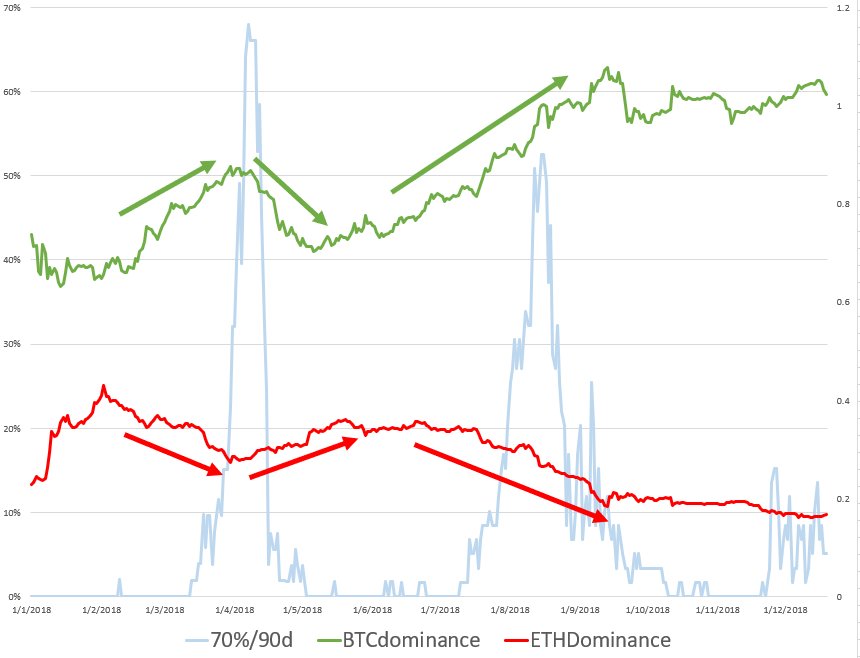

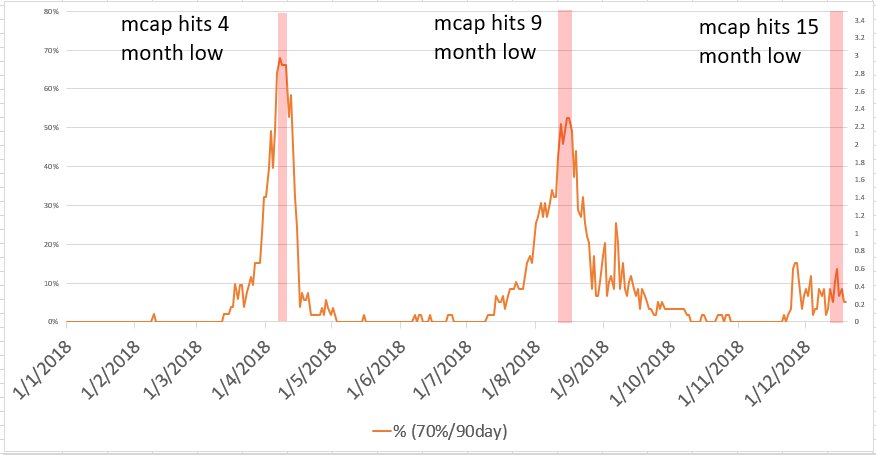

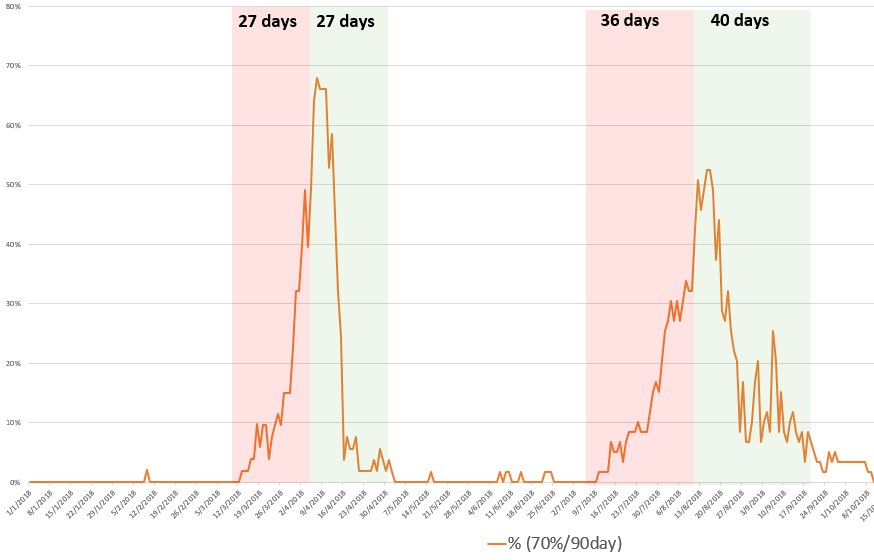

Let's take a look at a metric partly inspired by @BMBernstein @fundstrat (% of select top 200 market cap assets declining >70% over trailing 90 days). As usual, not financial advice and not reflective of company's views.

cc @nlw @KyleSamani @cburniske @Travis_Kling @QWQiao /end