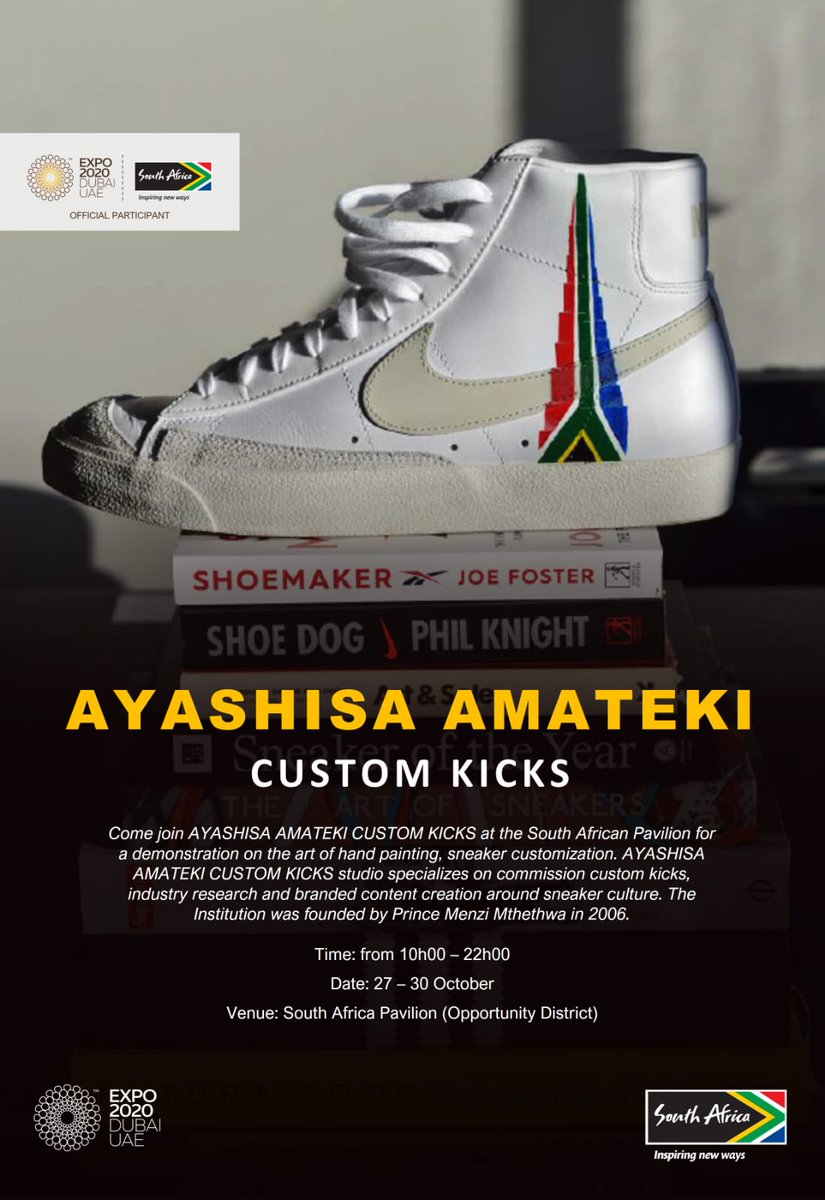

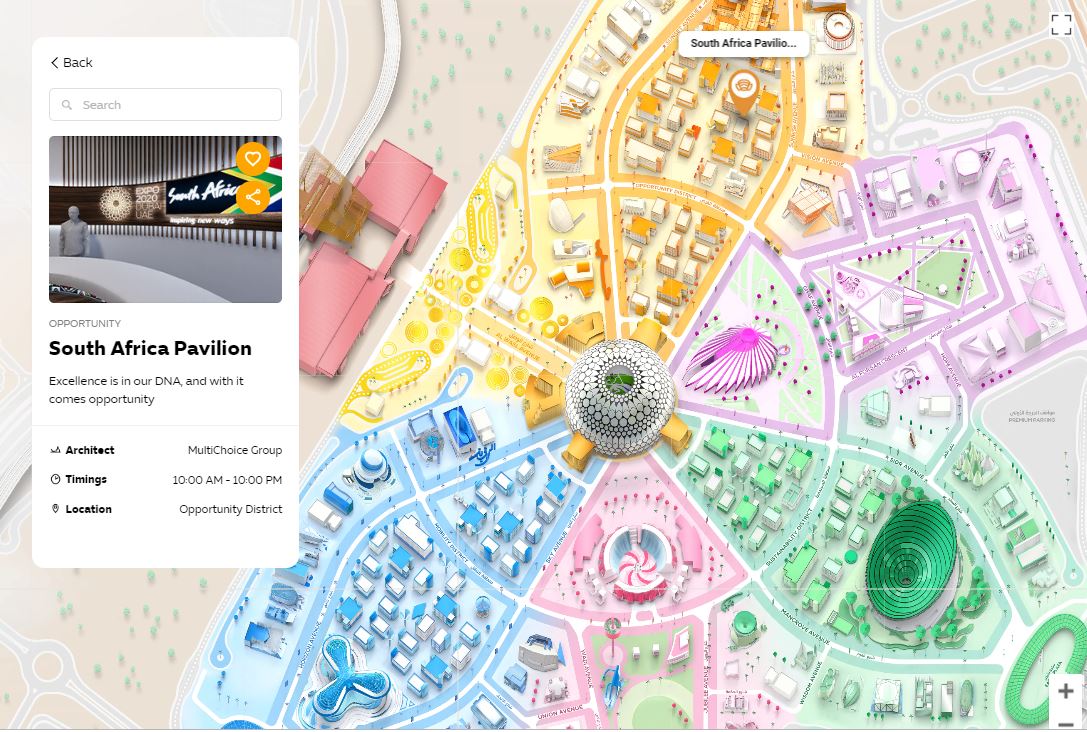

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#CULTURE #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#CULTURE #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

Are you #Addicted to #Fresh?

Do you #RespectYourFeet?

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#CULTURE #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

Do you #RespectYourFeet?

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#CULTURE #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

A premier celebration of #Arts and #Culture

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#DrESTHERMAHLANGU #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#DrESTHERMAHLANGU #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

South Africa Pavilion visitors enjoyed customizing their favourite pair of sneakers by a talented set of South African artists 🇿🇦

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021 #DontSleep on

@MenziMthethwa & @Ayashisaamateki at #Expo2020

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021 #DontSleep on

@MenziMthethwa & @Ayashisaamateki at #Expo2020

Dr. Esther Mahlangu will be at the SA pavilion showcasing her beautiful talent to the world & customising the AJ1 sneaker.

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

With more than 190 countries in one place, if you're in #Dubai - 25 - 31 Oct 2021

#DontSleep on our Folks @MenziMthethwa & @Ayashisaamateki at #Expo2020

#DontSleep on the OFFICIAL UNVEILING of the Dr. ESTHER MAHLANGU #AirJordan1

29th Oct. 2021 - DSTV Channel 405

Show your love to our Folks @MenziMthethwa & @Ayashisaamateki at #Dubai #Expo2020

#DrESTHERMAHLANGU #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

29th Oct. 2021 - DSTV Channel 405

Show your love to our Folks @MenziMthethwa & @Ayashisaamateki at #Dubai #Expo2020

#DrESTHERMAHLANGU #OFFICIALTISSUE #KICKGAME #SouthAfrica Pavilion 🔥🔥🔥🚀😎

If you missed it, I feel bad for you kid.

The #Dubai #Expo2020Dubai was BIG for #SNEAKER #Culture 🔥

#Shouts to the LEGENDARY #DrESTHERMAHLANGU & our people @MenziMthethwa & @Ayashisaamateki

"They said we couldn't do it but it's done, they said we couldn't win but we won" 😊

The #Dubai #Expo2020Dubai was BIG for #SNEAKER #Culture 🔥

#Shouts to the LEGENDARY #DrESTHERMAHLANGU & our people @MenziMthethwa & @Ayashisaamateki

"They said we couldn't do it but it's done, they said we couldn't win but we won" 😊

Major Love goes out to the good folks @BusinessInsider for shining light on the AMAZING #ART being churned out by our peoples @MenziMthethwa & @Ayashisaamateki.

P.S. #NuffRespect due for giving me a young cameo 😁 BLessUP

#SNEAKER #CULTURE #Expo2020Dubai #DrESTHERMAHLANGU 🔥🚀

P.S. #NuffRespect due for giving me a young cameo 😁 BLessUP

#SNEAKER #CULTURE #Expo2020Dubai #DrESTHERMAHLANGU 🔥🚀

@threadreaderapp Kindly unroll...

• • •

Missing some Tweet in this thread? You can try to

force a refresh