Multi Asset Trader | Futures | Forex | Commodities | Crypto | Equity |

3 subscribers

How to get URL link on X (Twitter) App

Strategy 1 for Friday and Monday

Strategy 1 for Friday and Monday

1. Discipline is key to successful traders

1. Discipline is key to successful traders

In such cash-strapped situations, the first idea that occurs is to use your savings and liquidate your investments even at a loss. And if that is still not enough, you look for a loan.

In such cash-strapped situations, the first idea that occurs is to use your savings and liquidate your investments even at a loss. And if that is still not enough, you look for a loan.

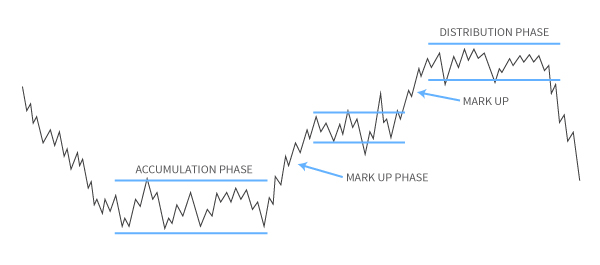

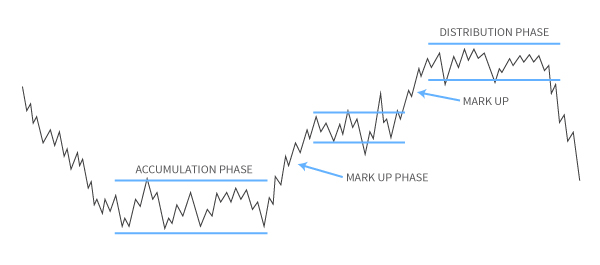

• The basic idea of Dow Theory is that market price action reflects all available information and the market price movement is comprised of three main trends.

• The basic idea of Dow Theory is that market price action reflects all available information and the market price movement is comprised of three main trends.