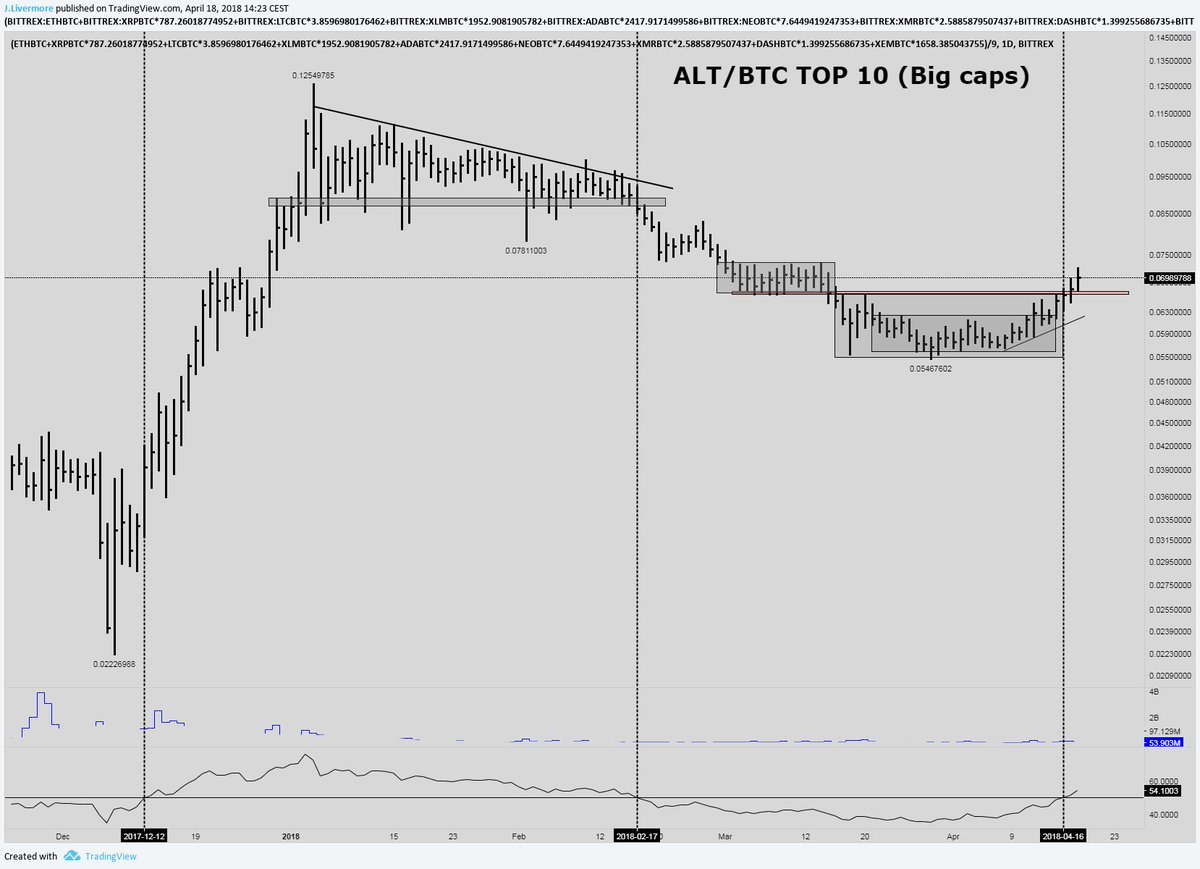

- large cap vs mid vs small

- event driven > coinbase adds

- psychological > low sat coins or sector or exchange specific

In this thread I'll explain my approach to positioning for market cap themes.

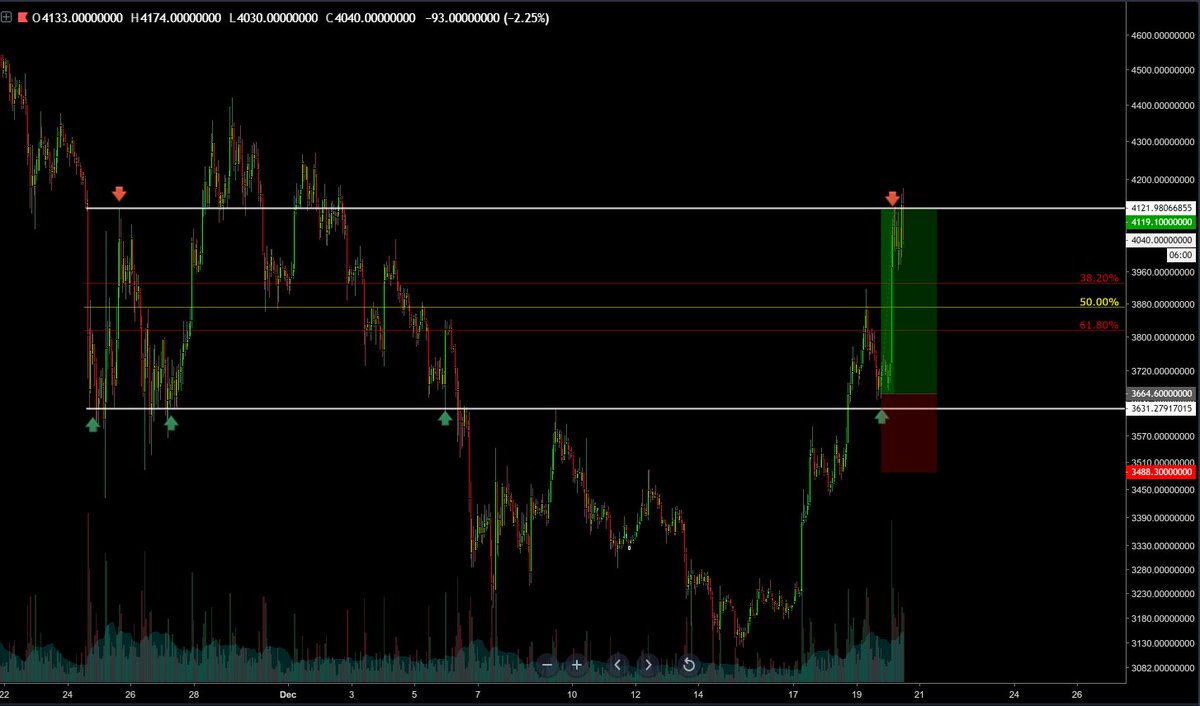

Coins like $XRP and $BCH doing the best. $ADA and others are close behind.

See here:

Large caps first > Mid caps > Small caps.

It could be due to money/liquidity flowing to easiest to access coins first. It could be due to risk tolerance increasing or search for more yield. Probably a combo of both.

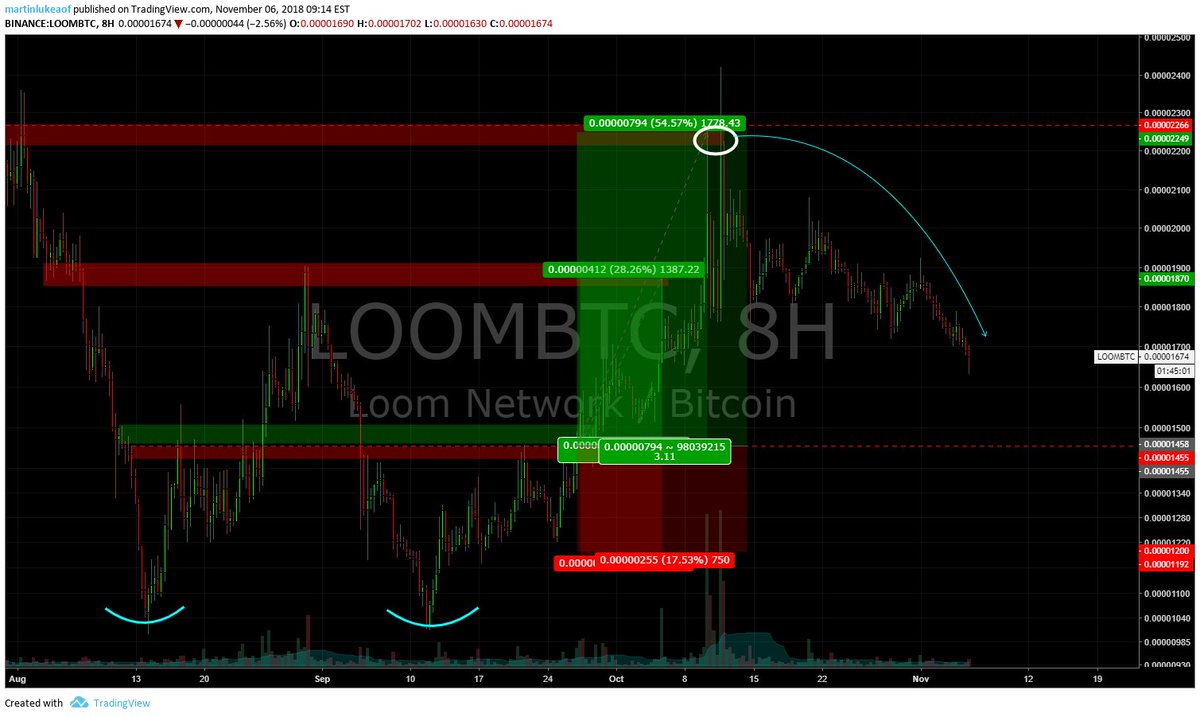

The first coins to move when *most* alts bottomed on Sept 12 were large caps

$ADA $TRX $XRP were a few

more on that here:

Whether it was Binance coins or Idex coins, they moved while large caps were stagnant/dipped.

more on that here:

Since total crypto market cap has been stagnant - this is emphasized. With no new money coming in it's the same money rotating.

I noticed it and shared my thoughts about why I thought it was right to take profits on on coins that moved

If 1/2 coins move past major levels, and can sustain push - it's easy to adjust and start holding longer.

NOW while large caps move the most and everyone wants those - mid caps are getting attractive again.

Money will flow out when they are expensive into cheaper, better R plays in mid caps

You can be early or late into a theme - the most important part is knowing which one you are.