@chainlink is one of the most important, yet least understood, pillars of the #crypto ecosystem

It currently serves a vital role for DeFi, NFTs and L1s/L2s, and may ultimately be the unifying layer of #Web3

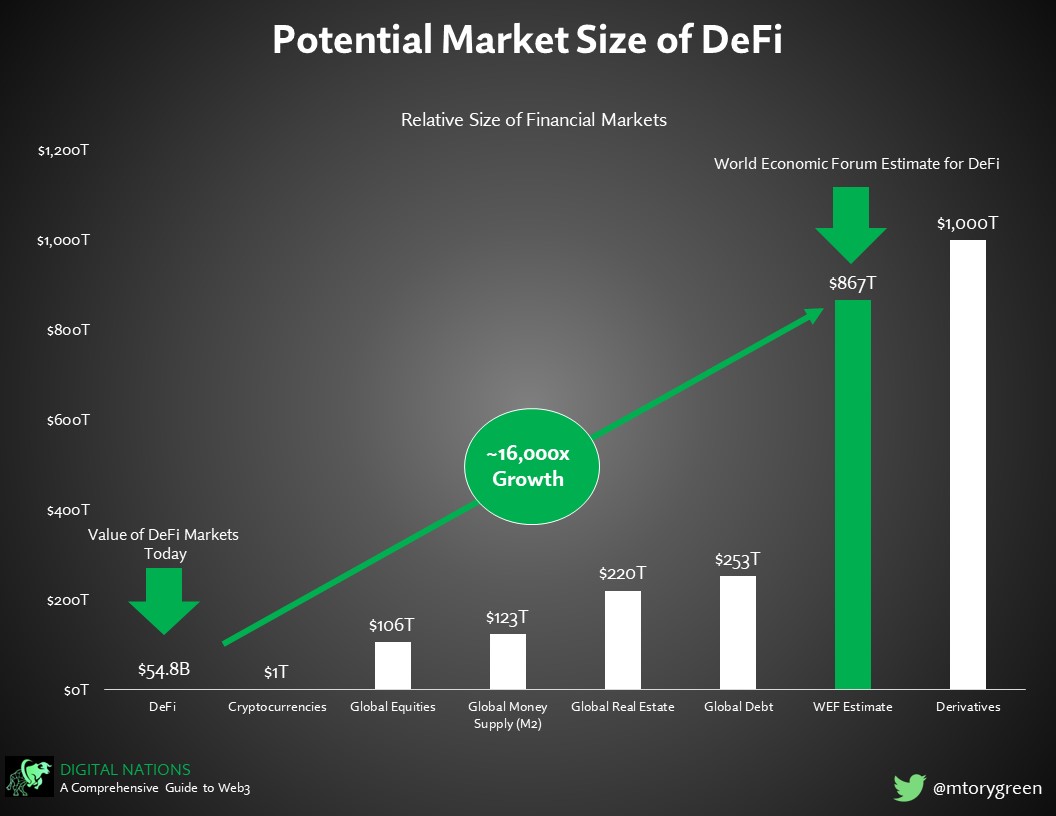

Here’s why $LINK token has the potential to 50x to 100x

👇

🧵

It currently serves a vital role for DeFi, NFTs and L1s/L2s, and may ultimately be the unifying layer of #Web3

Here’s why $LINK token has the potential to 50x to 100x

👇

🧵

2/

Chainlink is a “decentralized oracle network” that allows blockchains to connect to real-world data (we’ll explain this in a second)

It has a market cap of $3.6B, FDV of $7.2B and its $LINK token trades at $7.15

During the last #crypto bull market, the price exceeded $50

Chainlink is a “decentralized oracle network” that allows blockchains to connect to real-world data (we’ll explain this in a second)

It has a market cap of $3.6B, FDV of $7.2B and its $LINK token trades at $7.15

During the last #crypto bull market, the price exceeded $50

3/

This thread will cover the following:

• What is an oracle?

• What problem does Chainlink solve?

• How does it work?

• What is Chainlink 2.0?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of #LINK?

This thread will cover the following:

• What is an oracle?

• What problem does Chainlink solve?

• How does it work?

• What is Chainlink 2.0?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of #LINK?

4/

🔶 What is an Oracle?

#Blockchains have one major limitation – they are unable to access data from external systems

This is by design, like a computer without an internet connection, they maintain their isolation to guarantee security and streamline efficiency

🔶 What is an Oracle?

#Blockchains have one major limitation – they are unable to access data from external systems

This is by design, like a computer without an internet connection, they maintain their isolation to guarantee security and streamline efficiency

5/

Unfortunately, the vast majority of potential use cases for #Web3 require a connection to the outside world

Exchanges need accurate price information, insurance needs data to make decisions on policy payouts and many apps require market information to determine settlements

Unfortunately, the vast majority of potential use cases for #Web3 require a connection to the outside world

Exchanges need accurate price information, insurance needs data to make decisions on policy payouts and many apps require market information to determine settlements

6/

The solution to this problem is known as an #oracle, a separate piece of infrastructure that bridges a #blockchain to real-world data

Oracles can source a variety of information including prices, weather, sports scores, election results, geodata, random numbers, etc…

The solution to this problem is known as an #oracle, a separate piece of infrastructure that bridges a #blockchain to real-world data

Oracles can source a variety of information including prices, weather, sports scores, election results, geodata, random numbers, etc…

7/

🔶 Problem

While oracles solve one problem, they introduce another (centralization)

Oracles are vulnerable to hacking, denial of service attacks, insider manipulation & abuse – if one node is compromised, the entire system is ruined

This is known as the “Oracle Problem”

🔶 Problem

While oracles solve one problem, they introduce another (centralization)

Oracles are vulnerable to hacking, denial of service attacks, insider manipulation & abuse – if one node is compromised, the entire system is ruined

This is known as the “Oracle Problem”

8/

🔶 Solution

The solution to this problem is to rely on multiple oracles that independently gather data & cross-check their results

This structure is known as a “decentralized oracle network” (“DON”)

In a #DON, a single oracle can be compromised without harming the system

🔶 Solution

The solution to this problem is to rely on multiple oracles that independently gather data & cross-check their results

This structure is known as a “decentralized oracle network” (“DON”)

In a #DON, a single oracle can be compromised without harming the system

9/

🔶 Protocol Overview

#Chainlink is the largest decentralized oracle network, offering solutions to a variety of industries including:

• DeFi

• Enterprise

• NFTs and Gaming

• Social Impact

• Climate Markets

Let's take a look at each

🔶 Protocol Overview

#Chainlink is the largest decentralized oracle network, offering solutions to a variety of industries including:

• DeFi

• Enterprise

• NFTs and Gaming

• Social Impact

• Climate Markets

Let's take a look at each

10/

🔹 DeFi

Chainlink provides real-time prices for a variety #DeFi uses including:

• #DEXs

• #Stablecoins

• #Derivatives

• #Insurance

• #Yieldfarming

Notable partners include @synthetix_io, @AaveAave, @traderjoe_xyz, @LidoFinance, @BreederDodo and @LiquityProtocol

🔹 DeFi

Chainlink provides real-time prices for a variety #DeFi uses including:

• #DEXs

• #Stablecoins

• #Derivatives

• #Insurance

• #Yieldfarming

Notable partners include @synthetix_io, @AaveAave, @traderjoe_xyz, @LidoFinance, @BreederDodo and @LiquityProtocol

11/

🔹 Enterprise

The protocol provides enterprise-grade infrastructure to allow large corporations to access the #Web3 ecosystem.

Notable enterprise partners include T-Systems, LexisNexis, Swisscom and Accuweather

🔹 Enterprise

The protocol provides enterprise-grade infrastructure to allow large corporations to access the #Web3 ecosystem.

Notable enterprise partners include T-Systems, LexisNexis, Swisscom and Accuweather

12/

🔹 NFTs & Gaming

Chainlink provides services for several players in the #NFT & #P2E gaming space including @AxieInfinity, @BoredApeYC & @illuviumio

Notaby, it provides a random number generator (#VRF) that assists with NFT creation, unpredictable gameplay & fair rewards

🔹 NFTs & Gaming

Chainlink provides services for several players in the #NFT & #P2E gaming space including @AxieInfinity, @BoredApeYC & @illuviumio

Notaby, it provides a random number generator (#VRF) that assists with NFT creation, unpredictable gameplay & fair rewards

13/

🔹 Social Impact

The protocol partners with several nonprofits, NGOs and other institutions to assist with sustainability, financial inclusion and public goods projects.

Notable partners include Technalia, Lemonade and Arbol

🔹 Social Impact

The protocol partners with several nonprofits, NGOs and other institutions to assist with sustainability, financial inclusion and public goods projects.

Notable partners include Technalia, Lemonade and Arbol

14/

🔹 Climate Markets

Chainlink provides enterprise-grade middleware that help power climate markets

Notable partners include Hyphen, Floodlight and Correst

🔹 Climate Markets

Chainlink provides enterprise-grade middleware that help power climate markets

Notable partners include Hyphen, Floodlight and Correst

15/

🔶 How it works

The ecosystem is powered by the $LINK token, which has three purposes. It’s:

• Used by clients to pay for services

• Received by oracles as compensation for work performed

• Serves as collateral to ensure that oracles behave properly

Let’s explore:

🔶 How it works

The ecosystem is powered by the $LINK token, which has three purposes. It’s:

• Used by clients to pay for services

• Received by oracles as compensation for work performed

• Serves as collateral to ensure that oracles behave properly

Let’s explore:

16/

Let’s say that a #DEX wants to show the price of #Ethereum on its site. They would:

1. Create a request for data from the Chainlink network to obtain the price of $ETH

2. Submit this request along with payment in the form of Chainlink’s native token, $LINK

Let’s say that a #DEX wants to show the price of #Ethereum on its site. They would:

1. Create a request for data from the Chainlink network to obtain the price of $ETH

2. Submit this request along with payment in the form of Chainlink’s native token, $LINK

17/

3. Chainlink selects the best oracles based on 1) their reputation and 2) their ability to find the necessary data

4. Oracles will find the requested data and send it back to Chainlink. Oracles must stake $LINK tokens as collateral to ensure proper behavior

3. Chainlink selects the best oracles based on 1) their reputation and 2) their ability to find the necessary data

4. Oracles will find the requested data and send it back to Chainlink. Oracles must stake $LINK tokens as collateral to ensure proper behavior

18/

5. Chainlink aggregates the results, chooses the most accurate answers and discards outliers. Oracles that are deemed to be negligent and / or malicious may face penalties and lose some or all of their collateral

6. The information is routed through Chainlink to the DEX

5. Chainlink aggregates the results, chooses the most accurate answers and discards outliers. Oracles that are deemed to be negligent and / or malicious may face penalties and lose some or all of their collateral

6. The information is routed through Chainlink to the DEX

19/

🔶 Chainlink 2.0

#Chainlink occupies a unique position as the dominant “middleware” layer transferring data between blockchains and the real world

Since it’s already transferring data, it’s not a huge leap to perform computations on that data, store or even transmit it

🔶 Chainlink 2.0

#Chainlink occupies a unique position as the dominant “middleware” layer transferring data between blockchains and the real world

Since it’s already transferring data, it’s not a huge leap to perform computations on that data, store or even transmit it

20/

This is exactly what the protocol plans to do with the release of Chainlink 2.0

It’s utilizing “hybrid smart contracts” – computer programs that that combine ON-chain data with OFF-chain data – to create a new layer that can perform computations off-chain

This is exactly what the protocol plans to do with the release of Chainlink 2.0

It’s utilizing “hybrid smart contracts” – computer programs that that combine ON-chain data with OFF-chain data – to create a new layer that can perform computations off-chain

21/

If executed correctly, this hybrid smart contract layer could create a lot of benefits, such as:

1. Scalability

2. Privacy

3. Interoperability

Let’s dig into each

If executed correctly, this hybrid smart contract layer could create a lot of benefits, such as:

1. Scalability

2. Privacy

3. Interoperability

Let’s dig into each

22/

🔹 Scalability

#Chainlink 2.0 could serve as a de facto “Layer 2” network

Like traditional #L2 solutions like roll-ups, it is designed to perform calculations off-chain and plug the results back into the native chain

This should ↑ throughput, ↓ latency and reduce fees

🔹 Scalability

#Chainlink 2.0 could serve as a de facto “Layer 2” network

Like traditional #L2 solutions like roll-ups, it is designed to perform calculations off-chain and plug the results back into the native chain

This should ↑ throughput, ↓ latency and reduce fees

23/

🔹 Privacy

As an independent bridge between blockchains and real-world data, Chainlink 2.0 is in a unique position to provide privacy solutions

For instance, #DONs can encrypt off-chain computations and conceal them from their relaying blockchains

🔹 Privacy

As an independent bridge between blockchains and real-world data, Chainlink 2.0 is in a unique position to provide privacy solutions

For instance, #DONs can encrypt off-chain computations and conceal them from their relaying blockchains

24/

🔹 Interoperability

Chainlink 2.0 would theoretically be able to use its system of hybrid smart contracts to connect different blockchains

Its network of oracles could securely route messages between one another and transfer tokens between chains

🔹 Interoperability

Chainlink 2.0 would theoretically be able to use its system of hybrid smart contracts to connect different blockchains

Its network of oracles could securely route messages between one another and transfer tokens between chains

25/

In a way, #Chainlink could function as an “upside down” Cosmos or Polkadot

Instead of connecting multiple #L1s at a base, or “#L0” layer, it could connect them at the #L2 layer

If successful, this could be huge, as it could replace traditional interoperability solutions

In a way, #Chainlink could function as an “upside down” Cosmos or Polkadot

Instead of connecting multiple #L1s at a base, or “#L0” layer, it could connect them at the #L2 layer

If successful, this could be huge, as it could replace traditional interoperability solutions

26/

While it’s too early to tell whether Chainlink 2.0 will succeed, if it does it could represent a major paradigm shift in Web3 - a unified “middleware” layer that provides the functionality of a:

• Privacy tool

• Layer 2

• Bridge

While it’s too early to tell whether Chainlink 2.0 will succeed, if it does it could represent a major paradigm shift in Web3 - a unified “middleware” layer that provides the functionality of a:

• Privacy tool

• Layer 2

• Bridge

27/

🔶 Market Overview

While there are dozens of oracles serving the #crypto market, Chainlink is by far the most popular with nearly 1,500 connections

Other notable players include Berry and Band Protocol

🔶 Market Overview

While there are dozens of oracles serving the #crypto market, Chainlink is by far the most popular with nearly 1,500 connections

Other notable players include Berry and Band Protocol

28/

🔶 Traction

#Chainlink has achieved significant traction to date, it:

• Has enabled over $6 trillion in transaction volume

• Delivered 5 billion data points on-chain

• Supports 14+ #blockchains and L2s

🔶 Traction

#Chainlink has achieved significant traction to date, it:

• Has enabled over $6 trillion in transaction volume

• Delivered 5 billion data points on-chain

• Supports 14+ #blockchains and L2s

29/

The protocol has also partnered with a variety of players in Web 2.0, such as Google Cloud and Oracle and dozens of projects across the #Web3 ecosystem

The protocol has also partnered with a variety of players in Web 2.0, such as Google Cloud and Oracle and dozens of projects across the #Web3 ecosystem

30/

#Chainlink also boasts a very strong community, often called the #linkmarines with 79K reddit subs, 900K Twitter followers and 114K Discord members

#Chainlink also boasts a very strong community, often called the #linkmarines with 79K reddit subs, 900K Twitter followers and 114K Discord members

31/

🔶 Team

Chainlink was created in 2017 by @SergeyNazarov and Steve Ellis

It has over 400 employees listed on LinkedIn including Chief Ecosystem Officer @adelynzhou, COO @mikedfresh and CPO @kelmoujahid

🔶 Team

Chainlink was created in 2017 by @SergeyNazarov and Steve Ellis

It has over 400 employees listed on LinkedIn including Chief Ecosystem Officer @adelynzhou, COO @mikedfresh and CPO @kelmoujahid

32/

🔶 Advisors

The protocol has a strong advisory board including @AriJuels, @ericschmidt (ex-CEO of Google), @danboneh, @socrates1024, @ccatalini, @jeffweiner, @tgonser, @balajis (ex-CTO of Coinbase) and @lyndakatesmith (ex-CMO of Twilio)

🔶 Advisors

The protocol has a strong advisory board including @AriJuels, @ericschmidt (ex-CEO of Google), @danboneh, @socrates1024, @ccatalini, @jeffweiner, @tgonser, @balajis (ex-CTO of Coinbase) and @lyndakatesmith (ex-CMO of Twilio)

33/

🔶 Tokenomics

$LINK has a capped token supply of 1 billion tokens

At launch, 35% of these were allocated to the public, 35% to the ecosystem and 30% to the company

There are currently 508M tokens circulating

🔶 Tokenomics

$LINK has a capped token supply of 1 billion tokens

At launch, 35% of these were allocated to the public, 35% to the ecosystem and 30% to the company

There are currently 508M tokens circulating

34/

While 30% to the company may seem high, it’s important to note that these funds aren’t simply going into the founder’s pockets

As @DeFiMinty points out, Chainlink is using this capital to fund development in lieu of VCs (notice there is no “private investor” allocation)

While 30% to the company may seem high, it’s important to note that these funds aren’t simply going into the founder’s pockets

As @DeFiMinty points out, Chainlink is using this capital to fund development in lieu of VCs (notice there is no “private investor” allocation)

https://twitter.com/DeFiMinty/status/1596195137809530882

35/

🔶 Valuation

It’s difficult to value Chainlink because there is no real-world analog to an oracle network

While oracles are important, they are a unique phenomenon to #Web3

But that’s not too concerning, as I’m not sure that $LINK should be valued as an oracle anyway…

🔶 Valuation

It’s difficult to value Chainlink because there is no real-world analog to an oracle network

While oracles are important, they are a unique phenomenon to #Web3

But that’s not too concerning, as I’m not sure that $LINK should be valued as an oracle anyway…

36/

Given the plans for Chainlink 2.0, I don’t think it’s unrealistic to value #Chainlink as a Layer 1

In a sense, it could achieve what Cosmos and Polkadot are hoping to do and provide a unified layer for:

• Privacy

• Scalability

• Interoperability

Given the plans for Chainlink 2.0, I don’t think it’s unrealistic to value #Chainlink as a Layer 1

In a sense, it could achieve what Cosmos and Polkadot are hoping to do and provide a unified layer for:

• Privacy

• Scalability

• Interoperability

37/

Layer1s have already achieved substantial valuations – #Ethereum crossed $500B in 2021 and both Solana and BNB exceeded have $100B in FDV in the past

As such, I don’t think a long-term valuation of $500B to $1T is impossible for #LINK

Layer1s have already achieved substantial valuations – #Ethereum crossed $500B in 2021 and both Solana and BNB exceeded have $100B in FDV in the past

As such, I don’t think a long-term valuation of $500B to $1T is impossible for #LINK

38/

At 1B total tokens, this would imply a price of $500 to $1K per token, a 75x to 150x return over today and 10x to 20x over its ATH

At 1B total tokens, this would imply a price of $500 to $1K per token, a 75x to 150x return over today and 10x to 20x over its ATH

39/

🔶 Big Picture

Oracles are the “invisible backbone” of #Web3

They’re needed for over 90% of blockchain use-cases, and will be a vital infrastructure tool that helps #crypto “cross the chasm”

As the largest #DON, Chainlink is a leader to watch in this space

🔶 Big Picture

Oracles are the “invisible backbone” of #Web3

They’re needed for over 90% of blockchain use-cases, and will be a vital infrastructure tool that helps #crypto “cross the chasm”

As the largest #DON, Chainlink is a leader to watch in this space

40/

If you want to learn more about @chainlink, check out these accounts:

@ChainLinkGod

@ChainlinkIntern

@ChainlinkLinkie

@ChainlinkP

@CryptoDragonite

@DAdvisoor

@DefiDrew

@defi_naly

@DeFiMinty

@DrakeLinked

@LINKNewsOracle

@LifeisMalleable

@NickDrakon

@rektdiomedes

@uCeLiNk

If you want to learn more about @chainlink, check out these accounts:

@ChainLinkGod

@ChainlinkIntern

@ChainlinkLinkie

@ChainlinkP

@CryptoDragonite

@DAdvisoor

@DefiDrew

@defi_naly

@DeFiMinty

@DrakeLinked

@LINKNewsOracle

@LifeisMalleable

@NickDrakon

@rektdiomedes

@uCeLiNk

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1597274199965413376

• • •

Missing some Tweet in this thread? You can try to

force a refresh