[1/🧵] Is this you? 🤨

• Holder of #XRP since December 2020

• Has never heard of $FLR before (Hello, #Spark?)

• Has no idea what the fuss is all about

• Slept under a rock for two years

Allow me to bring you up to speed w/ this crash course on @FlareNetworks and $FLR. 🧵👇

• Holder of #XRP since December 2020

• Has never heard of $FLR before (Hello, #Spark?)

• Has no idea what the fuss is all about

• Slept under a rock for two years

Allow me to bring you up to speed w/ this crash course on @FlareNetworks and $FLR. 🧵👇

[2/20] If you've been following this topic, you'll recall that there was once a #XRPL snapshot:

• 12th December 2020, 00:00 UTC

• #XRP Ledger index 60,155,580

. . .

• 12th December 2020, 00:00 UTC

• #XRP Ledger index 60,155,580

. . .

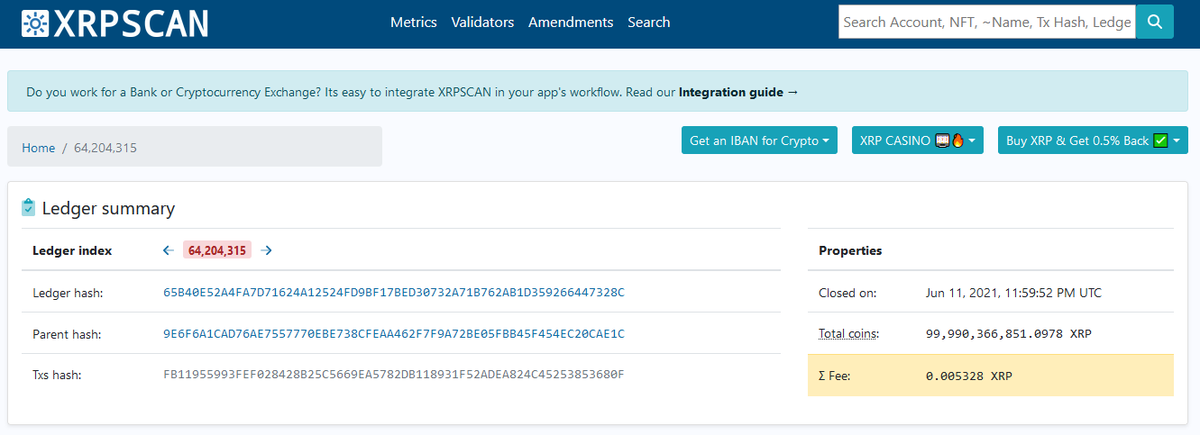

[3/20] . . .

You may recall that you had to claim your #Spark coins by providing your #EVM-based $FLR address in the message key field of your #XRPL account.

→ claim period expired on #XRPLedger index 64,204,315

→ Message could be changed until 11th June 2021, 23:59 UTC

. . .

You may recall that you had to claim your #Spark coins by providing your #EVM-based $FLR address in the message key field of your #XRPL account.

→ claim period expired on #XRPLedger index 64,204,315

→ Message could be changed until 11th June 2021, 23:59 UTC

. . .

[4/20] . . .

Time has passed and the term "#Spark" has been renamed "#Flare ( $FLR )"

Furthermore, the initial purpose of bringing smart-contract capabilities to the #XRPL through so-called "F-Assets (#FXRP)" has been substantially revamped and broadened.

. . .

Time has passed and the term "#Spark" has been renamed "#Flare ( $FLR )"

Furthermore, the initial purpose of bringing smart-contract capabilities to the #XRPL through so-called "F-Assets (#FXRP)" has been substantially revamped and broadened.

. . .

[5/20] . . .

@FlareNetworks is no longer what it once was, and it is far more innovative than you may recall.

Let's read the most recent $FLR-#Whitepaper 2.0 and go through all the specifics 👇

🔹 The Network & Token

🔹 State Connector

🔹 FTSO

🔹 Consensus

🔹 Governance

🔹 ...

@FlareNetworks is no longer what it once was, and it is far more innovative than you may recall.

Let's read the most recent $FLR-#Whitepaper 2.0 and go through all the specifics 👇

🔹 The Network & Token

🔹 State Connector

🔹 FTSO

🔹 Consensus

🔹 Governance

🔹 ...

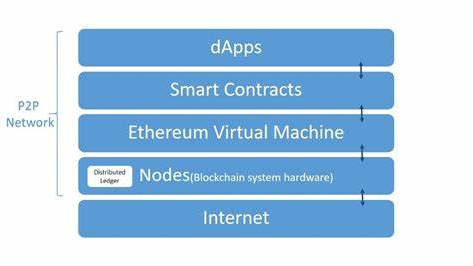

[6/20] 👉 Introduction

#FlareNetwork is a Layer 1 [E]thereum [V]irtual [M]achine (#EVM) based #blockchain that allows for "data-interoperability" in the same manner as #XRP allows for "value-interoperability"

. . .

#FlareNetwork is a Layer 1 [E]thereum [V]irtual [M]achine (#EVM) based #blockchain that allows for "data-interoperability" in the same manner as #XRP allows for "value-interoperability"

. . .

[7/20] . . .

This Means that @FlareNetworks enables 👇

• Secure Cross-Chain interoperability

• Collateralization of decentralized apps

• Literally "everything" revolving around #data

• Smart-Contract capabilities for every #blockchain

• True decentralized #Token-Bridging

This Means that @FlareNetworks enables 👇

• Secure Cross-Chain interoperability

• Collateralization of decentralized apps

• Literally "everything" revolving around #data

• Smart-Contract capabilities for every #blockchain

• True decentralized #Token-Bridging

[8/20] 👉 The Network & Token

The Native Token $FLR is used for 👇

• Payments

• Spam Control (gas fees)

• Governance Voting

• Liquid Staking (Hello, #Cardano 👋)

• Collateralization of assets (e. g. for minting)

. . .

The Native Token $FLR is used for 👇

• Payments

• Spam Control (gas fees)

• Governance Voting

• Liquid Staking (Hello, #Cardano 👋)

• Collateralization of assets (e. g. for minting)

. . .

[9/20] . . .

Importantly, the network enables programmable additions through "wrapped $FLR / #WFLR"

These #ERC20-#EVM-based #tokens enhance token usage by earning #FTSO incentives, providing collateral, and gov. voting.

Importantly, the network enables programmable additions through "wrapped $FLR / #WFLR"

These #ERC20-#EVM-based #tokens enhance token usage by earning #FTSO incentives, providing collateral, and gov. voting.

[10/20] 👉 #StateConnector

Uses 2 novel methods:

1⃣ Request-Commit-Reveal protocol

2⃣ Branching protocol

The #RCR protocol's objective is to collect user queries & proofs about #blockchains, whereas the branching protocol's purpose is for the network to evaluate these.

. . .

Uses 2 novel methods:

1⃣ Request-Commit-Reveal protocol

2⃣ Branching protocol

The #RCR protocol's objective is to collect user queries & proofs about #blockchains, whereas the branching protocol's purpose is for the network to evaluate these.

. . .

[11/20] . . .

☑️ Secured on-chain (#consensus) decentralized acquisition of #blockchain or "off-chain"-based external data may now be used to develop any type of #dApp or #App imaginable.

E.g., a #dApp that tips #BTC based on whether $XRP is valued at $589 or not. 😅

☑️ Secured on-chain (#consensus) decentralized acquisition of #blockchain or "off-chain"-based external data may now be used to develop any type of #dApp or #App imaginable.

E.g., a #dApp that tips #BTC based on whether $XRP is valued at $589 or not. 😅

[12/20] 👉 #FlareTimeSeriesOracle [#FTSO]

"The #FTSO is a dec. protocol that seeks to create accurate estimations of off-chain time series data on the #FlareNetwork"

❗️ To put it simply, we now have our own decentralized @CoinMarketCap, which can be accessed using #API-Calls.

"The #FTSO is a dec. protocol that seeks to create accurate estimations of off-chain time series data on the #FlareNetwork"

❗️ To put it simply, we now have our own decentralized @CoinMarketCap, which can be accessed using #API-Calls.

[13/20] 👉 #FlareConsensus

I've previously gone into all the specifics here, so have a look 👇

I've previously gone into all the specifics here, so have a look 👇

https://twitter.com/krippenreiter/status/1603148120359067648?s=20&t=rz3o--lsT-FqyHRUsFqDJg

[14/20] 👉 #FlareGovernance

#Flare's token, $FLR, serves as the #Flare's governance mechanism.

Proposals for network governance can come from either the #FlareFoundation or the community through #Songbird [ $SGB ].

flare.network/governance/

#Flare's token, $FLR, serves as the #Flare's governance mechanism.

Proposals for network governance can come from either the #FlareFoundation or the community through #Songbird [ $SGB ].

flare.network/governance/

[15/20] 👉 Post-Quantum Security

@FlareNetworks released a paper in regards to a hybrid post-#quantum digital signature scheme for the EVM.

It's about adding the so called "#deterministic CRYSTALS-Dilithium Level 2" sig. to the usual elliptic curve sig.

flare.network/wp-content/upl…

@FlareNetworks released a paper in regards to a hybrid post-#quantum digital signature scheme for the EVM.

It's about adding the so called "#deterministic CRYSTALS-Dilithium Level 2" sig. to the usual elliptic curve sig.

flare.network/wp-content/upl…

[16/20] 👉 #LayerCake — #Bridging

To keep things brief for everyone:

☑️ Bridges #SmartContract Tokens or #SmartContract-enabled #Tokens rapidly, #decentralized, and multilaterally.

☑️ Insured and collateralized

☑️ Unified liquidity (same token representation)

To keep things brief for everyone:

☑️ Bridges #SmartContract Tokens or #SmartContract-enabled #Tokens rapidly, #decentralized, and multilaterally.

☑️ Insured and collateralized

☑️ Unified liquidity (same token representation)

[17/20] 👉 #FAssets — #Bridging

Add #SmartContracts to every Chain/#DLT:

☑️ Use #DeFi with FDOGE on FBTC through Layer Cake (wait what? 😆)

☑️ Trustlessly—without the use of any middlemen

☑️ Spread risk across members in the system

Add #SmartContracts to every Chain/#DLT:

☑️ Use #DeFi with FDOGE on FBTC through Layer Cake (wait what? 😆)

☑️ Trustlessly—without the use of any middlemen

☑️ Spread risk across members in the system

[18/20] 🔄 To recap, nothing appears to be impossible in terms of #data utilization for the @FlareNetworks

Any type and form of #data may be conveyed, verified trustlessly and #decentralized, and used for #dApps while linking any #SmartContract Platform with on-/off-chain #data

Any type and form of #data may be conveyed, verified trustlessly and #decentralized, and used for #dApps while linking any #SmartContract Platform with on-/off-chain #data

[19/20] ☀️ Truely magnificent to say the least ☀️

With #ILP x #XRP x #FLR / #SGB linking every payment network/Ledger w/ every source of liquidity for faster payments and genuine public data- and #SmartContract interoperability, the sky is truly the limit. 💛

#ConnectEverything

With #ILP x #XRP x #FLR / #SGB linking every payment network/Ledger w/ every source of liquidity for faster payments and genuine public data- and #SmartContract interoperability, the sky is truly the limit. 💛

#ConnectEverything

[20/20] Thank you to everyone who took the time to read this lengthy topic about $FLR / $SGB and @FlareNetworks! ❤️

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

If you enjoyed the thread, please follow me:

@krippenreiter

Please feel free to contribute by sharing here 👇

https://twitter.com/krippenreiter/status/1611545139293618176?s=20&t=f8e1bvT5wuLCB6vrefrqiQ

@threadreaderapp unroll

@WKahneman @digitalassetbuy @Fame21Moore @sentosumosaba @BCBacker @XRPcryptowolf @X__Anderson @stedas @Kevin_Cage_ @AlexCobb_

@MrFreshTime @lIllIlllIIIll 👋 💛☀️

— My most recent post on #FLR's technology, use cases, and protocols focused on @FlareNetworks' newest Whitepaper2.0 —

@MrFreshTime @lIllIlllIIIll 👋 💛☀️

— My most recent post on #FLR's technology, use cases, and protocols focused on @FlareNetworks' newest Whitepaper2.0 —

• • •

Missing some Tweet in this thread? You can try to

force a refresh