-> Less being raised in public sales

-> Investors that can provide more than capital will start earning more allocation

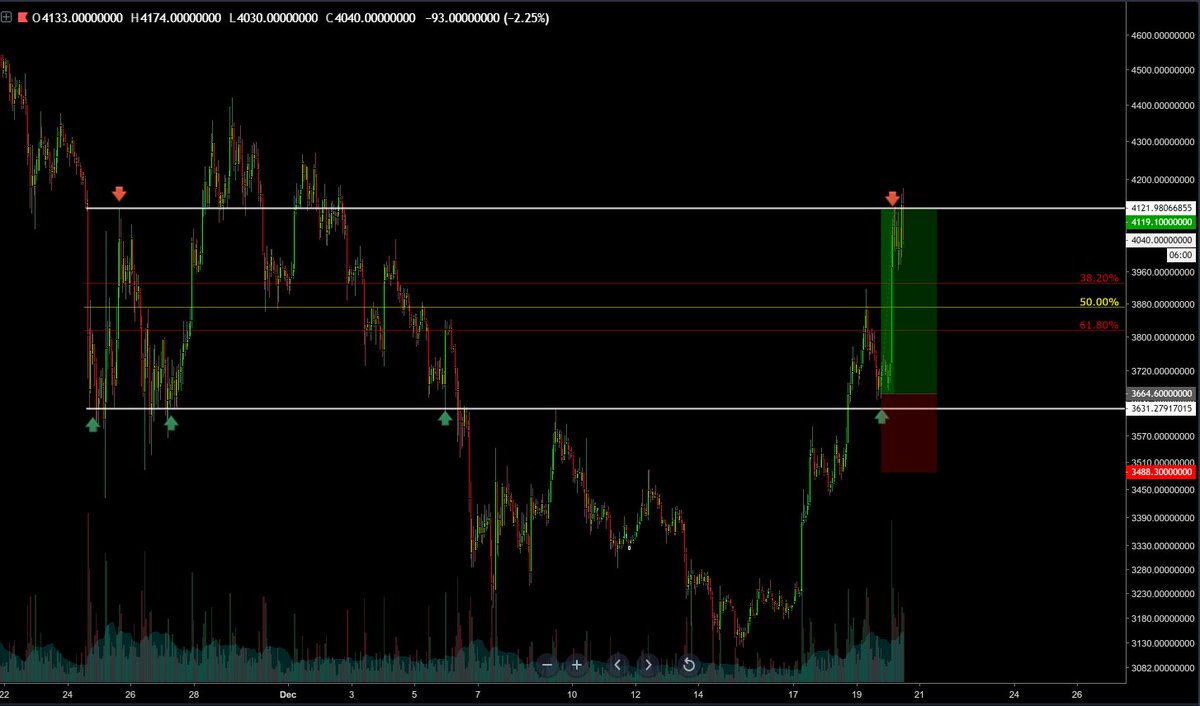

-> The risk:reward ratio

-> Strategy even if you missed the initial sale

DYOR and find a strategy that is suitable for you.

more here:

-legal or any structuring service

-investors/funds with influence

-connections to exchanges

-investors that can introduce them to people they need access to

Still - the risk:reward is very favorable currently.

e.g. make 2-50x or lose 50%

Adapt or get left behind.