It's alarming to see the Dutch government doing absolutely nothing to get the #Groningen #NaturalGas field going again.

A thread

1/6

A thread

1/6

To be clear, the Dutch government made a big mistake by closing it down in the first place.

And now it has become impossible to move people even if it would come up with ‘an offer you can't resist.’

Understandable if people say ‘no.’

2/6

And now it has become impossible to move people even if it would come up with ‘an offer you can't resist.’

Understandable if people say ‘no.’

2/6

But the Dutch government can immediately start investing in repair/strengthening/restoration

This would allow some exploration but, more importantly, at least create a longer-term optionality. 3/6

This would allow some exploration but, more importantly, at least create a longer-term optionality. 3/6

Instead, the Dutch government does nothing, which means it has to send the king to the #WorldCup2022 in #Qatar to ensure the #Netherlands, with all its natural gas, gets enough LNG to keep its population from freezing. 4/6

How do you explain having to go from #Russia to #Qatar for your energy supply and not even attempting to make this is as temporary as possible? Unfortunately, that still means year's after taking the wrong decision earlier but al least it's something. 5/6

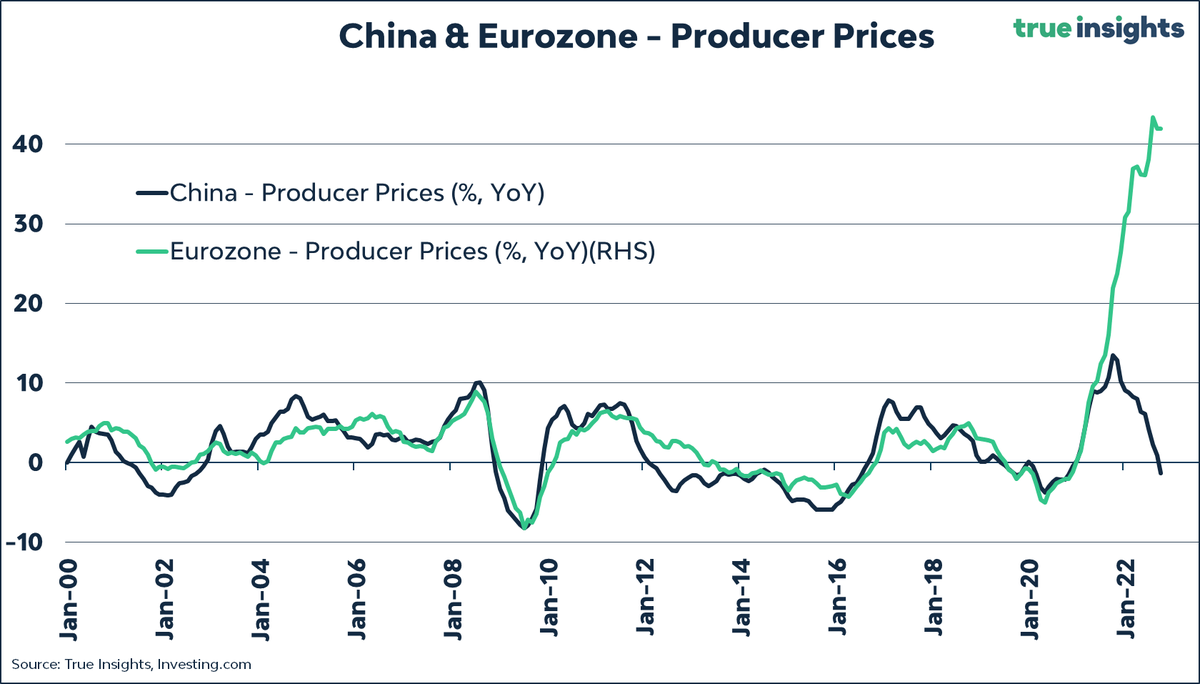

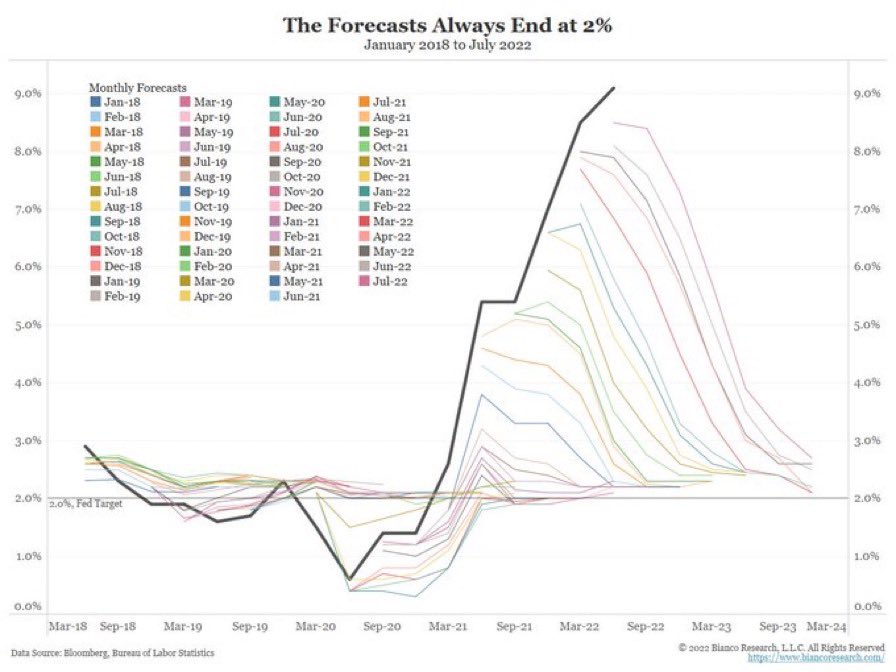

The #Netherlands and the Eurozone have a habit of hurting themselves... on purpose! Next to #energy, the regulations related to #sustainability are entirely unrealistic and directly harmful to the economy, businesses, and consumers. Where did it go wrong?

6/6

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh