libertyblitzkrieg.com/2018/08/01/u-s…

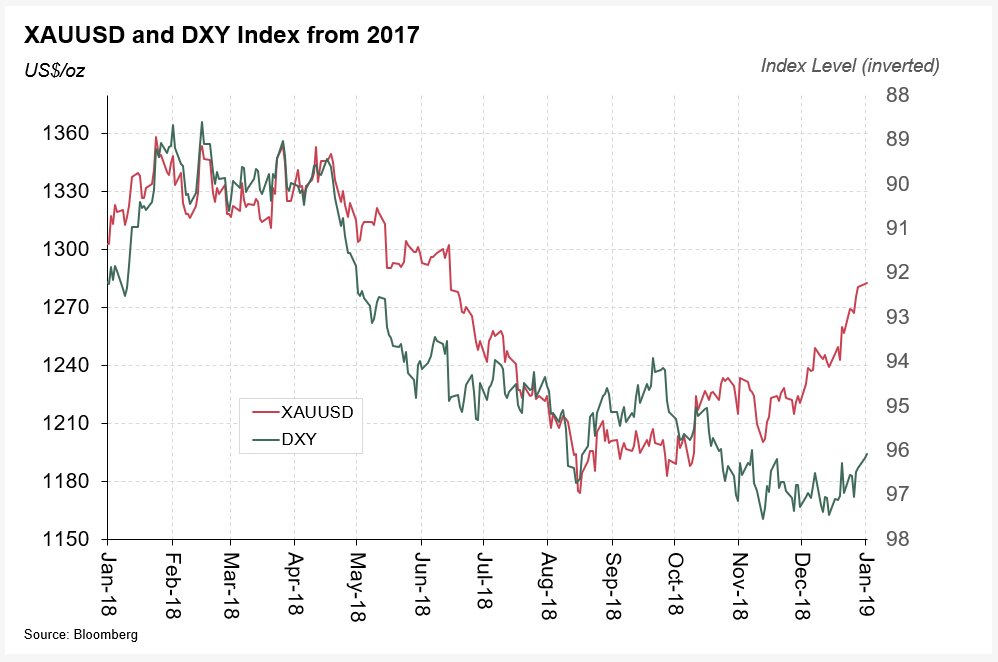

1) Market cycles turning (discussed above).

2) Geopolitics, emerging multi-polar world order.

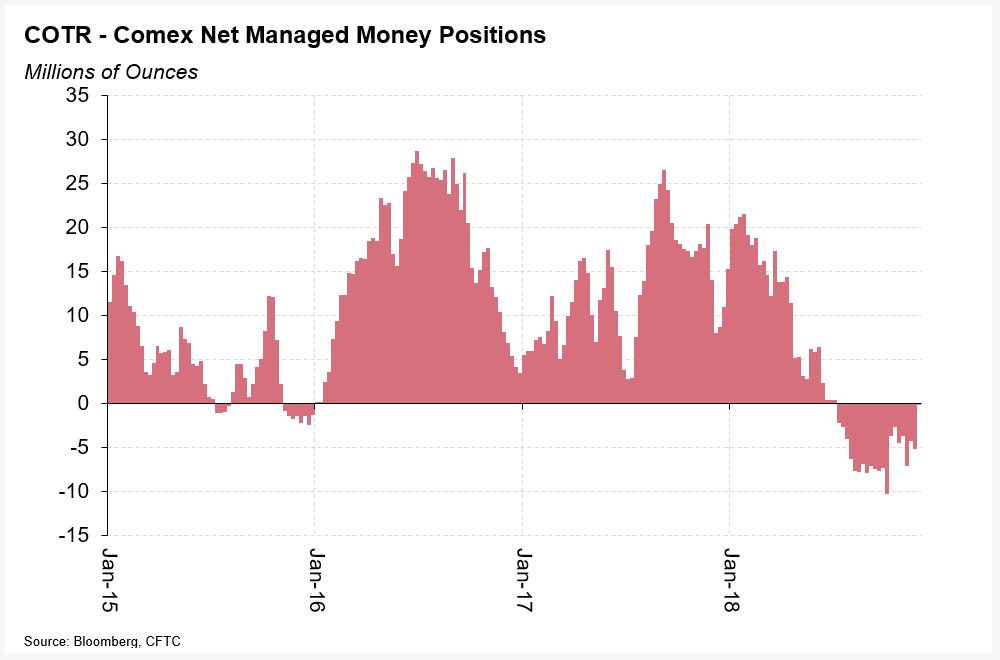

3) Sentiment.

4) Trading action.

Here's the most relevant post:

libertyblitzkrieg.com/2018/04/19/the…

See: strategic-culture.org/news/2018/12/1…

libertyblitzkrieg.com/2018/12/20/is-…

- The End