1/27 This top 10 TVL chain has been secretly BUIDLing since 2017🐱👤

NOBODY on CT is talking about the Mixin Network

So here's CT's very first DEEP DIVE into @Mixin_Network

🧵

NOBODY on CT is talking about the Mixin Network

So here's CT's very first DEEP DIVE into @Mixin_Network

🧵

2/27

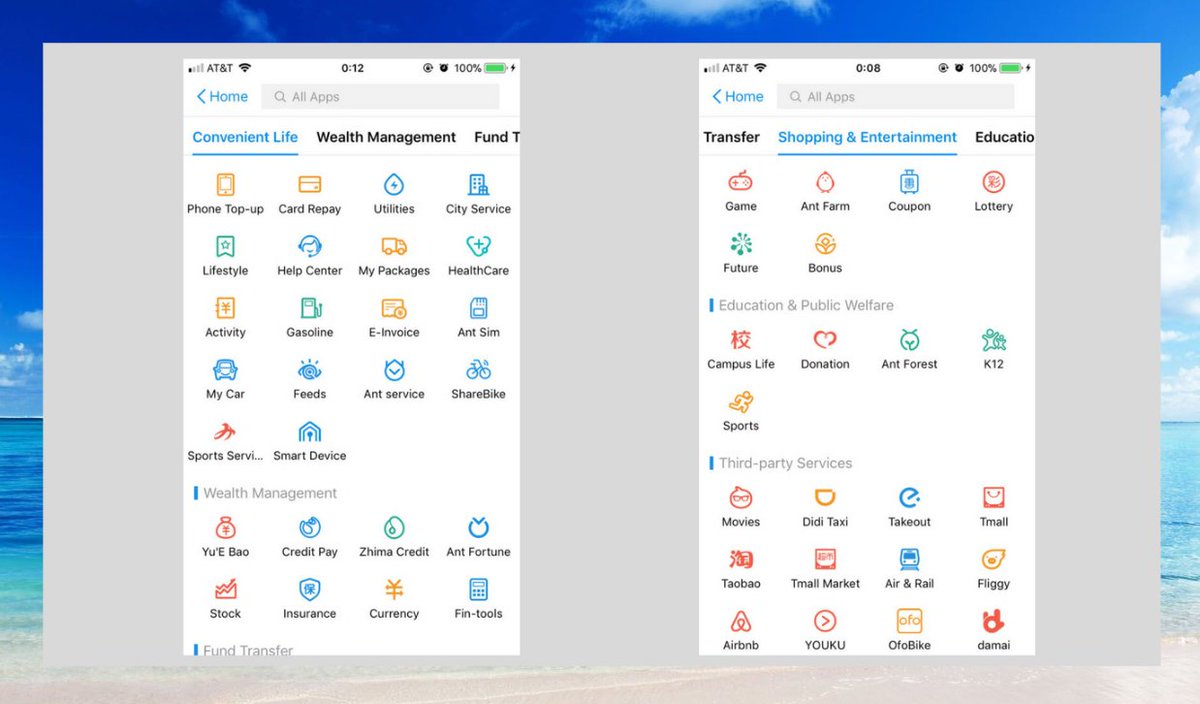

Mixin has been working on exactly what Telegram is trying to achieve - Superapp status.

A quick primer on super apps:

Mixin has been working on exactly what Telegram is trying to achieve - Superapp status.

A quick primer on super apps:

https://twitter.com/0xsurferboy/status/1602317410769330177

3/27

If I had to take a stand on the super-app race situation:

Mixin is FARRR.. far.. behind

A key metric for chat apps is user adoption.

Telegram has 700M+ users, Mixin has barely 0.015% of that.

If I had to take a stand on the super-app race situation:

Mixin is FARRR.. far.. behind

A key metric for chat apps is user adoption.

Telegram has 700M+ users, Mixin has barely 0.015% of that.

4/27

Telegram is going from messaging -> web3/defi

Mixin is going from web3/defi -> messaging

Looking at it from an existing userbase perspective, Telegram might outcompete Mixin as a super-app (Mixin still has a slim chance).

Or at least that's my take.

Telegram is going from messaging -> web3/defi

Mixin is going from web3/defi -> messaging

Looking at it from an existing userbase perspective, Telegram might outcompete Mixin as a super-app (Mixin still has a slim chance).

Or at least that's my take.

5/27

Let's focus on the DeFi aspects of the Mixin ecosystem since that's where they are thriving.

Mixin was founded in 2013 and launched at the end of 2017.

INBlockchain, a highly influential Chinese blockchain VC, invested in Mixin in Nov 2017.

Let's focus on the DeFi aspects of the Mixin ecosystem since that's where they are thriving.

Mixin was founded in 2013 and launched at the end of 2017.

INBlockchain, a highly influential Chinese blockchain VC, invested in Mixin in Nov 2017.

6/27

The Mixin ecosystem consists of 1,000+ apps according to the Mixin website.

These are just a handful of their most popular dApps:

The Mixin ecosystem consists of 1,000+ apps according to the Mixin website.

These are just a handful of their most popular dApps:

7/27

Mixin's TVL is spread across few dApps, with the top 2 comprising 99% of TVL:

B.watch - cryptoasset management platform (63%)

Pando - Defi service suite (36%)

ExinPool - Staking

Option Dance - Options trading

HodlFox - Staking

OceanOne - DEX

ExinSwap - DEX

Mixin's TVL is spread across few dApps, with the top 2 comprising 99% of TVL:

B.watch - cryptoasset management platform (63%)

Pando - Defi service suite (36%)

ExinPool - Staking

Option Dance - Options trading

HodlFox - Staking

OceanOne - DEX

ExinSwap - DEX

8/27

B.watch comprises ~63% of TVL

From my understanding, b.watch is an investment management platform that uses $BOX token as a proof of equity.

For every 10,000 $BOX tokens, it comprises:

1 BTC

1 ETH

300 EOS

50 DOTs

100 MOBs

8 XINs

100 UNIs

B.watch comprises ~63% of TVL

From my understanding, b.watch is an investment management platform that uses $BOX token as a proof of equity.

For every 10,000 $BOX tokens, it comprises:

1 BTC

1 ETH

300 EOS

50 DOTs

100 MOBs

8 XINs

100 UNIs

9/27

Pando comprises 36% of TVL

Pando is a DeFi service suite, comprising the following DApps:

Leaf - place where you can deposit collateral to mint and burn Pando USD (pUSD)

Lake - AMM DEX

Rings - Lending/Borrowing

Catkin - L2E concept

Wave - Staking

(More in 21/n)

Pando comprises 36% of TVL

Pando is a DeFi service suite, comprising the following DApps:

Leaf - place where you can deposit collateral to mint and burn Pando USD (pUSD)

Lake - AMM DEX

Rings - Lending/Borrowing

Catkin - L2E concept

Wave - Staking

(More in 21/n)

10/27

$XIN is the native coin of the Mixin network used by many services in Mixin, including full node collateral, DApp creation and API calls.

oken Distribution

Total Supply - 1,000,000

For trading (against EOS) - 400K

Core dev team - 50K

Early Adopters - 50K

Nodes - 500K

$XIN is the native coin of the Mixin network used by many services in Mixin, including full node collateral, DApp creation and API calls.

oken Distribution

Total Supply - 1,000,000

For trading (against EOS) - 400K

Core dev team - 50K

Early Adopters - 50K

Nodes - 500K

11/27

The 400K in supply was released via an ICO on the BigONE exchange, traded against EOS in Nov 2017.

By Jan 2018, prices peaked over $2,000 (bag holders wya 👀)

The top 10 holders of $XIN make up 70.22% of total supply.

The 400K in supply was released via an ICO on the BigONE exchange, traded against EOS in Nov 2017.

By Jan 2018, prices peaked over $2,000 (bag holders wya 👀)

The top 10 holders of $XIN make up 70.22% of total supply.

13/27

Full node collateral is 10,000 $XIN to establish initial trust.

Nodes are rewarded $XIN by verifying PoS transactions.

If a node is deemed untrustworthy, staked tokens are confiscated and redistributed into mining pools - like ETH.

Full node collateral is 10,000 $XIN to establish initial trust.

Nodes are rewarded $XIN by verifying PoS transactions.

If a node is deemed untrustworthy, staked tokens are confiscated and redistributed into mining pools - like ETH.

14/27

Every dApp creation will have a one-time cost in $XIN, the amount is determined by the resources the dApp claims to consume.

API calls from dApps may cost some $XIN too, depending on the call type and count.

Every dApp creation will have a one-time cost in $XIN, the amount is determined by the resources the dApp claims to consume.

API calls from dApps may cost some $XIN too, depending on the call type and count.

15/27

All of this is powered by Mixin's unique network of high performance distributed ledgers with the core called the "Kernel", supporting ledgers called "Domains" and "Domain Extensions"

The consensus algorithm adopted by Mixin is PoS and ABFT.

All of this is powered by Mixin's unique network of high performance distributed ledgers with the core called the "Kernel", supporting ledgers called "Domains" and "Domain Extensions"

The consensus algorithm adopted by Mixin is PoS and ABFT.

16/27

Mixin's distributed ledger (kernel) is maintained by 35 mainnet nodes (ie 350K $XIN are locked up in nodes).

Mixin's distributed ledger (kernel) is maintained by 35 mainnet nodes (ie 350K $XIN are locked up in nodes).

17/27

Mixin domains are gateways that provide assets for the Kernel

(ie If someone wants to BTC to Mixin, the domain creates a transaction to the Mixin public key, and the Mixin kernel will verify the transaction)

Mixin domains are gateways that provide assets for the Kernel

(ie If someone wants to BTC to Mixin, the domain creates a transaction to the Mixin public key, and the Mixin kernel will verify the transaction)

18/27

Mixin Domain Extensions enable functionality in the form of smart contracts.

Separating each component makes Mixin Kernel the fastest decentralized solution for transferring digital assets.

I'm not highly technical, so for a deeper read, see tinyurl.com/mixindocs

Mixin Domain Extensions enable functionality in the form of smart contracts.

Separating each component makes Mixin Kernel the fastest decentralized solution for transferring digital assets.

I'm not highly technical, so for a deeper read, see tinyurl.com/mixindocs

19/27

Throttled Identity Protocol is a decentralized key derivation protocol, allowing users to obtain a strong secret key using a simple passphrase (6-digit PIN)

TIP makes it easy for people to manage their own keys and digital assets, without requiring advanced tech skills

Throttled Identity Protocol is a decentralized key derivation protocol, allowing users to obtain a strong secret key using a simple passphrase (6-digit PIN)

TIP makes it easy for people to manage their own keys and digital assets, without requiring advanced tech skills

20/27

More on TIP can be found here: developers.mixin.one/docs/mainnet/c…

More on TIP can be found here: developers.mixin.one/docs/mainnet/c…

21/27

Continuing from 9/n, Pando is a pretty big ecosystem on its own.

The most notable product being its stablecoin, pUSD.

Of the total 1T supply, only 25M is available to the public through Pando Leaf.

The rest are locked and managed by Mixin Trusted Group

Continuing from 9/n, Pando is a pretty big ecosystem on its own.

The most notable product being its stablecoin, pUSD.

Of the total 1T supply, only 25M is available to the public through Pando Leaf.

The rest are locked and managed by Mixin Trusted Group

22/27

Minting pUSD can be done on Pando Leaf using vaults.

As with most stables, pUSD requires overcollateralization by >150% (depending on the asset).

Info can be found here: leaf.pando.im/#/market

Minting pUSD can be done on Pando Leaf using vaults.

As with most stables, pUSD requires overcollateralization by >150% (depending on the asset).

Info can be found here: leaf.pando.im/#/market

23/27

You can repeatedly mint pUSD in your vault if the collateral ratio is >150%.

Paying back pUSD decreases the borrowing size to save a vault from being liquidated.

You can repeatedly mint pUSD in your vault if the collateral ratio is >150%.

Paying back pUSD decreases the borrowing size to save a vault from being liquidated.

24/27

pUSD can be used to generate APY by:

1. Supplying pUSD to Pando Rings (Lending Platform)

2. Liquidity provision in Pando Lake or 4swap (DEX)

pUSD can be used to generate APY by:

1. Supplying pUSD to Pando Rings (Lending Platform)

2. Liquidity provision in Pando Lake or 4swap (DEX)

25/27

Mixin recently collaborated with Telegram's TONchain, seeing its MixinBot wallet bot become available on Telegram. $TON was also listed on Mixin.

Mixin recently collaborated with Telegram's TONchain, seeing its MixinBot wallet bot become available on Telegram. $TON was also listed on Mixin.

26/27

It's very interesting how Mixin is so well hidden on CT despite being a top 10 TVL chain.

Part of it could be attributed to Mixin being a Chinese project, hence less covered on Western/English CT.

Hoping to get thoughts on this from Chinese CT @0xJamesXXX @BitRunX

It's very interesting how Mixin is so well hidden on CT despite being a top 10 TVL chain.

Part of it could be attributed to Mixin being a Chinese project, hence less covered on Western/English CT.

Hoping to get thoughts on this from Chinese CT @0xJamesXXX @BitRunX

27/27

I put a lot of effort into these threads.

If you found them helpful please leave a❤️& Retweet the first tweet below if you can 🙏

Follow me

@0xsurferboy for more analytical threads on untapped CT topics.

I put a lot of effort into these threads.

If you found them helpful please leave a❤️& Retweet the first tweet below if you can 🙏

Follow me

@0xsurferboy for more analytical threads on untapped CT topics.

https://twitter.com/0xsurferboy/status/1611254680071573505

Tags for awareness 🔥

@WuBlockchain

@DefiIgnas

@0xJamesXXX

@Arthur_0x

@samczsun

@CryptoKaleo

@DeFiSurfer808

@ceterispar1bus

@0xFlips

@Crypto_McKenna

@rektdiomedes

@defi_mochi

@TheDeFinvestor

@thedailydegenhq

@WuBlockchain

@DefiIgnas

@0xJamesXXX

@Arthur_0x

@samczsun

@CryptoKaleo

@DeFiSurfer808

@ceterispar1bus

@0xFlips

@Crypto_McKenna

@rektdiomedes

@defi_mochi

@TheDeFinvestor

@thedailydegenhq

#Mixin #Polygon #Solana #crypto #cryptocurrecy #stablecoin #USDC #USDT #BUSD #binance #FTX #Metamask #Arbitrum #blockchain #Celsius #BlockFi #Genesis #Web3 #Bybit #uniswap #BNB #MATIC #Cardano #Defi #Cefi

• • •

Missing some Tweet in this thread? You can try to

force a refresh