senior partner, AUDIBLEBRAILE Entertainment, Producer, Emcee & all round Scholar of this HIPHOP culture

How to get URL link on X (Twitter) App

Are you #Addicted to #Fresh?

Are you #Addicted to #Fresh?

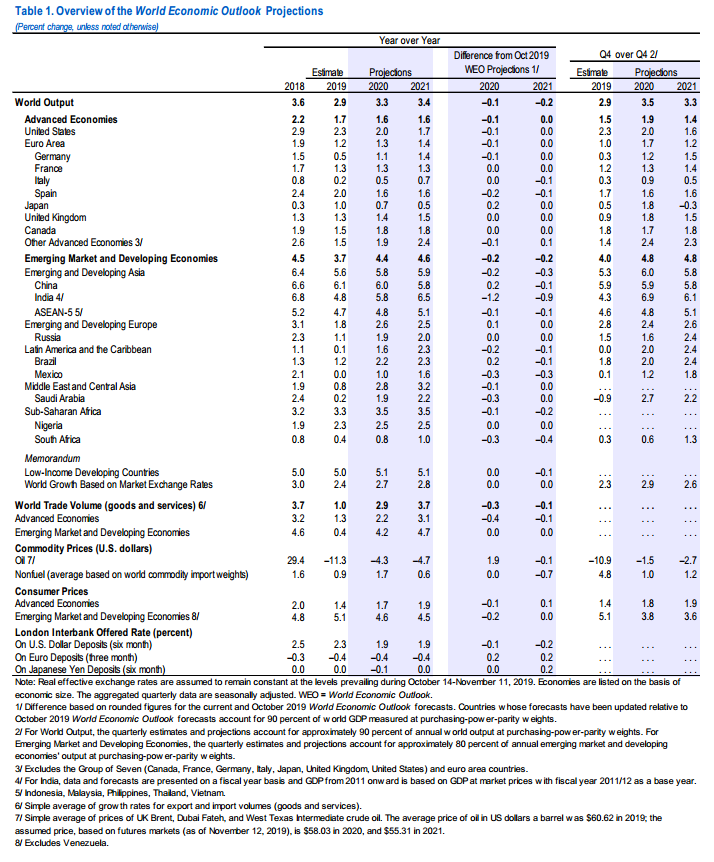

So far this year, I have successfully published three #Research articles in #Macroeconomics & #Finance, with another two in press. I am currently hammering away at a handful of working papers which will most certainly find a home in reputable #Journals, come 2021 🙏🏽🙂

So far this year, I have successfully published three #Research articles in #Macroeconomics & #Finance, with another two in press. I am currently hammering away at a handful of working papers which will most certainly find a home in reputable #Journals, come 2021 🙏🏽🙂

https://twitter.com/BraSmoove/status/1287957332920606721

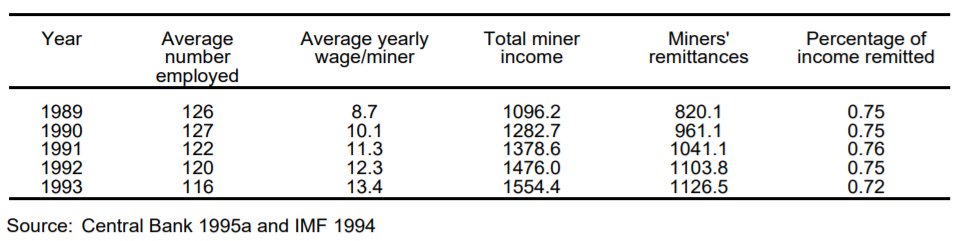

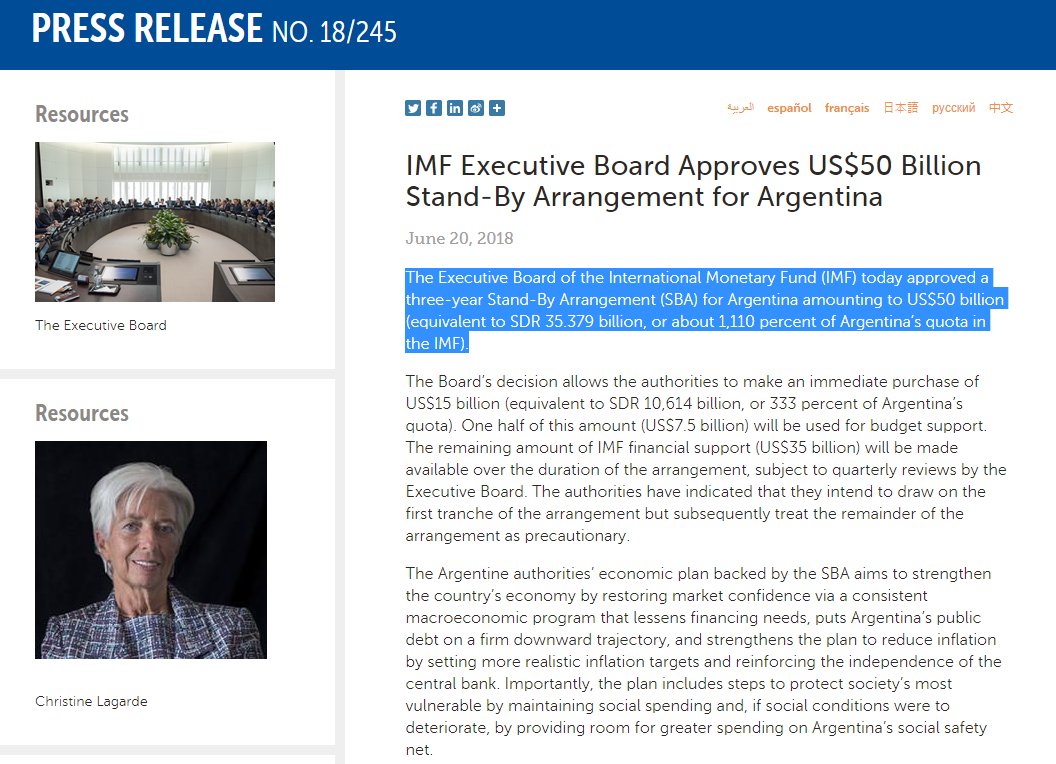

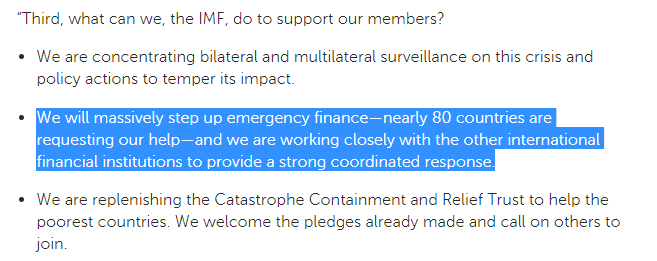

@BraSmoove If facility modalities (qualification requirements etc.) are understood, it becomes apparent the loans are concessional. If overlaps between external & internal shocks are appreciated & public gross financing needs articulated, BoP support from IMF best option.

@BraSmoove If facility modalities (qualification requirements etc.) are understood, it becomes apparent the loans are concessional. If overlaps between external & internal shocks are appreciated & public gross financing needs articulated, BoP support from IMF best option.

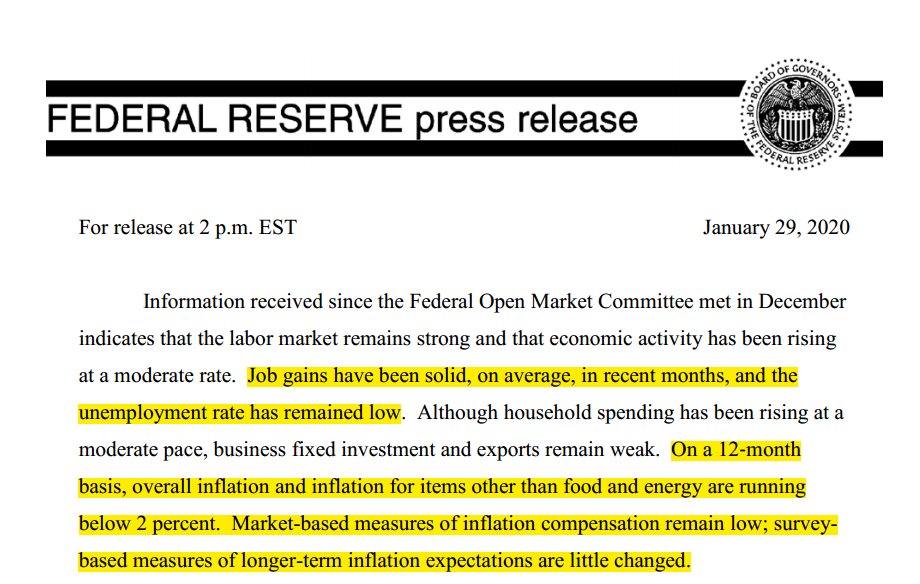

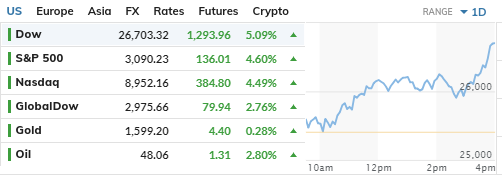

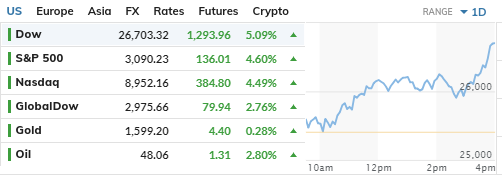

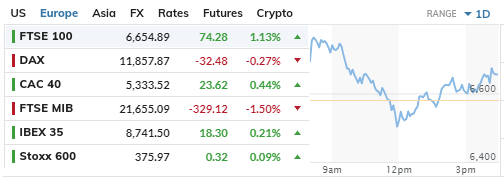

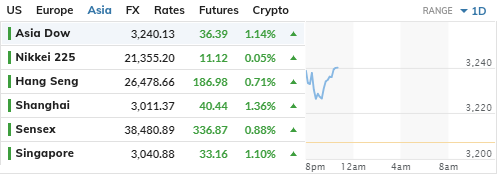

While #CentralBank commitment to "lower for longer" might help rally markets today, it is still imperative for us to consider the #Global #MonetaryPolicy #Toolbox and if policy makers will have enough space to "keep cutting" or providing "stimulus" moving forward.

While #CentralBank commitment to "lower for longer" might help rally markets today, it is still imperative for us to consider the #Global #MonetaryPolicy #Toolbox and if policy makers will have enough space to "keep cutting" or providing "stimulus" moving forward.