To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

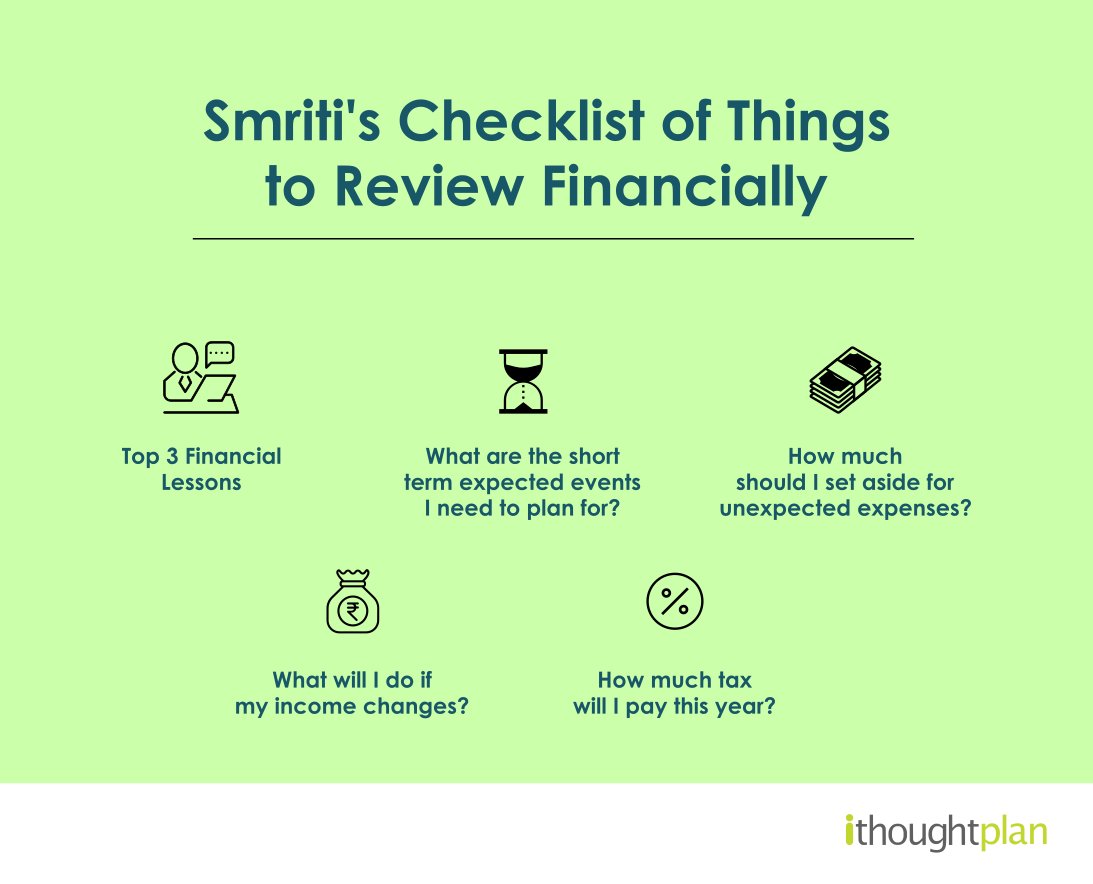

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

Say your monthly expenses are ₹10,000. Your ideal emergency corpus should be ₹60,000.

No compromises should be made here, as the first line of defence absorbs most of the damage. (4/n)

#emergencycorpus

No compromises should be made here, as the first line of defence absorbs most of the damage. (4/n)

#emergencycorpus

#2 Plan Your Big Expenses for the Long-Term

It may be tempting to buy a new iPhone📱 or a car🏎, but putting off the purchase until you have a good corpus built up in savings is essential. Here is why. (5/n)

#financialgoals #financialplanning

It may be tempting to buy a new iPhone📱 or a car🏎, but putting off the purchase until you have a good corpus built up in savings is essential. Here is why. (5/n)

#financialgoals #financialplanning

Let's say your salary is ₹35,000 P.M. the EMI for the new iPhone comes to around ₹13,500 for 6 months. So, for the next half-year, your earnings are reduced to ₹21,500, or 38% of your income is locked up in EMIs. (6/n)

#salary #emi

#salary #emi

Try the 50/30/20 rule with your income.

50% - On needs

30% - On wants

20% - Savings/investments.

Or even better, go aggressive in your initial days. Try saving and investing more. The best time to do so is now when the commitments are low! (7/n)

#investing #savings

50% - On needs

30% - On wants

20% - Savings/investments.

Or even better, go aggressive in your initial days. Try saving and investing more. The best time to do so is now when the commitments are low! (7/n)

#investing #savings

#3 Beware of the Debt Trap

Avoid locking up your cashflows💸 in lengthy EMIs. Credit cards can be tempting, but misuse can quickly trap you in debt!

Falling into the debt trap is particularly easy when loans and offers seem like they are too good to miss! (8/n)

#cashflow #debt

Avoid locking up your cashflows💸 in lengthy EMIs. Credit cards can be tempting, but misuse can quickly trap you in debt!

Falling into the debt trap is particularly easy when loans and offers seem like they are too good to miss! (8/n)

#cashflow #debt

E.g.: A housing loan🏠may seem beneficial from a taxation point of view. And owning a house as an asset may not seem so bad.

It is always best to focus the early stages of your career towards building a proper foundation of savings & investments. (9/n)

#investments #taxation

It is always best to focus the early stages of your career towards building a proper foundation of savings & investments. (9/n)

#investments #taxation

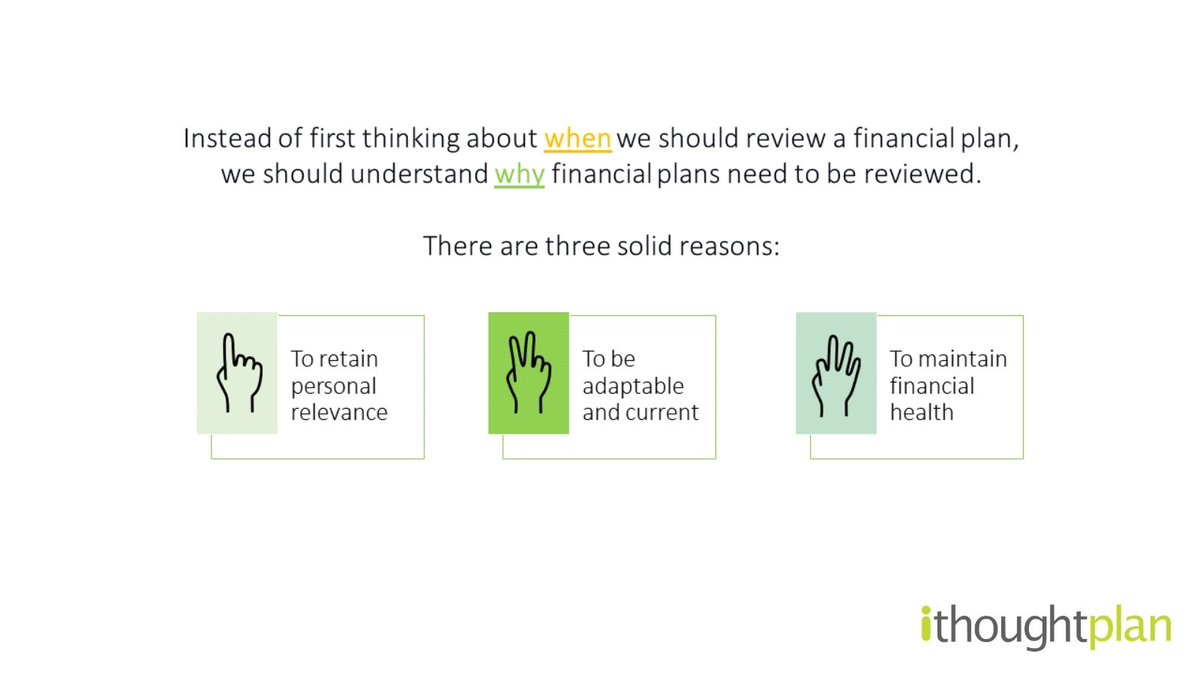

#4 Choosing the Right Investments

The number of options available often presents the problem of plenty.

Seek the advice of a professional. Preferably someone who is SEBI registered. They can help focus your investments on the right products. (10/n)

#financialadvisor

The number of options available often presents the problem of plenty.

Seek the advice of a professional. Preferably someone who is SEBI registered. They can help focus your investments on the right products. (10/n)

#financialadvisor

If you are new to investing, starting slow can help you ease into this process.

Once you are comfortable, slowly bring focus to growing your corpus with 10-15% additional investments💹 every year.

A SIP is a great way to get started! (11/n)

#SIP #investing #mutualfunds

Once you are comfortable, slowly bring focus to growing your corpus with 10-15% additional investments💹 every year.

A SIP is a great way to get started! (11/n)

#SIP #investing #mutualfunds

#5 Insure & Be Sure!

Health insurance allows you to preserve your hard-earned savings and investments. Though you may have employer-provided health coverage🛡, you should get a separate health insurance policy. Wondering Why? (12/n)

#healthinsurance #financialfreedom

Health insurance allows you to preserve your hard-earned savings and investments. Though you may have employer-provided health coverage🛡, you should get a separate health insurance policy. Wondering Why? (12/n)

#healthinsurance #financialfreedom

Your employer-provided cover may come with a lower sum assured, and in case of a loss of your job, it will not cover you. If you have dependents, consider getting a simple term insurance policy as well. (13/n)

#terminsurance #insuranceplanning

#terminsurance #insuranceplanning

Think of Health & Term insurance as something like a fire extinguisher🧯 - you may never encounter a fire, but if you do, you will need it.

Lastly, remember to keep your insurance and investments separate! (14/n)

#insurance #investments

Lastly, remember to keep your insurance and investments separate! (14/n)

#insurance #investments

To Summarize:

✅Set up an Emergency Fund

✅Start small with a SIP

✅Proper asset allocation goes a long way

✅Reduce debt/EMIs

✅Health & Term Insurance is a Must (15/n)

#emergencyfunds #SIP #EMI #insurance

✅Set up an Emergency Fund

✅Start small with a SIP

✅Proper asset allocation goes a long way

✅Reduce debt/EMIs

✅Health & Term Insurance is a Must (15/n)

#emergencyfunds #SIP #EMI #insurance

If you find this thread useful, retweet it and help us reach more people like you. (16/n)

#salary #cashflows #savings #personalfinance

#salary #cashflows #savings #personalfinance

• • •

Missing some Tweet in this thread? You can try to

force a refresh