1/13 The bussin LSD Narrative: Will Lido's share of ETH stake skyrocket after the Shanghai upgrade?

What will happen to the withdrawn ETH? 🧵

What will happen to the withdrawn ETH? 🧵

2/13

A quick mention to @ViktorDefi for pointing out this narrative! 💪

Give it a read if you haven't yet 👇

A quick mention to @ViktorDefi for pointing out this narrative! 💪

Give it a read if you haven't yet 👇

https://twitter.com/ViktorDefi/status/1612584127341154312

3/13

ETH's staking ratio isn't too great compared to other chains and a few reasons include:

- High risk associated with the inability to withdraw stake

- Capital inefficiency of having >32ETH.

ETH's staking ratio isn't too great compared to other chains and a few reasons include:

- High risk associated with the inability to withdraw stake

- Capital inefficiency of having >32ETH.

https://twitter.com/ViktorDefi/status/1612584160396464133

4/13

Ethereum's Shanghai upgrade launch timeline:

Ethereum's Shanghai upgrade launch timeline:

https://twitter.com/ViktorDefi/status/1612584151433236490

5/13

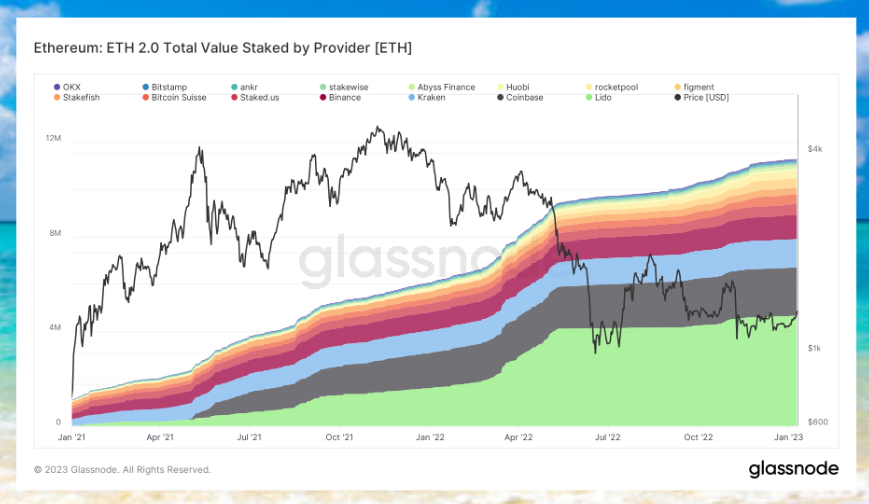

Before diving into the narrative of LSD protocols skyrocketing, let's take a look at the process leading up to it.

To understand that, we need to analyze the staking and withdrawing mechanism ⚙

Before diving into the narrative of LSD protocols skyrocketing, let's take a look at the process leading up to it.

To understand that, we need to analyze the staking and withdrawing mechanism ⚙

6/13

ETH validators have what's called an Effective Balance ("EB") used to calculate rewards/penalties:

- EB will never be >32ETH

- EB is a multiple of 1 (ie 29.5ETH = EB of 29)

- The "Hysteresis zone" indicates areas where EB never changes:

ETH validators have what's called an Effective Balance ("EB") used to calculate rewards/penalties:

- EB will never be >32ETH

- EB is a multiple of 1 (ie 29.5ETH = EB of 29)

- The "Hysteresis zone" indicates areas where EB never changes:

7/13

The EB means even if a validator has accumulated 50 ETH over the course of staking, he only gets 32 ETH worth of rewards - capital inefficient.

Data from Beaconchain (as at 10 Jan) indicates an average validator balance of 34ETH.

The EB means even if a validator has accumulated 50 ETH over the course of staking, he only gets 32 ETH worth of rewards - capital inefficient.

Data from Beaconchain (as at 10 Jan) indicates an average validator balance of 34ETH.

8/13

With 497K Validators, that's 994K ETH ($1.32B) worth of inefficient capital.

And that's what could potentially be pumped into LSD protocols 😋

With 497K Validators, that's 994K ETH ($1.32B) worth of inefficient capital.

And that's what could potentially be pumped into LSD protocols 😋

9/13

Each epoch supports 256 withdrawals -tinyurl.com/withdrawalsper…

An ETH epoch lasts 6.4mins which equates to ~225 epochs a day, or 57.6K withdrawals.

Logically, validators would withdraw the 2 excess ETH for better use, ie 57.6K x 2 = 115.2K ETH withdrawn a day.

Each epoch supports 256 withdrawals -tinyurl.com/withdrawalsper…

An ETH epoch lasts 6.4mins which equates to ~225 epochs a day, or 57.6K withdrawals.

Logically, validators would withdraw the 2 excess ETH for better use, ie 57.6K x 2 = 115.2K ETH withdrawn a day.

10/13

Hence, it takes around 10 days for the full 994K of "inefficient ETH" to be withdrawn.

Hence, it takes around 10 days for the full 994K of "inefficient ETH" to be withdrawn.

11/13

This 994K ETH could be re-staked into LSDs like Lido or Rocket Pool or sold in open markets, potentially leading to sell pressure across the 10 or more days.

This 994K ETH could be re-staked into LSDs like Lido or Rocket Pool or sold in open markets, potentially leading to sell pressure across the 10 or more days.

12/13

While the narrative of Lido's 51% monopoly is possible, LidoDAO is contemplating limiting their max stake to a fixed % of total staked ETH to ensure decentralization.

While the narrative of Lido's 51% monopoly is possible, LidoDAO is contemplating limiting their max stake to a fixed % of total staked ETH to ensure decentralization.

13/13

I hope you've found this thread helpful.

Follow me @0xsurferboy for more threads on untapped crypto topics 😊

Like ❤/Retweet the first tweet below if you can 🙏

I hope you've found this thread helpful.

Follow me @0xsurferboy for more threads on untapped crypto topics 😊

Like ❤/Retweet the first tweet below if you can 🙏

https://twitter.com/0xsurferboy/status/1612781342718296065

Tagging gigabrains who may be interested 🔥

@DefiIgnas

@rektdiomedes

@thedailydegenhq

@crypto_linn

@0xJamesXXX

@crypto_condom

@DeFiSurfer808

@crypthoem

@defi_mochi

@CryptoShiro_

@DAdvisoor

@TheDeFinvestor

@Slappjakke

@CharlieXYZ_

@ViktorDeFi

@DefiIgnas

@rektdiomedes

@thedailydegenhq

@crypto_linn

@0xJamesXXX

@crypto_condom

@DeFiSurfer808

@crypthoem

@defi_mochi

@CryptoShiro_

@DAdvisoor

@TheDeFinvestor

@Slappjakke

@CharlieXYZ_

@ViktorDeFi

#Ethereum #Polygon #Solana #crypto #cryptocurrecy #stablecoin #USDC #USDT #BUSD #binance #FTX #Metamask #Arbitrum #blockchain #Celsius #BlockFi #Genesis #Web3 #Bybit #uniswap #BNB #MATIC #Cardano #altcoins #Defi #Cefi #Cosmos

• • •

Missing some Tweet in this thread? You can try to

force a refresh