Keep reading before you tell me I’m wrong.

👇👇👇

medium.com/coinshares/hal…

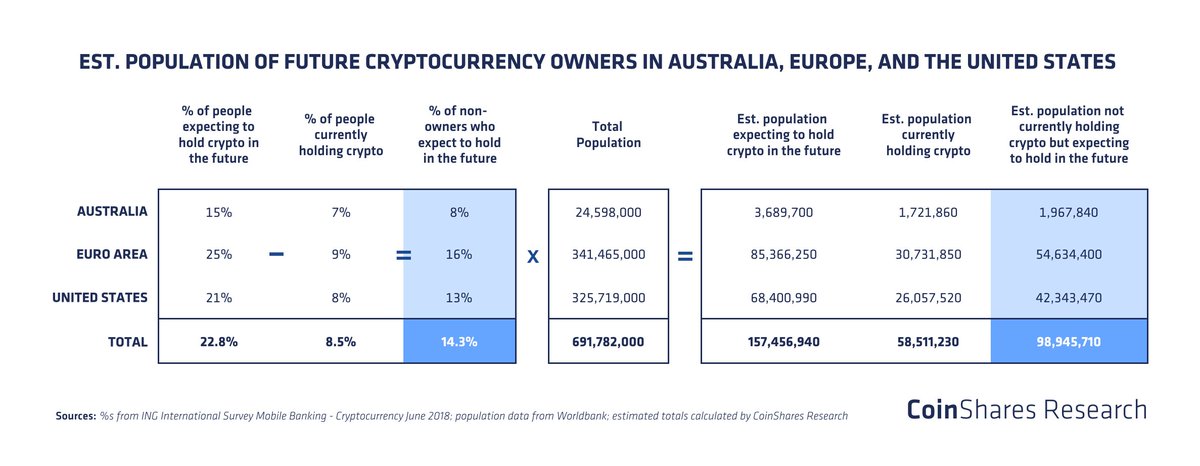

What these people *really* want to understand is potential future demand, or the classic concept of Total Addressable Market (TAM).

It caught my eye because for the first time I can remember - due to results and sample size (14,828) - I have what I need to build a data-driven base to start determining potential TAM.

Said differently, roughly half of the remaining non-minted supply.

Even worse... THE VALUE PROPOSITION HASN’T CHANGED!!! If anything, @lightning, market maturation, regulatory clarity + increased awareness are all muy bueno.

Again —>

My take - entry point timing is a dangerous game to play. @Melt_Dem did a 🔥 job covering this on @CNBCFastMoney —>

So why did companies that are so clearly viable in hindsight, take so long to reclaim their high valuations from Y2K?

When you come down from great heights, the "growth story" is harder to see… and most people then (and now) are investing in the (future) growth story.

Side bar - go read @nic__carter’s “Visions of Bitcoin” if you haven’t already. Well worth your time —>

Network effects are a beautiful thing.

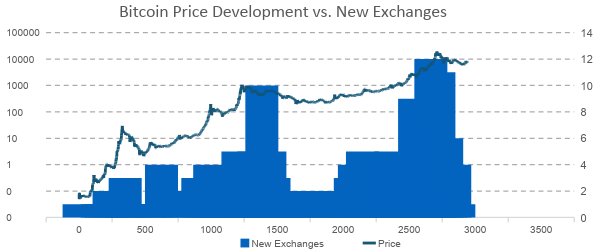

The point is that each narrative attracts more people — for different reasons — into the space. And each wave of talent = 📈 value in the space and new access points for everyone else.

Let's be clear: in our opinion, each Bitcoin speculation hype-cycle since inception in 2009 to date, has been driven by individual buyers.

Institutions will drive new layers of access; and bring a bit more liquidity, no doubt.

...but the reason they’ll help drive the next bull run is consistent with every growth cycle that came before:

The more people who want to play in the sandbox, the bigger the sandbox (and more sand) you need.

Over the past 2 years, we've seen slow growth in institutional interest & participation in the space. This has led to an significant increase in 2 things:

Access — as institutions are given the tools to integrate with cryptocurrencies, they in turn render access to their clients

in other words... INCREASING ACCESS IS THE GOOD NEWS!!!

The 2017 run DID catch the interest of institutional players, who are now increasingly recognizing Bitcoin's value proposition and are responding to their customer's demand for access to #crypto.

One - #crypto awareness keeps rising, with hundreds of millions of ppl now having heard of cryptocurrencies.