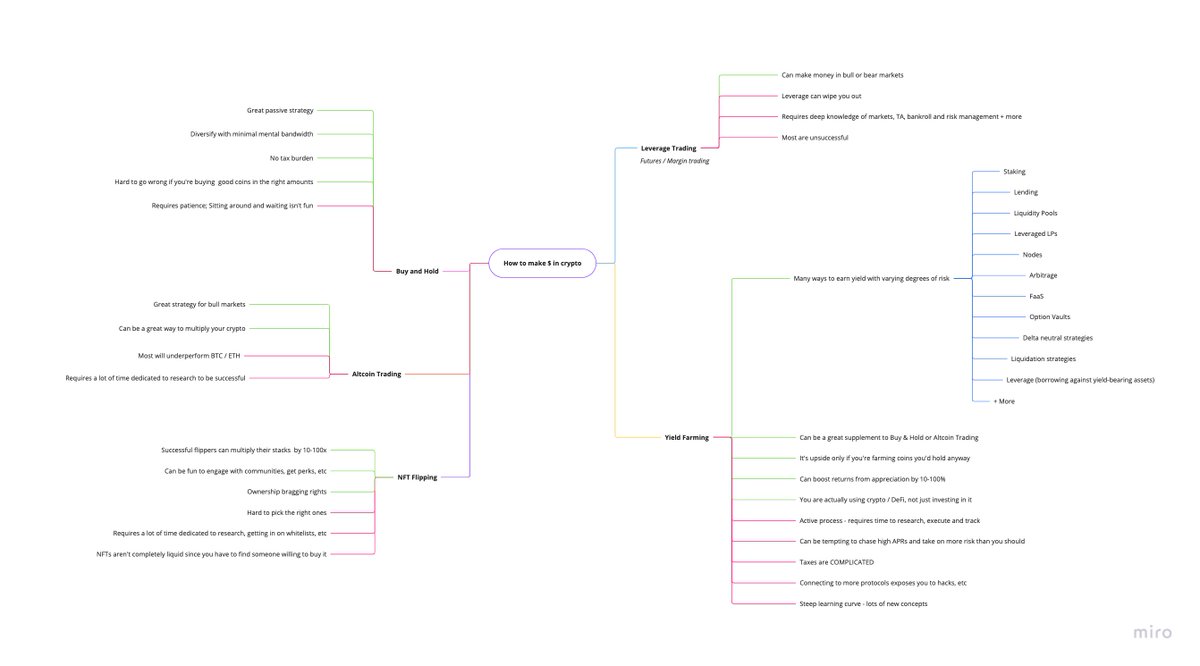

1/ Provide liquidity for stablecoin pairs and earn 60% APR with low risk?! Here's how it works, and the risks you should be aware of 👇🏴☠️

#DeFi #LiquidityPools #YieldFarming #StableCoin #cryptocurrency #crypto #stablecoins $USDC $UST $USDT $DAI $MIM $LUNA $BTC $ETH

#DeFi #LiquidityPools #YieldFarming #StableCoin #cryptocurrency #crypto #stablecoins $USDC $UST $USDT $DAI $MIM $LUNA $BTC $ETH

2/ In the 2021 cryptocurrency space, there are many different stablecoins:

Some like @Tether_to's $USDT or $USDC are centralized and (supposedly) backed by assets. 🏦

Others like #Terra $UST are #algorithmic, relying on #arbitrage to bring the value back to peg. 🌕

Some like @Tether_to's $USDT or $USDC are centralized and (supposedly) backed by assets. 🏦

Others like #Terra $UST are #algorithmic, relying on #arbitrage to bring the value back to peg. 🌕

3/ These stablecoins might only exist on a specific chain like #ethereum, #avalanche, #terraluna, #fantom, #solana or they may have contracts on many different chains. 🎁

4/ People use these stablecoins for various purposes like #lending, #borrowing, #trading, #staking, etc. But all stablecoins are not equal for all #DeFi opportunities. For example, you might specifically need the Fantom chain's $USDC but you might only have $USDT on #Fantom. 🤑

5/ So now, you have to use a #DEX or #DecentralizedExchange on Fantom (like @SpookySwap) to swap your $USDT for $USDC.

People providing liquidity for this pair on #spookyswap get a fee in exchange for this service. 💸

The fee depends on how many others are providing liquidity.

People providing liquidity for this pair on #spookyswap get a fee in exchange for this service. 💸

The fee depends on how many others are providing liquidity.

6/ One of the risks with providing #liquidity is that one token's price could move up (or down) a lot relative to the other token, in which case you experience something called Impermanent Loss (#impermanentloss).

This risk should not exist for stablecoin-stablecoin pairs. 🥳

This risk should not exist for stablecoin-stablecoin pairs. 🥳

7/ In addition - these stablecoins should always have a value of $1, which means there is no risk of price exposure, as there is with something like #bitcoin or #ethereum.

But of course, there are always risks... ☠️👇

But of course, there are always risks... ☠️👇

8/ Peg risk - there is always the risk that a stablecoin loses it's peg and is no longer worth $1. Although designed to never happen, many of these projects are new and haven't been battle tested in all market conditions.

For good stablecoins, this risk should be very low.

For good stablecoins, this risk should be very low.

9/ Smart Contract Risk: There could be bugs in the #smartcontract, that makes it vulnerable to attacks, hacks, or other algorithmic failures.

This is a risk with every #DeFi project, and can be mitigated with smart contract audits and time to test it out.

This is a risk with every #DeFi project, and can be mitigated with smart contract audits and time to test it out.

10/ The risks above have a very low probability (especially for good projects like $UST / $USDC), but if all hell breaks loose and shit hits the fan, it could mean losing everything. Always be prepared for that risk with crypto. #cryptorisks

11/ Finally, the APR that you get from providing liquidity to stablecoin pairs is variable and depends on the amount of liquidity in the pool. More liquidity = lower fees = lower APR. So the 60% APR today is not likely to be around all year.

12/ Help a farmer out - like / follow / retweet! :) #happyfarming 🚜

• • •

Missing some Tweet in this thread? You can try to

force a refresh