I am humbled and privilleged to note that my #Research paper; "Sources of #Unemployment in #Lesotho" is now available and can be accessed via the People's Republic of #China's National #Science and #Technology #Library - #NSTL. I give thanks 😎

So far this year, I have successfully published three #Research articles in #Macroeconomics & #Finance, with another two in press. I am currently hammering away at a handful of working papers which will most certainly find a home in reputable #Journals, come 2021 🙏🏽🙂

Im currently internalising the very insightful reviewer comments on my latest #Research paper titled; "Investigating Determinants of Commercial Bank Spreads in #Lesotho", from the good folks over at the globally reputable #International #Journal of #Finance & #Economics #IJFE 😊

Iv'e just received galley proof of my #Research article, wherein I investigate determinants of #Household #Debt in #Lesotho, from the #International #Journal of #Economic #Policy in #Emerging #Economies - #IJEPEE. We're getting closer to publication. Quite excited & thankful🙏🏽😎

After working on the reviewer's comments & baking in the richness of the peer review process into my final #Research paper, I am very happy & proud to wake up to this acceptance letter of #Publication from the #International #Journal of #Finance & #Economics #IJFE 🙏🏽😎

I absolutely love how easy it is to work with the #International #Journal of #Finance & #Economics - #IJFE #Online #Proofing #System. I am going through my final galley proof & its a breeze. If you're interested in #Bank Spreads, in #Lesotho, article will be published soon 🙏🏽😎

I am humbled and honoured to note that my #Research paper titled: "The effects of regional cross listing on firm value and financial performance: Drawing lessons for #Lesotho" has been cited in a December 2020 article on "#CrossListing" in #China. I give thanks 🙏🏽😎

On December 17, 2020; two exciting #Research articles were published in the #International #Journal of Finance & Economics - #IJFE. One of them is by my colleagues & the other one is mine. I thank God for all the #Blessings. 🙏🏽 #Finance #Volatility #Economics #Spreads📈🔥🔥🔥🚀😎

I woke up this morning to an email from a Colleague whom I greatly admire. His words of life fuel my drive and keep me going. I send #Peace, #Wisdom & #LongLife to my fellow Scholar & Brother; Prof. Nicholas Odhiambo 🙏🏽

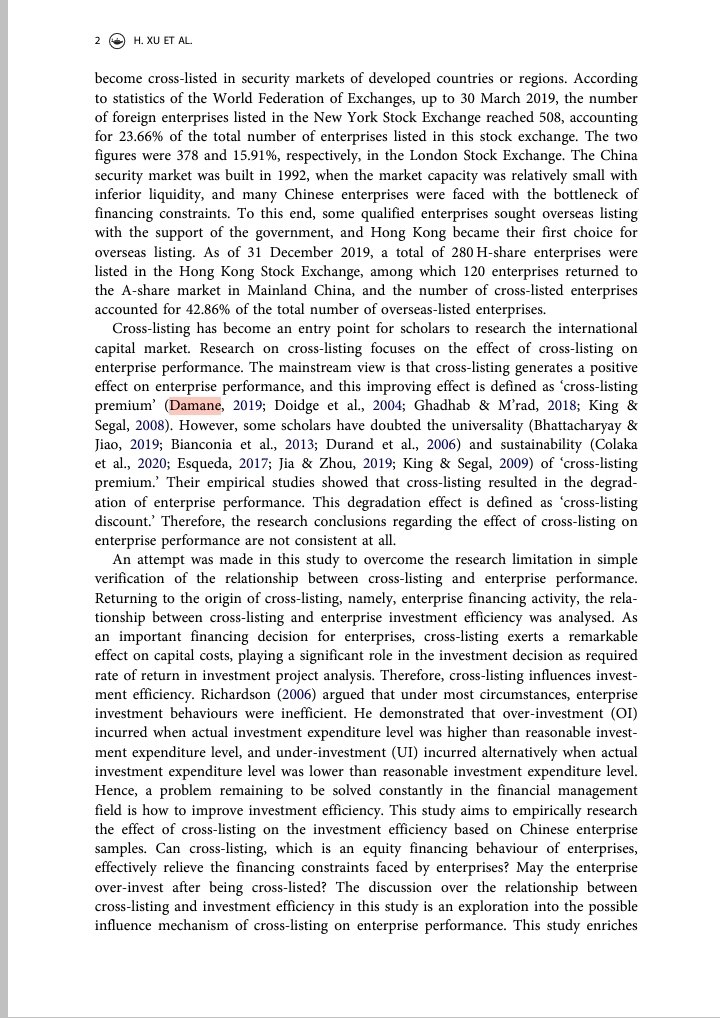

In the year 2020, I published a handful of #Empirical #Research papers that explore various #Macroeconomic themes, with the use of cutting edge #Econometrics 😎

In 2020, I published 4 #Research articles in international journals. I came into 2021 with 2 #Empirical papers in press. I will add 6 papers to this list & publish a total of 8 papers by the end of 2021 & present atleast 2 of them at international conferences. #ItWasWritten..!

The year is off to a fly start for the kid. I am humbled to note that my paper where I use #SVAR to evaluate impact of the #US #FEDfundsrate on #SouthAfrica has been cited in a 2021 paper by colleagues looking at #Causality of #Islamic & conventional #Banking #DepositRates. 🙏🏽😎

#Note: My #Research article wherein I use #PrincipalComponents & #ARDL #Cointegration to investigate determinants of #Household #Debt in #Lesotho is now available to #Researchers #Academicians & #Scholars via #International #Journal of #Economic Policy in Emerging Economies 🙏🏽😎

My Colleague & I have been investigating the impact of #COVID19 on #Lesotho's #InformalSector - #HairDressing Sector. We use #RealTime #SurveyData & #QualitativeResponseModels. Preliminary results make for very interesting #Policy lessons. We cant wait to share them soon 📈😎

My colleague & I recently completed the 1st draft of our empirical #Research work wherein we investigate the impact of #COVID19 on #Lesotho's #InformalSector. We are very proud of this work and we look forward to sharing it with all interested, soon 😎

Just got word that my #Research paper on the demand for #Money has been cited in a 2020 #ConferencePaper by Colleagues from #UCT, Capetown #SouthAfrica . Colleagues looked into matters of #FinancialInclusion. I give thanks for the opportunity to add to the body of #Knowledge 🙏🏽😎

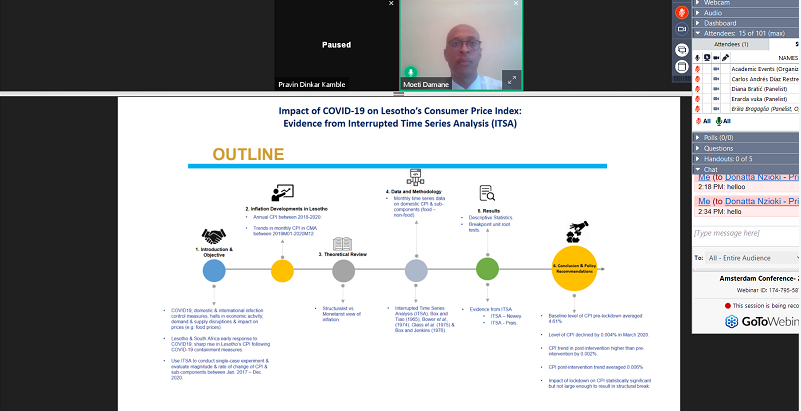

I just got the most amazing news! My #Research paper wherein I investigate #COVID19 impact on #Lesotho's #CPI using #ITSA, has been accepted for presentstion at the 2021 #International #Conference of #Management #Economics & #Finance #ICMEF, in Amsterdam. Incredibly honoured 🙏🏽

#FiscalPolicy is back in vogue. Now more than ever, authorities need well laid out ways to track & perform rapid evaluations of #Fiscal #Stimulus initiatives in an #Economy. I recently completed a #Research article wherein I introduce a simple #Framework for doing just that:

I am humbled & thankful to note that my #Empirical #Research paper on the sources of #Unemployment in #Lesotho has been cited in another research paper by colleagues, published in Feb 2021. Check for both papers, when you can 🙏🏽😎

#Shouts to the good folks @ResearchGate for the weekly #Report #Stats #Research #Reads #Citations 🙏🏽🔥🔥🔥🚀😎

My colleagues & I developed three #Research papers so far in the 1st quarter of 2021. The papers are currently undergoing peer review. In time, they'll be published in reputable international journals. Look out for them, if you're interested in #Econometrics #Macroeconomics 📈😎

I am honoured & privilleged to be attending the 3rd annual #ICMEF to present my paper titled; "Impact of #COVID19 on #Lesotho's #CPI: Evidence from ITSA". Hope to see you there. Looking to build, especially on cutting edge #Econometrics #Macroeconomics #Modelling & #Simulation 😎

I'm 45% done with this paper. I should have the first draft knocked out by Mid-March 2021. I am enjoying working with the #Dynamic #Common #Correlated #Effects - #DCCE #Estimator. The #Programming & #Coding in #STATA makes it a breeze to work with the #Model variants #MG #PMG

If you are interested in the longterm linear & non-linear relationship between #Bank spreads & macrodrivers, be sure to pick up & #Read my latest #Emprical #Research via #IJFE. I use the #ARDL & #NARDL to arrive at very insightful results 😎

God has been incredibly good to me. I give thanks daily. My love & passion for #Economics / #Research / #Econometrics / #KnowledgeSharing has afforded me great honour & privilege. Humbled to represent #Lesotho at #ICMEF2021 #Conference #Amsterdam #Highlighted #Speakers 🔥🔥🔥🚀😎

The programme for the upcoming #International #Conference of #Management #Economics and #Finance - #ICMEF to be held in #Amsterdam has been released. I am proud to be presenting our #Empirical #Research paper on #COVID19's impact on #Lesotho's #CPI, using #ITSA 🔥🔥🔥🚀😎

I send #Peace to @ResearchGate for the updates. I am humbled to note that my #Research paper wherein we use #SVAR to investigate determinants of #Unemployment in #Lesotho has been cited in a very educative paper on causes & solutions to #Poverty, by colleagues at #PAUGHSS. 🙏🏽😎

Join us on 26 – 28 February, 2021 in #Amsterdam, Netherlands for the 3rd #ICMEF. Between engaging presentations, buzzing networking, & immersive learning opportunities, this #Conference is a must-attend event for scholars, #Researchers, scientists, & other members of the academia

This weekend in #Amsterdam, at the #International #Conference of #Economics #Management & #Finance - #ICMEF, I am honoured to present an #Empirical #Manuscript my colleague & I wrote. Owing to that & more, this song will carry huge significance in my life, going forward🔥🔥🔥🚀😎

My colleague & I are humbled & privileged to have our #Empirical #Research #Work; "Impact of #COVID19 on #Lesotho's #Consumer #Price #Index: Evidence from Interrupted #TimeSeries Analysis #ITSA", recognised at the 3rd #ICMEF - #Amsterdam. We give thanks 🙏🏽🔥🔥🔥🚀😎

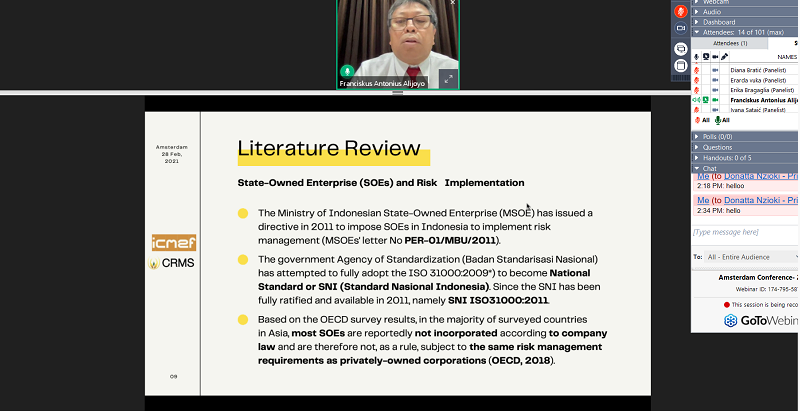

This weekend was a gift. I give thanks. The presentation went very well 🔥🔥🔥🚀😎. I send peace to the good folks at #ICMEF - #Amsterdam for providing the platform to #Build & #ShareKnowledge with colleagues from around the world🌍. I enjoyed many of the papers. Three stood out.

Very insightful #Empirical #Research #Work coming out of my Alma mater; The #National #University of #Lesotho, looking at #Regulation and its role in #Bank #Lending...🔥🔥🔥🚀😎

My #Empirical #Research wherein I investigate #Macroeconomic determinants of #Household #Debt in #Lesotho, can now be found on @sciencegate_ch @ScienceGateinfo alongside other similar works from; #Brazil, #Malaysia etc. Check for it, if you like #Econometrics & Macro #Policy...

I had fun deliberating #FinancialInclusion #Macroeconomic #Policy #PrincipalComponentAnalysis #InterruptedTimeSeriesAnalysis #COVID19 #StructuralBreaks #CPI #Options #Derivatives #Economics #Finance #Modelling, with colleagues from around the world at the #ICMEF - #Amsterdam 😎

This is a very important paper. If you look for it on #GoogleScholar you'll see only 6 citations. By the end of this year (2021), I anticipate atleast 20 if not 30. Why? You have to understand #PanelData & how significant of a contribution this paper is. #CrossSectionalDependence

I have plenty of #Empirical #Research papers to share with you in 2021. Im most excited by my current #Work with #PanelData / #CrossSectionalDependence; #InterruptedTimeSeries / #SyntheticControls & #TopicModelling using #NaturalLanguageProcessing, to inform #EconomicPolicy..!

If you are interested in #MachineLearning #Algorithms #MonetaryPolicy #Communication #LatentDirichletAllocation #STATA #Python #Coding #Programming #Economics #Statistics and #Research in a #Digital world; here is a little taste of what I am currently working on...

Draft One: #TopicClassification of the #MonetaryPolicyStatements of the #CentralBankofLesotho: Evidence from #LatentDirichletAllocation (LDA).

#MonetaryPolicy #TextMining #BigData #MachineLearning🤖 #Coding #Programming #Policy #Communication #Digital #Modelling 📈📚🖥️😎

#MonetaryPolicy #TextMining #BigData #MachineLearning🤖 #Coding #Programming #Policy #Communication #Digital #Modelling 📈📚🖥️😎

I am proud and humbled to note that my #Empirical #Research paper titled "The effects of regional #CrossListing on firm value and financial performance" has been cited in a recent paper by colleagues out of Lithuania. I give thanks 🙏🏽🔥🔥🔥🚀😎

In between text mining / #TopicModelling #MonetaryPolicy Statements & other such documents, I couldn't help but start playing around with the #dsgenl command in #STATA/MP16. Its quite impressive & intuitive. You can expect a #Research paper wherein I use #NonLinearDSGE, soon 😎

God is Good & deserves all praise! I am extremely honoured & humbled to be invited to present my #Research paper at the prestigious #AfricanFinanceAssociationConference 2021. So excited to share on #AI #MachineLearning #Algorithms #LatentDirichletAllocation #MonetaryPolicy 🤖📈😎

I'm having incredible fun working on this paper #nldsge #dsge #NewKeynesian #Lesotho #Econometrics #Microfoundations #Macroeconomics #FixedExchangeRate #ImpulseResponseFunction #FinancialFrictions #Shocks #Control #State 📈😎

The 17th @Africagrowth #Africa #Finance Association #Conference is coming up in a few weeks. I am excited to present my #Empirical #Research on #BigData - #UnstructuredData - #BigDataAnalytics - #MachineLearning - #ArtificalIntelligence #LDA in #Economics / #Finance 🔥🔥🔥🚀😎

Mad #Respect goes out to my Bro, Timothy Okoli. Him and I did nuff damage at the #AREF - #WBS 😎

If you are interested in all things #FinTech, make sure you pick up his recently published #Empirical #Research paper on the same...

If you are interested in all things #FinTech, make sure you pick up his recently published #Empirical #Research paper on the same...

I am Humbled & Honoured that my #Empirical #Research paper on #FinancialInnovation , Co-Authored with my colleague, has been #Published in the #International #Journal of #Financial #Innovation in #Banking #IJFIB. It makes my first publication for 2021 (more to come) 🔥🔥🔥🚀😎

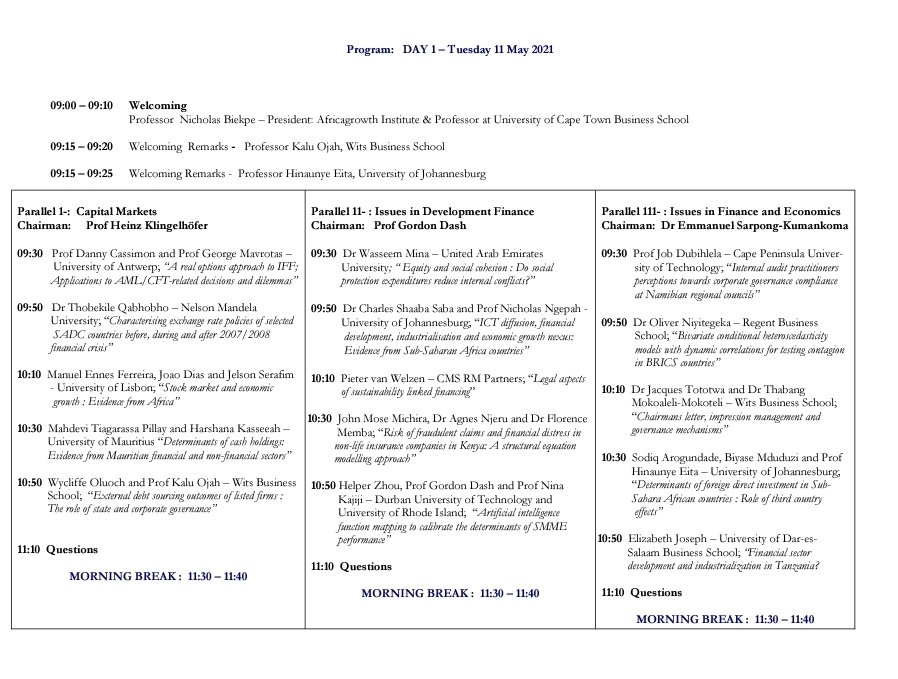

I just received the conference #Programme for the upcoming 17th #African #Finance #Association #Conference - #AFAC via @Africagrowth. I'm looking through it now and its 🔥🔥🔥🚀😎

Guess who's also in it, alongside #Giants in the game...

I'll share more later 😉

Guess who's also in it, alongside #Giants in the game...

I'll share more later 😉

The 17th annual #African #Finance Association #Conference starts today. It promises to be an exhilarating experience. Take a look at the full programme list...

Cc @Africagrowth

Cc @Africagrowth

It is a great privilege to be among the presenters at this year's #AFAC via @Africagrowth. My paper on #MachineLearning #AI #Algorithms and #TopicModelling in #Policy #Banking & #finance will open the closing session of the conference; a HUGE HONOUR. I give thanks 🙏🔥🔥🔥🚀😎

In Jan. 2021, I set out to publish 8 #Empirical #Research papers on #Finance & #Economics in respected journals & present atleast 2 at reputable #International #Conferences. God has been good to me. Ive presented at 2 conferences & published 1 paper so far, with 4 under review 🙏

I captured a healthy bunch of my random #Threads on #Macroeconomics via @threadreaderapp's #Unroll. looking at them now, they make a nice little portfolio. I should write some more 😎📚

threadreaderapp.com/user/iamSANhed…

threadreaderapp.com/user/iamSANhed…

• • •

Missing some Tweet in this thread? You can try to

force a refresh