This week, were going to introduce a new twist on screening for stocks

- by demoing how you can decompose factor performance by sector!

No idea what this means? Don't worry, we're jargon free and the concept is approachable

A factor is a rules-based way of categorizing cos

By grouping cos w/ similar traits (val metric, mkt cap, etc) you can:

1. See mkt rotations occurring

2. Invest/Trade w/ a certain trait in mind (ie focusing on value or momo etc)

more: msci.com/msci-factor-in…

There's many on the Factors Page (koyfin.com/fact), but lets explore one in particular

Namely, in 4Q 2018, the Low Vol factor (cos bucketed based on lowest vol of returns) outperformed Momentum (cos based on highest 6 & 12 mo returns)

This just changed...

Lets add a second layer to this observation in the next tweet

Track here: koyfin.com/charts/g/MTUM%…

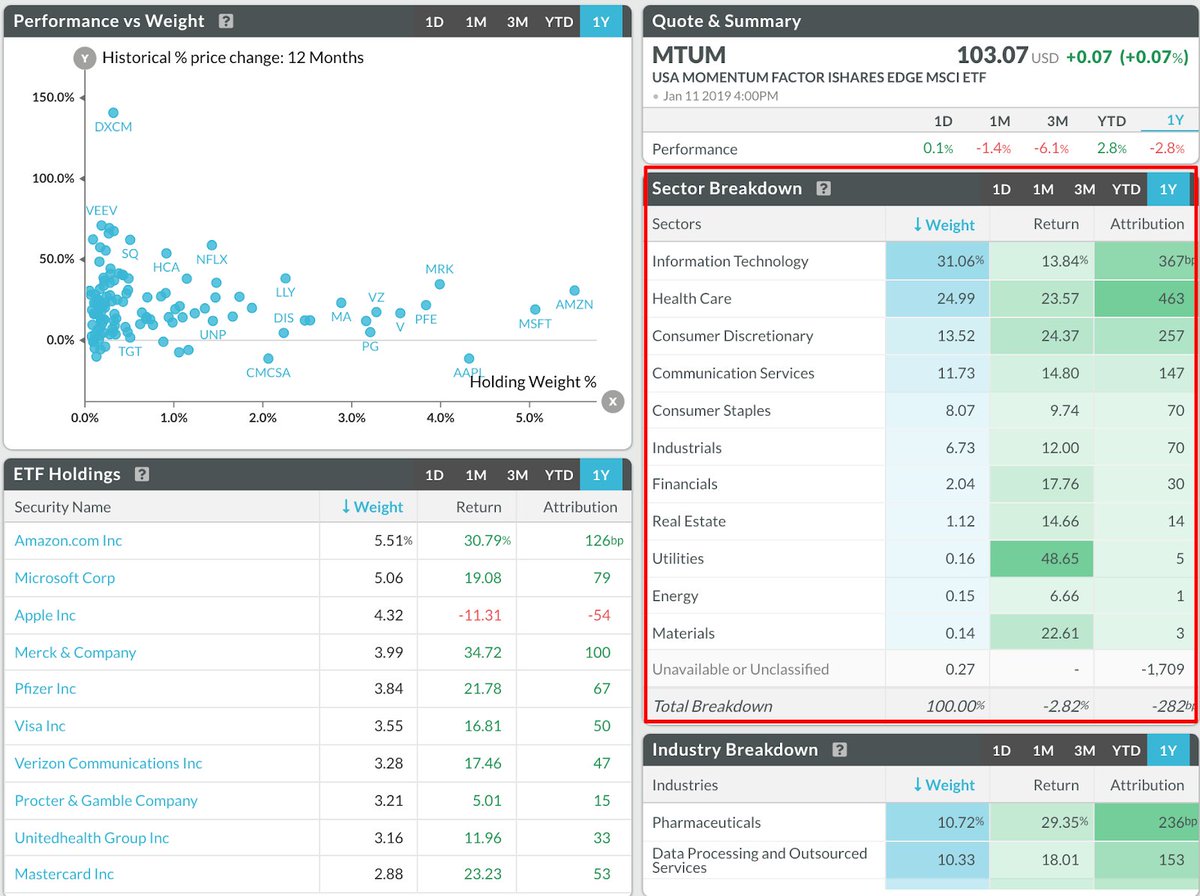

1. load ETF holdings by typing MTUM -> enter on keyboard -> HDS -> enter

Not surprisingly, 55% of the Momo ETF is weighted to Info Tech & Healthcare

koyfin.com/snapshot/hds/M…

columns:

- Sectors in Momo ETF

- % weight

- Return in the past yr (can select other timeframes)

- How much the Weight * Perf = Contribution to Total Return

in the lower left, same this breakdown on a co specific level

If we want to find momo opportunities, we have narrowed the pool into stocks that are leading the momo pack - a great way to analyze and filter markets

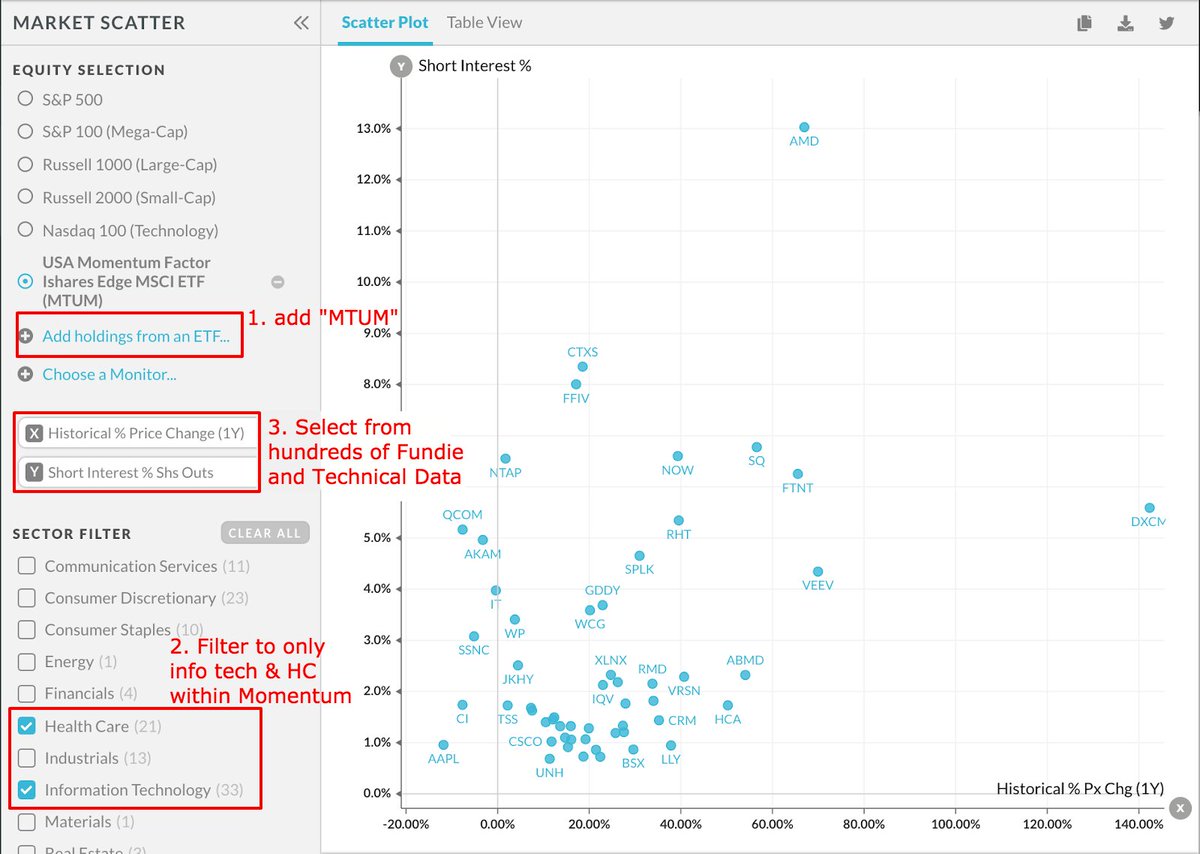

1. Load the ETF holdings into Market Scatter

2. Filter to Info Tech & HC only

3. Examine hundreds of different fundie & technical datapoints on the individual cos themselves

In this ex, well use short interest vs. price return

here: koyfin.com/s/2ffcbaf3

Or we can draw a conclusion on which companies are more likely to squeeze if momentum continues. Possibilities are endless

Of course, the next step is to extract a premium for this effort over market performance... but this gets you started!

As always feedback, ideas, and contributions are welcome

(unless the suggestion you have is bad, in which we still want to hear it, just please leave it with our secretary who can be reached at 867-5309)