Country X protects a, b, & c and country Y will protect d, e &f. You can't necessarily do a direct comparison on individual items.

wits.worldbank.org/wits/wits/wits…

Th MFN rule is the cornerstone of GATT/WTO. It's actually the core part of Article I.

But there are exceptions, which I'll come to.

1. Customs Unions, where tariffs are eliminated between members.

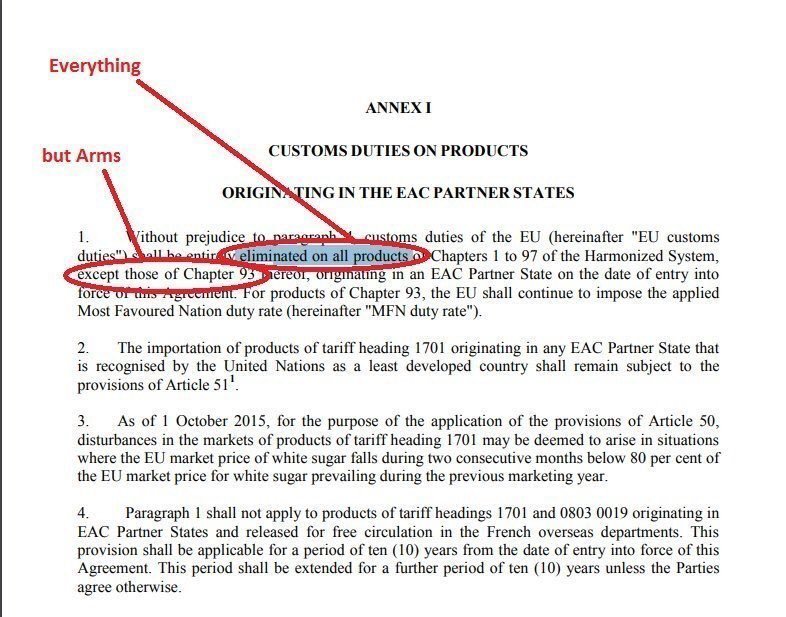

2. Free Trade Areas (Agreements), where a substantial number of tariffs must be eliminated.

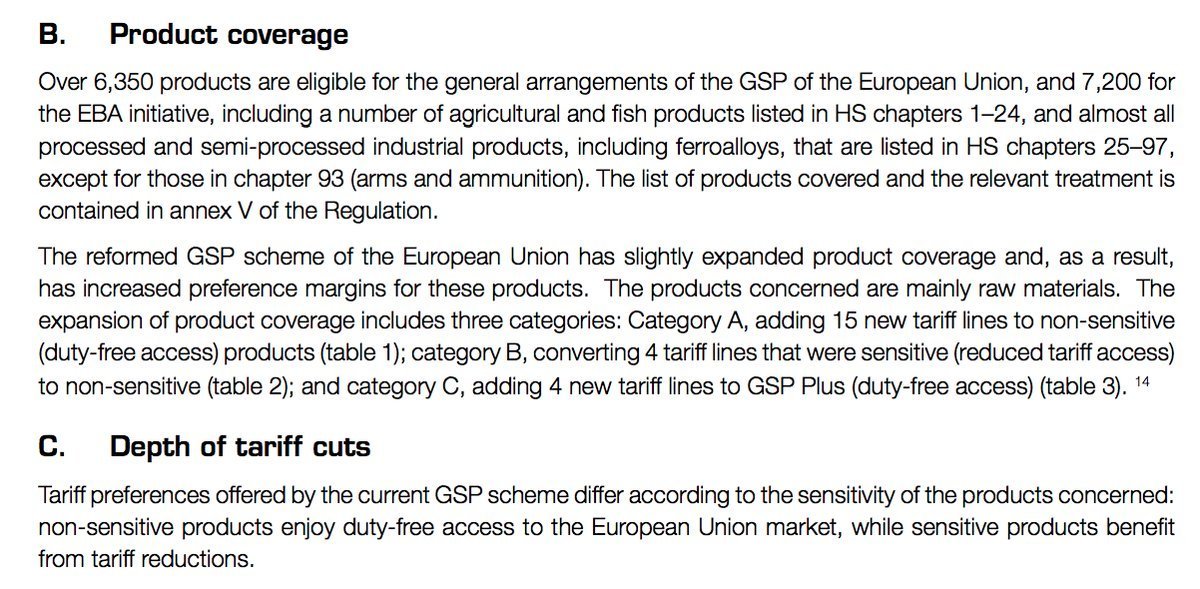

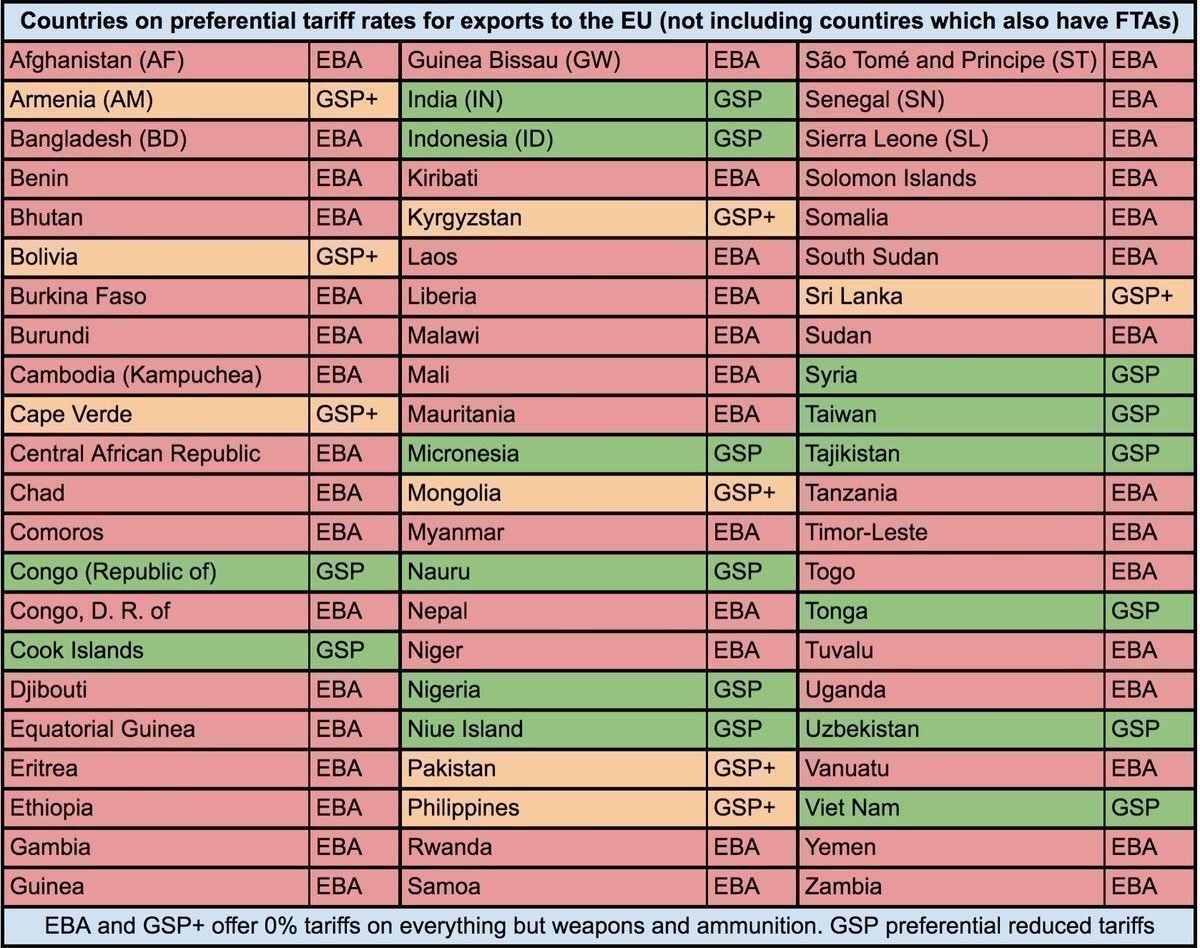

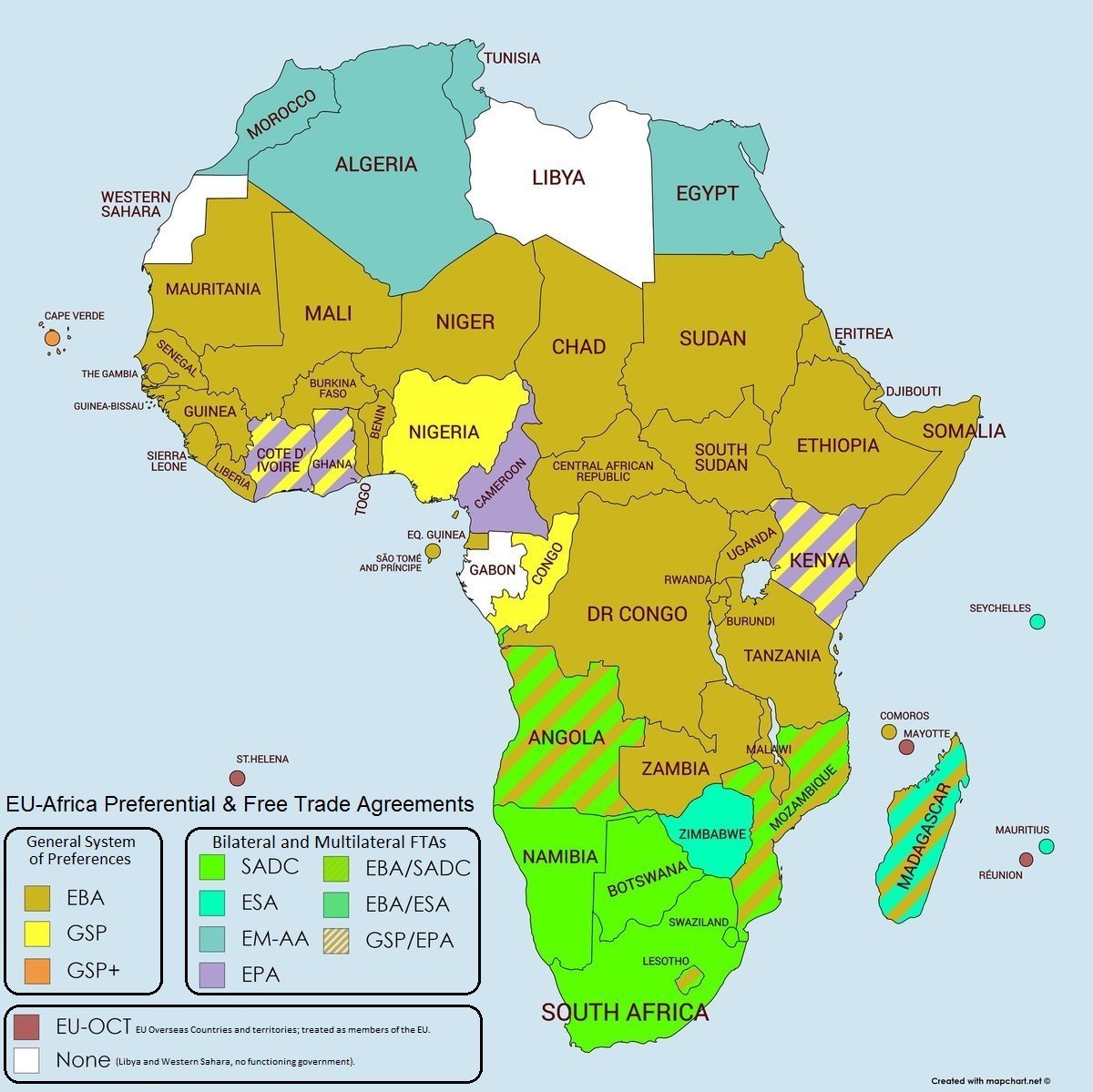

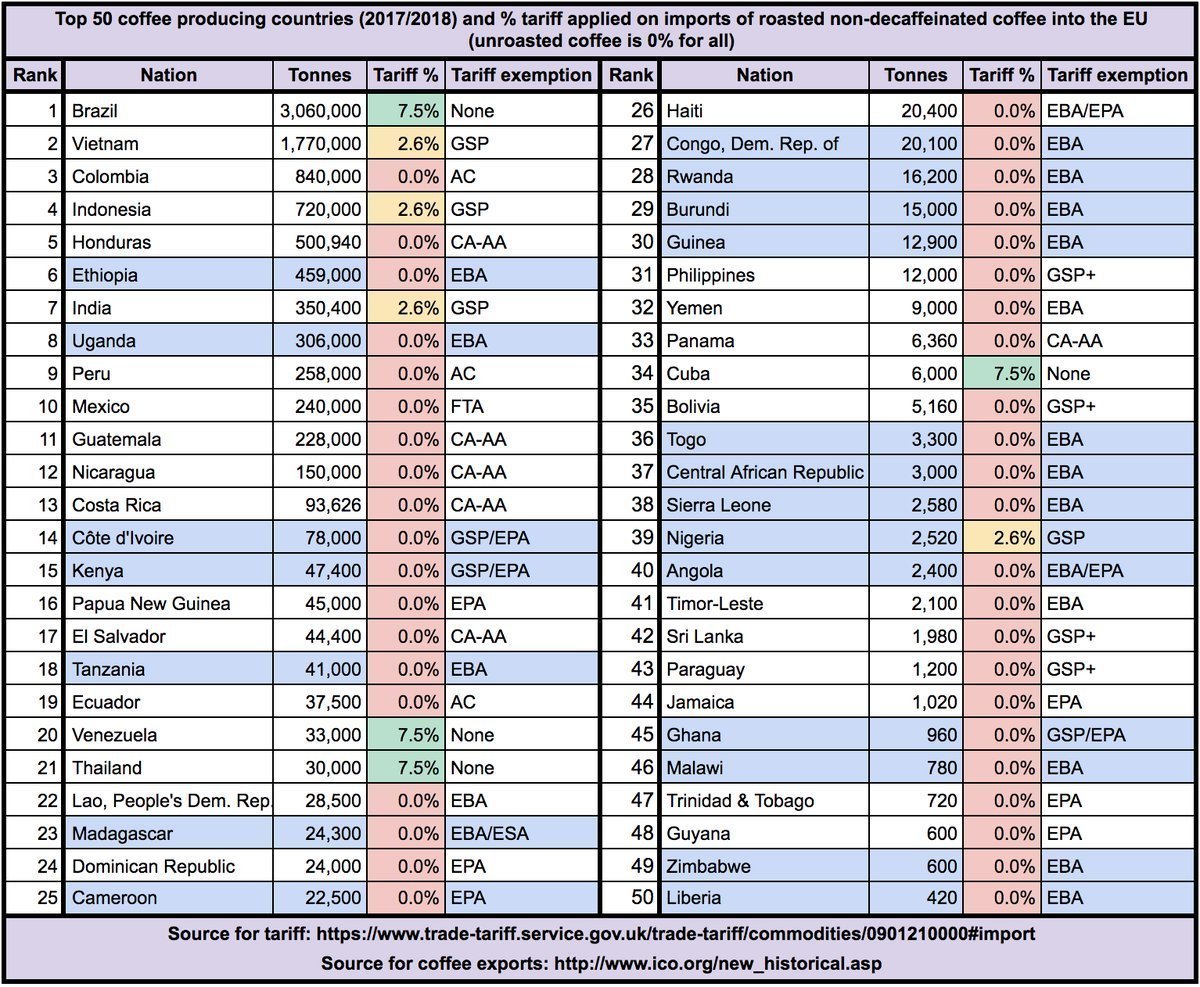

Today 75 countries currently benefit from widespread tariff elimination & reductions. EBA (total elimination of tariffs for the least developed countries) is part of GSP.

unctad.org/en/Publication…

Everyone has them. The MFN rule means that an importer has to apply to same rate all exporting countries, bar FTA & CU exceptions, and there are also exceptions for developing countries.

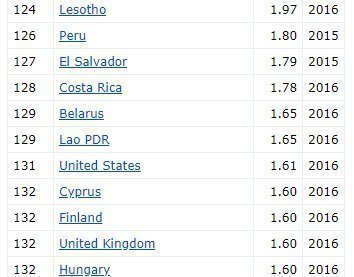

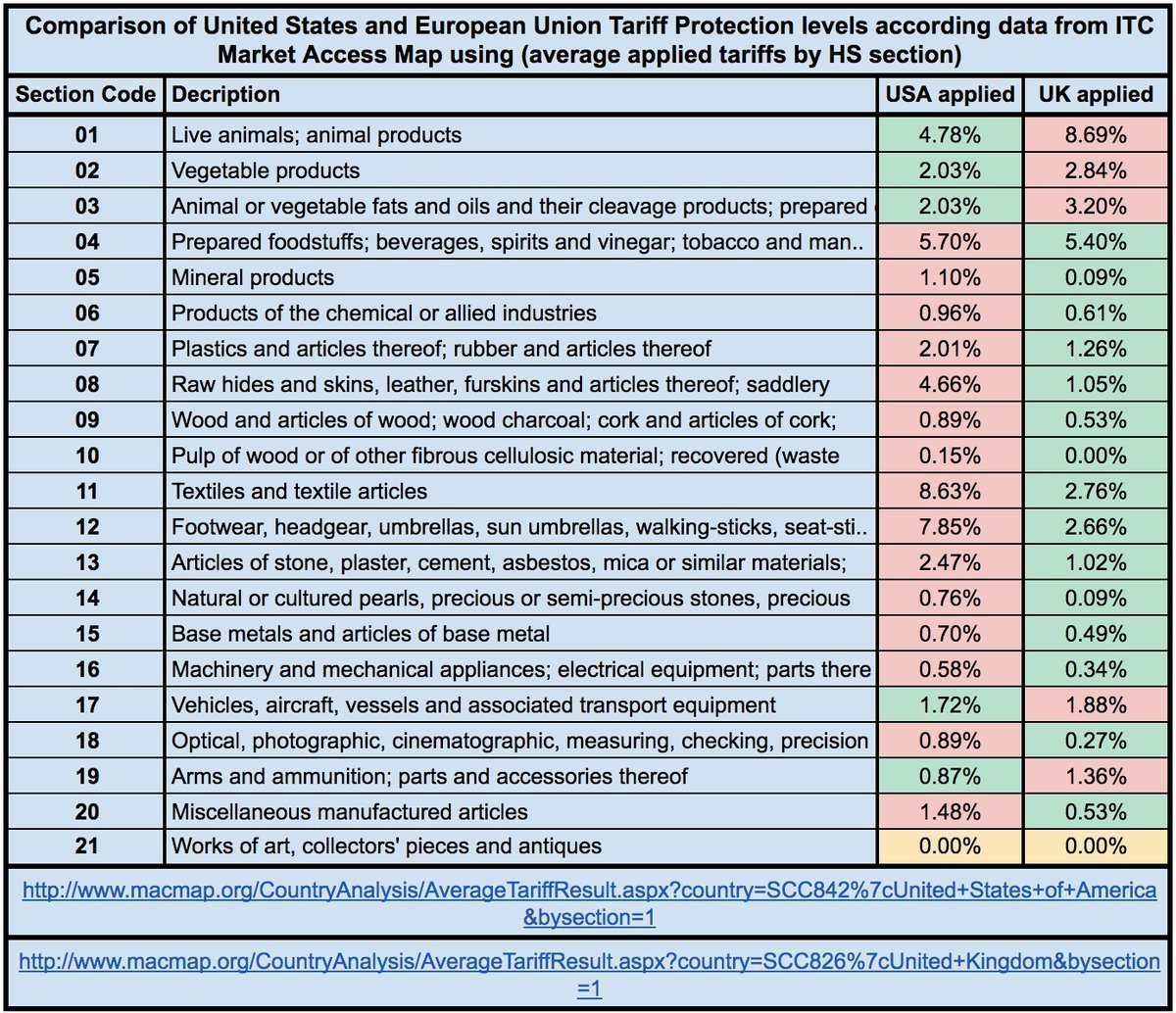

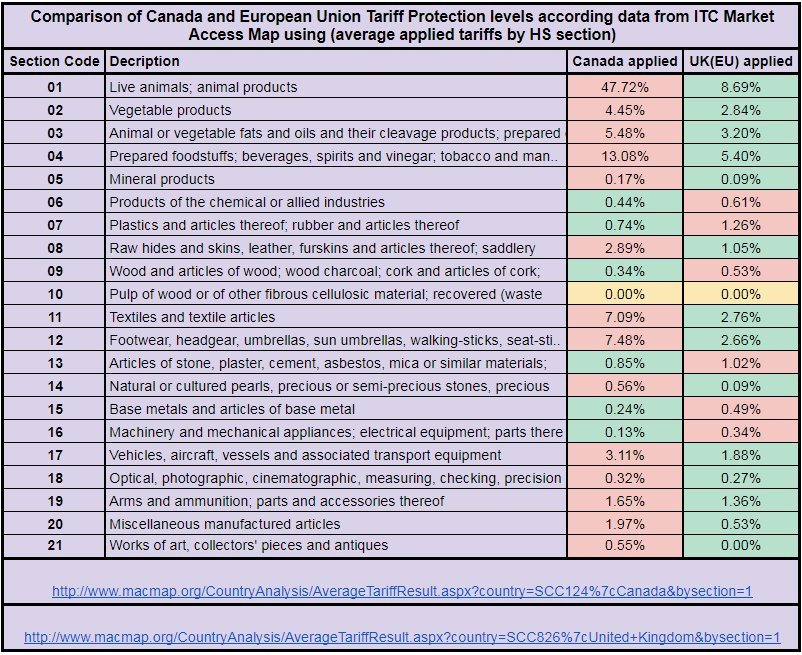

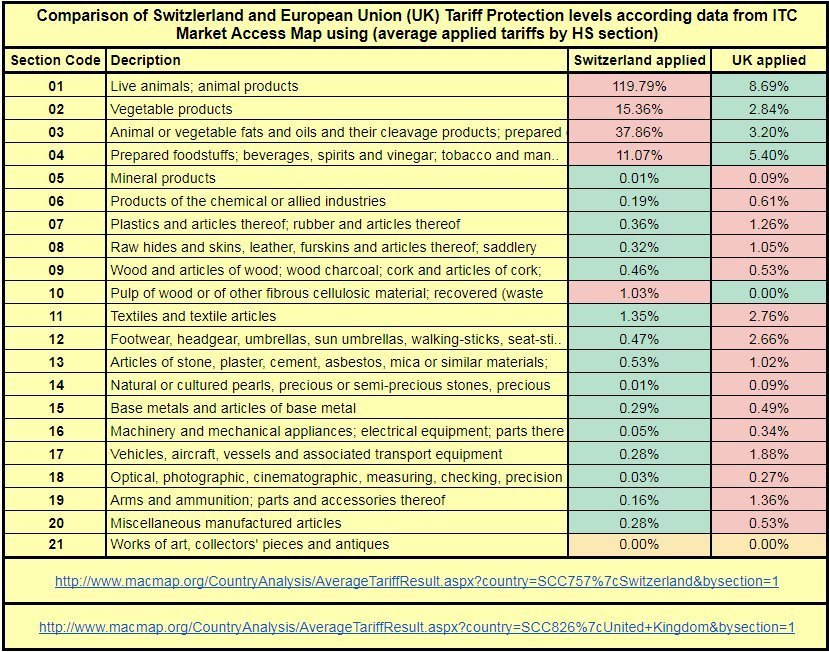

Let's now see how the EU compares to others

indexmundi.com/facts/indicato…

Red is higher.

Well Canada's Ag tariffs are much higher

Switzerland?

Here's the data source by the way so you can check these stats for yourself.

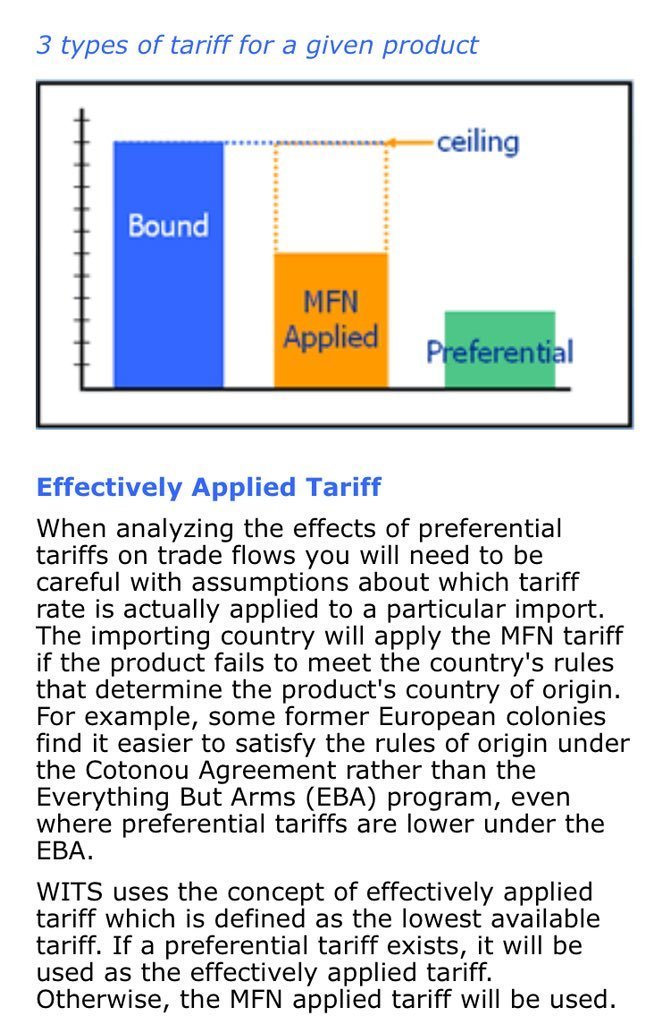

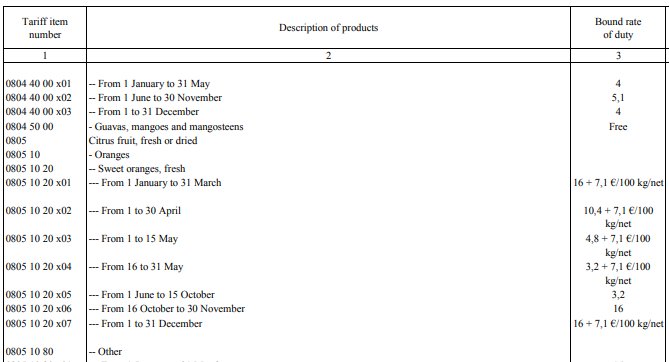

Remember it's the applied not the bound rate that's important.

macmap.org/CountryAnalysi…

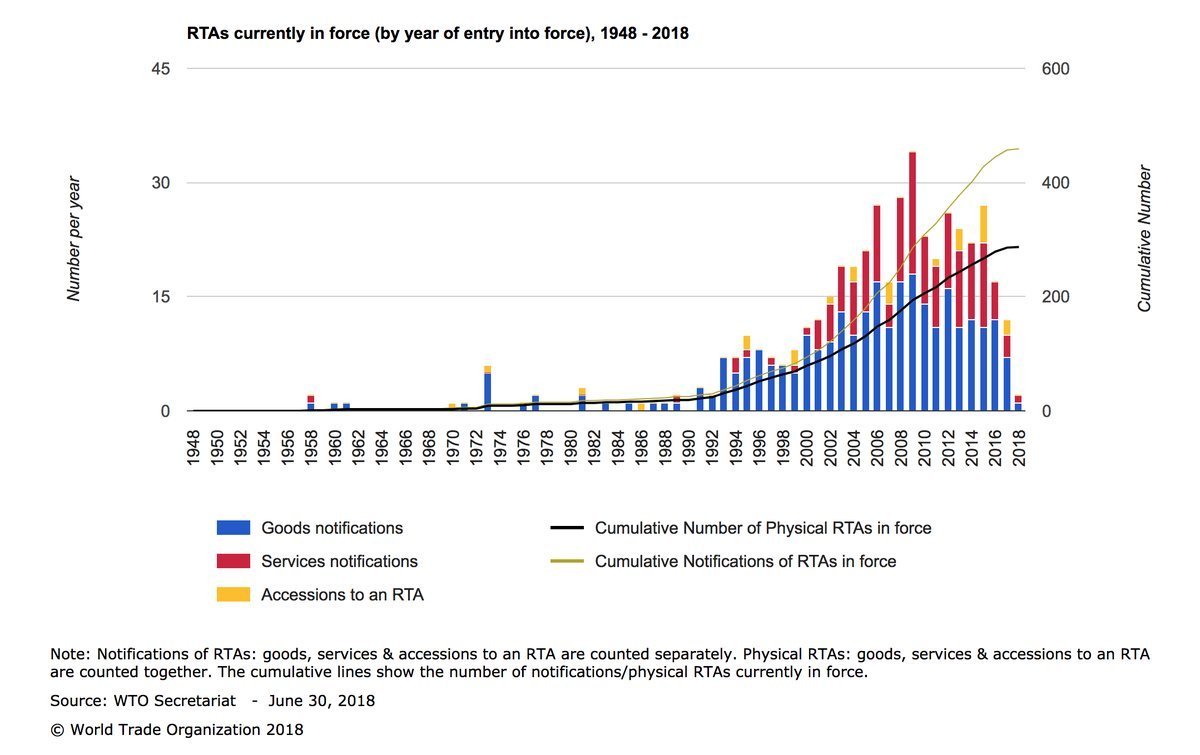

Further reductions are only likely through FTAs.

Here's the link so you can check for yourself. rtais.wto.org/UI/PublicMaint…

But what about the actual trade partners in these deals?

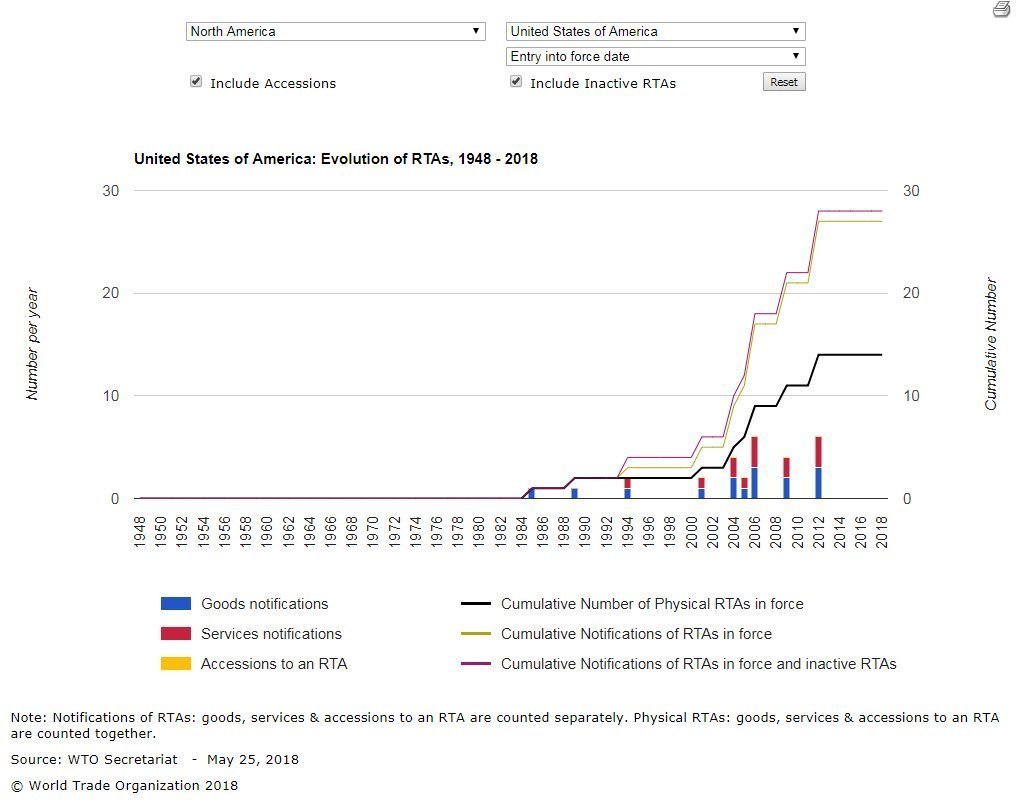

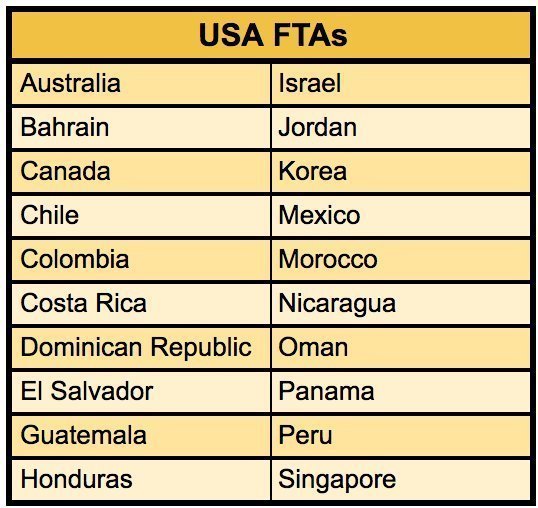

USA first.

rtais.wto.org/UI/PublicSearc…

Some big names, Canada, Korea &Australia and a bunch of much smaller economic powers. But then most of the would falls into that category.

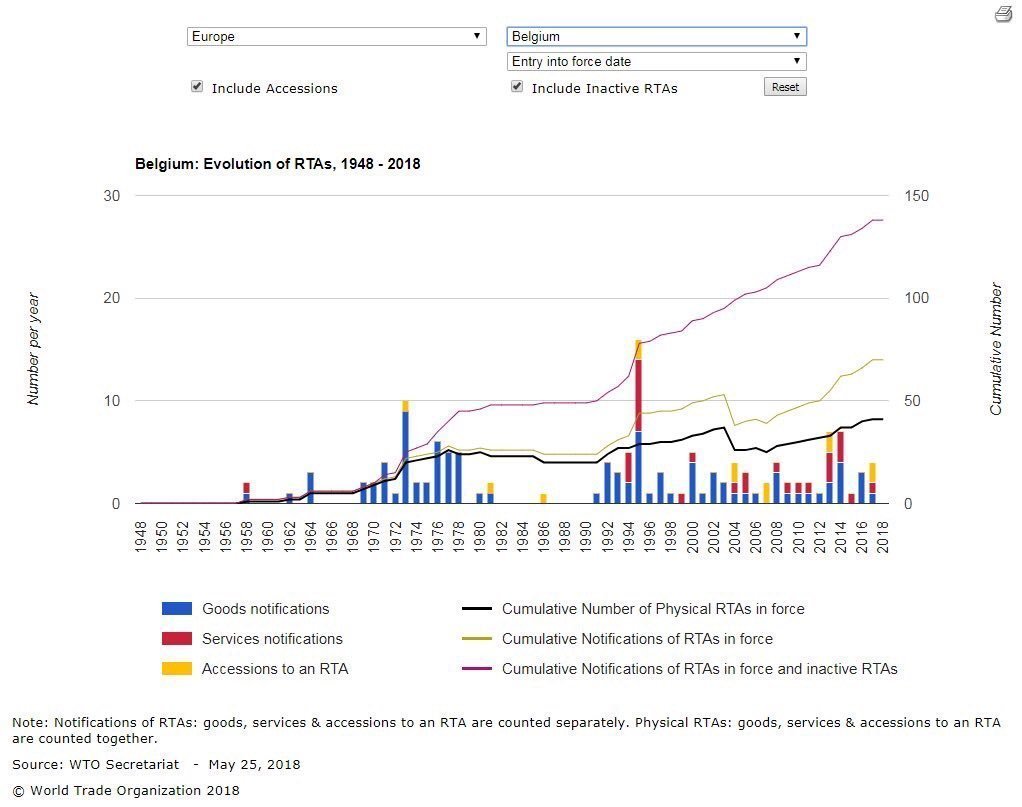

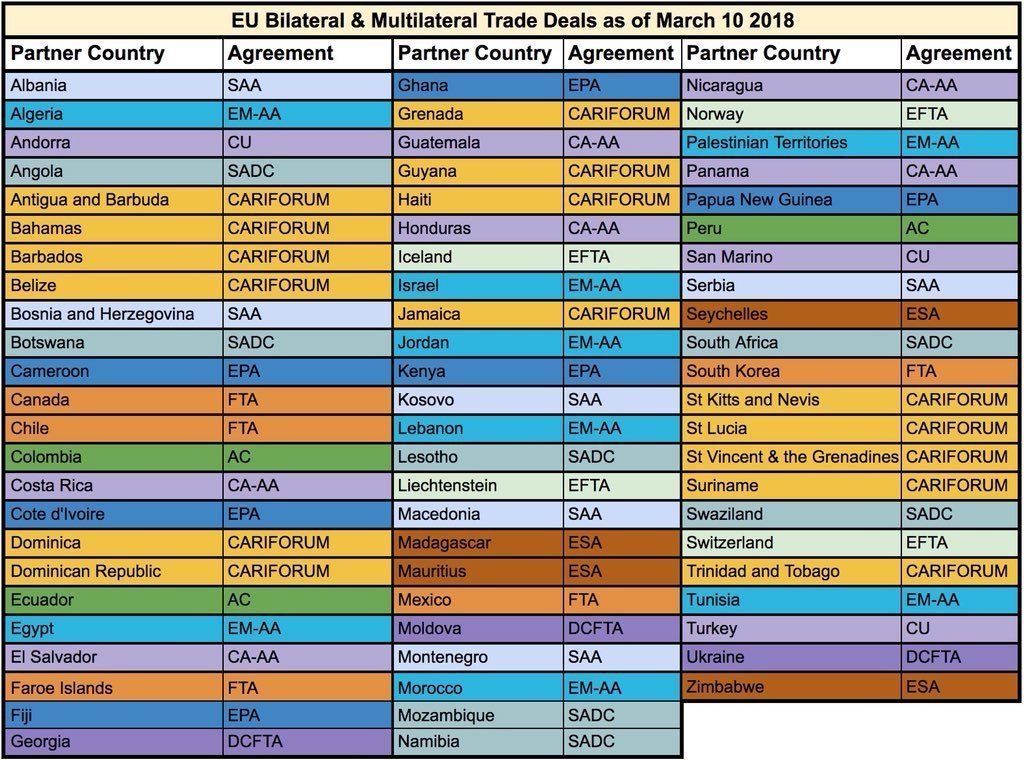

What about the EU?

That's 70 countries on this list. Not including Japan which has just been ratified & deals with Vietnam & Singapore near completion.

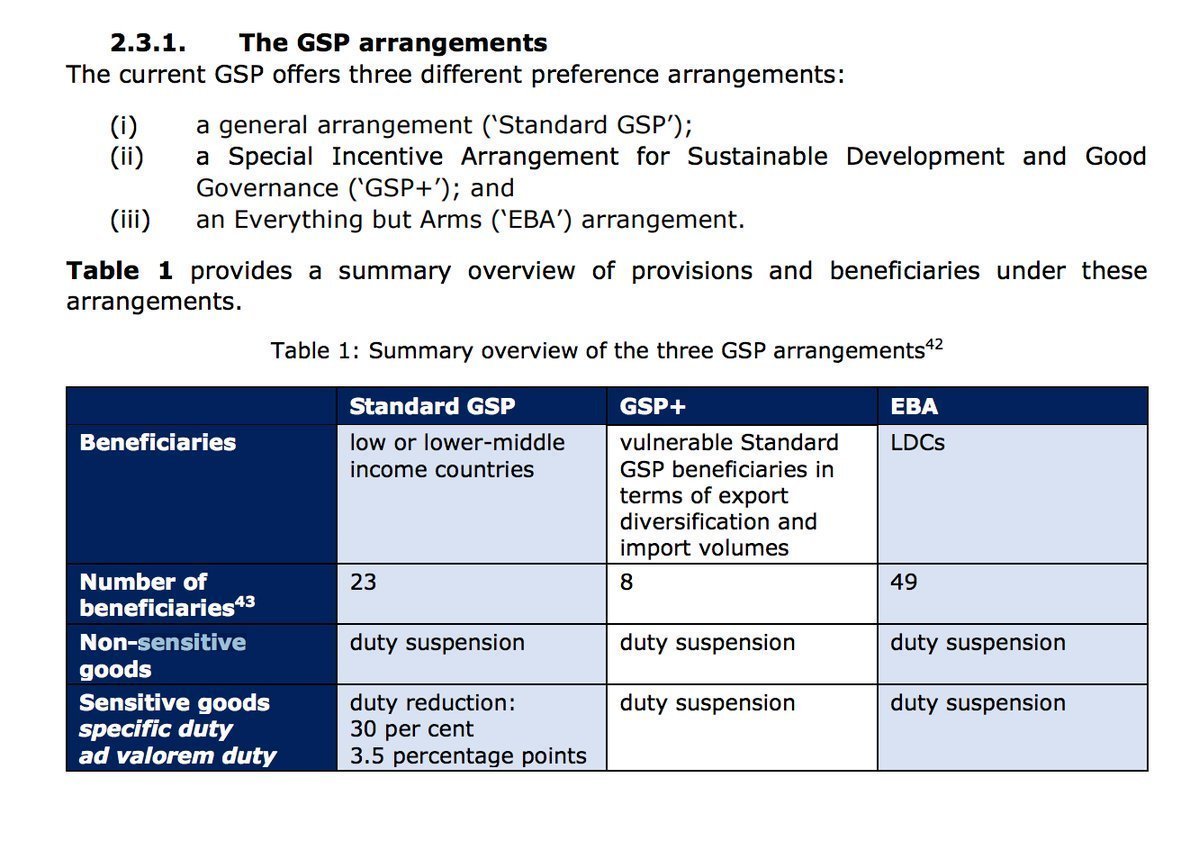

Standard GSP for low to low-middle income countries.

GSP+ (GSP countries showing commitment to sustainable development)

And EBA for the least developed countries (LDCs).

Red and yellow are on complete tariff elimination (bar for armaments) through EBA or GSP+.

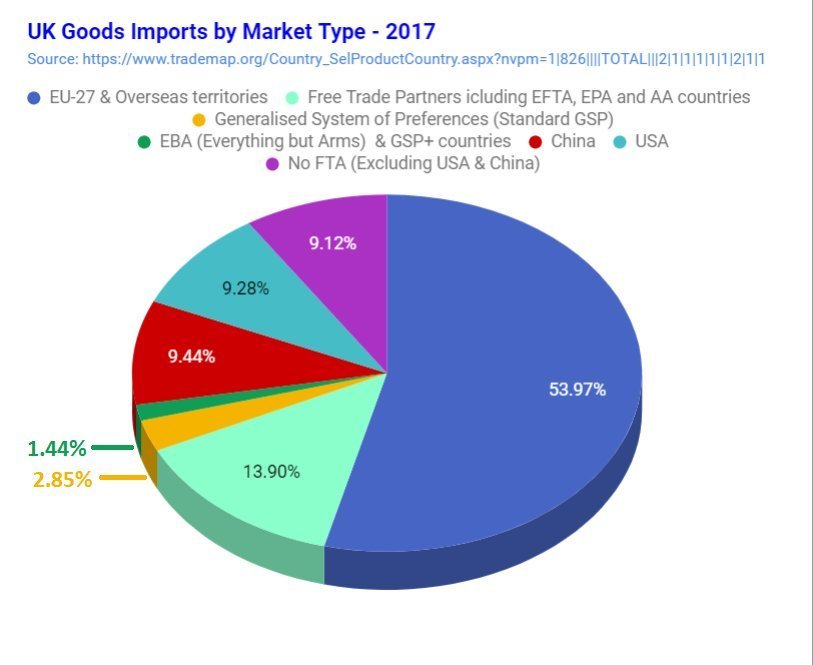

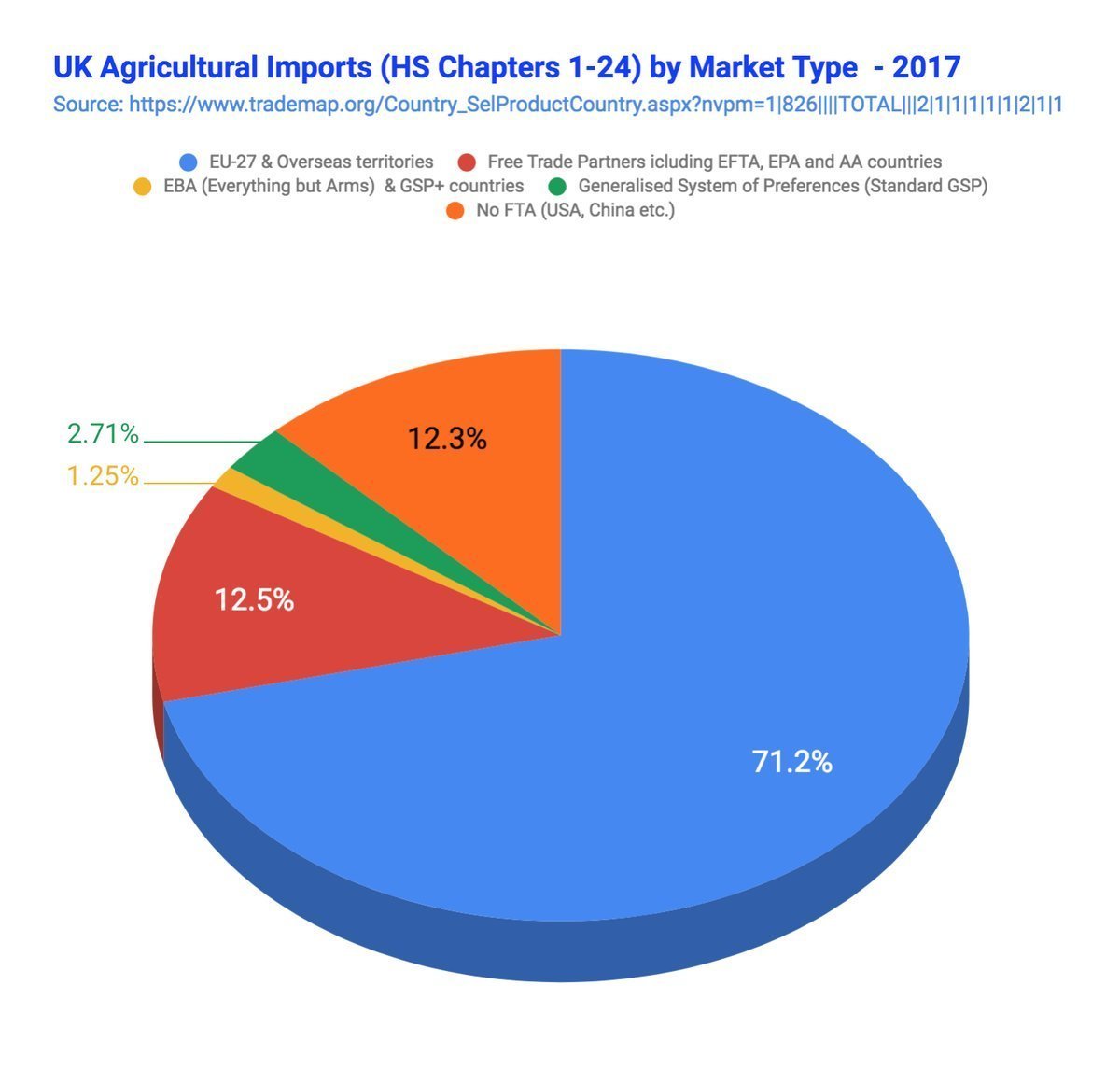

Only 12.3% of all food/Ag imports into the UK is non-preferential.

trademap.org/Country_SelPro… …

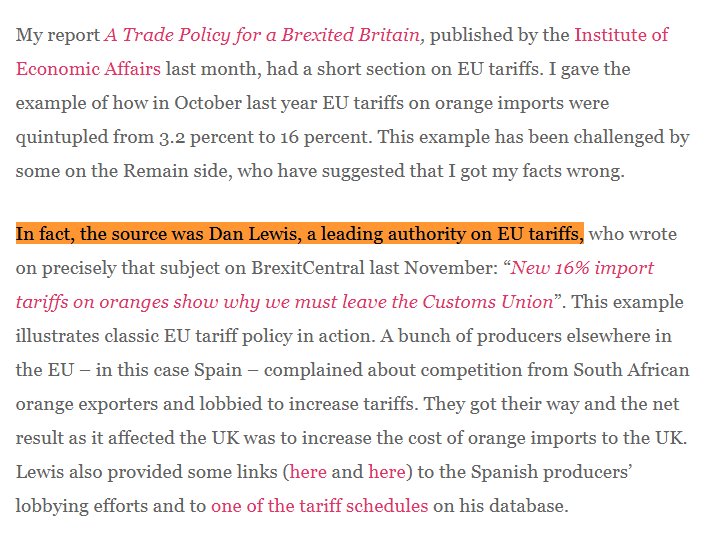

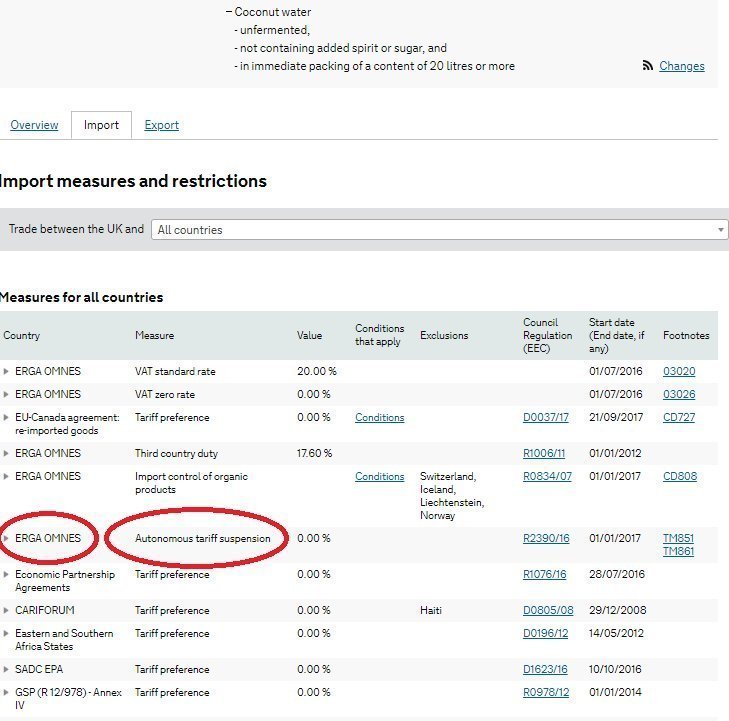

You linked to this (iea.org.uk/the-eus-thousa…) article on BrexitCentral by Kevin Dowd. He's defending an earlier article and saying his source is tariffs "Expert" Dan Lewis. That's not a plus, as we'll see.

He makes you pay for publicly available information. The ESSENTIAL GUIDE TO EU IMPORT TARIFFS 2016 with the annex containing a list of tariffs.

The main difference the UK and EU's databases are up-to-date. While's Dan's website's DB is scrapped periodically.

ec.europa.eu/taxation_custo…

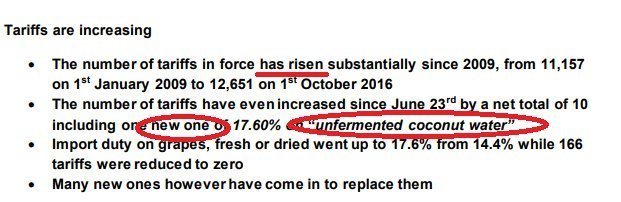

"The number of tariffs .. has risen substantially since 2009, from 11,157 on .. to 12,651 .. [in] 2016".

This shows his fundamental misunderstanding of tariffs schedules.

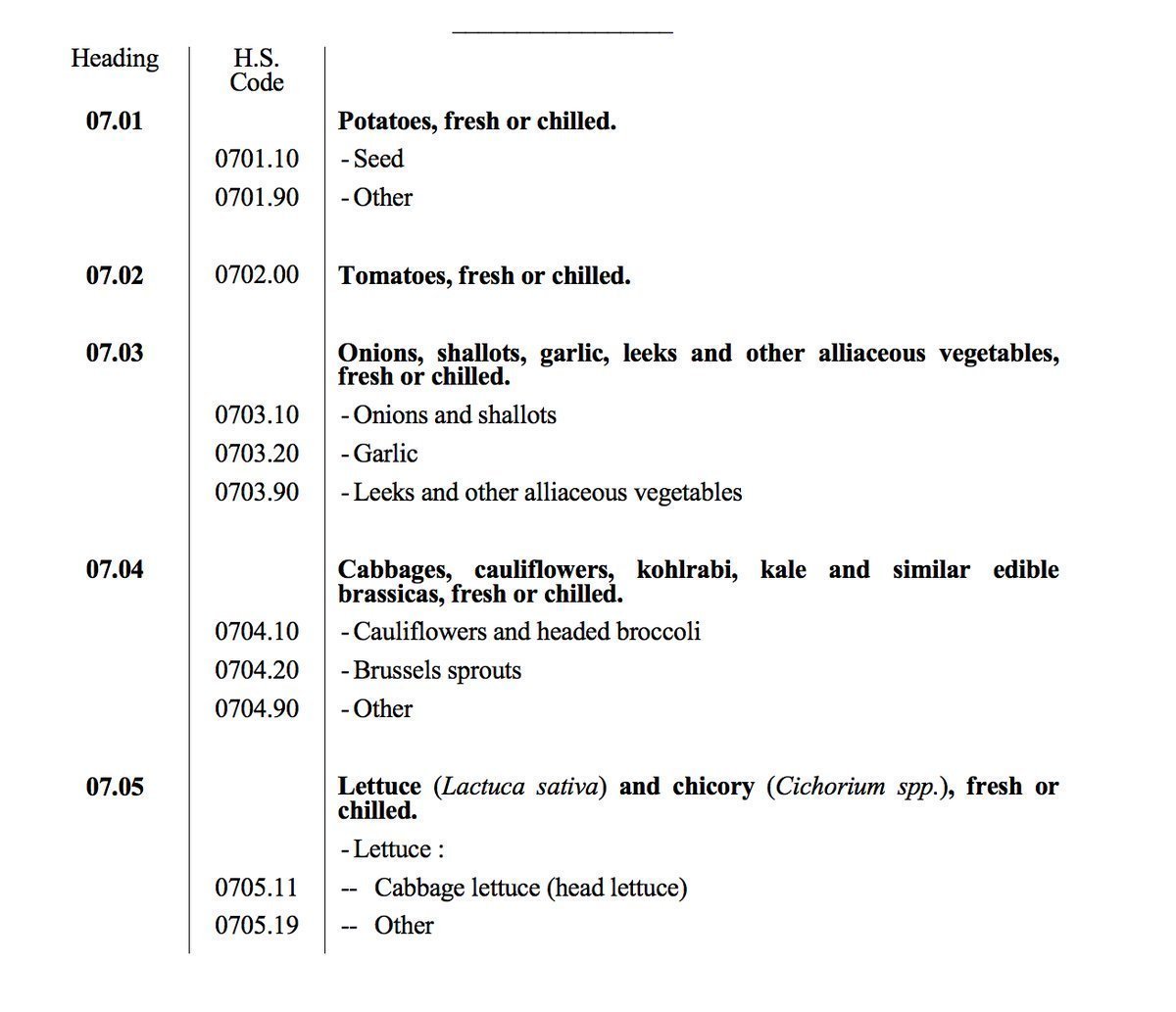

The nomenclature for the codes for customs are defined to the 6-digit level by the World Customs Organisation. Here is the 2017 edition.

wcoomd.org/en/topics/nome…

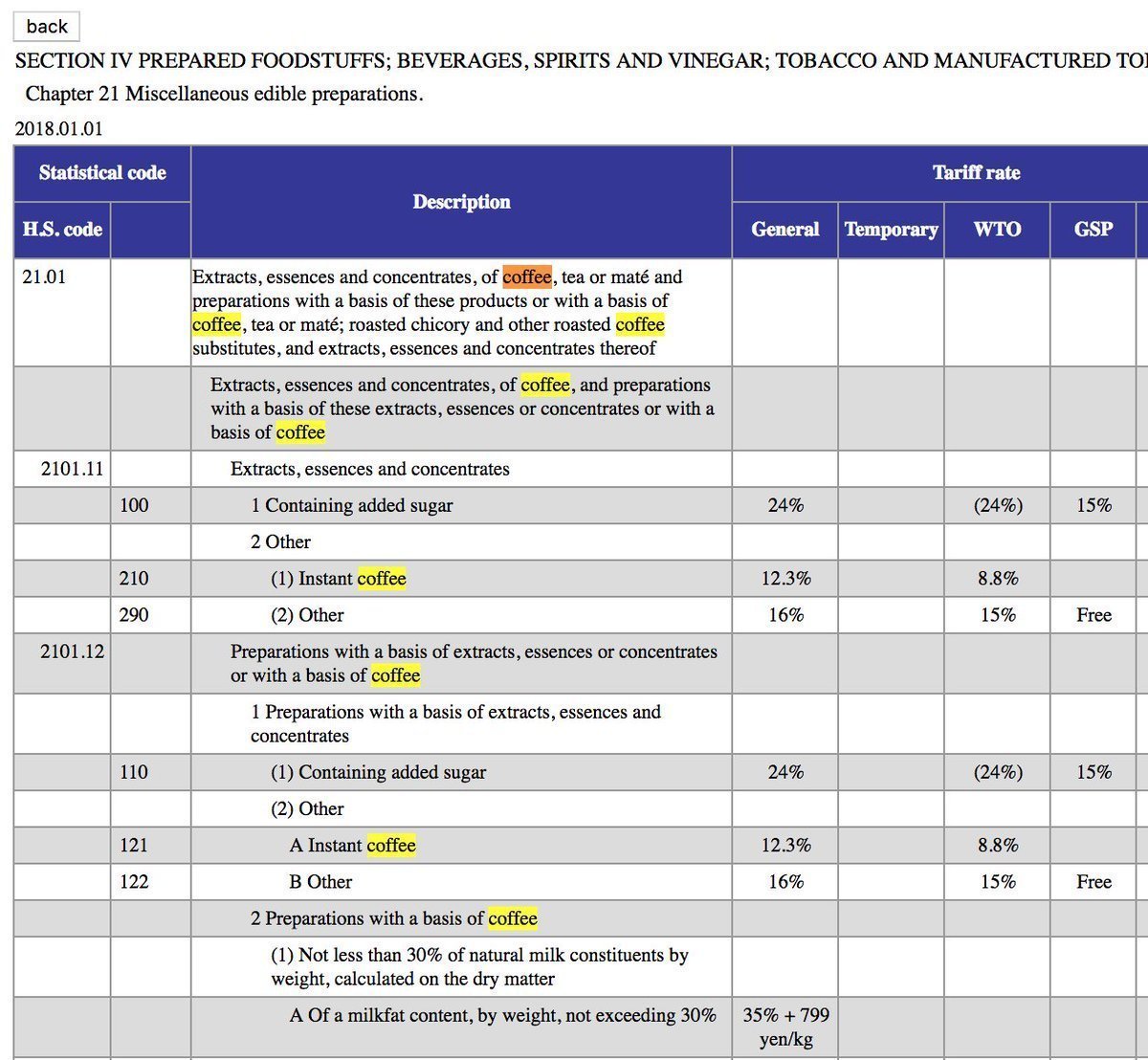

Every country in the world uses the Harmonised System as a basis for their tariff schedule. Here's part of Japan's schedule, for instant coffee.

customs.go.jp/english/tariff…

Fruit Juice

-- Citrus Fruit Juice

-- Other

.. and then it gets updated to be

Fruit Juice

-- Citrus Fruit Juice

---- Orange Juice

---- Other

-- Other

No new duties have been added.

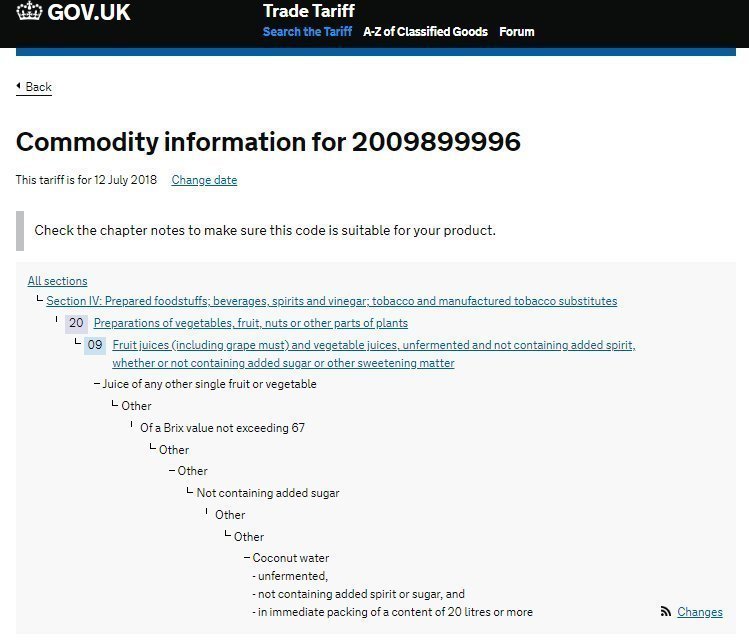

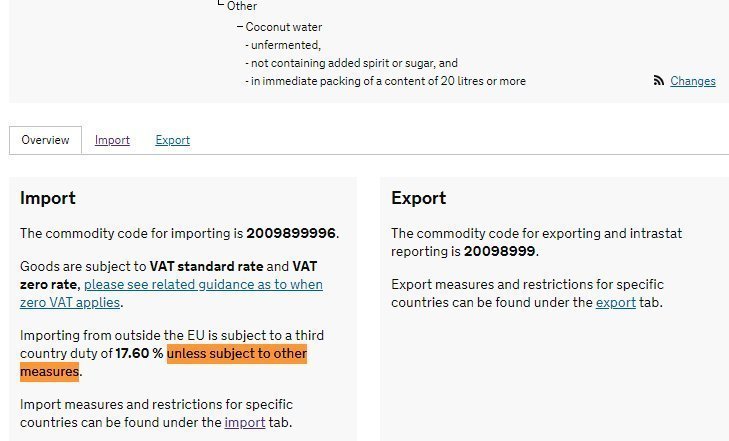

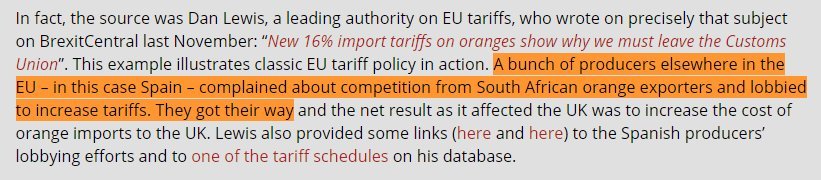

Here is it CN code 2009899996.

Check for yourself with this link: trade-tariff.service.gov.uk/trade-tariff/c…

Note it says "unless subject to other measures.". Dan stopped looking at this point. He didn't bother checking the "other measures". This kind of thing is important!

The duty code was carved out specifically so that it could be excluded from the duty for the category it previously belong to.

Dan got this backwards. A duty he said was added was actually being removed.

Worth re-emphasising Dan's choice example of a tariff being added was actually a tariff being removed.

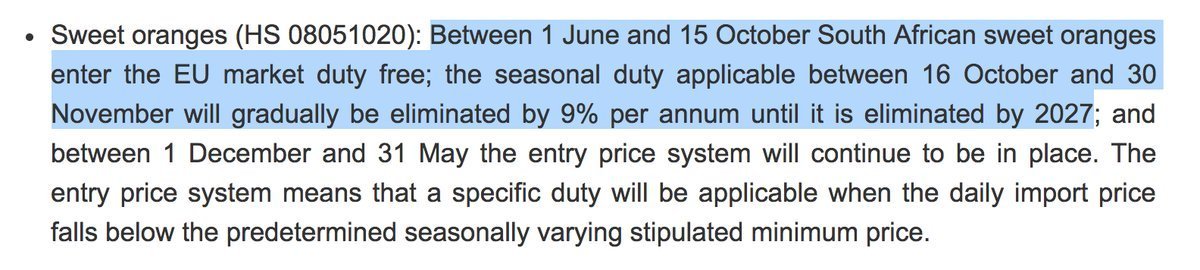

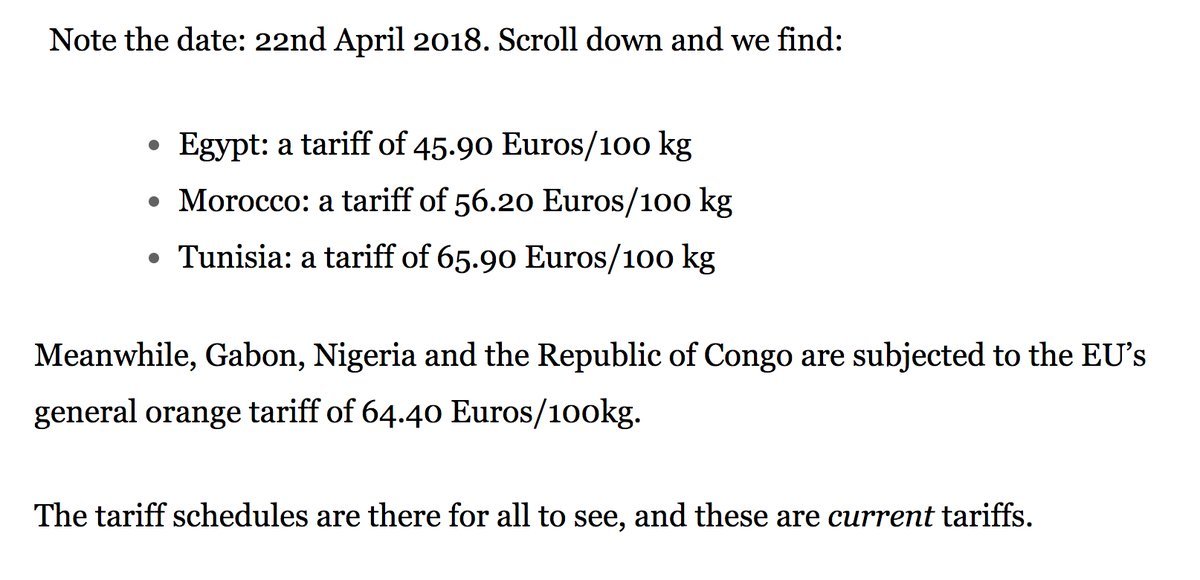

Lewis and Dowd say that Spanish growers objected to low tariffs for South African oranges, lobbied the eU and got their way with an increase in duties.

This is a totally untrue.

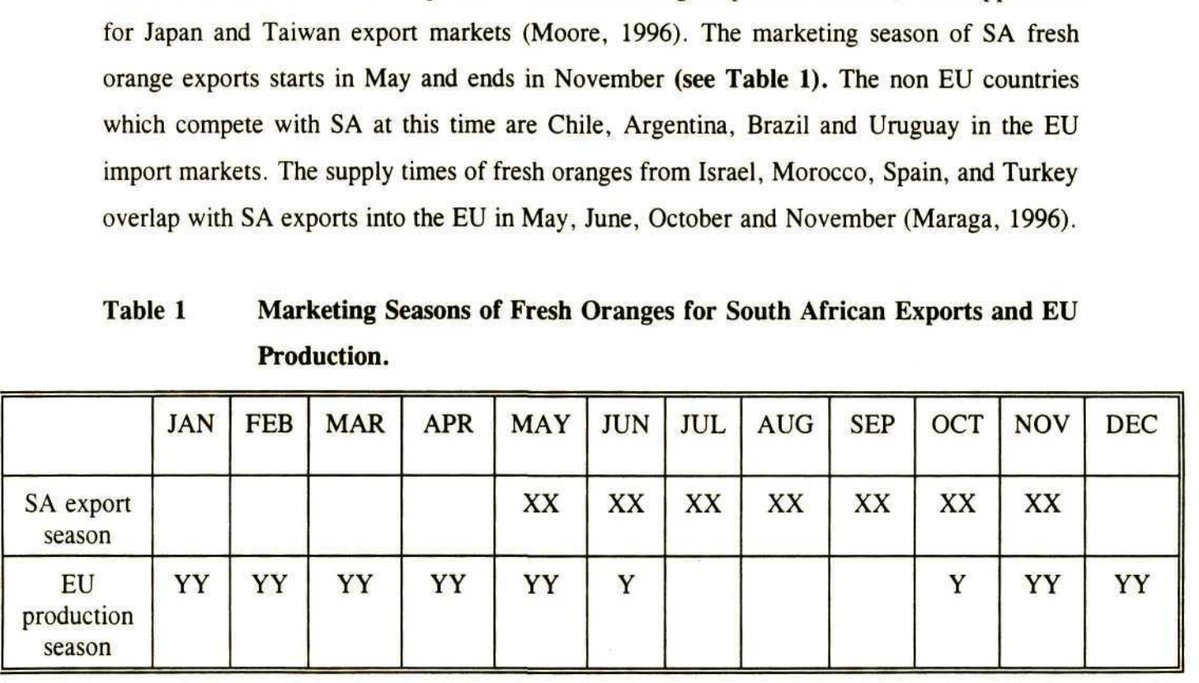

Here's a table showing the seasonality of oranges grown in the northern hemisphere and South Africa in the Southern hemisphere.

The two sources are only in potential competition during a brief overlap period.

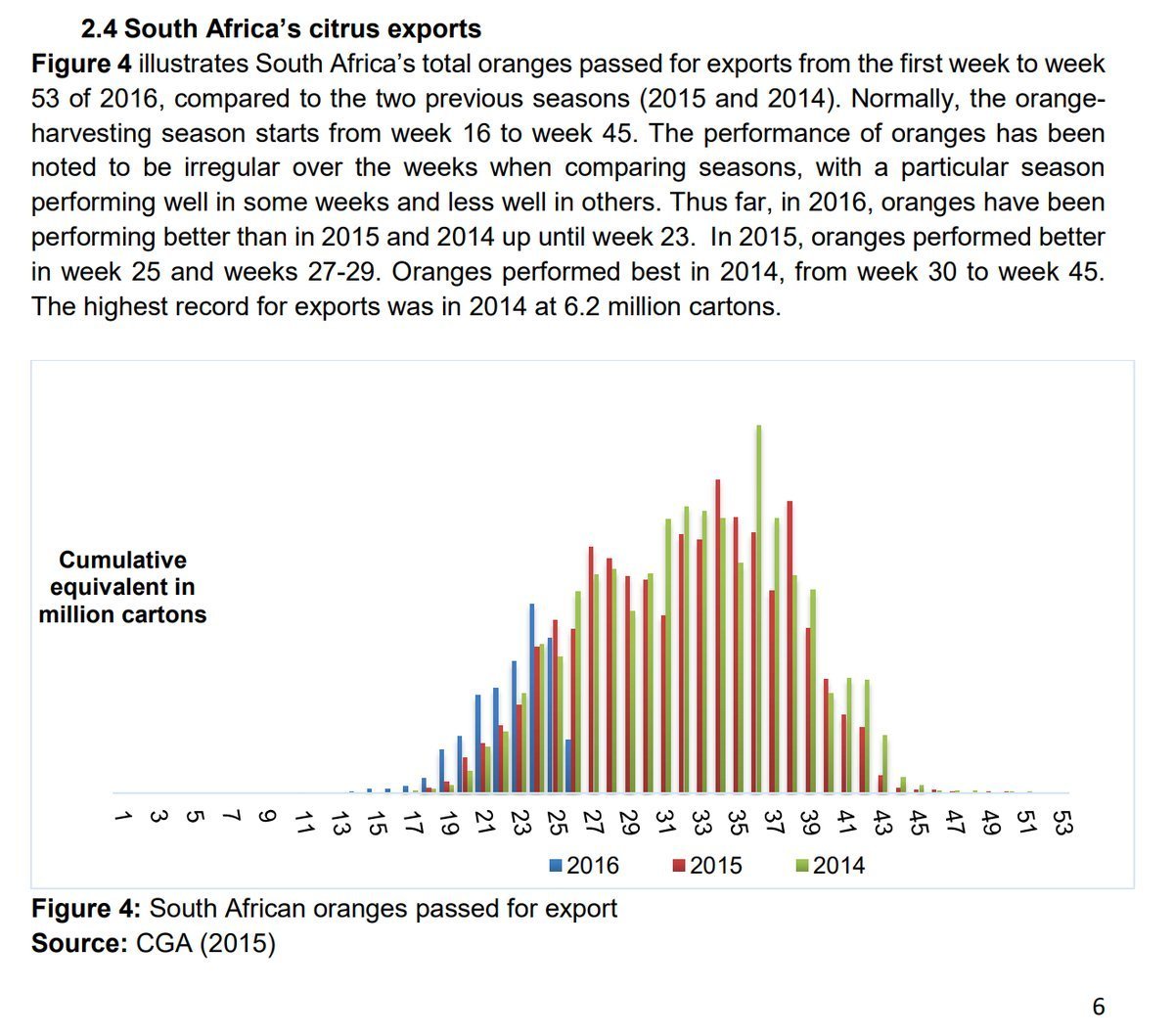

By the time we get to November we're talking about late season poorer quality produce. kzndard.gov.za/images/Documen…

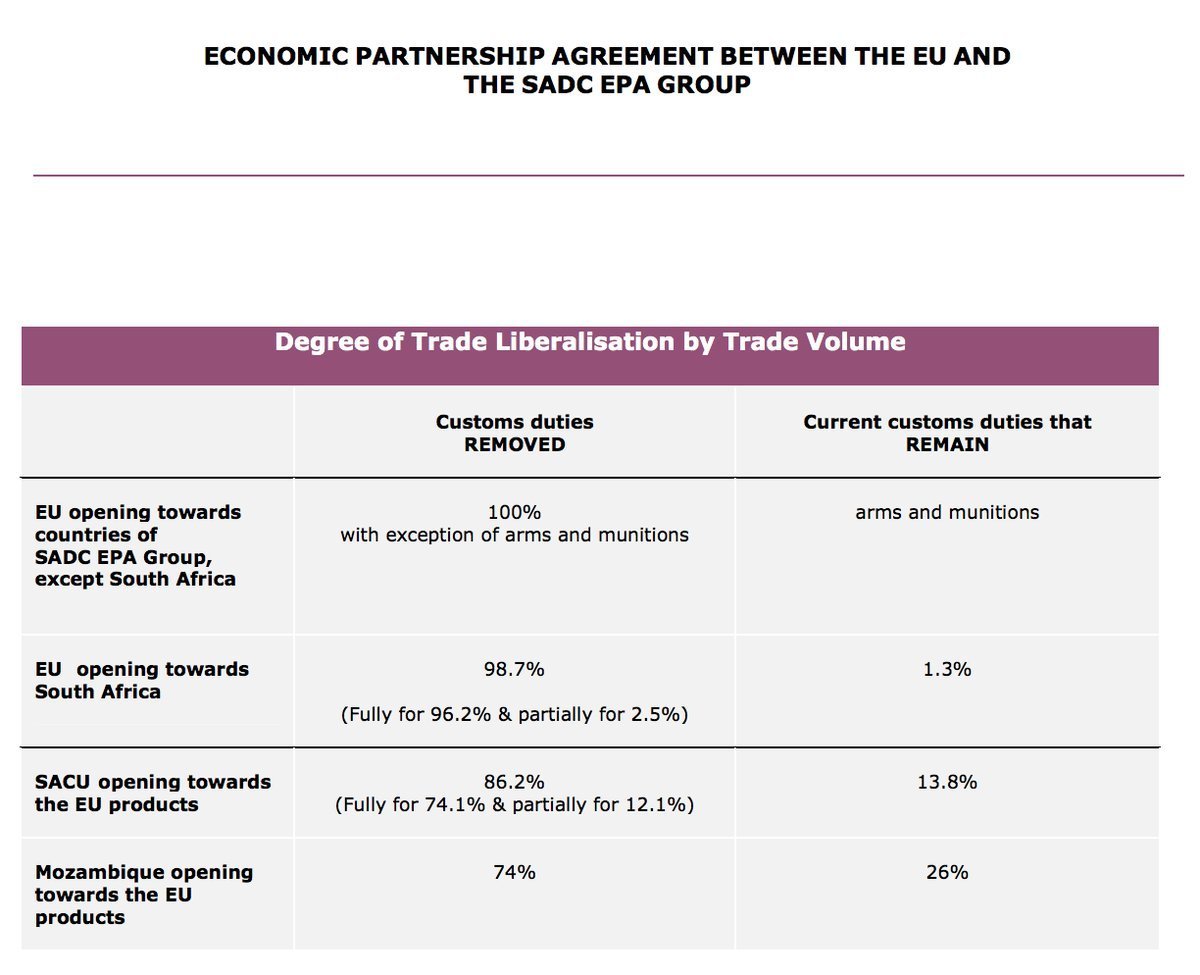

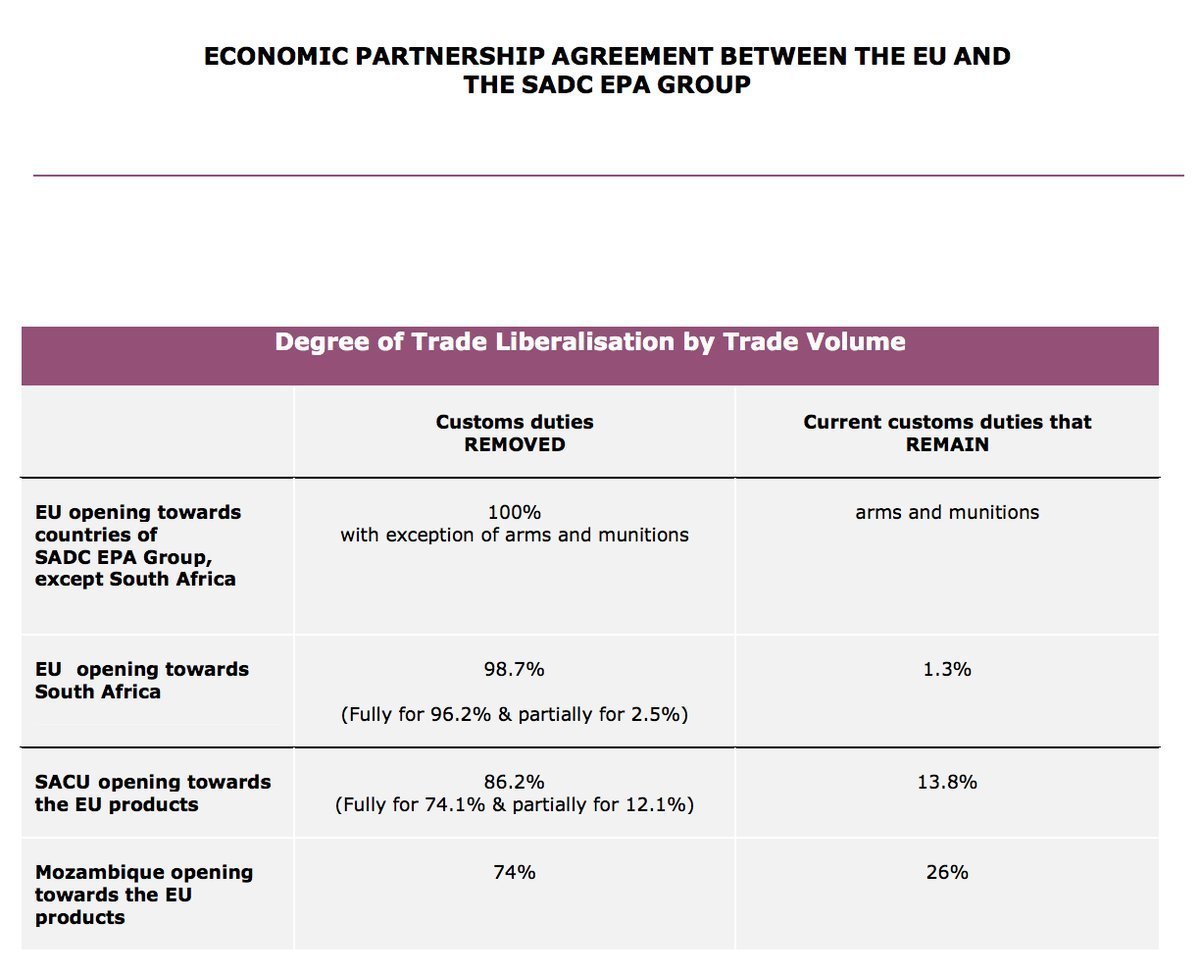

This eliminates 100% of duties for other SADC countries and over 98% for south Africa.

trade.ec.europa.eu/doclib/docs/20…

There was no "lobbying" as such. Just MEPs asking questions in Parliament.

And what was the result of this "lobbying"?

Nothing.

I'ts utter, ignorant, stupid nonsense. 2+2 =27.

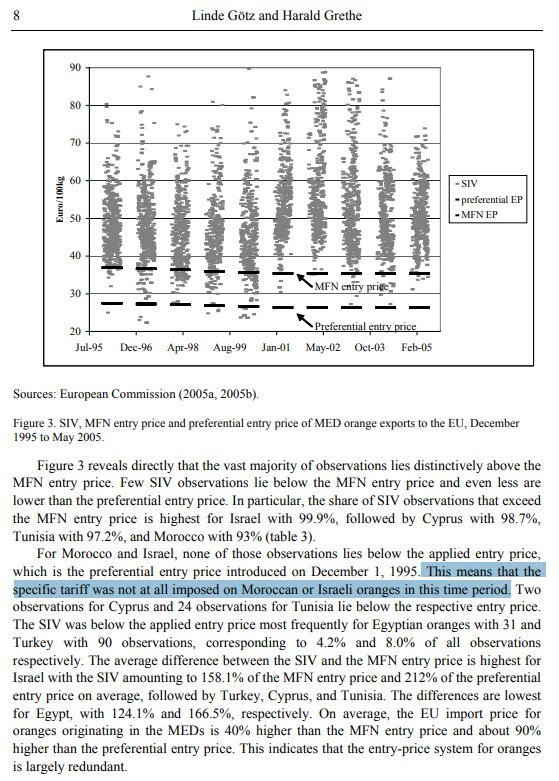

Because the MFN tariff applied to non-FTA partners changes seasonally. It has done since at least 1995 when the current Entry Price system was introduced and possibly since before then.

tradebetablog.files.wordpress.com/2017/02/1220-0…

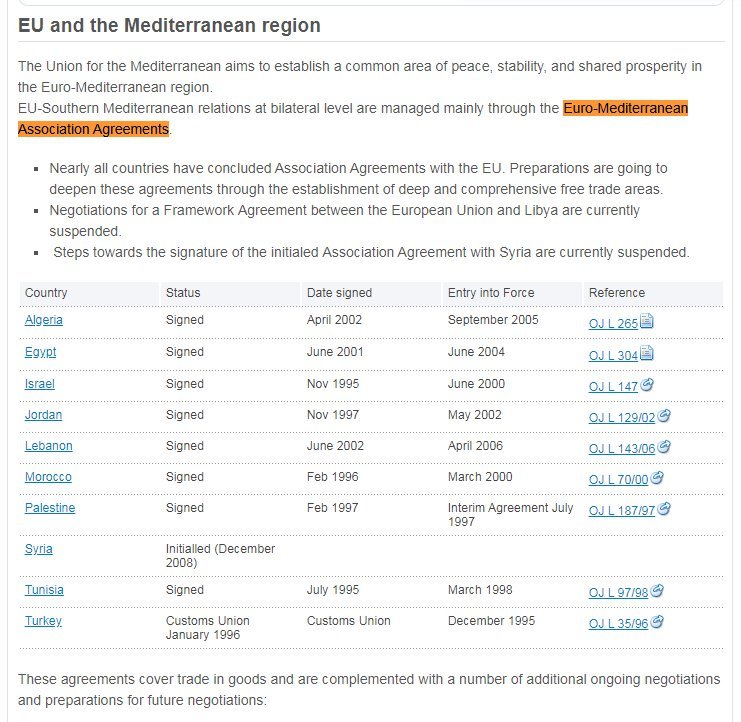

Well the biggest exporters of oranges to the EU are Morocco and Tunisia.

Both countries have Association Agreements with the EU.

ec.europa.eu/trade/policy/c…

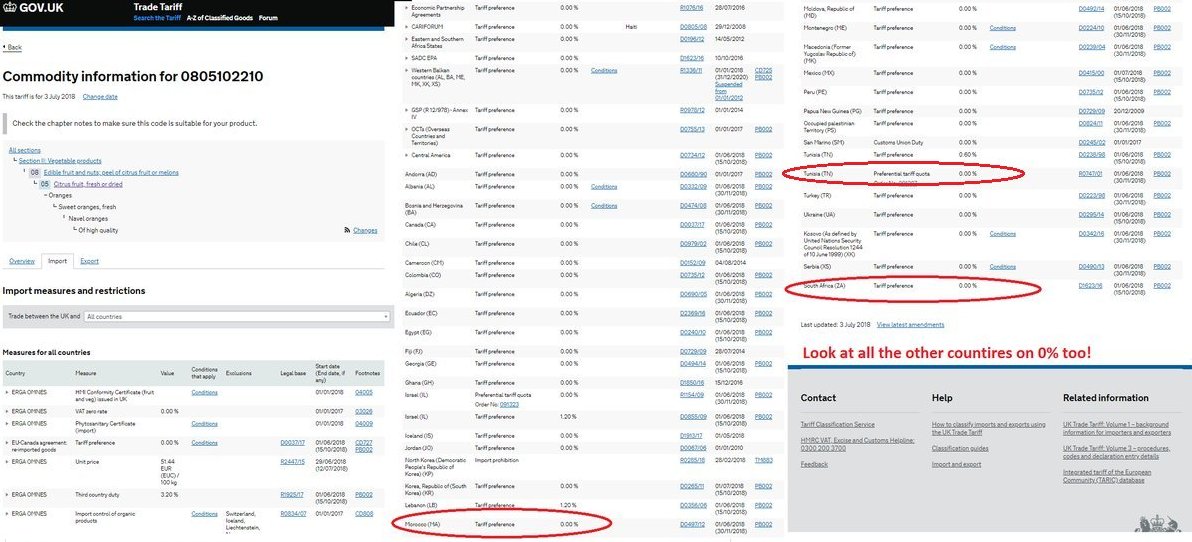

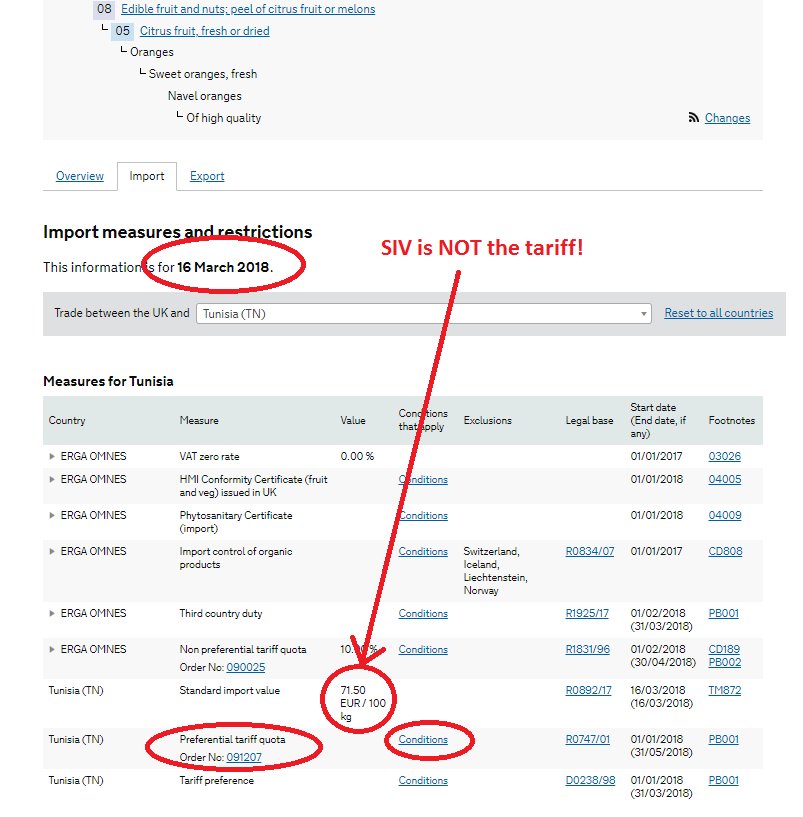

trade-tariff.service.gov.uk/trade-tariff/c…

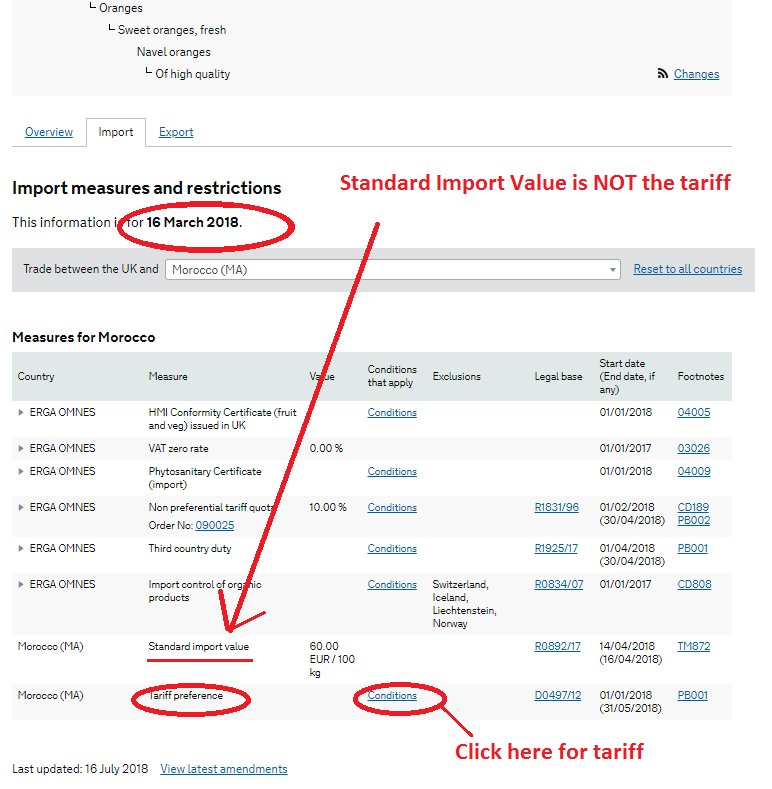

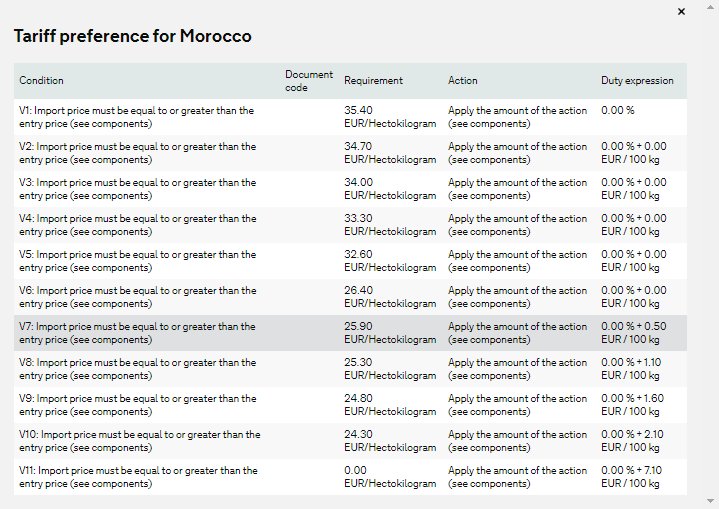

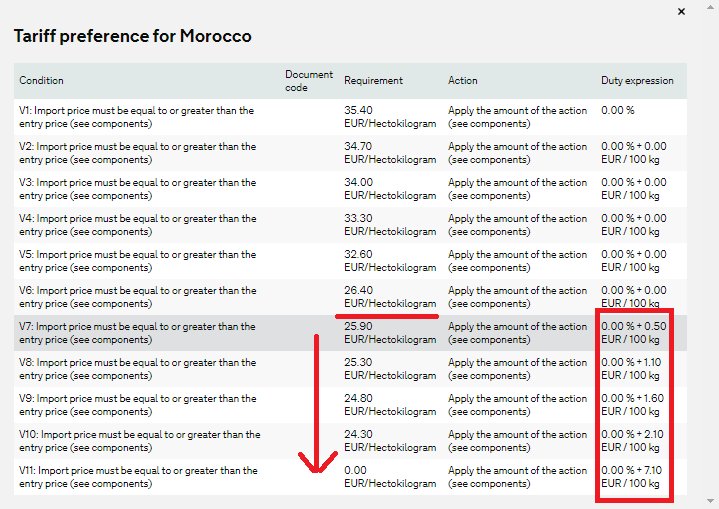

Here's the tariff for Morocco. You have to click on the conditions link to see the tariff.

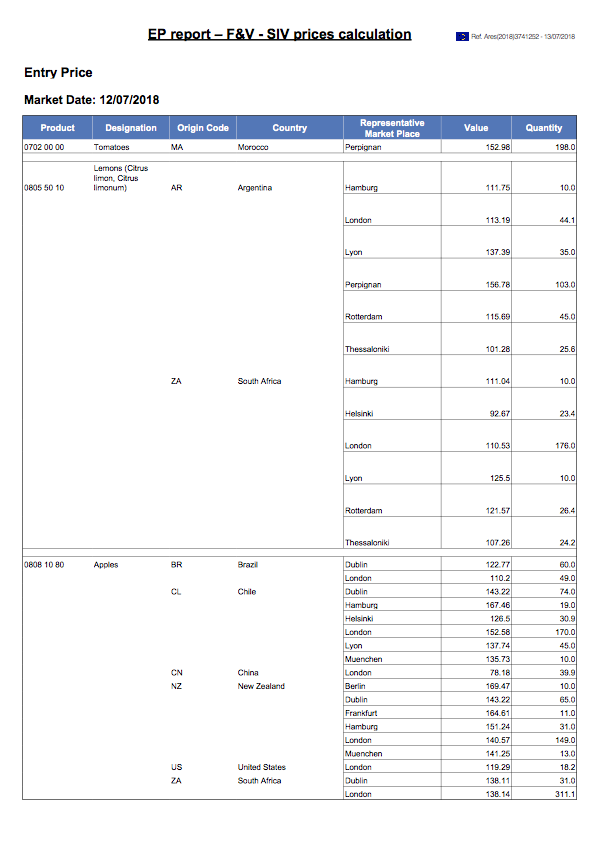

Please note the Standard Import Value is NOT the tariff

Here's an explanation of the Standard Import Value, Produce prices vary daily. So if a tariff is 10% and there's no price per kilo on the invoice the SIV is used to work out how much in Euros 10% is.

circabc.europa.eu/sd/d/e1a6bbb8-…

On the Entry Price System a tariff only applies when the invoice price falls below the figure shown under Requirement. Then the tariff on the right applies.

Note: this is 0% until the price drops to dumping levels.

How often does this sort of thing happen?

No tariff on Moroccan oranges observed during the period researched at all.

uni-hohenheim.de/qisserver/rds?…

Well again winding the clock back to the height of the EU growing season in March the tariff shows this, Note the SIV (which is NOT the tariff) for Tunisia is higher than from Morocco at over 70 Euros.

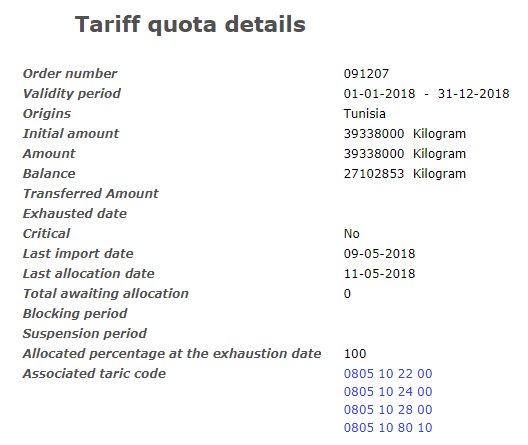

There's a quota here though.

The quota is for 39338 tonnes. They have 27102.853 tonnes remaining for when the season starts again October.

ec.europa.eu/taxation_custo…

You'll recall the original article you posted was from Kevin Dowd writing for the IEA. iea.org.uk/tag/kevin-dowd/

But note the Article on the top left in defence of Lord Ridley attacking Lord Hannay.

brexitcentral.com/author/kevin-d… …

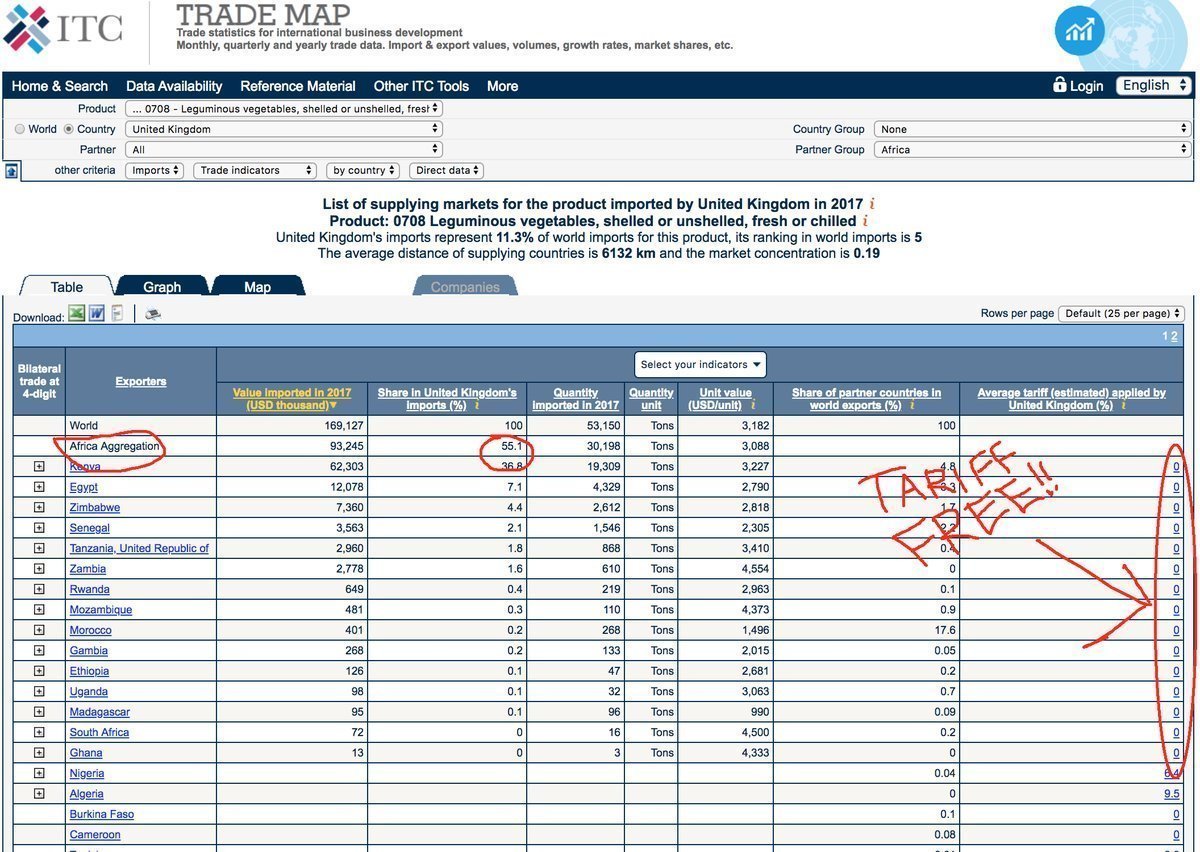

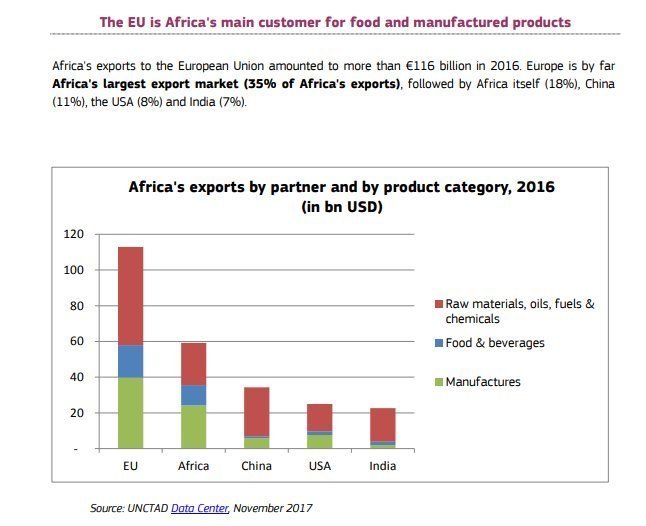

Ridley was claiming that African countries face huge tariffs. Hannay stood up to say "Zero tariffs on all Arican countires". He should have said virtually.

The only reason it’s not on 0% is because the President has yet to sign an EPA agreement that would give its export 0% access to the EU.

edition.cnn.com/2018/04/06/afr…

All of those on EBA or an an Economic Partnership Agreement (EPA) ,except SA, are on 0% duties for everything they export apart from Arms and Ammunition.

But, here's the important thing...

Kevin Dowd writes about the SIVs thinking they are the the tariffs!

He's clueless.

brexitcentral.com/remainer-lord-…

South Africa for obvious reasons is not a typical Sub-Saharan country,

This is as part of the SADC (Botswana, Lesotho, Mozambique, Namibia, Swaziland and South Africa) EPA deal. trade.ec.europa.eu/doclib/docs/20…

trade.ec.europa.eu/doclib/docs/20…

trade.ec.europa.eu/doclib/docs/20…

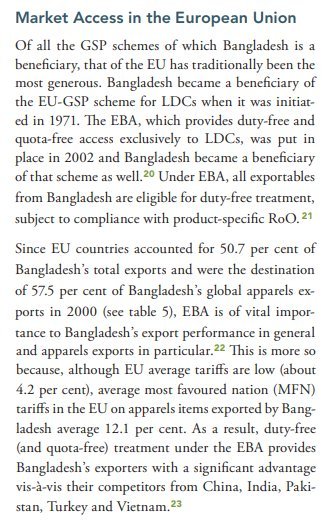

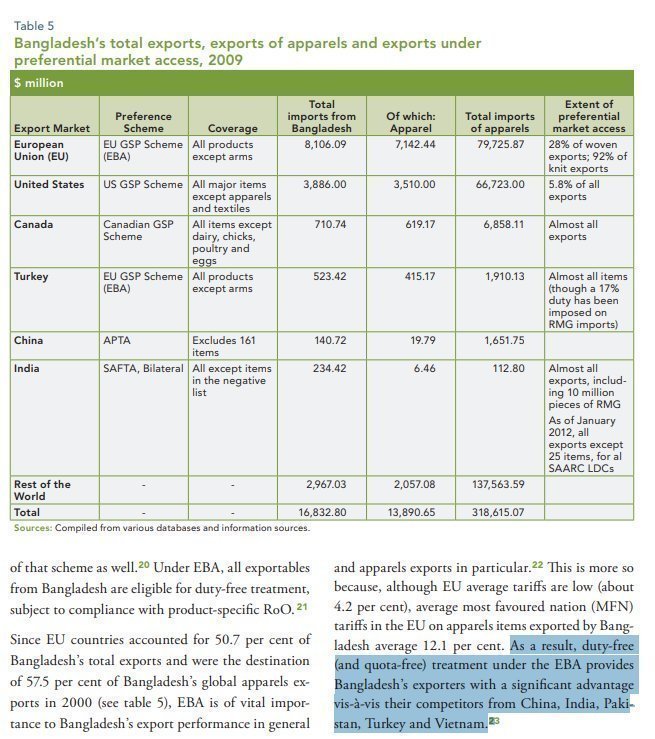

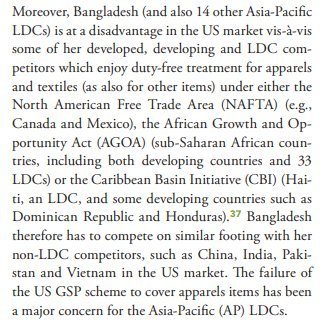

Bangladesh is and EBA country that benefits greatly from being able to export under the preferential arrangement.

The EU accounts for over 50% of Bangladesh's total export and nearly 60% of exports for apparel. EBA allows Bangladesh to compete.

un.org/en/development…

un.org/en/development…

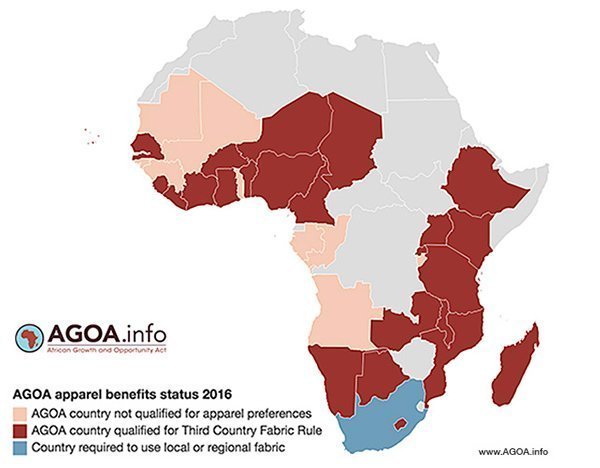

Also it is limited to African countries.

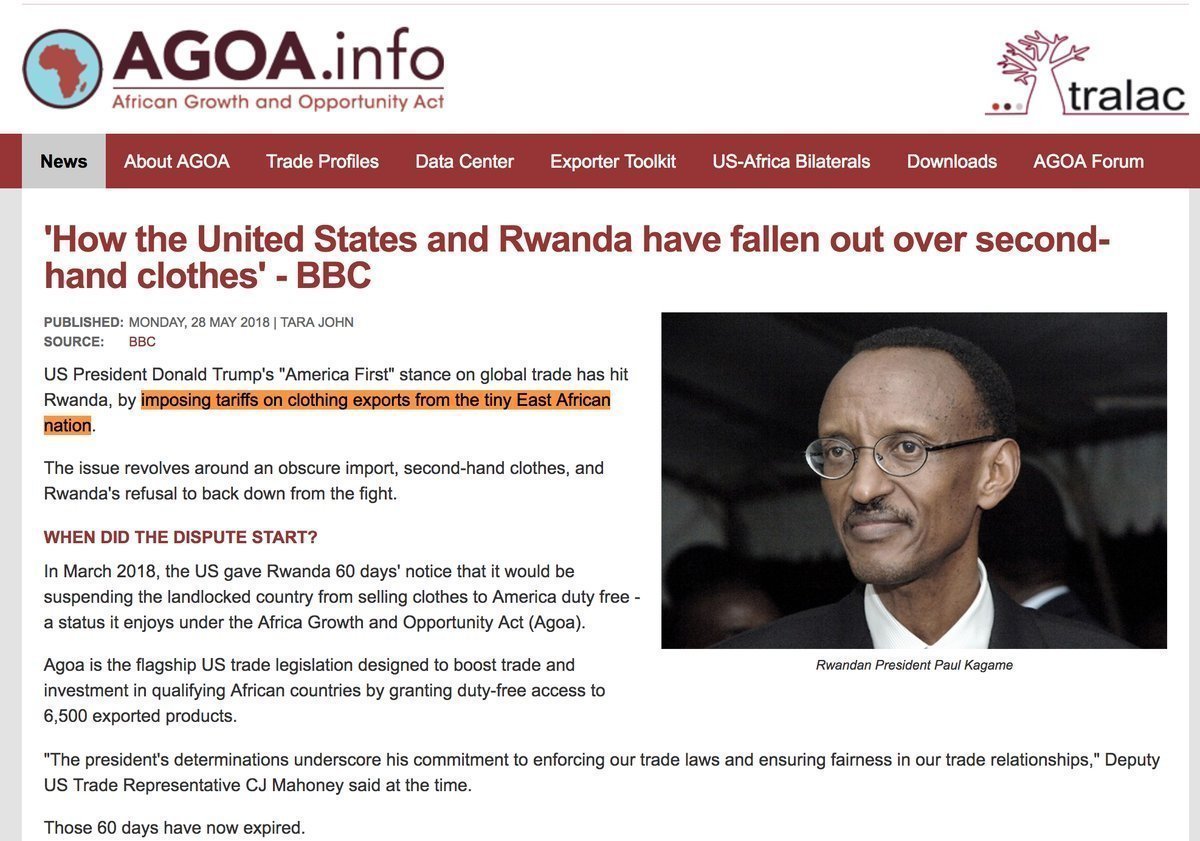

Rwanda wants to develop a clothing industry and rely less on second-hand clothes from USA. So it has banned those imports.

The USA have reacted by suspending Rwanda from AGOA meaning it falls back to the US's GSP.

agoa.info/news/article/1…

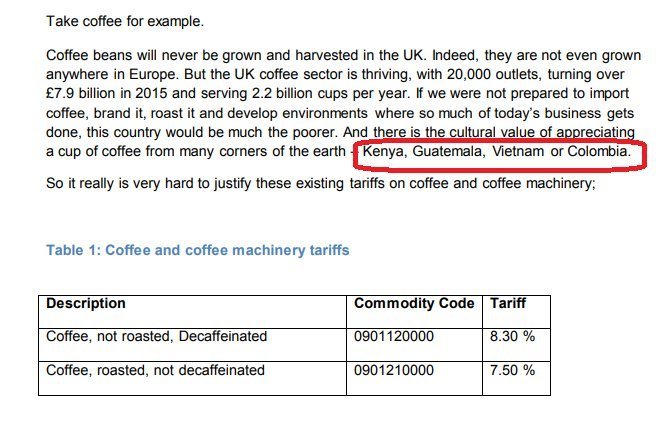

Now, is he right here do you think?

eutariffs.com/system/assets/…

Guatemala is party to the EU-Central America Association Agreement tariffs are 0%

Vietnam is GSP. Coffee is 1/3rd the tariff. The zero-duty FTA negotiations are in final stages.

We have an FTA with Colombia. Tariffs are 0%

/Done.

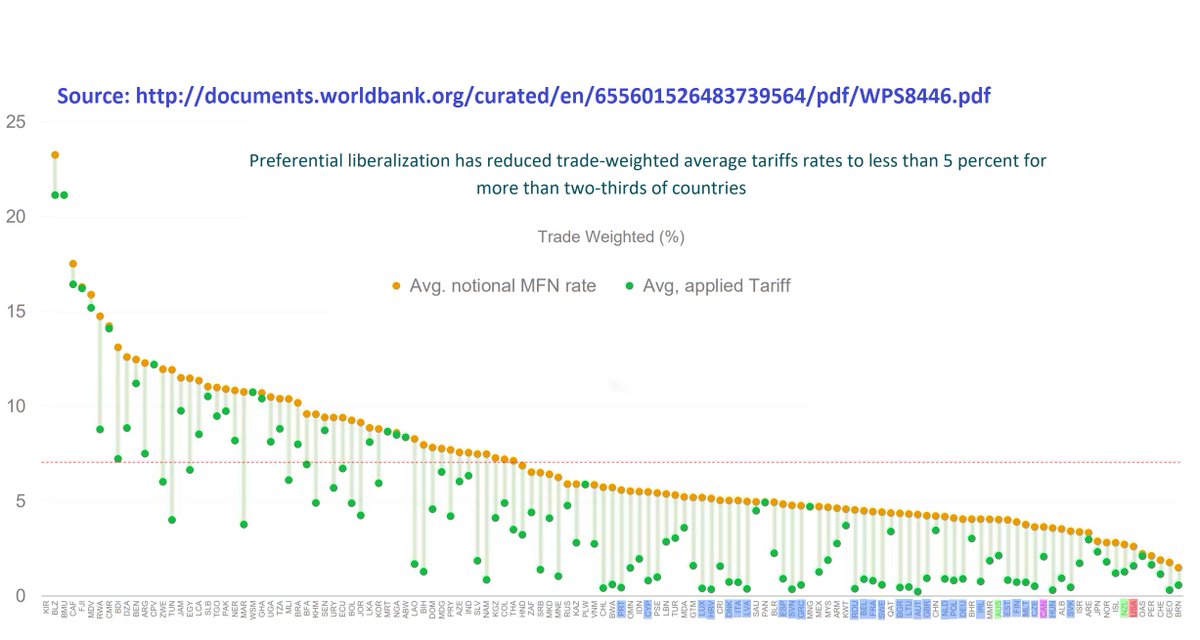

This document "How Preferential Is Preferential Trade?" was published recently by the World Bank.

There's a nice graph on page 10 showing average MFN and applied tariffs rates. I took the liberty of annotating it to highlight EU countries.

documents.worldbank.org/curated/en/655…