Treasury Market Signal 🧵

1. CPI Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

1. CPI Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

2. However, we think it is important to note that excluding food and energy, i.e., core CPI, was up 0.40% this month— implying a 4.9% annualized rate for core inflation. This data is far removed from the Fed’s objective.

3. As such, #bond markets have moved to re-#discount expectations, moving away from aggressive expectations of easing, consistent with our views outlined in our Month In Macro note. We show this below:

4. Markets have moved from pricing 1 #interest rate cut over the next year & 4 over the next 2 to now pricing 0 cuts in the next year and 2 cuts over the next 2 Ahead of this repricing, our trend signals on 10- Year Treasuries had already turned negative and remains there:

5. Additionally, we show daily trend signals for the #Treasury ETFs our systems track. As we can see, they all show short signals across the curve:

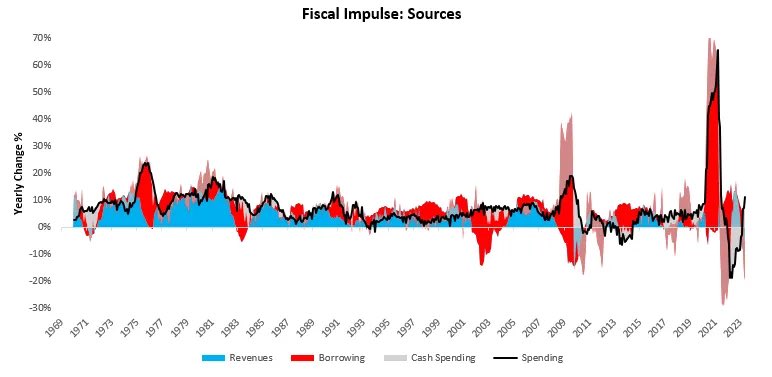

6. Inflationary dynamics continue to create a challenging dynamic for Treasuries, and the #disinflationary pricing we expected to support a 60/40 portfolio in H1 of 2023 is likely to dissipate in H2 of 2023 as markets come to terms with potential #inflation entrenchment:

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter