as you might imagine, we have some thoughts

(1 of 2,354)

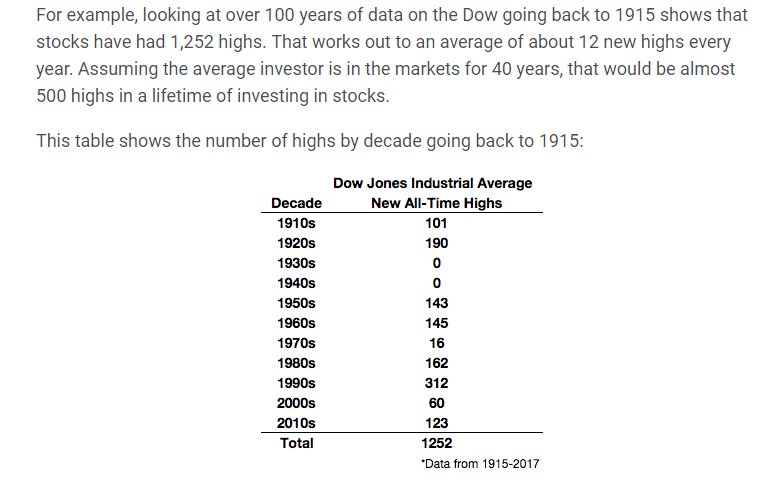

all-time highs are usually followed by... more all-time highs:

"Generally speaking, stocks go up most of the time. A few of those highs will be temporary peaks but most will simply lead to even more highs down the road."

awealthofcommonsense.com/2017/03/all-ti…

(2)

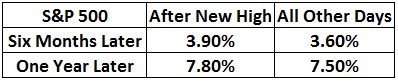

counter-intuitively, the performance of markets after all-time highs is actually better than all other time periods (!)

"New highs are nothing to fear, in fact they are the cornerstone of every great bull market."

theirrelevantinvestor.com/2016/11/22/thi…

(3)

"Many new all-time highs are merely stepping stones toward the next set of new all-time highs, after all."

thereformedbroker.com/2015/01/04/new…

(4)

"Once you have hit an all time high, the very next month you are likely to hit another all time high. To be exact, of the 356 market peaks... ~90% of them were followed by another market peak within the next 4 months."

ofdollarsanddata.com/strike-while-t…

(5)

"Not buying something — anything — solely because it’s at an “all-time high” is, perhaps, the worst investing advice anyone could ever give (or receive) and evidences a total ignorance of investing fundamentals."

ritholtz.com/2013/02/dave-r…

"This is the single greatest challenge long-term investors face; finding new reasons not to sell."

theirrelevantinvestor.com/2016/07/11/ele…

(6)

"The market has been a wall for the dip-buyers. Impenetrable. They cannot get in unless they’re willing to pay the all-time high. It’s a high barrier of entry psychologically, esp. if counseling caution... to their clients."

thereformedbroker.com/2014/11/26/the…

"Although stocks have gone up for a long while, they haven’t gone up that much. This is consistent with our earlier observation of a slow gradual grind higher."

ritholtz.com/2018/01/2017-t…

(7)

"But just because there’s an all-time high does not mean that you are guaranteed to call a new market top."

awealthofcommonsense.com/2016/11/dont-b…

(8)

"Whenever we have big down days & it seems like the bull market is on last legs, I remind myself of this line from MLK: 'Even if I knew that tomorrow the world would go to pieces, I would still plant my apple tree.'”

theirrelevantinvestor.com/2018/02/03/its…

end