1/13) #Uranium #mining #stocks are blessed with increasingly bullish fundamentals🤠🐂 as surging demand for #CarbonFree #Nuclear #energy for #NetZero🌞⚛️🏗️⬆️ collides with a sustained #U3O8 supply deficit.💥⛏️⬇️ Here's a thread 4U that explores the Uranium #investing thesis💰🧵👇

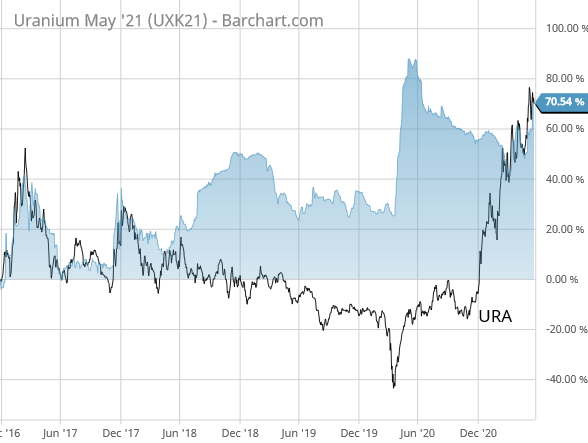

2) #Uranium #mining #stocks are famous⭐️ for delivering investors extraordinary life-altering returns😎🍹🏝️ when they enter a boom cycle⤴️ after a long painful bear market for #Nuclear fuel😩 when supply/demand fundamentals shift🌊 as they have now in a strong bull market🤠🐂../3

3) #Uranium is a cyclical commodity🔃 that goes through boom & bust cycles based on supply vs demand imbalances⚖️ magnified to extremes🌜 by supply security fears😟 as there is no substitute fuel for #nuclear reactors⚠️ so fear can lead to panic buying by nuclear utilities🛒.../4

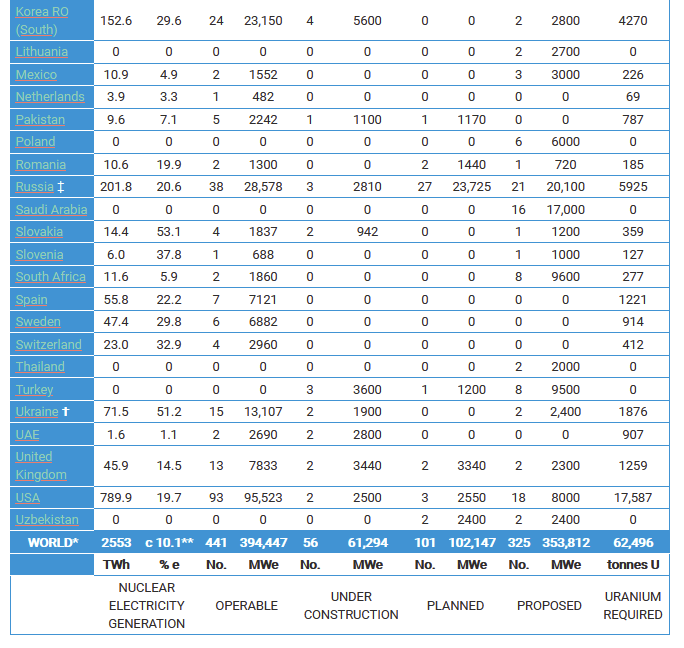

4) The World #Nuclear Association estimates that 2020 mined Global #Uranium production was just 47,731tU (124M lbs #U3O8) which was the lowest annual production since 2008⏬⛏️ meeting only 74% of the world's 2020 nuclear reactor fuel demand.⚠️⚛️😟 .../5

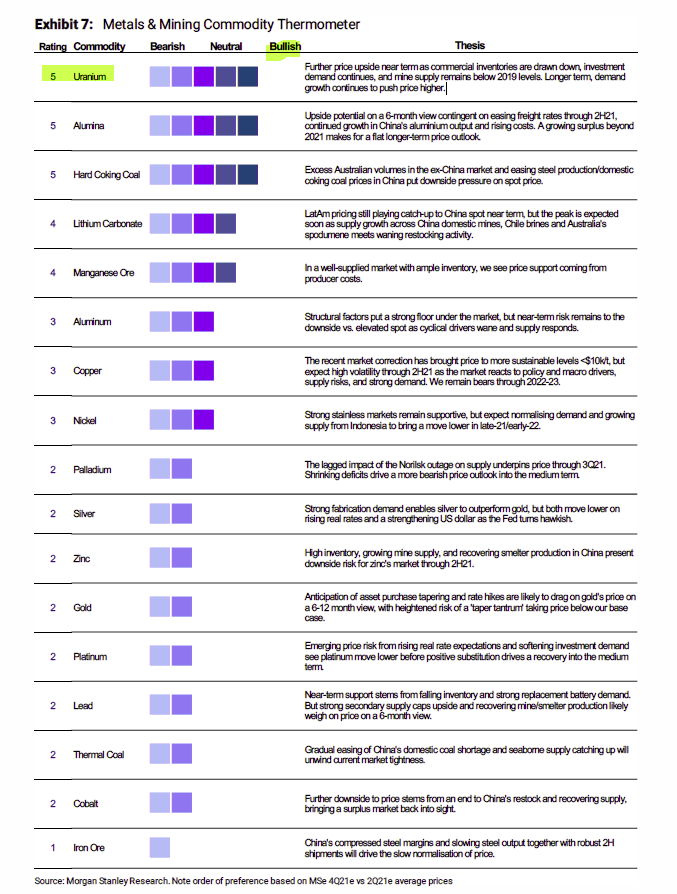

5) World #Nuclear Association reports 441 operable reactors⚛️ providing 394GW of 24/7 #CarbonFree power🌞⚡️ plus 56 under construction (61.3GW)🏗️ with 101 units in advanced planning or ordered🧾 and 325 more proposed👩💼 with a raised 2.6% per year growth rate forecast.🔮↗️🐂 .../6

6) Like other commodities #Uranium rises in value when supply is scarce🏜️ which in turn triggers more production to meet demand🏭 but because it's the most regulated mined metal📚 subject to extremes of environmental scrutiny🧐 bringing new mines online is costly💰 & slow🐌 .../7

7) Long time periods👴 to get new #Uranium mines built and idled mines restarted🦥 while #nuclear fuel demand keeps growing🏗️⚛️ leads to what can become an intense supply deficit⏬ that propels uranium prices higher & higher🚀 as fuel buyers panic that they won't get fuel😱 .../8

8) Today mined #Uranium is in a significant #U3O8 supply deficit⏬ after 10 years of a low commodity price🤿 & under-investment in development & construction of new mines.0⃣🏭⛏️ U prices must rise to $60/lb for idled & be sustained at over $70/lb to build new major mines🏗️ .../9

9) Throughout this period of declining mined supply↘️ #Nuclear utilities were under-buying U, drawing down inventory & relying on other #uranium sources (Secondary Supply) to meet demand instead of signing new supply contracts.✍️🧾 They're now running low & must restock ⛽️.../10

10) What may make this #Uranium boom even more extreme🚀🌜 is new global decarbonization🌞 & #ESG drive🌳 requiring far more #CarbonFree 24/7 #Nuclear #energy to meet #NetZero emissions goals⚛️🏗️ which could spike #U3O8 demand higher in the midst of a sustained U deficit🗜️ .../11

11) New @Sprott Physical #Uranium Trust🏦 has added even more fuel⛽️ to macro fundamentals fire already burning under U #mining stocks🔥 with $3.5B in financing💰 & daily At-the-Market program🏧 to purchase & hoard🔒 millions of lbs of Spot #U3O8, hastening U price rise🏎️ .../12

12) New mines⛏️ to meet today's #Uranium demand🛒 should have been financed, licensed & built yesterday🏭 to avoid today's major supply deficit.⚠️ Now a sustained far higher #U3O8 price💲💲 & many $Billions of new investment is needed to build the required new mines ASAP💵 .../13

13) But building large new #Uranium mines takes many years💤 for this highly regulated commodity.🐌 Even if U prices were to soar overnight to $200/lb🚀 it can't speed up mine permitting & construction🦥 so U #stocks will likely soar higher providing life-changing gains 4 U😎🍸💰

• • •

Missing some Tweet in this thread? You can try to

force a refresh