1/15

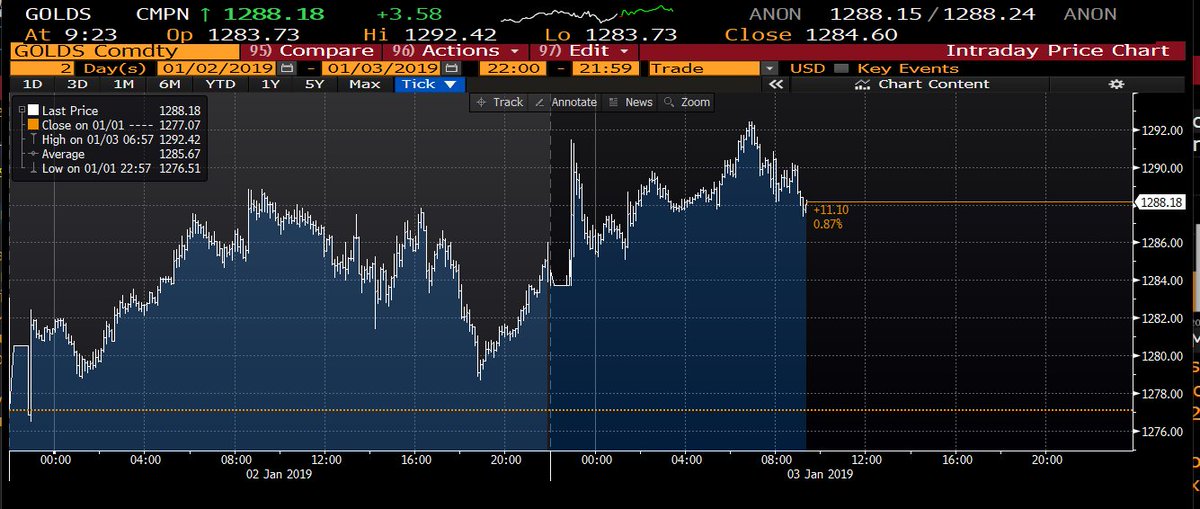

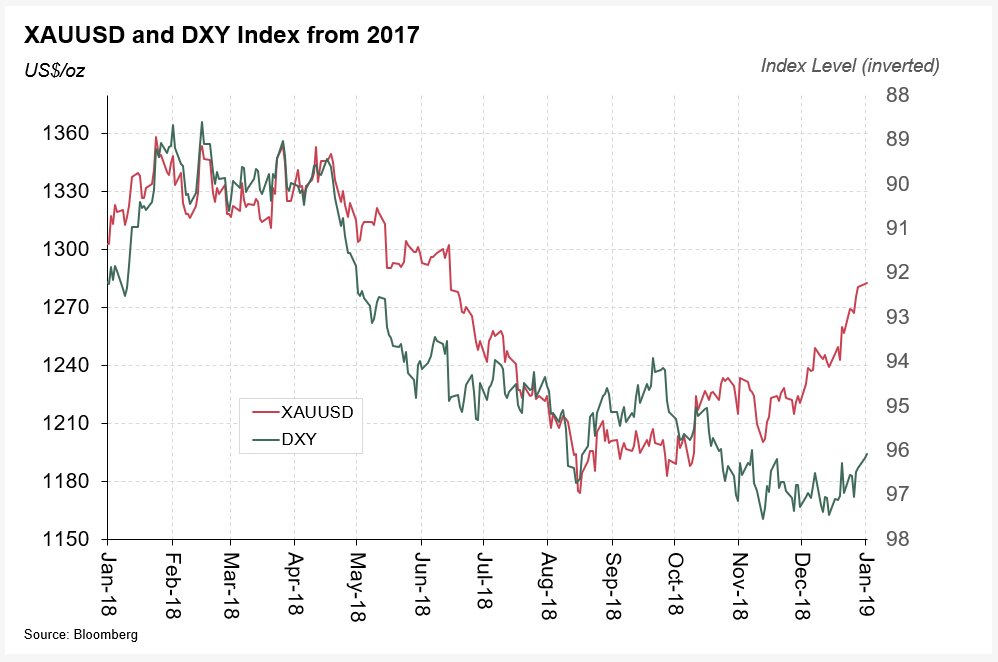

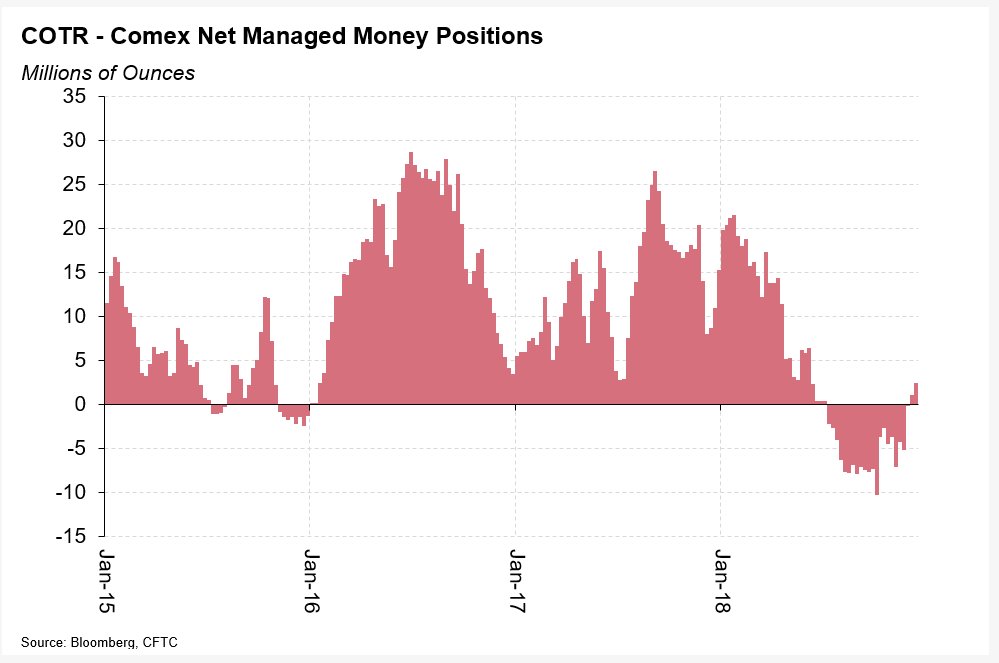

But as this chart shows, #gold has run ahead of the weakening dollar.

2/15

3/15

4/15

5/15

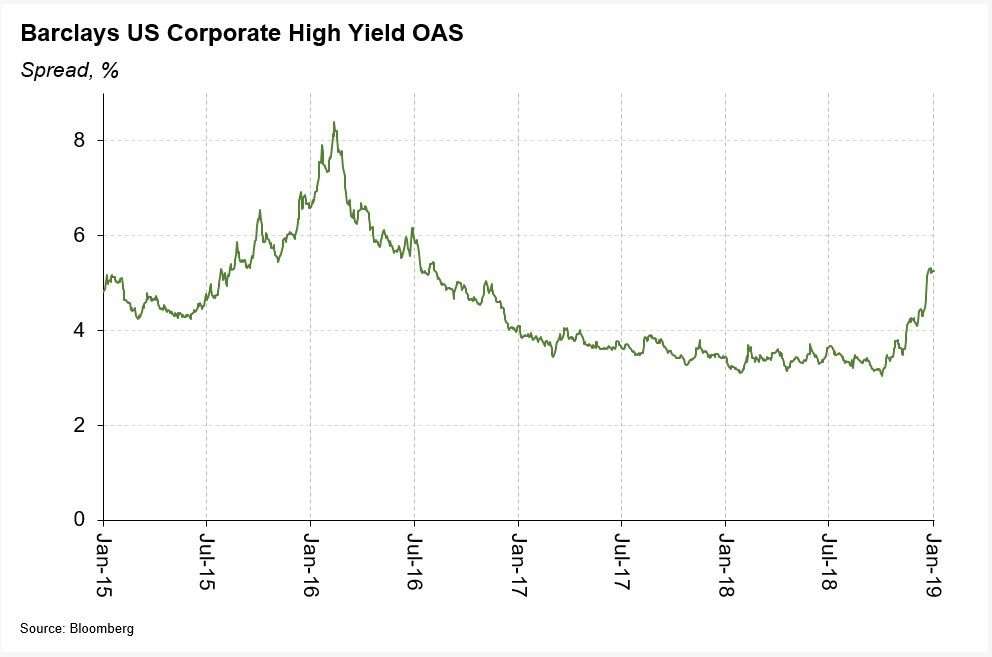

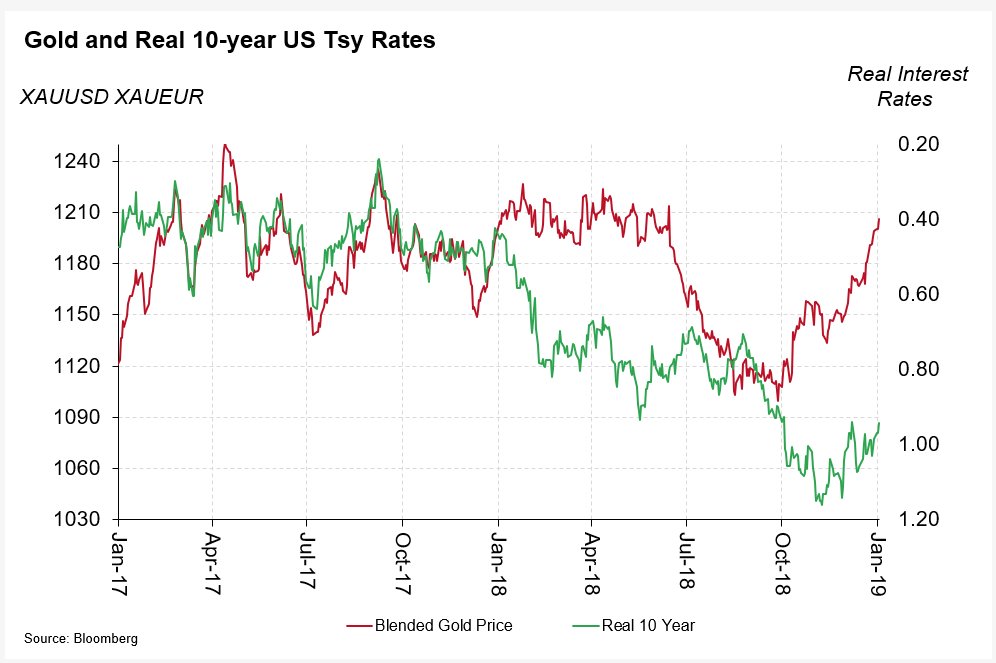

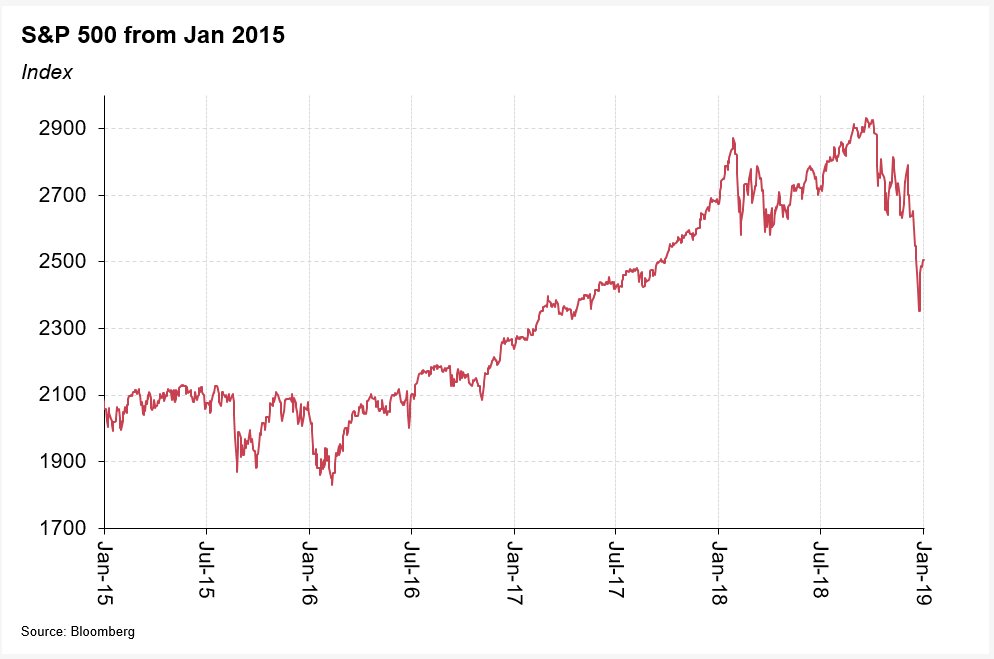

Updating this chart today reminded me of the size of the declines in late December and make the post-October fall look more significant.

7/15

11/15

12/15

14/15

Best of luck for 2019!

15/15